The principles of risk management are not about avoiding risk; they are about engaging with it intelligently. For decision-makers, mastering these fundamentals transforms risk management from a defensive, compliance-driven exercise into a core driver of strategic growth. It is the framework for making calculated choices that don't just protect the organization but actively propel it forward.

The Strategic Value of Risk Management Principles

Image

For underwriters, brokers, and risk managers, the modern landscape is defined by complex, interconnected threats, from volatile climate events to shifting regulatory demands. A principled approach to risk provides a reliable compass to navigate this complexity. This is no longer just about loss prevention; it’s about leveraging risk intelligence to build a more resilient and competitive organization.

This guide provides a roadmap from foundational concepts to practical, actionable tactics tailored for the commercial insurance and climate risk sectors. We will focus on actionable insights, not abstract theory.

From Defense to Strategic Advantage

Risk management has historically been viewed as a cost center focused on compliance. This perspective is obsolete. Leading organizations now recognize that a mature risk framework does more than secure assets—it uncovers pathways to innovation and operational excellence. This strategic shift is especially critical in commercial insurance, where the accurate pricing and management of risk are central to business success.

In the financial sector, enterprise risk management (ERM) has evolved from a back-office function to a C-suite priority. By 2025, leading firms are embedding risk maturity frameworks that align strategy, governance, and operations. These systems are designed to transition companies from a reactive, fragmented approach to a centralized, intelligent one. To understand how these frameworks are evolving, discover more about evolving risk management trends in 2025.

Why Principles Matter More Than Ever

In a dynamic environment, a static checklist is insufficient. The core principles of risk management offer a stable yet flexible foundation for high-stakes decision-making.

Adopting these principles delivers critical business outcomes:

- Informed Decision-Making: Principles embed risk awareness into the fabric of every strategic choice, from new product development to market entry.

- Enhanced Resilience: By systematically identifying and addressing vulnerabilities *before* they manifest, an organization can withstand shocks—whether from a natural disaster or an economic downturn—and maintain momentum.

- Competitive Edge: Organizations that excel at managing risk can pursue opportunities that risk-averse competitors cannot. They operate with calculated confidence, creating a distinct market advantage.

Understanding the Eight Foundational Principles

Image

Effective risk management is not about following a rigid checklist; it is about embedding a specific mindset into an organization’s culture. The globally recognized ISO 31000 standard outlines eight principles that serve as the foundation for this resilience. These are not rules but guiding philosophies that differentiate a reactive, siloed risk function from a strategic asset that drives business value.

Here is a breakdown of what these principles mean in practice for underwriters, brokers, and risk managers.

Principle 1: Integrated

Risk management must be Integrated. It should function as the central nervous system of the business, connected to every function, process, and strategic decision. When risk management is integrated, an underwriter does not price a policy in a vacuum. They understand how a single risk impacts the company's entire portfolio, financial targets, and market position.

Principle 2: Structured and Comprehensive

The approach must be Structured and Comprehensive. This principle provides the architectural blueprint for organizational resilience. A structured framework ensures that risk management methodologies are thorough, consistent, and repeatable. It demands a systematic process for identifying, analyzing, and treating risks across the enterprise. For a brokerage advising clients on climate perils, this means having a replicable methodology to evaluate flood, wildfire, and windstorm exposures, ensuring no critical vulnerabilities are overlooked.

Principle 3: Customized

While the framework provides the blueprint, it must also be Customized. A one-size-fits-all risk plan is ineffective because no two organizations share the same threats, opportunities, or strategic objectives. The framework must reflect the company’s unique operational context, risk appetite, and business goals. For instance, a commercial insurer specializing in coastal properties operates in a fundamentally different risk environment than one focused on inland manufacturing.

Key Takeaway: Customization ensures that risk management efforts are directed at the most material issues, concentrating resources where they will deliver the greatest impact.

Principle 4: Inclusive

Risk management must be Inclusive. This requires engaging key stakeholders across the organization—not just the risk team, but also department heads, frontline staff, and external experts. Inclusivity is the most effective defense against blind spots. It incorporates diverse perspectives and deep operational knowledge into the decision-making process, leading to more accurate risk assessments. When developing a new cyber insurance product, for example, input from IT security, legal, and sales ensures the final policy is both technically robust and commercially viable.

