In an era defined by volatility, from unprecedented climate events to complex market shifts, a reactive approach to risk is a direct path to obsolescence. For decision-makers in commercial insurance and climate risk, mastering risk management is not a defensive play; it's the core of strategic growth and client trust. Proactive, intelligent risk mitigation separates industry leaders from the laggards, safeguarding assets and building resilience into every facet of the operation.

This article delivers a comprehensive guide to the most critical and actionable best practices for risk management. We have curated nine essential strategies that empower underwriters, brokers, and risk managers to transform uncertainty into a competitive advantage. This guide provides a clear roadmap for protecting portfolios, enhancing operational integrity, and leading with confidence in a turbulent landscape.

This guide provides specific, practical insights into:

- Establishing a foundational risk management framework and culture.

- Implementing comprehensive risk identification and assessment protocols.

- Integrating risk management directly with strategic business planning.

- Developing robust crisis management and business continuity capabilities.

Each section is a functional tool, offering implementation details tailored to the unique challenges of the insurance and climate risk industries. By applying these proven strategies, your organization can build a more resilient, predictable, and profitable future. We will explore how to establish clear governance, implement effective mitigation tactics, and create robust monitoring systems that provide a crucial strategic edge.

1. Establish a Risk Management Framework and Culture

A foundational best practice for risk management is to construct a comprehensive framework that integrates risk awareness into your organization's core DNA. This goes beyond a simple checklist; it involves creating a systematic, organization-wide approach to identifying, assessing, mitigating, and monitoring risks. A robust framework ensures that risk management is not an isolated function but a core component of strategic planning and daily operations, championed from the boardroom to front-line teams.

Establish a Risk Management Framework and Culture

This structure provides clarity on roles, responsibilities, and escalation paths, ensuring that potential threats—whether operational, financial, or climate-related—are addressed promptly and effectively. For a deeper understanding of the sequential steps involved in building a robust risk framework, explore this guide on the five stages of risk management. A well-defined framework, promoted by bodies like COSO and the Institute of Risk Management (IRM), transforms risk management from a reactive exercise into a proactive, value-adding discipline.

How to Implement a Risk-Aware Culture

A framework is only as effective as the culture that supports it. Fostering an environment where every team member feels responsible for managing risk is critical for success.

- Champion from the Top: Leadership must visibly and consistently endorse the risk management framework. When executives actively discuss risk in meetings and strategic sessions, it signals its importance to the entire organization.

- Integrate and Normalize: Embed risk discussions into routine business activities, such as project kick-offs, quarterly reviews, and team meetings. This makes risk consideration a natural part of the workflow rather than a separate, burdensome task.

- Provide Practical Training: Use real-world case studies and scenarios relevant to your industry, like modeling the portfolio impact of a specific climate event or a significant cyber breach. This makes training more engaging and its lessons more tangible.

- Measure and Communicate: Develop key risk indicators (KRIs) and culture metrics, such as the number of risks identified by front-line staff or the speed of incident reporting. Regularly share these metrics to reinforce accountability and demonstrate progress.

2. Implement Comprehensive Risk Identification and Assessment

Once a framework is in place, the next critical step is to systematically identify and evaluate potential risks across every business dimension. This involves a disciplined, repeatable process for discovering, analyzing, and prioritizing threats before they can impact operations, finance, or strategic objectives. Effective risk identification moves beyond surface-level reviews, employing both quantitative and qualitative methods to understand the likelihood and potential impact of diverse events, from supply chain disruptions to sudden climate-related disasters.

Implement Comprehensive Risk Identification and Assessment

This comprehensive approach allows organizations to develop a detailed risk register and apply sophisticated techniques like scenario analysis and stress testing. For example, financial institutions utilize Value-at-Risk (VaR) modeling to quantify potential portfolio losses, while energy firms conduct extensive scenario analysis to assess the long-term impacts of climate change. By rigorously evaluating risks, businesses can allocate resources more effectively, turning this core discipline into a strategic advantage. For a closer look at the foundational concepts that power this process, you can explore these core risk management principles.

