Effective insurance lead generation is not a marketing task—it is the core engine that powers profitability and secures long-term market position. For decision-makers in commercial insurance, mastering this function is the difference between stagnation and building a resilient, profitable enterprise.

This guide outlines a strategic system for attracting, nurturing, and converting high-intent prospects into valuable, long-term clients. It provides actionable frameworks for underwriters, brokers, and risk managers to move beyond reactive tactics and build a predictable pipeline of ideal-fit business.

Why Strategic Lead Generation Is Your Growth Engine

Image

In a competitive market, a passive approach to client acquisition is a business liability. Relying on referrals or outdated methods leaves growth to chance. A strategic lead generation framework reverses this dynamic, empowering underwriters, brokers, and risk managers to proactively build a pipeline of qualified clients.

This is not about casting a wide net; it is about surgical precision. The objective is to evolve from a reactive model—chasing low-quality, high-cost leads—to a proactive system that consistently delivers clients whose risk profiles align with your underwriting appetite and business objectives.

Fueling Premium Growth and Portfolio Quality

A sophisticated lead generation system directly fuels premium growth by creating a steady, predictable flow of qualified opportunities. By consistently identifying and engaging businesses with specific, unaddressed needs—such as emerging climate risks—you are not just selling a policy. You are delivering a critical solution at the point of need.

This targeted approach improves the quality of your risk portfolio. By focusing on high-intent prospects, you attract clients who understand the value of robust coverage, which leads to:

- Higher Lead-to-Quote Ratios: Prospects are pre-qualified by relevance and intent.

- Improved Quote-to-Bind Rates: Engaged, relevant leads are more likely to convert.

- Stronger Client Retention: Relationships are built on solving specific business problems.

This proactive stance is critical. The global lead generation market is projected to reach USD 6.38 billion by 2025, growing at 8.3% annually. This growth is driven by the demand for more targeted, data-driven marketing. You can discover more about these lead generation market trends to understand how they are reshaping the industry.

The Shift from Reactive to Proactive

Mastering lead generation requires a fundamental shift from a reactive to a proactive operational mindset.

Comparing Lead Generation Approaches

| Attribute | Traditional Approach | Strategic Approach |

|---|---|---|

| Mindset | Reactive (Waiting for inquiries) | Proactive (Manufacturing opportunities) |

| Focus | Volume of leads | Quality and relevance of leads |

| Tactics | Purchased lists, cold calls | Data-driven prospecting, content, referrals |

| Outcome | Unpredictable pipeline, high cost-per-acquisition | Sustainable growth, higher ROI |

This table illustrates the core difference: the traditional approach is vulnerable to market volatility, while the strategic approach puts you in control of your growth.

Adopting a strategic model means integrating modern tactics that build a sustainable asset for your business. For instance, understanding how inbound marketing for lead generation can create a powerful attraction mechanism is a critical first step. It is about drawing clients in rather than perpetually chasing them.

A high-performance lead generation engine doesn't just find customers; it manufactures opportunities. It systematically identifies businesses with specific risk profiles and delivers them to your underwriting team, turning market intelligence into profitable growth.

Ultimately, a strategic insurance lead generation program is the foundation of market leadership. It provides control over your growth trajectory, enables fine-tuning of your risk portfolio, and builds a resilient business that can thrive in any market condition.

Building Your High-Performance Lead Generation Funnel

Image

A top-tier insurance lead generation strategy is not a single tactic; it is a high-performance engine where every component works in unison to drive profitable growth. For decision-makers in commercial insurance, this engine is a modern lead funnel designed to attract, engage, and convert ideal clients.

This is a marketing ecosystem, not a series of random acts. Each channel and tactic must be aligned to generate profitable growth and maximize the return on every dollar and hour invested.

Pillar 1: Digital Advertising for Immediate Impact

Precision-targeted digital advertising is the ignition for your lead generation engine. It delivers immediate visibility and places your solutions directly in front of decision-makers at their moment of need.