Principle 5: Dynamic

The business environment is not static, and neither is risk. Therefore, risk management must be Dynamic. It should function like a ship's radar, continuously scanning the horizon for emerging threats and new opportunities. A dynamic framework is designed to anticipate, identify, and respond to changes both internal and external to the company. As new climate models are released or regulations shift, a dynamic system enables an insurer to adjust its underwriting criteria and pricing in near real-time. This agility is a core component of best practices for risk management.

Principle 6: Best Available Information

Decisions must be based on the Best Available Information. This principle requires that actions are informed by data, not intuition. It involves synthesizing historical data, expert analysis, stakeholder feedback, and forward-looking models to create a clear, evidence-based view of risk. For a risk manager assessing supply chain vulnerabilities, this means moving beyond logistics reports to analyze geopolitical forecasts, climate projections, and supplier financial health to build a comprehensive intelligence picture.

Principle 7: Human and Cultural Factors

Human and Cultural Factors are the invisible currents that shape how individuals perceive and respond to risk. An organization’s culture—its shared values, attitudes, and behaviors—can either amplify the effectiveness of a risk framework or undermine it entirely. Acknowledging this means understanding that a team's psychological safety, its approach to failure, and its communication norms are themselves critical risk controls. A culture that encourages transparency and learns from errors will always be more resilient than one that penalizes dissent.

Principle 8: Continual Improvement

Finally, risk management is a commitment to Continual Improvement. This principle is the engine of evolution, driving the organization to enhance its capabilities by learning from experience. An organization that embodies this principle consistently asks, "What did we learn from that near-miss?" and "How can we refine this process?" This iterative feedback loop builds lasting organizational resilience.

The following table translates each ISO 31000 principle into a practical analogy and highlights its direct benefit for insurance and risk professionals.

Core Principles of Risk Management Explained

| Principle (ISO 31000) | Core Concept Analogy | Benefit for Underwriters & Risk Managers |

|---|---|---|

| Integrated | The *central nervous system* of the business, connecting all parts. | Ensures risk is considered in every underwriting, pricing, and strategic decision, not as an afterthought. |

| Structured & Comprehensive | The *architectural blueprint* for resilience, ensuring consistency. | Creates reliable, repeatable, and defensible risk assessment processes across all lines of business. |

| Customized | A *bespoke suit* tailored to the company’s specific context. | Focuses resources on the most relevant threats and opportunities, avoiding generic, ineffective controls. |

| Inclusive | A *roundtable discussion* where all key stakeholders have a voice. | Prevents dangerous blind spots by incorporating diverse expertise and frontline knowledge into risk models. |

| Dynamic | The *ship's radar*, constantly scanning for changing conditions. | Allows for rapid adjustments to underwriting criteria and portfolio strategy in response to market shifts. |

| Best Available Information | An *intelligence-gathering operation* for informed decisions. | Leads to more accurate pricing and risk selection by grounding decisions in hard data and expert analysis. |

| Human & Cultural Factors | The *invisible currents* influencing behavior and perception. | Builds a culture where risks are openly discussed and managed, strengthening the human line of defense. |

| Continual Improvement | The *engine of evolution*, learning from experience. | Refines risk models, controls, and strategies over time, building compounding resilience and a competitive edge. |

By internalizing these eight principles, decision-makers can elevate risk management from a compliance function to a powerful tool for strategic advantage.

Putting The ISO 31000 Framework Into Action

If the eight principles are the constitution, the ISO 31000 framework is the implementation plan. This is not a rigid, bureaucratic checklist but a dynamic, cyclical process designed for continuous improvement and alignment with business objectives. For professionals in commercial insurance and climate risk, this framework provides the necessary structure to navigate an increasingly volatile world, translating abstract principles into a logical series of value-creating steps.

Step 1: Establishing The Context

Before managing risk, one must first understand the operating environment. Establishing the context is the foundational step of mapping both the internal organizational landscape and the external environment. For an underwriter, this extends beyond policy applications to understanding the firm's overall risk appetite, strategic goals for a particular line of business, and capital adequacy.

Externally, this involves identifying and analyzing macro-level threats, such as climate change and regulatory shifts. Key questions to address include:

- How will evolving climate models impact our property insurance portfolio over the next five to ten years?