How to Implement Systematic Risk Assessment

A thorough and recurring assessment process is essential for maintaining an accurate view of your organization's risk landscape. This ensures that your risk management strategies remain relevant and effective.

- Use Diverse Identification Techniques: Combine methods like stakeholder workshops, structured interviews, historical data analysis, and checklists to uncover a wide spectrum of risks. Involving a cross-functional team ensures you capture operational, financial, and strategic threats from multiple perspectives.

- Regularly Update Risk Profiles: The business environment is dynamic. Schedule periodic risk assessment reviews, especially after significant events like a merger, a new product launch, or a major regulatory change, to keep your risk register current.

- Apply Quantitative and Qualitative Analysis: Use qualitative methods like risk matrices to rank risks by likelihood and impact. For high-priority risks, apply quantitative techniques like Monte Carlo simulations or sensitivity analysis to model financial or operational impacts with greater precision.

- Document Assumptions and Methodology: Maintain clear and transparent documentation for how each risk was identified, assessed, and evaluated. This creates a defensible audit trail and ensures consistency in future assessments.

3. Develop Risk Appetite and Tolerance Statements

A crucial element of effective risk management is clearly defining the amount and types of risk an organization is willing to accept in pursuit of its objectives. This involves establishing formal risk appetite and tolerance statements that act as guideposts for strategic and operational decision-making. These statements translate the organization's high-level strategy into practical risk-taking boundaries, ensuring alignment from the C-suite to front-line underwriters.

Develop Risk Appetite and Tolerance Statements

This practice, strongly advocated by bodies like the Financial Stability Board, provides a consistent language for discussing risk and prevents decentralized or inconsistent risk-taking. For instance, a commercial insurer's appetite statement might specify zero tolerance for regulatory non-compliance but a moderate appetite for underwriting risks in emerging climate-resilient industries. This clarity helps allocate capital and resources efficiently, preventing the firm from taking on unintended or excessive exposures that could threaten its solvency or reputation.

How to Implement Risk Appetite and Tolerance

Translating strategic goals into actionable risk limits requires a structured approach. An effective risk appetite statement is not a theoretical document; it is an active management tool.

- Align with Business Strategy: Ensure your risk appetite directly supports your organization's strategic objectives. If a key goal is expanding into catastrophe-prone regions, the appetite statement must reflect the increased risk tolerance for natural hazard exposures, balanced by specific limits on aggregate portfolio concentration.

- Use Both Quantitative and Qualitative Metrics: Combine high-level qualitative statements (e.g., "We have a low appetite for reputational damage") with quantitative key risk indicators (KRIs) and tolerance limits (e.g., "Aggregate probable maximum loss from a single climate event must not exceed 10% of shareholder equity"). This dual approach makes the appetite tangible and measurable.

- Communicate Clearly and Consistently: The risk appetite framework must be communicated effectively across all levels of the organization. Underwriters, brokers, and recovery partners need to understand how these boundaries impact their daily decisions, from policy pricing to claims management.

- Test and Review Regularly: An organization's risk profile and the external environment are constantly changing. Regularly review and stress-test your risk appetite against actual risk-taking behavior and emerging threats, such as new climate models or regulatory shifts, to ensure it remains relevant and effective.

4. Create Robust Risk Monitoring and Reporting Systems

Effective risk management is not a one-time assessment; it is a continuous, dynamic process. Implementing robust monitoring and reporting systems is a critical best practice, allowing organizations to maintain constant vigilance over their risk landscape. This involves establishing processes and leveraging technology to track key risk indicators (KRIs), monitor control effectiveness, and deliver timely, actionable intelligence to stakeholders at all levels.

Create Robust Risk Monitoring and Reporting Systems

A well-designed system transforms raw data into strategic insight, enabling proactive decision-making rather than reactive problem-solving. It provides a clear line of sight into emerging threats, whether they are market fluctuations impacting an investment portfolio, supply chain disruptions affecting recovery efforts, or evolving climate-related perils. Platforms that integrate vast datasets to provide comprehensive risk views exemplify this principle of technology-driven risk oversight.