Data from the U.S. market underscores its importance. Insurance companies invested approximately $11.7 billion in digital advertising in 2021, with projections reaching $12.51 billion in 2022. The sector's marketing spend outpaces all others by nearly 8%, signaling the critical role of these campaigns.

For commercial insurance brokers and underwriters, effective strategy requires more than generic ads:

- LinkedIn Targeting: Isolate specific industries, company sizes, and job titles like "Risk Manager" or "CFO."

- Geofenced Campaigns: Target businesses in geographic zones recently impacted by severe weather or new regulations.

- Retargeting: Re-engage prospects who visited specific policy pages (e.g., commercial property, liability) but did not convert.

Pillar 2: Content Marketing to Build Authority

While advertising provides initial velocity, content marketing is the high-octane fuel for sustained performance. This is how you establish your firm as an authority, attracting prospects who are actively researching solutions to specific risk management challenges.

Your content must directly address the pain points of risk managers and business owners. Develop assets that solve specific problems.

A risk manager grappling with escalating wildfire threats does not need a generic article on "business insurance." They require a detailed guide on parametric policies for wildfire risk, a case study on post-fire business continuity, or a practical checklist for hardening commercial properties against ember intrusion.

This targeted approach builds trust and pre-qualifies prospects. You transition from selling a product to providing demonstrable value, turning expertise into a magnet for ideal clients.

Pillar 3: SEO for Sustainable Organic Traffic

Search Engine Optimization (SEO) is the framework of your lead generation engine, providing long-term durability. A robust SEO strategy ensures your firm is discovered by businesses actively searching for your solutions, generating a consistent stream of organic traffic without a per-click cost.

When a decision-maker searches for "commercial flood insurance in Texas" or "cyber liability for manufacturers," your agency must appear prominently. This requires a sharp focus on:

- Keyword Research: Identifying the exact terms your ideal clients use in search engines.

- On-Page Optimization: Structuring your web pages to directly answer those search queries.

- Local SEO: Optimizing your Google Business Profile to appear in local and map-based search results.

To optimize funnel efficiency, consider implementing effective chatbot strategies for lead generation. Chatbots can engage visitors 24/7, field initial questions, and qualify leads in real-time, preventing opportunity loss. For further insights on funnel optimization, our guide on how to generate insurance leads effectively provides additional actionable tactics.

Using Climate Intelligence For Precision Targeting

Traditional insurance lead generation relies on broad targeting based on firmographics or industry codes. This approach fills the pipeline with low-intent prospects, forcing brokers and underwriters to waste resources sifting through unqualified leads—an inefficient and costly process.

A more effective method is now available: insurance lead generation powered by climate-risk intelligence. This model enables surgical, risk-based prospecting, allowing you to identify and engage businesses with specific, unaddressed exposures at their moment of need.

Moving Beyond Demographics to Risk-Based Prospecting

Imagine being able to instantly pinpoint every commercial property within a 5-mile radius of a recent hailstorm, or identify every logistics company whose primary routes are now threatened by a new flood zone designation. This is the power of climate intelligence. It transforms prospecting from a guessing game into a data-driven science.

Instead of targeting all manufacturers in a state, you can focus *only* on those whose facilities are in areas with escalating wildfire risk scores. This hyper-specific targeting means every lead is pre-qualified by a tangible, urgent need. The conversation shifts from, "Do you need insurance?" to, "We've identified a specific risk to your operations—here's how we can mitigate it."

This approach fundamentally changes the sales dynamic. You are no longer a vendor selling a policy; you are a proactive risk advisor armed with critical data that proves your value before the first contact.

This focus on relevance impacts the entire sales cycle. Leads generated this way are businesses with a clear problem your products solve. This alignment between need and solution leads to higher engagement, faster conversions, and a more profitable book of business.

How Climate Intelligence Amplifies Lead Quality

Integrating real-time environmental data into your strategy enables highly targeted campaigns that resonate with prospects. This data-first approach drives significant improvements across key performance indicators. For a closer look at the mechanics, explore our guide on climate risk assessment tools.