- What emerging environmental regulations could increase our clients' liability exposures?

- How are geopolitical tensions affecting the supply chains of the businesses we insure?

Answering these questions ensures that the risk management process is grounded in the real-world conditions the organization and its clients face.

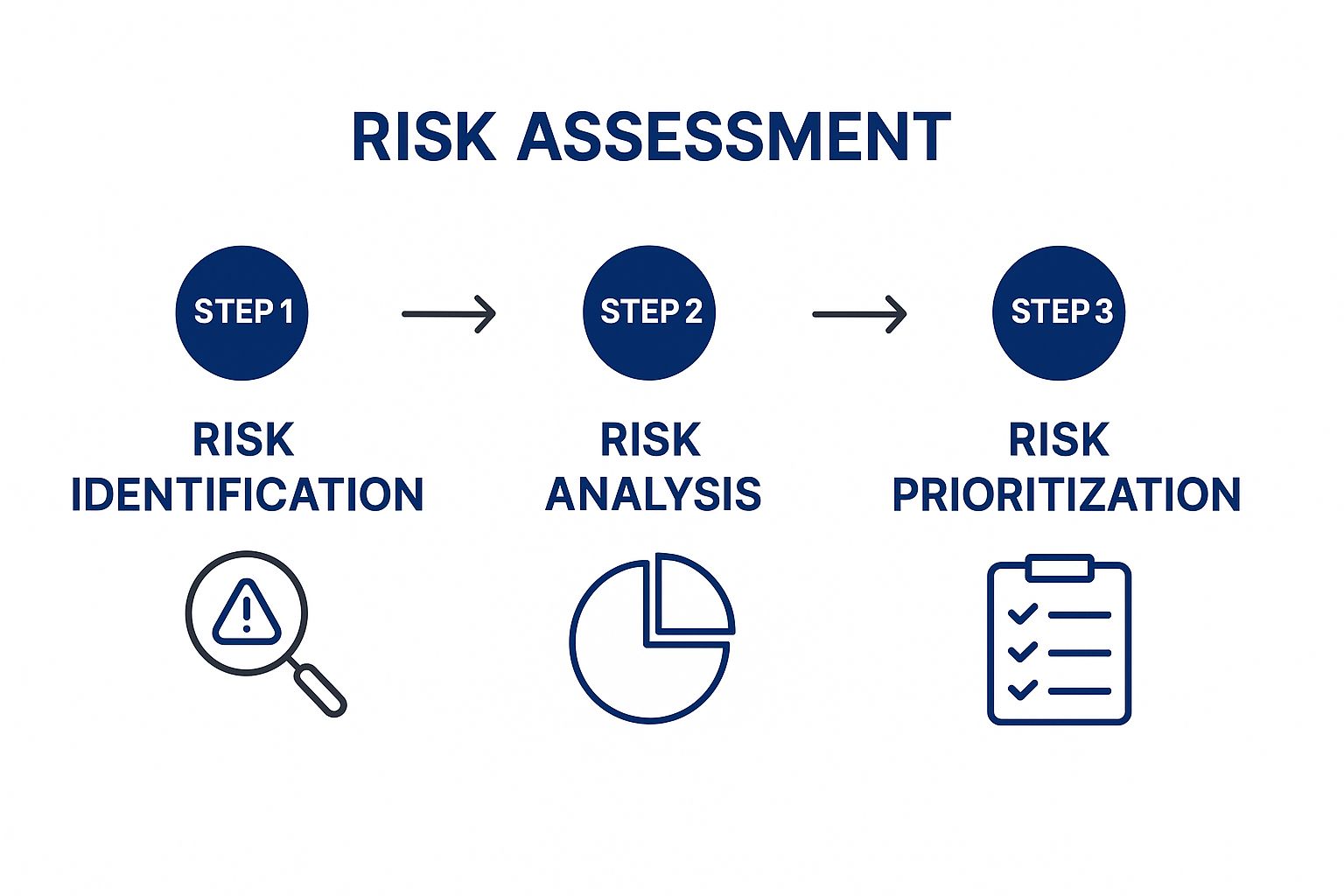

Step 2: The Risk Assessment Process

With the context established, the next phase is risk assessment. This is a structured investigation, not a speculative exercise. It is a multi-stage process designed to systematically identify, analyze, and evaluate all risks relevant to the organization's objectives. The goal is to move from a broad inventory of potential threats to a prioritized action plan, ensuring resources are allocated to the most significant risks.