How to Implement Effective Monitoring and Reporting

Building a system that delivers the right information to the right people at the right time is essential. A successful approach moves beyond simple data collection to create meaningful, decision-useful reporting.

- Focus on Actionable Metrics: Avoid "analysis paralysis" by concentrating on KRIs directly linked to business objectives and risk appetite. Instead of tracking every possible variable, identify the vital few metrics that signal a meaningful change in your risk profile.

- Customize Reports for Different Audiences: The Board of Directors requires a high-level, strategic overview of top risks, while an underwriting team needs granular data on portfolio concentrations. Tailor dashboards and reports to provide relevant context and detail for each stakeholder group.

- Implement Automated Alerts: Set up automated notifications for when a KRI breaches a pre-defined threshold. This ensures that emerging threats are escalated immediately, allowing for rapid response and mitigation before a minor issue becomes a major crisis.

- Regularly Review and Update Criteria: The risk landscape is constantly evolving. Schedule periodic reviews of your monitoring criteria, KRIs, and reporting formats to ensure they remain relevant, effective, and aligned with your organization's strategic priorities.

5. Establish Clear Risk Governance and Accountability

A critical best practice for risk management involves establishing clear governance structures with well-defined roles and responsibilities. This ensures that accountability for identifying and managing risks is not ambiguous but is instead embedded within the organization’s hierarchy. Effective governance creates a formal system of checks and balances, distributing risk management duties from the board level down to individual business units, ensuring comprehensive oversight and swift decision-making.

This structure provides a clear chain of command and designates who owns specific risks, who is responsible for mitigation efforts, and who has the authority to make critical decisions. Major financial institutions have repeatedly restructured their risk oversight functions after significant losses, demonstrating how governance reform directly addresses systemic failures. These models, often influenced by regulations like the Sarbanes-Oxley Act, turn abstract policies into a functioning, accountable system.

How to Implement Clear Risk Governance

An effective governance model provides the authority and independence needed for the risk function to operate without undue influence, balancing oversight with business enablement.

- Define Clear Roles and Reporting Lines: Establish roles like a Chief Risk Officer (CRO) and dedicated risk committees with formal charters outlining their authority. Ensure the risk function has a direct reporting line to the board or a board committee to maintain independence.

- Create Formal Escalation Paths: Develop and communicate clear procedures for escalating risk issues. Front-line teams must know precisely when and to whom they should report emerging threats, ensuring that critical information reaches decision-makers without delay.

- Empower with Authority: The risk management function must have the necessary authority to challenge business decisions. This includes the power to veto projects or initiatives that carry unacceptable levels of risk, a key principle highlighted by financial regulators.

- Conduct Regular Training and Reviews: Provide ongoing training for board members and risk committee members on emerging risks, such as new climate-related financial disclosures or evolving cyber threats. Regularly review and update the governance framework to ensure it remains effective and aligned with business strategy.

6. Implement Effective Risk Mitigation Strategies

Once risks are identified and assessed, the next critical step is to develop and implement effective mitigation strategies. This best practice involves creating a deliberate plan to treat identified threats based on the organization's risk appetite and strategic goals. It’s about making a conscious choice to either reduce, transfer, avoid, or accept each risk to minimize potential negative impacts on operations, finance, and reputation.

A well-executed mitigation plan translates assessment into action. It includes deploying a range of tools like insurance programs, operational controls, hedging strategies, and detailed contingency planning. For example, a global logistics firm diversifies its shipping routes to mitigate geopolitical and climate-related disruptions, while a commercial property insurer might require specific building code enhancements in high-risk zones. This strategic approach, central to frameworks like ISO 31000, ensures that the response is proportional to the risk and aligned with business objectives.

How to Implement Risk Mitigation Strategies

Effective implementation requires a structured, multi-faceted approach that goes beyond a single solution and focuses on building resilience across the organization.

