A climate risk assessment tool is a platform designed to translate complex climate science into quantifiable financial risk. These tools leverage data and sophisticated models to forecast how climate change will impact specific business assets, operations, and supply chains.

For decision-makers in commercial insurance, this is not theoretical data—it's essential foresight. These tools provide underwriters, brokers, and risk managers with the intelligence to price risk accurately, advise clients effectively, and maintain portfolio stability in an increasingly volatile world.

Why Climate Risk Tools Are Now Business-Critical

Ignoring climate risk is no longer a viable business strategy. For underwriters and risk managers, navigating today's market without advanced analytics is equivalent to flying a cargo plane through a hurricane without radar. The potential for catastrophic miscalculation is too high.

The escalating frequency and intensity of climate-driven events have elevated these tools from a "nice-to-have" to a fundamental component of business infrastructure. The financial consequences are significant and growing. A single wildfire can sever a supply chain for months. Gradual sea-level rise can render a coastal asset uninsurable long before it is physically damaged.

Relying on historical data alone is a formula for failure, as the past is no longer a reliable predictor of future conditions.

The core challenge is converting vast climate science into granular, actionable financial intelligence. We must move beyond general awareness of climate change to asset-level insights that directly inform underwriting, pricing, and strategic planning.

To help decision-makers manage this complexity, modern platforms have developed a core set of capabilities. These features are engineered to provide a clear, data-driven view of climate-related financial exposures.

The table below outlines the essential functions of a comprehensive climate risk assessment tool.

Core Capabilities of Modern Climate Risk Tools

| Capability | Description | Business Application |

|---|---|---|

| Physical Risk Modeling | Simulates the financial impact of acute events (hurricanes, floods, wildfires) and chronic changes (sea-level rise, drought) on specific assets. | Pinpointing property-level vulnerabilities, adjusting insurance premiums, and informing underwriting decisions for high-risk locations. |

| Transition Risk Analysis | Models the financial effects of shifting to a low-carbon economy, including policy changes, new technologies, and market sentiment. | Assessing portfolio exposure to carbon-intensive industries and identifying opportunities in emerging green sectors. |

| Supply Chain Vulnerability Mapping | Identifies critical dependencies and weak points in a company's supply chain that are exposed to climate perils. | Proactively rerouting logistics, advising clients on operational resilience, and avoiding business interruption losses. |

| Regulatory & Disclosure Reporting | Generates data and scenario analyses required for compliance with frameworks like the TCFD, CSRD, and SEC climate rules. | Ensuring regulatory compliance, enhancing corporate transparency, and meeting investor demands for climate risk disclosure. |

| Opportunity Identification | Pinpoints new business opportunities arising from climate adaptation and mitigation efforts, such as new insurance products or advisory services. | Developing innovative products for renewable energy projects, offering climate resilience consulting, and gaining a first-mover advantage. |

These capabilities work in concert to provide a 360-degree view, enabling organizations to shift from a reactive to a proactive posture.

The Shift to Proactive Risk Management

This new environment demands a fundamental change in mindset—from reactive disaster recovery to proactive, data-driven resilience. The objective is no longer merely to respond after a catastrophe but to anticipate and prepare for it. Climate risk assessment tools are the critical enablers of this transition.

They empower you to:

- Quantify future losses: Model the financial impact of specific perils like floods, droughts, or storms on an individual property or an entire portfolio.

- Strengthen business resilience: Identify hidden vulnerabilities in supply chains and operations before a climate event exposes them.

- Meet regulatory demands: Confidently comply with emerging disclosure frameworks like the TCFD by running data-backed scenario analyses.

- Gain a competitive edge: Offer clients superior risk advisory and develop more precise, competitive insurance products.

This is not a theoretical shift; significant capital is flowing into this sector as industries move to manage emerging risks.

The market data is clear. The global market for these tools, valued at USD 5.15 billion in 2024, is projected to grow to USD 48.21 billion by 2034. This growth reflects an urgent and expanding demand for data-driven foresight. You can read the full research on climate impact tool growth at Polaris Market Research.

Understanding Physical and Transition Risk

Image

To leverage any climate risk tool effectively, you must understand the two fundamental types of risk: physical risk and transition risk. These are not academic terms; they represent the primary ways climate change impacts a balance sheet, affects portfolio performance, and determines an asset's insurability.

They are two sides of the same coin. One is the direct impact of a changing climate. The other is the economic consequence of the global response to it. A strategy that overlooks either is incomplete.