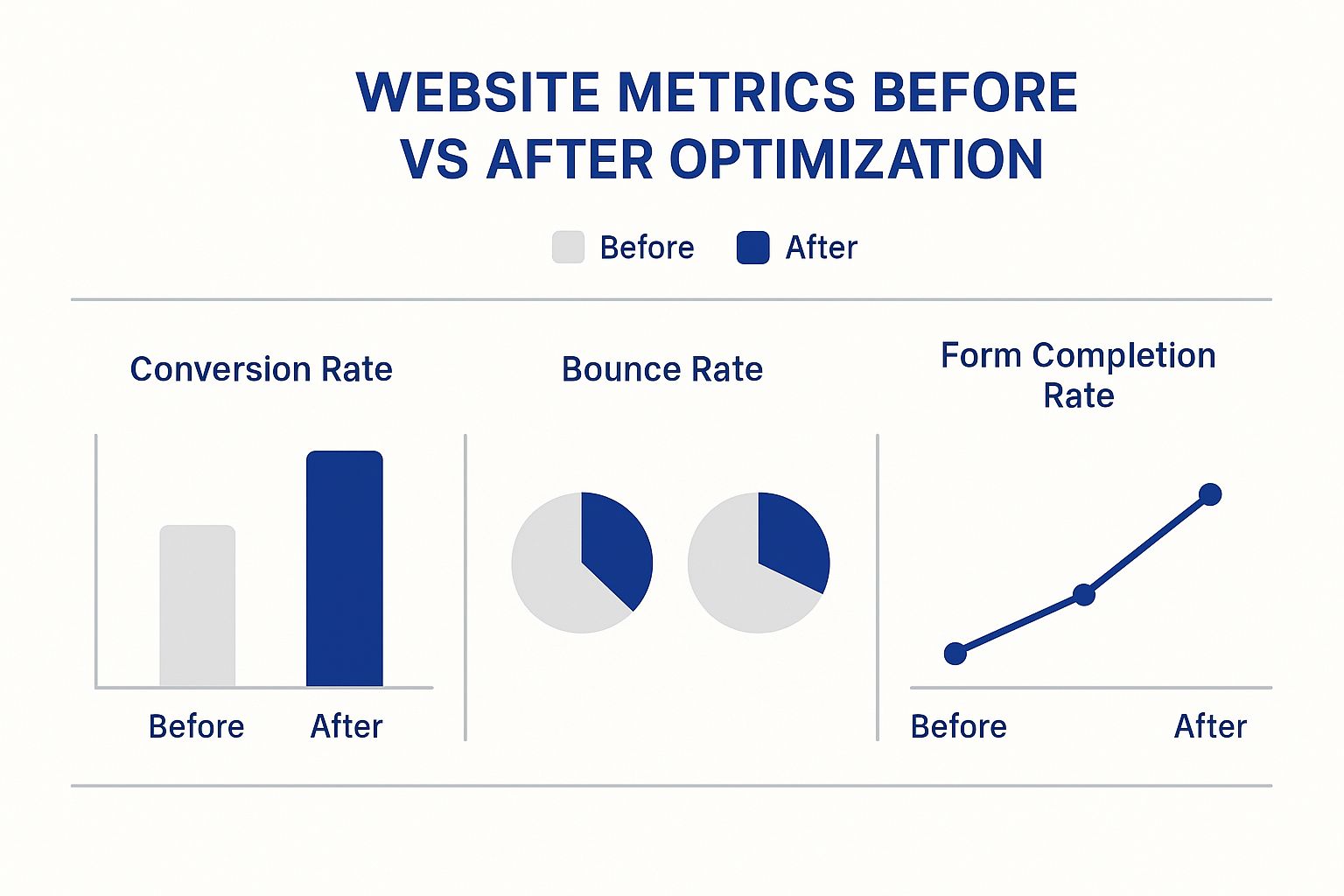

The infographic below illustrates the impact of precision data on critical website metrics.

Image

The data is conclusive: a more relevant, targeted approach dramatically boosts conversion rates and form completions while slashing bounce rates. It is definitive proof that lead quality trumps lead quantity.