- Select Appropriate Treatments: Evaluate each risk and choose the best course of action. This could mean Avoiding the risk by ceasing a certain activity, Reducing it through improved controls, Transferring it via insurance or contracts, or Accepting it when the potential impact is within the defined risk appetite.

- Conduct a Cost-Benefit Analysis: Every mitigation effort has a cost. Analyze whether the expense of implementing a control, such as a new cybersecurity system or a business continuity plan, is justified by the potential reduction in risk exposure. This ensures resources are allocated efficiently.

- Develop and Test Contingency Plans: Don't wait for a crisis to test your response. Regularly conduct drills and simulations for critical scenarios, such as the operational impact of a major hurricane, to identify gaps and refine your contingency plans. For businesses in specific sectors, detailed approaches such as applying essential retail loss prevention strategies can be critical for protecting assets.

- Diversify Mitigation Efforts: Avoid relying on a single mitigation strategy, which can create a new point of failure. Combine different approaches, such as purchasing insurance, implementing stronger internal controls, and establishing redundant operational capabilities to create layered defenses against significant threats.

7. Conduct Regular Risk Reviews and Updates

Risk management is not a static, one-time exercise; it is a dynamic process that must adapt to a constantly shifting landscape. One of the most critical best practices is to establish a systematic cycle of reviewing and updating your risk assessments, strategies, and controls. This ensures that your framework remains relevant and effective as your business, the market, and the external environment—including climate patterns—evolve.

A disciplined review process transforms risk management from a reactive measure into a proactive, continuous improvement loop. It allows organizations to validate the effectiveness of existing mitigation efforts, identify new and emerging threats, and realign risk priorities with strategic objectives. This approach, central to frameworks like ISO 31000 and the Plan-Do-Check-Act (PDCA) methodology, ensures that risk management practices do not become outdated or ineffective, thereby protecting portfolio value and enhancing resilience over the long term.

How to Implement Regular Risk Reviews

An effective review process is scheduled, comprehensive, and action-oriented. It should be embedded into the organization’s operational rhythm to ensure consistency and accountability.

- Schedule Formal Review Cycles: Align risk reviews with key business planning cycles, such as quarterly business reviews or annual strategic planning sessions. This ensures risk insights directly inform decision-making. For example, a leading insurer might conduct formal enterprise-wide risk assessments annually to update its risk profile.

- Incorporate Diverse Perspectives: Look beyond the internal risk team. Involve department heads, front-line managers, and even external consultants or industry benchmarks to challenge assumptions and uncover blind spots. This provides a more holistic and objective view of the risk landscape.

- Focus on Both Existing and Emerging Risks: While it is crucial to assess the performance of controls for known risks, dedicate significant attention to identifying emerging threats. For climate risk professionals, this means regularly updating models with new scientific data and monitoring shifts in regulatory policies.

- Document and Communicate Changes: Clearly document all findings, decisions, and updates to the risk register and mitigation plans. Communicate these changes effectively across the organization to ensure all stakeholders are aware of new priorities and responsibilities, reinforcing a culture of proactive risk awareness.

8. Integrate Risk Management with Strategic Planning

One of the most powerful best practices for risk management involves weaving it directly into the strategic planning process. This approach elevates risk management from a compliance-focused, siloed activity to an integral component of high-level decision-making. By embedding risk considerations into strategy, organizations can proactively balance risk and opportunity, ensuring that every major business decision is made with a full understanding of its potential consequences.

This integration ensures that risk appetite is not just a theoretical statement but a practical guide that shapes strategic objectives. When strategic planning and risk management are aligned, a company can pursue ambitious goals, such as market expansion or product innovation, with greater confidence. This principle is a cornerstone of modern corporate strategy, emphasizing that sustainable competitive advantage is built on making informed, risk-adjusted choices.

How to Implement Integrated Strategic Risk Management

Fusing risk analysis with strategic planning requires a deliberate and structured approach. The goal is to make risk-based thinking a natural part of charting the organization's future.