This process can be visualized as a funnel, refining a wide universe of potential threats into a manageable list of priorities.

Image

Risk Identification

The first stage is Risk Identification. The objective is comprehensive discovery: creating a complete inventory of events and conditions that could impact business objectives. This includes market, legal, operational, and environmental risks. For a broker advising a manufacturing client, this phase would involve workshops with plant managers, analysis of incident reports, and review of industry-wide loss data to uncover latent operational vulnerabilities.

Risk Analysis

Once risks are identified, the next stage is Risk Analysis. Here, each risk is examined to understand its nature, characteristics, likelihood, and potential consequences. Methodologies can range from simple qualitative matrices to complex quantitative models. For a deeper look at advanced modeling, explore specialized climate risk assessment tools. This stage also reveals interconnections between risks. For example, a physical climate risk, such as increased hurricane frequency (likelihood), can trigger business interruption (consequence), creating a major financial risk for the insurer.

Risk Evaluation

The final stage of assessment is Risk Evaluation. Here, the results of the risk analysis are compared against pre-established risk criteria to determine significance and priority.

Key Takeaway: Risk evaluation is about deciding which risks are acceptable, which require immediate treatment, and which should be monitored. This is the mechanism for focusing resources effectively.

Step 3: Risk Treatment

Following evaluation, the next step is Risk Treatment—the action phase. This involves selecting and implementing measures to modify high-priority risks to align with the organization's risk appetite.

Standard risk treatment options include:

- Avoidance: Discontinuing the activity that gives rise to the risk. An insurer might place a moratorium on writing new policies in a high-risk flood zone.

- Mitigation: Implementing measures to reduce the likelihood or impact of the risk. This could involve requiring a client to install a fire suppression system to lower property risk.

- Transfer: Sharing the risk with a third party. Insurance is the primary example, but this also includes contractual mechanisms like indemnity clauses.

- Acceptance: Making an informed decision to retain the risk. This is typically applied to low-impact, low-likelihood risks where the cost of treatment outweighs the potential loss.

Step 4: Monitoring and Review

The framework is not linear but cyclical. Monitoring and Review is the ongoing process that ensures its continued relevance and effectiveness. Risks are dynamic and evolve with the business environment. This stage involves tracking identified risks, evaluating the effectiveness of treatment plans, and scanning for new threats. For a risk manager, this means regular reporting to leadership, monitoring Key Risk Indicators (KRIs), and conducting periodic audits. This feedback loop drives continual improvement and builds long-term organizational resilience.

Putting Risk Principles to the Test

Applying risk management principles under pressure is the true measure of their value. For underwriters, brokers, and risk managers, this is where abstract concepts like "integration" and "customization" become practical tools for protecting assets and creating value.

Let's examine how these principles are applied in high-stakes commercial scenarios.

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/pMKtWoec37c" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Case Study 1: Pricing Climate Risk for Coastal Properties

A senior underwriter is tasked with managing a portfolio of coastal commercial properties amid escalating hurricane frequency and intensity. Historical loss data is no longer a reliable predictor of future risk, rendering traditional pricing models inadequate.

This scenario demands the application of the Best Available Information and Dynamic principles. The underwriting team integrates forward-looking climate models with its actuarial data, creating a customized approach to risk assessment.

Here’s the practical application:

- Structured Analysis: The framework is expanded beyond wind and flood damage to assess secondary effects, such as prolonged business interruption for tenants and supply chain disruptions.

- Inclusive Input: External climate scientists and structural engineers are engaged to provide expert input, enabling vulnerability assessments at the building level rather than relying on broad geographical risk scores.

- Actionable Treatment: The analysis informs a more sophisticated, tiered pricing structure. It also identifies specific risk mitigation measures. The underwriter can now advise clients, "Install storm shutters and elevate critical equipment in exchange for premium credits."

The underwriter transforms from a price-setter into a strategic risk advisor, building a more profitable and resilient portfolio. A crucial element of this strategy is ensuring clients have a robust continuity plan. For further guidance, see our guide on business disaster recovery planning.