This table breaks down how key metrics improve when shifting from traditional methods to a strategy enhanced by climate intelligence.

How Climate Intelligence Impacts Lead Quality

| Metric | Traditional Method | With Climate Intelligence Integration |

|---|---|---|

| Outreach Relevance | Low (Based on broad SIC codes or firmographics) | High (Based on specific, verified asset-level risk) |

| Lead Conversion Rate | Low (Generic messaging fails to create urgency) | High (Outreach addresses an immediate, tangible need) |

| Sales Cycle Length | Long (Requires extensive education and convincing) | Short (Prospect already understands the problem) |

| Underwriting Alignment | Poor (Often generates leads outside of risk appetite) | Excellent (Prospecting is synched with underwriting goals) |

| Customer Acquisition Cost (CAC) | High (Wasted spend on unqualified, low-intent leads) | Low (Resources are focused only on high-value prospects) |

Integrating this level of precision does not just offer a slight improvement—it fundamentally elevates the efficiency and profitability of your entire lead generation function.

Forward-thinking brokers and carriers are using climate intelligence platforms to:

- Identify Emerging Risks: Pinpoint commercial assets exposed to perils like floods, storms, or wildfires down to the ZIP code.

- Prioritize Outreach: Focus sales and marketing on prospects with the strongest intent signals, such as those in a disaster-declared zone.

- Tailor Messaging: Craft hyper-specific outreach referencing the exact risk a business faces, instantly establishing credibility.

- Align with Underwriting: Ensure marketing is synced with underwriting appetite, delivering a stream of leads that fit the desired risk profile.

By embedding this intelligence into your process, your firm can stop reacting to the market and start proactively solving problems, creating the most direct path to high-value commercial clients and sustainable growth.

Measuring The Metrics That Actually Matter

Image

Vanity metrics like impressions and clicks do not translate to revenue. For underwriters, brokers, and risk managers, success in commercial insurance lead generation is measured by profitable growth, not marketing activity.

This requires a disciplined focus on key performance indicators (KPIs) that directly reflect business outcomes. It means shifting from top-of-funnel noise to the financial metrics that define the efficiency and profitability of your efforts.

Core Metrics for Profitability

To build a lead generation engine that contributes to the bottom line, you must track the metrics connecting marketing spend to revenue. These KPIs provide the essential feedback loop for strategy refinement.

- Cost Per Acquisition (CPA): Your ultimate efficiency metric. CPA measures the total cost to acquire a new client, including all marketing and sales expenses. A high CPA signals inefficient spending or low-quality leads, while a low CPA indicates a profitable acquisition funnel.

- Lead-to-Quote Ratio: A direct indicator of lead quality. A low ratio signals that marketing is attracting prospects who do not fit your underwriting appetite or lack purchase intent. A high ratio confirms your targeting and messaging are effective.

- Quote-to-Bind Ratio: This KPI measures the effectiveness of your sales or underwriting process. A strong ratio indicates your team is successfully converting qualified prospects into policyholders. A low ratio may point to issues with pricing, follow-up, or value communication.

Tracking these metrics is the first step. The real value comes from analyzing them to optimize your entire pipeline. For a closer look at how these stages connect, our guide on building a B2B sales funnel offers a deeper analysis.

Moving to Advanced Performance Indicators

Once you have established a baseline with core metrics, elevate your analysis to long-term value. This is where strategic decisions are made, moving beyond the initial sale to understand the full financial impact of each client relationship.

Customer Lifetime Value (CLV): This is the most critical metric for long-term strategic planning. CLV forecasts the total net profit a client will generate over the entire duration of the relationship. A high CLV demonstrates that you are not just acquiring customers, but building and retaining profitable, long-term partnerships.

Focusing on CLV fundamentally changes your strategy. You begin to prioritize lead sources that deliver high-value, loyal clients, even if their initial CPA is marginally higher. This insight is essential for building a resilient and profitable book of business.