- Involve Risk Professionals Early: Ensure risk managers, underwriters, and climate-risk analysts are included in strategic planning sessions from the very beginning, not just as reviewers at the end. Their insights can help shape more resilient and realistic strategic goals.

- Use Risk-Adjusted Metrics: Move beyond traditional performance metrics. Incorporate risk-adjusted return on capital (RAROC) and other similar measures to evaluate the true potential of strategic initiatives, ensuring that potential rewards justify the associated risks.

- Align Risk Appetite with Objectives: Explicitly define and communicate the organization's risk appetite and tolerance levels. Then, ensure all strategic objectives are evaluated against this framework. For example, a goal to enter a new, volatile market must align with the stated appetite for geopolitical and climate-related risks.

- Employ Scenario Analysis: Develop and analyze multiple strategic scenarios, including best-case, worst-case, and most-likely outcomes. Stress-test strategies against potential disruptions like sudden regulatory changes, supply chain breakdowns, or severe weather events to build a more robust plan.

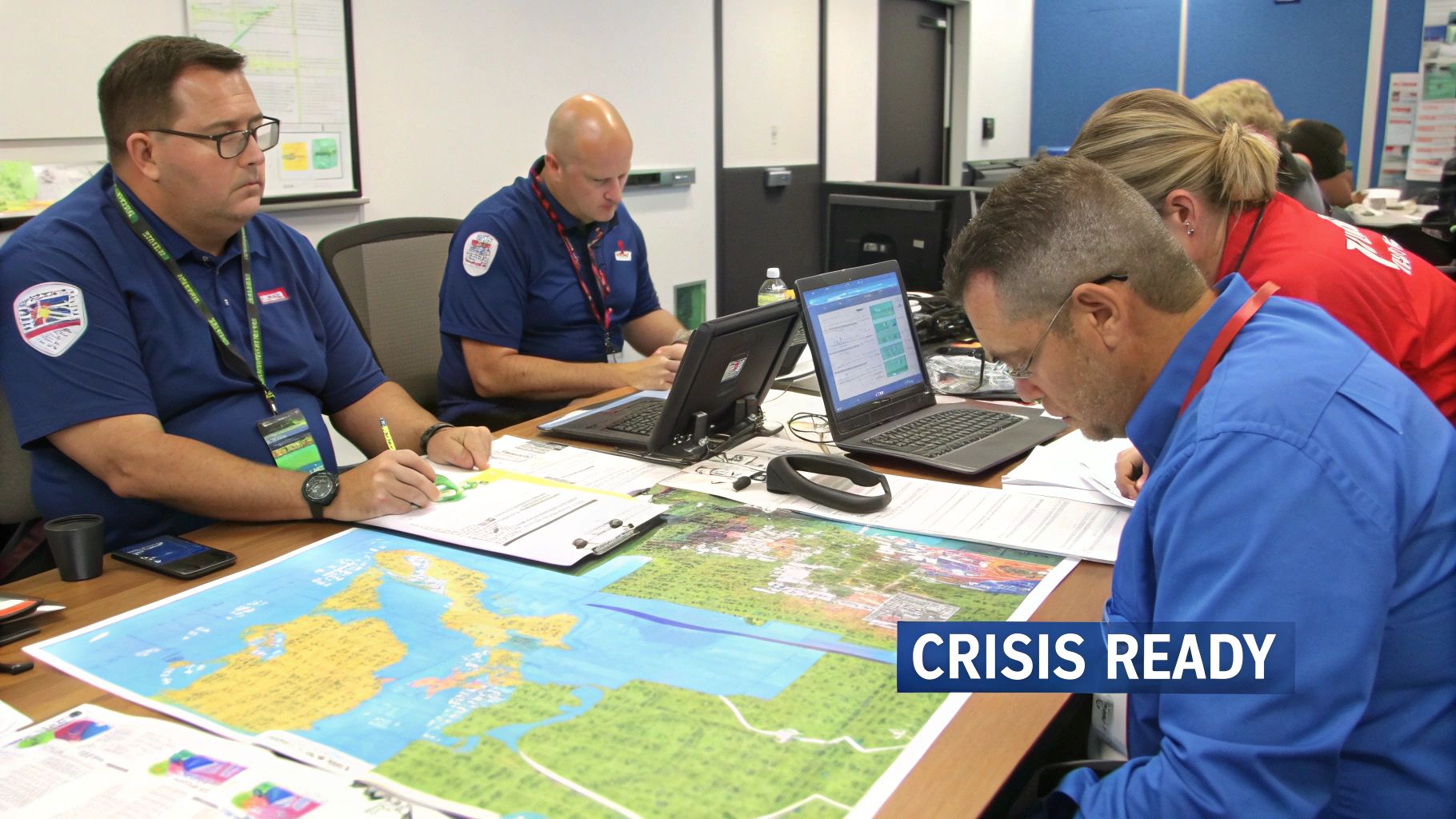

9. Develop Crisis Management and Business Continuity Capabilities

Even the most robust risk management framework cannot eliminate all threats. Therefore, a critical best practice involves building comprehensive capabilities to respond effectively when major risk events occur. This means establishing crisis management protocols, business continuity plans, and disaster recovery procedures designed to navigate low-probability, high-impact events that could disrupt operations or threaten organizational survival, from severe climate events to reputational crises.

This proactive preparation ensures that leadership can act decisively, employees know their roles, and the business can maintain essential functions during a crisis. A fundamental aspect of this is creating a robust strategy, often guided by a comprehensive business continuity plan template and guide, to ensure organizational resilience. The goal is not just to survive a crisis but to manage it in a way that protects brand reputation, stakeholder trust, and long-term value.

How to Implement Crisis and Continuity Plans

Effective crisis management is about preparation, not improvisation. Building this capability requires a structured and disciplined approach to ensure your organization is ready to act under pressure.