The Immediate Threat of Physical Risk

Physical risk encompasses the financial damage and operational disruption caused by more frequent and severe weather events, as well as by gradual environmental changes. These risks are categorized into two distinct types that require different analytical approaches.

- Acute Physical Risks: These are the sudden, high-impact events that capture headlines. A hurricane causing billions in damages, a wildfire destroying a critical manufacturing facility, or a flash flood shutting down a logistics hub for weeks. These are short-duration, high-intensity events that result in immediate, quantifiable financial losses.

- Chronic Physical Risks: These are slower-moving issues that can be more destructive over the long term. Examples include a persistent drought that degrades agricultural water supplies or the incremental rise in sea levels that renders coastal properties and infrastructure uninsurable long before they are directly impacted by a storm.

For an underwriter, an acute risk like a hurricane might influence policy pricing for the next season. A chronic risk, like rising sea levels, will determine if that same property is insurable at all in a decade.

The imperative for insurers and risk managers is to move beyond reacting to disasters. The objective is to use modern climate risk tools to model their future probability and price their financial impact with geographic precision. This transforms unpredictable threats into quantifiable, manageable risks.

The Economic Shock of Transition Risk

While physical risk covers the direct impacts of climate events, transition risk addresses the financial consequences of the global shift to a low-carbon economy. This is a more complex, human-driven category of risk, stemming from new policies, disruptive technologies, and shifts in market sentiment. Ignoring it is as perilous as ignoring a hurricane warning.

Transition risk is driven by several key forces:

- Policy and Legal: A government can introduce a carbon tax, implement an emissions trading scheme, or enforce stringent new environmental regulations. Carbon-intensive assets can become significant liabilities overnight. For example, a portfolio of coal-fired power plants could face substantial write-downs.

- Technology: Clean technology is advancing rapidly. As innovations like affordable battery storage or green hydrogen become mainstream, they can render older, fossil-fuel-dependent business models obsolete. A company that fails to adapt will lose its competitive advantage.

- Market and Reputation: Investor and consumer attitudes are changing. Companies perceived as climate laggards already face higher costs of capital, divestment campaigns from major funds, and reputational damage that directly impacts sales.

For a commercial insurer, transition risk can manifest as a client in a high-emissions industry being unable to secure financing for a new project, resulting in the loss of associated premiums. It is a systemic financial risk, and forward-looking organizations must prepare for its impact.

Essential Features of Top Assessment Tools

Not all climate risk platforms are created equal. To move from theory to decision-making, you must understand what distinguishes a powerful tool from a basic one. The right features deliver the granular intelligence required to take strategic action against climate risk.

Image

The market for these solutions is expanding rapidly, with clear demand for specific capabilities. Services focused on physical risk currently dominate the sector. This is logical, as businesses are focused on understanding the direct, tangible impacts of climate change on their assets and operations.

Forward-Looking Scenario Analysis

The most critical feature is forward-looking scenario analysis. The past is no longer a reliable guide. This capability allows you to model potential outcomes across different global warming pathways, such as a 1.5°C, 2.0°C, or 3.0°C warmer world.

For an underwriter, this means stress-testing a portfolio against future climate conditions, not just historical ones. This is the core engine of any serious risk assessment, converting scientific projections into quantifiable financial impacts for business planning.

Asset-Level Risk Scoring and Mapping

Broad, regional risk assessments are insufficient for making precise business decisions. Top-tier tools provide granular, asset-level risk scoring. They assign a specific risk value to each property, warehouse, or factory based on its exact geographic coordinates.

This is typically visualized through interactive maps that show risk concentrations within a portfolio. A risk manager for a carrier with 500 insured properties can instantly identify which are most exposed to future wildfires or flooding. This enables surgical underwriting, targeted mitigation advice, and smarter capital allocation.

The objective is to translate large-scale climate projections into a specific, actionable risk score for an individual building. Without this hyper-local precision, climate data remains abstract and difficult to act upon.

This powerful capability is driving the growth of the climate intelligence market. Forecasts project the global market to reach USD 42.94 billion in 2025 and USD 66.82 billion by 2032. This growth is fueled by advancements in AI and big data analytics that make such detailed analysis possible. You can discover more insights about the climate risk market at Coherent Market Insights.

Key Features for Insurance Professionals

Beyond modeling and mapping, several other features are mission-critical for underwriters, brokers, and risk managers.