Case Study 2: Fortifying a Global Supply Chain

A risk manager for a global manufacturer faces heightened geopolitical tensions that threaten key suppliers. A factory shutdown or a blocked shipping lane represents a significant threat to production and revenue.

An Integrated and Comprehensive approach is required. Supply chain risk is not a siloed logistics issue but a core enterprise threat with direct financial, operational, and reputational implications.

Key Insight: A resilient supply chain is not about preventing every disruption; it is about building the capacity to absorb shocks and adapt quickly. This requires a proactive, not reactive, risk culture.

The risk manager initiates a project with three key objectives:

- Identifies Critical Nodes: The entire supply chain is meticulously mapped to identify single points of failure, such as over-reliance on a single supplier or a high-risk region.

- Analyzes Potential Scenarios: Scenario planning is used to model the financial and operational impacts of various disruptions, from new trade tariffs to regional conflicts.

- Treats the Risk: The team diversifies its sourcing strategy, pre-qualifies alternative suppliers in stable regions, and increases inventory levels for critical components.

This structured defense strengthens the company’s ability to maintain operations and meet customer demand in a volatile global environment.

Case Study 3: Mitigating Cyber Threats for a Tech Client

A commercial insurance broker is advising a fast-growing software company whose leadership is focused on product and sales, overlooking their significant cyber exposure.

Cyber incidents have become the #1 business risk for 2025, with threats like ransomware attacks and data breaches topping global risk surveys for the fourth consecutive year. Meanwhile, natural catastrophes have caused over US$100 billion in insured losses annually for five straight years. You can discover more insights about these global business risks in the full Allianz Risk Barometer report.

To drive action, the broker applies the principle of Inclusivity. A workshop is convened that includes not just the CEO, but also the heads of engineering, sales, and legal. This fosters a shared understanding that cyber risk is a business-wide problem, not an isolated IT issue. The strategies in cyber security risk management provide a critical framework for this challenge.

The broker guides the client through a structured process:

- Establish Context: The client defines its risk appetite and identifies its most valuable data assets—the "crown jewels" that would be most attractive to attackers.

- Assess Vulnerabilities: A third-party firm is engaged to conduct a risk assessment, providing an objective evaluation of security gaps in their network and software.

- Develop a Treatment Plan: A multi-layered defense is created, incorporating employee training, advanced endpoint protection, and a tested incident response plan.

Through this process, the broker has done more than prepare the client for a policy quote; they have helped them become a more attractive, insurable, and resilient business.

Common Implementation Pitfalls and How to Avoid Them

Image

Even a well-designed risk management framework can fail if its implementation is flawed. For professionals in commercial insurance and climate risk, these failures translate directly into financial and operational losses. Moving beyond generic advice to build a resilient risk management culture is essential.

Overcoming Departmental Silos

Risk management fails when it is isolated. If risk is perceived as the sole responsibility of one department, other business units disengage, leading to a lack of cooperation and visibility. To be effective, risk management must be treated as a shared language embedded across the entire organization.

- Create 'Risk Champion' Teams: Distribute, rather than centralize, risk expertise. Embed dedicated risk champions within underwriting, claims, and finance to translate high-level risk objectives into practical, team-specific actions.

- Tie Risk to Performance: Link risk management outcomes directly to departmental KPIs. This transforms risk management from an external mandate into a shared priority.

Shifting from Compliance to Culture

A "check-the-box" mentality is another significant hurdle. When risk management is viewed as a compliance exercise, it elicits only the minimum effort required to satisfy auditors, and its strategic value is lost. The objective is to cultivate a culture of genuine risk awareness, which requires visible and consistent commitment from leadership.

Key Takeaway: A strong risk culture develops when leaders consistently demonstrate that managing risk is integral to achieving business objectives, not a roadblock to them.

Data reveals a significant gap: while the risk management market is expanding, 87% of risk professionals report that their processes are not fully embraced by their own organizations. This failure stems from a lack of cultural buy-in. To learn more, discover more insights on risk management adoption challenges.