- Establish Clear Protocols: Define specific triggers for activating the crisis management team, outline roles and responsibilities, and create clear decision-making and communication hierarchies. This removes ambiguity when a crisis hits.

- Conduct Regular Drills and Simulations: Test your plans with realistic scenarios, such as a major supply chain disruption following a hurricane or a widespread data breach. These exercises identify weaknesses and build "muscle memory" for the response team.

- Develop a Communications Strategy: Prepare pre-approved messaging templates and identify designated spokespersons for internal and external stakeholders. A clear, consistent, and empathetic communication plan is vital for managing perceptions and maintaining trust.

- Continuously Learn and Adapt: After any drill or actual event, conduct a thorough post-mortem to analyze what worked and what didn't. Use these lessons to refine and update your plans, ensuring they remain relevant and effective. To explore this topic further, discover more on building effective business resilience strategies.

Best Practices for Risk Management: 9-Point Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Establish a Risk Management Framework and Culture | High: Requires cultural change and governance setup | High: Time, training, and governance resources | Consistent risk approach, improved decision-making | Organizations seeking enterprise-wide risk integration | Enhances compliance, stakeholder confidence |

| Implement Comprehensive Risk Identification and Assessment | Medium-High: Data-heavy and systematic analysis | High: Data collection, modeling tools | Comprehensive risk landscape visibility | Businesses needing detailed risk profiling | Enables data-driven prioritization |

| Develop Risk Appetite and Tolerance Statements | Medium: Policy development and board approval | Medium: Analytical and communication resources | Clear risk boundaries and aligned decision-making | Companies defining risk limits aligned with strategy | Improves resource allocation and communication |

| Create Robust Risk Monitoring and Reporting Systems | High: Technology and process implementation | High: IT systems and ongoing maintenance | Proactive risk tracking and early warning | Firms requiring real-time risk oversight | Speeds decision-making, regulatory reporting |

| Establish Clear Risk Governance and Accountability | Medium: Role definition and committee setup | Medium-High: Staffing and governance investment | Defined accountability and improved oversight | Organizations focusing on risk ownership clarity | Strengthens independent risk oversight |