- Supply Chain Vulnerability Analysis: This maps a client’s entire supply chain, identifying weak links at supplier locations exposed to climate perils. It helps prevent business interruption losses before they occur.

- Automated Regulatory Reporting: Leading platforms can automatically generate the data and scenario analyses required for frameworks like TCFD, CSRD, and new SEC climate rules. This streamlines a complex reporting process.

- API and System Integration: Climate data is most effective when integrated into daily workflows. The ability to pipe risk insights directly into existing underwriting platforms, CRMs, or enterprise risk systems via an API is essential for operationalization.

Comparing Climate Modeling Approaches

The core of any climate risk assessment tool is its modeling engine. Understanding how these engines work is crucial for selecting a platform that solves your specific business problems.

Broadly, these tools use either statistical models or physical climate models.

Statistical models analyze historical data—past storm frequency, temperature fluctuations, recorded losses—to identify patterns and project them forward. They are often fast and less computationally intensive, making them suitable for high-level portfolio screening. Their primary weakness is the assumption that future conditions will mirror the past, a premise that is increasingly unreliable.

Physical models, such as General Circulation Models (GCMs), simulate the actual physics of the atmosphere and oceans. Instead of extrapolating historical trends, they model fundamental earth systems under different greenhouse gas scenarios. This provides a forward-looking view of risk, which is essential for long-term investments and pricing long-tail risks.

This table compares the different modeling methodologies.

Comparison of Climate Modeling Methodologies

| Modeling Approach | Core Principle | Best For | Key Limitation |

|---|---|---|---|

| Statistical Models | Extrapolates future risk based on historical data patterns. | Rapid, high-level portfolio screening and identifying historical trends. | Assumes the future will resemble the past, which is increasingly unreliable. |

| Physical Models (GCMs) | Simulates the fundamental physics of the Earth's climate system under different scenarios. | Long-term strategic planning, infrastructure resilience, and pricing complex, long-tail risks. | Provides a broad, regional view (e.g., a 100km grid) that's too coarse for asset-level decisions. |

| Downscaled Models | Refines coarse physical model data using AI and local information (topography, weather stations). | Asset-level risk assessment, underwriting specific properties, and detailed hazard mapping. | Computationally intensive and only as good as the local data and AI used to refine the GCM output. |

The key takeaway is that each model serves a different purpose. The goal is to select the right tool for the specific job.

Downscaling: From Global Forecast to Asset-Specific Risk

A significant limitation of powerful physical models is their scale. A GCM might predict climate conditions for a 100-kilometer grid, which is useful for regional trends but not for underwriting a single warehouse.

This is where AI and machine learning are applied through a process called downscaling.

Downscaling uses AI to refine coarse GCM data. The algorithms combine GCM output with local factors—topography, land use, historical weather station data—to translate a regional forecast into a hyper-local risk profile for a specific address. This process transforms global climate science into actionable business intelligence.