Avoiding Analysis Paralysis

In an era of big data, the sheer volume of information from climate models, market analytics, and other sources can lead to "analysis paralysis." Teams become so focused on modeling every possibility that they fail to make timely decisions. Effective implementation of principles risk management is about focusing on what is most important.

- Define Key Risk Indicators (KRIs): Establish a concise set of KRIs that provide a clear and immediate view of the most significant exposures, filtering out informational noise.

- Embrace Scenario Planning: Instead of attempting to predict the future with perfect accuracy, use scenario planning to map out a range of plausible outcomes. This builds agility and prepares the organization to respond effectively regardless of how events unfold.

Clear communication is the unifying element for these solutions. For more on this topic, review our guide on crisis communication best practices. By proactively addressing these common pitfalls, an organization can transform its risk management framework from a liability into a source of competitive advantage.

Turning Risk Principles Into a Competitive Edge

Effective risk management is not a finite project; it is a continuous discipline. The objective is to embed these foundational principles so deeply into an organization’s culture that they transition from a defensive function to a strategic enabler. A principled approach allows an organization to not only guard against threats like climate volatility but also to confidently seize growth opportunities.

This mindset is essential for navigating modern business complexity. For any decision-maker, the first step is to critically evaluate existing risk frameworks and shift their posture from reactive to proactive. This shift is the foundation of sustainable resilience. For a detailed exploration, our guide on business resilience strategies provides practical next steps.

Adopting a principled framework is not about eliminating uncertainty. It is about building an organization structured to thrive *within* uncertainty. True resilience is derived from adaptability and informed action, turning potential weaknesses into sources of competitive strength.

This approach must extend beyond the organization to encompass its entire ecosystem of external partners. A robust strategy requires Mastering Third Party Risk Management to ensure every link in the value chain is as secure and resilient as the core business.

Common Questions About Risk Management Principles

Even with a clear set of principles, practical application can raise important questions. Here are answers to common queries from underwriters, brokers, and risk managers.

What’s the Real Difference Between a Principle and a Process?

The distinction can be understood as "why" versus "how."

Principles are the "why." They are the fundamental beliefs that guide your approach to risk—concepts like being integrated, dynamic, and inclusive. They are your guiding philosophy.

A process is the "how." It comprises the specific, repeatable steps taken to execute risk management, such as risk identification, analysis, and treatment.

A process without principles is merely a checklist that can quickly become obsolete. Principles ensure that the process has a strategic purpose and remains effective in a changing market.

How Can a Smaller Business Actually Apply These Big Principles?

These principles are scalable. A smaller business does not need a large, dedicated risk department to implement them effectively. The key is to adapt the *spirit* of the principles to your specific context.

For example, "integration" in a large corporation might involve a formal risk committee. In a smaller business, it could be a standing 15-minute agenda item in weekly leadership meetings to discuss emerging risks.

Similarly, "inclusivity" can be achieved by management regularly engaging with frontline staff to ask, "What are you observing in the market? What are our customers’ primary concerns?"

The Takeaway: Do not attempt to replicate a large corporate risk framework. Focus on embedding the *thinking* behind the principles into existing decision-making processes. Prioritize your most significant exposures—such as reliance on a single major client or a key supplier—and begin there.

How Often Should We Be Reviewing Our Risk Management Framework?

A risk framework should be a living document, not a static one. It must adapt in tandem with your business and its environment.

A formal, comprehensive review should be conducted at least annually. This provides an opportunity to assess performance, update risk criteria, and ensure alignment with strategic objectives.

However, the principle of being "Dynamic" requires more frequent attention. The framework must be revisited immediately following any major internal or external event that could materially alter your risk profile.

Triggers for an immediate review include:

- A merger or acquisition

- The launch of a new product or entry into a new market

- A significant regulatory change

- A major geopolitical event or natural disaster

This continuous cycle of review and refinement is what maintains the relevance and effectiveness of your risk management capabilities.

---

At Insurtech.bpcorp.eu, we turn climate volatility into actionable intelligence. Our Sentinel Shield platform monitors climate-related disasters in real-time, identifying businesses impacted by floods, storms, and wildfires. We deliver CRM-ready opportunities with verified decision-maker contacts, empowering you to connect with high-intent clients at the moment of greatest need. Discover how to transform climate crises into measurable growth at https://insurtech.bpcorp.eu.