| Implement Effective Risk Mitigation Strategies | Medium: Strategy design and execution | Medium-High: Controls, insurance, contingency | Reduced losses and enhanced resilience | Businesses managing operational, financial risks | Offers diverse risk treatment options |

| Conduct Regular Risk Reviews and Updates | Medium: Recurring processes and updates | Medium: Continuous resource allocation | Up-to-date risk management and identification | Organizations in dynamic or regulated environments | Ensures relevance and continual improvement |

| Integrate Risk Management with Strategic Planning | Medium-High: Requires alignment and cultural change | Medium: Training and planning integration | Balanced risk-opportunity decisions | Companies embedding risk in strategic decisions | Enhances sustainability and competitive edge |

| Develop Crisis Management and Business Continuity Capabilities | High: Complex planning and testing | High: Preparation, simulations, and training | Minimized disruption and faster recovery | Organizations prone to high-impact risk events | Protects reputation and operational continuity |

From Insight to Impact: Activating Your Risk Intelligence

We have explored nine foundational pillars for building a resilient organization. From establishing a framework to integrating risk with strategic planning, these best practices are not isolated tactics. They represent an interconnected ecosystem designed to transform your approach from defensive and reactive to proactive and strategic. This is a journey of organizational maturity, where risk is no longer viewed as a hazard to be avoided but as an integral variable in the equation of sustainable growth.

For professionals in commercial insurance and climate risk, mastering these principles is a strategic imperative. Your clients and portfolios are on the front lines of escalating climate volatility, economic uncertainty, and complex geopolitical shifts. A superficial approach to risk management is insufficient. The true value lies in embedding these concepts deep within your operational DNA, making them a reflexive part of every decision, from underwriting a new policy to planning a client's business continuity strategy.

The Synthesis of Strategy and Action

Effective risk management is an active, not a passive, discipline. It requires a continuous cycle of identification, assessment, mitigation, and monitoring. The core imperatives are clear:

- Culture Over Compliance: A robust framework is essential, but it is inert without a culture of risk awareness. The goal is to empower every team member to see themselves as a risk manager, fostering a collective responsibility that transcends departmental silos.

- Data-Driven Decisions: The era of relying on historical data alone is over, especially in climate risk. The implementation of comprehensive risk identification and robust monitoring systems must be powered by predictive analytics and real-time intelligence to gain a decisive edge.

- Strategic Alignment: Risk appetite statements and mitigation strategies cannot exist in a vacuum. They must be directly and explicitly linked to your organization's strategic objectives. This alignment ensures that risk management enables, rather than hinders, the pursuit of growth and innovation.

Ultimately, these best practices for risk management are about building organizational intelligence. They equip you to not only anticipate and navigate threats but also to identify and seize opportunities that others might miss.

Activating Your Advantage in an Uncertain World

In an environment defined by rapid change, particularly climate-related perils, your ability to translate risk insight into tangible impact is what will set you apart. For recovery service firms, this means anticipating where services will be needed most. For insurance brokers and underwriters, it means crafting policies that accurately reflect emerging threats while remaining competitive. This is the essence of risk intelligence: converting potential crises into moments of profound value creation for your clients and stakeholders.

The principles discussed in this article provide the blueprint. Your challenge is to bring that blueprint to life. It requires leadership commitment, investment in technology, and a relentless focus on continuous improvement. By doing so, you are not just managing risk; you are architecting a future of resilience, stability, and opportunity. You are building an organization that doesn't just survive uncertainty but is engineered to thrive within it. The path forward demands a commitment to transforming these concepts from a checklist into a core competency, ensuring your organization remains an indispensable partner in a world of ever-present risk.

---

Ready to elevate your risk management strategy with cutting-edge climate intelligence? Insurtech.bpcorp.eu transforms climate and peril data into actionable, validated business opportunities, connecting you with clients at their moment of need. Discover how our platform can help you implement these best practices for risk management by visiting Insurtech.bpcorp.eu today.