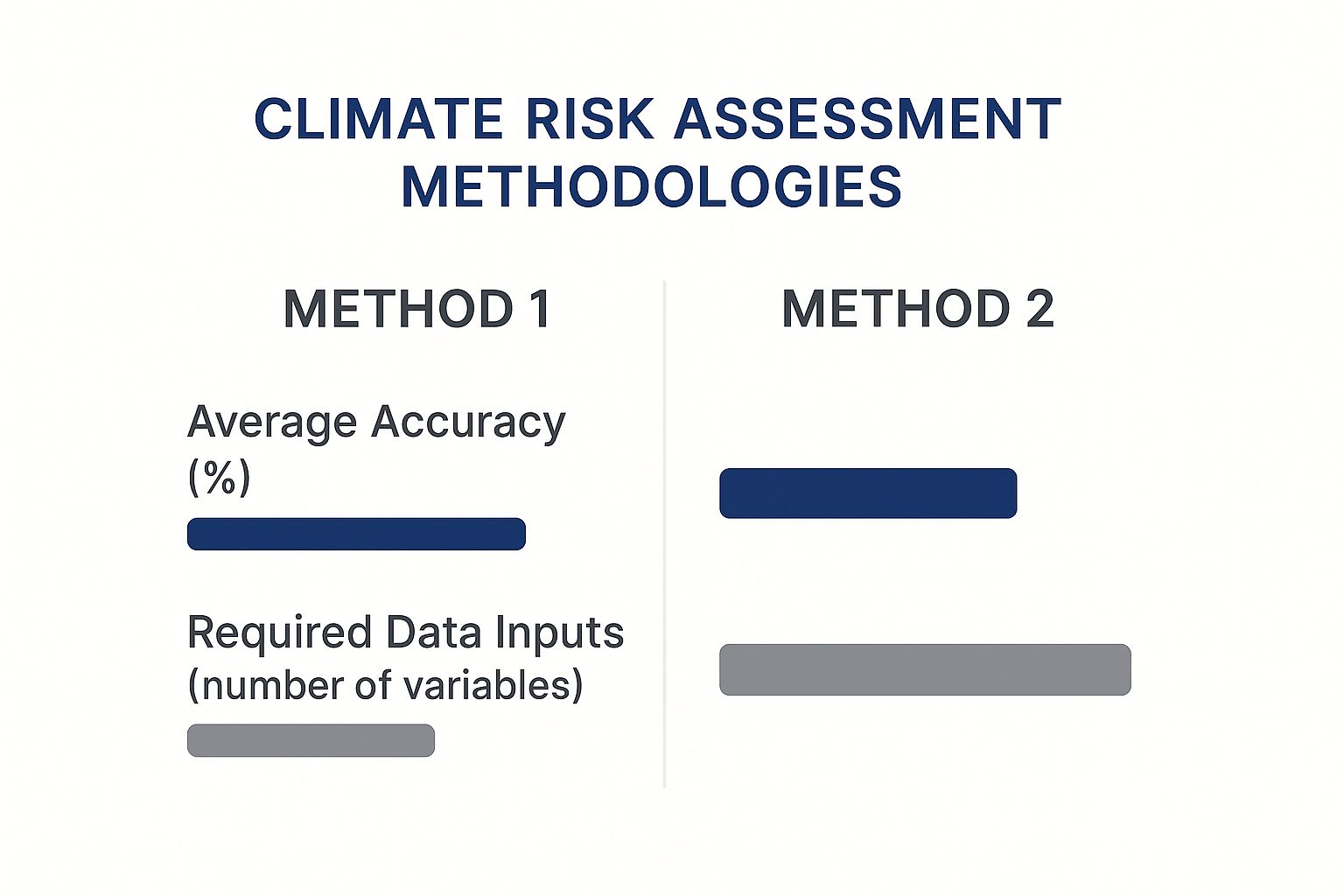

The image below illustrates how these different models compare in terms of data requirements and accuracy.

Image

As shown, forward-looking physical models require more complex inputs but deliver higher accuracy for assessing future risks. For specialized tasks, such as evaluating a building's resilience to future heatwaves or windstorms, more advanced techniques are necessary. For instance, IES three-dimensional modelling is vital for simulating how a specific building will perform under different climate pressures.

The choice of model depends on its fitness for purpose. For a high-level portfolio overview, a statistical model may be sufficient. For pricing a 30-year policy on critical infrastructure, a downscaled physical model is non-negotiable.

How To Select The Right Climate Risk Tool

Image

The market for climate risk assessment tools is expanding, and selecting one is a major strategic decision. A correct choice provides actionable intelligence that sharpens underwriting and protects your portfolio. An incorrect choice results in expensive "shelfware"—a platform that produces data that cannot be translated into meaningful business decisions.

A rigorous selection process begins with an internal assessment of your specific use cases. Are you aggregating risk across a large portfolio, underwriting high-value properties with precision, or conducting long-term strategic planning?

Key Evaluation Criteria

Once you have defined your requirements, you can evaluate vendors against a concrete set of standards.

Here’s what to focus on:

- Data Granularity and Accuracy: Can the tool pinpoint risk at a specific street address, or does it only provide broad, regional estimates? Challenge vendors to demonstrate how their models handle the specific perils relevant to your book of business, such as wildfire, flash floods, or hurricane storm surge.

- Model Transparency: You must understand the methodology behind a risk score. Inquire about the underlying climate models (statistical or physical GCMs) and the downscaling methods used. A reliable partner can explain their methodology clearly.

- Integration and Workflow: How will this data be integrated into your team's processes? The goal is to embed climate intelligence directly into your existing underwriting workbench or CRM, not to create a separate, cumbersome process.

The true test of a climate risk tool is not the volume of data it provides, but how effectively it answers your most critical business questions. The platform must connect global climate scenarios directly to the financial risk facing your portfolio and your clients' assets.

The rapid growth in the climate adaptation market highlights the critical need for effective risk assessment.