Fostering a Performance-Driven Culture

Data is useless without action. Building a performance-driven culture requires establishing clear, consistent feedback loops between marketing and underwriting teams. This alignment is critical. It ensures that insights from the front lines inform marketing campaigns and that marketing activities are synced with business objectives.

Set realistic benchmarks for each KPI based on your specific market and goals. Review performance against these benchmarks relentlessly. This continuous cycle of measurement, analysis, and optimization is what separates a standard marketing function from a powerful engine for profitable growth.

Solving Common Lead Generation Challenges

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/uygAaCsFDMQ" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Even well-designed insurance lead generation programs encounter obstacles. For brokers, underwriters, and risk managers, these roadblocks translate directly into lost revenue and wasted resources.

The key is not merely identifying problems but implementing systematic fixes. Addressing the root cause of operational friction allows you to apply targeted solutions that deliver lasting results.

Challenge 1: Poor Lead Quality

Low-quality leads are the most common and costly problem in the industry. A pipeline clogged with unqualified prospects drains team resources, damages morale, and inflates customer acquisition costs.

These leads do not fit your underwriting appetite, lack purchase intent, or cannot afford the necessary coverage. The problem typically originates from a failure to pre-qualify prospects before they enter the sales funnel. Generic marketing campaigns attract a wide audience but force your team to sift through noise to find a signal of real opportunity.

Solution: Build a Multi-Layered Qualification System

The solution is to become more selective. Implement a multi-layered qualification process to act as a gatekeeper.

- Implement Strict Lead Scoring: Develop a scoring model based on firmographics (industry, company size) and, more importantly, on intent signals. A prospect who visits your cyber liability policy page receives a higher score than one who reads a general blog post.

- Use Climate Intelligence: This is a powerful differentiator. Pre-qualify prospects based on tangible, asset-level risk. By identifying a business in a newly declared flood zone or a high-wildfire-risk area, you are not just finding a lead—you are finding a prospect with a clear, immediate need.

- Refine Your Targeting: Continuously sharpen ad campaigns and content to focus exclusively on niches that align with your ideal customer profile and underwriting goals.

A lead is not qualified until a specific need is confirmed. Using climate-risk data transforms a cold outreach into a critical consultation, elevating the entire engagement from the first touchpoint.

Challenge 2: Sky-High Acquisition Costs

An escalating Customer Acquisition Cost (CAC) is another significant threat to profitability. This occurs when capital is allocated to broad channels with low conversion rates or when there is an over-reliance on expensive, shared lead lists.

Every dollar spent on a lead that does not convert is a direct loss. It is a symptom of chasing volume over value and often indicates a mismatch between your marketing channels and target audience.

Solution: Optimize for Efficiency and Long-Term Value

The solution is to shift focus from lead volume to funnel efficiency. The goal is not just to generate leads but to acquire *profitable* customers. For a deeper analysis of this principle, our guide on strategic lead generation for insurance offers additional frameworks.

Here is how to bring your CAC under control:

- Prioritize Inbound Channels: Increase investment in SEO and high-value content. While they require an upfront commitment of time, they generate organic leads at a far lower long-term cost than paid advertising.

- Focus on CLV, Not Just CPA: Analyze which lead sources generate clients with the highest Customer Lifetime Value (CLV). It may be more profitable to accept a higher upfront CPA for a lead from a channel that consistently delivers loyal, high-premium clients.

- Establish a Tight Feedback Loop: Your sales and marketing teams must maintain constant communication. When underwriters report that leads from a specific campaign are unqualified, marketing must receive that feedback immediately to adjust targeting and prevent wasted spend.

The Future Of Insurance Lead Generation

To maintain a competitive advantage in commercial insurance, you must anticipate future trends. The strategies that are differentiating today will be standard practice tomorrow. The future of lead generation is being shaped by new technologies and fundamental shifts in customer behavior, creating a model that is more predictive, integrated, and responsive.

This evolution is not a distant concept; it is already underway. It is time to look beyond current funnels and prepare for the next wave of change and opportunity.