Image

This market was valued at USD 30.13 billion in 2024 and is projected to reach USD 104.93 billion by 2032. This represents a significant flow of capital into resilience and risk mitigation.

Before making a final decision, broaden your research. Investigating lists of the best tools to track environmental impact can provide a more comprehensive view of available solutions, ensuring an informed choice.

Embedding Climate Intelligence into Your Strategy

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/2AwT_zyx-eI" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Acquiring a powerful climate risk assessment tool is only the first step. The ultimate goal is to integrate climate analytics into your organization's core processes to make smarter business decisions.

This is not about generating another risk report. It is about operationalizing data to sharpen risk selection, build enterprise resilience, and identify opportunities that competitors miss. The insights from these tools must become a fundamental input for your most critical business decisions.

For example, underwriting teams can move beyond broad regional estimates. By feeding asset-level risk scores directly into pricing models and daily workflows, they can make precise, data-backed decisions on insuring, adjusting, or declining a specific property with speed and accuracy.

Climate risk assessment is not a one-time project; it is an ongoing process. Effective climate risk management requires clear ownership and collaboration across the entire organization, from the C-suite to front-line underwriters.

From Data To Decisive Action

Effective integration requires a clear roadmap for embedding climate intelligence into both daily operations and long-term strategy, ensuring every data point leads to a tangible business outcome.

Your plan should focus on three key areas:

- Sharpening Underwriting and Risk Selection: Embed hyperlocal climate peril data directly into underwriting platforms. This empowers your team to accurately price complex risks and decline exposures that fall outside your refined risk appetite.

- Bolstering Enterprise Risk Management: Use scenario analysis to stress-test your entire portfolio against different future climate pathways. This will uncover hidden risk concentrations and inform capital allocation and reinsurance structuring.

- Informing Strategic Growth: Use climate analytics to identify new revenue streams. This could include developing new insurance products for climate-resilient infrastructure, offering high-value advisory services, or strategically entering markets positioned to thrive in a changing climate.

Building Your Cross-Functional Climate Team

This is not a task for a single department. Success depends on a dedicated cross-functional team with leaders from underwriting, risk management, operations, and strategy.

This team's primary mission is to ensure that insights from your climate tools are understood, trusted, and acted upon. By establishing clear lines of responsibility and fostering collaboration, you can transform raw data into a powerful engine for long-term profitability and a sustainable competitive advantage.

Frequently Asked Questions

When evaluating climate risk tools for the first time, it is normal to have questions. Here are straightforward answers to some of the most common inquiries from decision-makers.

What's the Difference Between a Weather Forecast and a Climate Risk Assessment Tool?

The primary difference is timescale and purpose. A weather forecast provides short-term atmospheric predictions, typically for the next few days or week. It answers the question, "Do I need an umbrella tomorrow?"

A climate risk assessment tool is designed for long-term strategic analysis. It models how decades of climatic change will affect assets, considering chronic stresses like rising sea levels and acute shocks like more intense hurricanes. It answers the question, "Will this coastal asset be insurable in twenty years?"

How Do These Tools Help with Regulatory Frameworks Like TCFD?

These tools serve as the analytical engine for your TCFD (Task Force on Climate-related Financial Disclosures) reporting. Leading platforms automate the generation of quantitative data and scenario analyses required by frameworks like TCFD.

This includes modeling the potential financial impact on your business under different climate futures, such as a 1.5°C vs. a 3.0°C warming scenario. This capability transforms a significant reporting burden into a manageable, data-driven process.

These platforms are not just for compliance; they enable confident communication. They provide the hard data needed to articulate your climate strategy to investors, regulators, and stakeholders, all backed by credible scientific analysis.

Are These Tools Only for Large Corporations?

Not anymore. While this type of analysis was once limited to large enterprises, the landscape has changed.

A new generation of SaaS-based tools has made sophisticated climate intelligence accessible and affordable for small and mid-sized businesses (SMEs). An SME can now analyze risks to its facilities and supply chains. An insurance broker can use these platforms to deliver high-value advisory services to their entire book of business, creating a significant competitive advantage.

---

At Sentinel Shield, we turn climate crises into tangible business opportunities. Our platform detects disasters like floods and wildfires at a hyperlocal level and delivers verified, geo-targeted leads of affected businesses to insurance providers and recovery firms within 24 hours. Learn more about how Sentinel Shield can help you reach high-intent prospects at their moment of greatest need.