The Rise Of Predictive AI And Machine Learning

Artificial intelligence is the primary driver of the next evolution. The future of insurance lead generation is being reshaped by AI-powered advertising, but its true potential lies in predictive prospecting. Machine learning is moving beyond simple lead scoring into proactive opportunity identification.

Imagine an algorithm that analyzes market data, climate projections, and economic indicators to pinpoint which industries in specific regions will require new coverage types *before they recognize the need themselves*. This is the new frontier: identifying a future risk and initiating a consultative conversation, transforming lead generation into proactive risk advisory.

Embedded Insurance As A New Lead Channel

Embedded insurance is another transformative trend, weaving coverage offers directly into the point of sale in adjacent industries. This creates a seamless, low-friction channel for lead acquisition. Deloitte’s 2025 global insurance outlook projects that embedded policies will exceed $722 billion in premiums by 2030. This model enables insurers to partner with automotive, real estate, and B2B software companies, expanding distribution and reach. You can read the full Deloitte industry outlook to understand its full implications.

For commercial carriers and brokers, this translates into a new stream of highly qualified, high-intent leads. When a business secures a commercial real estate loan, the ability to embed a property insurance quote directly into the financing process is a powerful way to initiate a relationship.

Meeting Demand For Novel Risk Coverage

Finally, the definition of risk is expanding, creating demand for new insurance products. The growth of AI is introducing novel liabilities, while escalating cyber threats and fragile supply chains require more specialized coverage.

The most forward-thinking firms are already building lead generation campaigns around these emerging risks. This strategy positions them not just as providers but as expert partners capable of navigating an uncertain future. By developing content and outreach focused on topics like AI liability or parametric business interruption, you attract sophisticated clients seeking true expertise. This customer-focused, data-driven model will build a lasting competitive advantage.

Answering Your Top Questions

Even with a robust strategy, questions about optimizing insurance lead generation persist. Here are common inquiries from brokers, underwriters, and risk managers, with direct answers to sharpen your approach.

What Is The Most Effective Channel For Commercial Insurance Leads?

There is no single "best" channel. The most effective approach is an integrated, multi-channel strategy where each component reinforces the others.

A high-performance system is not about finding one magic bullet. It is about building an ecosystem that typically combines:

- Long-term SEO to capture prospects actively searching for solutions.

- Targeted content that addresses the specific risks and challenges of key industries.

- Precision digital ads on platforms like LinkedIn to reach specific decision-makers.

The key is to make these channels work in concert, creating a system that is more effective than the sum of its parts.

How Can I Improve My Lead-To-Quote Ratio?

A low lead-to-quote ratio almost always indicates a problem with lead *quality*, not sales execution. To fix this, you must improve lead qualification *before* they reach a sales or underwriting desk.

A lead's value is determined by its relevance. The fastest way to boost your ratio is to implement stricter lead scoring using firmographic and intent data. Tools offering climate-risk intelligence are ideal for this, allowing you to pre-qualify prospects based on verified needs. This ensures your team dedicates its time exclusively to high-intent opportunities.

Furthermore, do not neglect fundamentals. A rapid response time and a seamless handoff from marketing to underwriting are critical to preventing qualified leads from going cold.

Is Buying Insurance Leads A Good Strategy?

Buying leads can provide a short-term volume boost, but it is rarely a sustainable or profitable long-term strategy. These leads are almost always sold to multiple competitors, forcing you into a price-driven competition for low-quality prospects.

A superior allocation of resources is to invest in building your own proprietary lead generation engine. While it requires more upfront effort, it creates a durable, long-term asset that consistently delivers higher-quality prospects seeking *your* specific expertise. The ROI from this owned asset will invariably outperform that of purchased lead lists.

Ready to stop chasing cold leads and start engaging high-intent prospects at their moment of greatest need? The Sentinel Shield platform from Insurtech.bpcorp.eu uses real-time climate intelligence to deliver verified, geo-targeted leads directly to your pipeline. Turn climate events into clear business opportunities with Sentinel Shield.