A B2B sales funnel is the strategic framework that guides prospective clients from initial awareness to a signed contract. For decision-makers in complex sectors like commercial insurance and climate risk—including underwriters, brokers, and risk managers—this framework is not a marketing theory; it is a systematic process for generating predictable revenue and sustainable growth. It transforms disparate marketing and sales activities into a unified, efficient engine.

Why a Structured B2B Sales Funnel is Your Growth Engine

In high-value B2B industries, relying on ad-hoc tactics like sporadic cold calls or unfocused website traffic is a formula for wasted resources. A well-defined B2B sales funnel provides a clear, repeatable process for acquiring and retaining high-value clients. It maps the precise journey a prospective underwriter, broker, or risk manager takes to identify a business challenge, discover your solution, evaluate its merit, and commit to a partnership.

Without this operational map, marketing and sales teams often operate in silos. This disconnect leads to inconsistent messaging, lost opportunities, and qualified leads falling through the cracks. A unified funnel aligns all business development efforts, ensuring that every touchpoint is purposeful and moves the prospect closer to a decision.

The Unforgiving Reality of B2B Conversion Rates

Optimizing your sales funnel requires a pragmatic understanding of industry benchmarks. The average website visitor-to-lead conversion rate for B2B companies is a stark 1–3%. This means for every 100 decision-makers visiting your website, only one to three may take a meaningful action, such as requesting a consultation. For complex enterprise sales, this figure can drop to as low as 0.7%. These statistics underscore a critical business reality: every stage of your funnel must be meticulously engineered for maximum efficiency. For more context, you can explore these sales funnel conversion rate benchmarks.

A B2B sales funnel is not a marketing diagram; it is a disciplined business process. It forces an organization to understand the client's decision-making framework and systematically address their requirements at each stage—from initial risk awareness to final policy implementation.

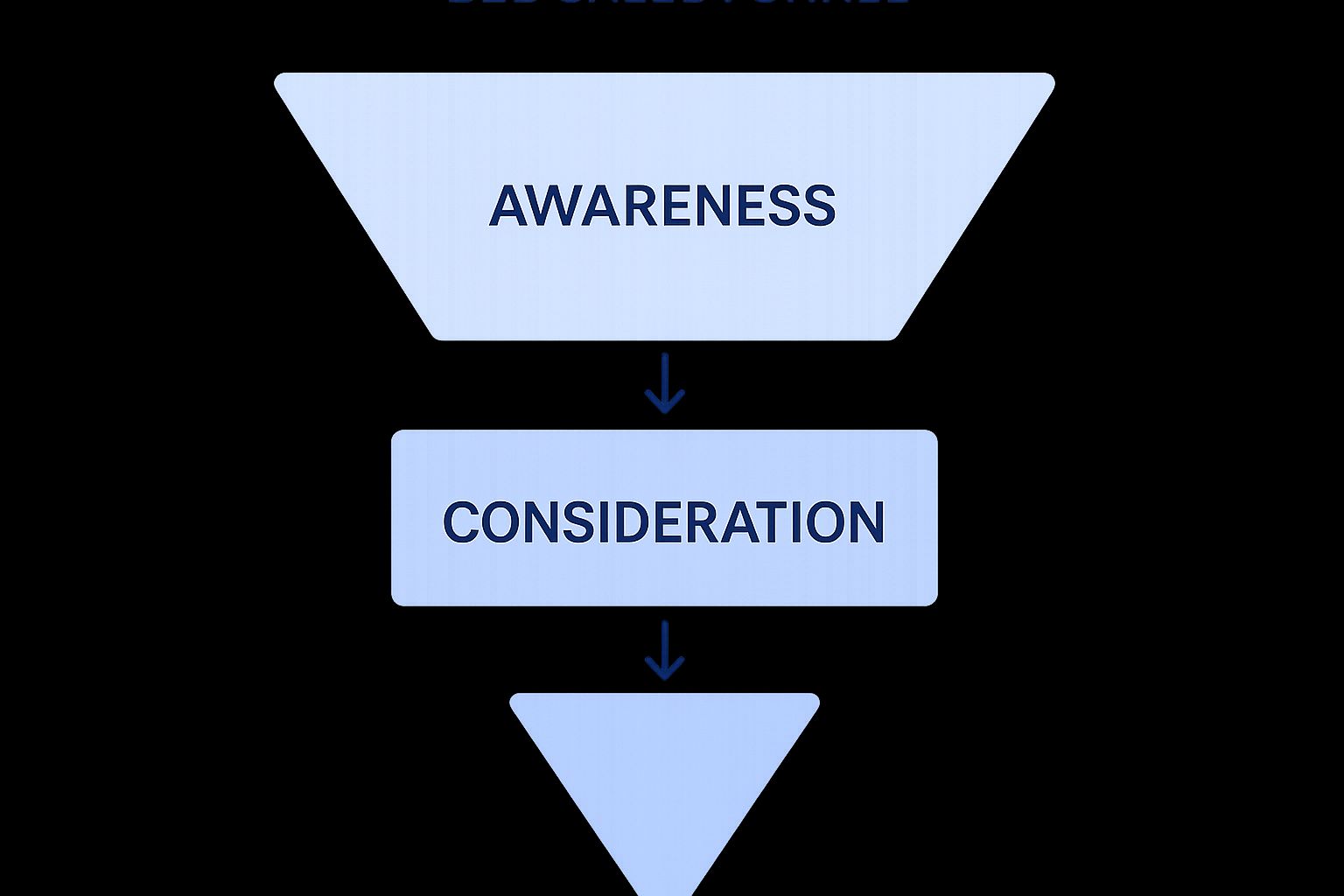

To illustrate, let's examine a visual breakdown of the B2B sales funnel's fundamental stages.

Image

As the diagram illustrates, the process begins with a broad audience at the top (Awareness) and progressively narrows as prospects are qualified through the Consideration and Decision stages, culminating in a core group of committed clients. Each stage demands a distinct strategy to maintain forward momentum.

This table provides a concise overview of the objectives at each stage.

The B2B Sales Funnel At a Glance

| Funnel Stage | Primary Business Objective |

|---|---|

| Awareness (Top of Funnel - ToFu) | Attract a targeted audience of decision-makers by addressing their critical business challenges and establishing brand credibility. |

| Interest & Consideration (Middle of Funnel - MoFu) | Nurture qualified leads with in-depth, solution-oriented content that demonstrates clear value and builds trust. |

| Decision (Bottom of Funnel - BoFu) | Convert high-intent prospects into clients by providing compelling proof, personalized demonstrations, and a clear business case. |

| Loyalty & Advocacy (Post-Funnel) | Maximize lifetime value by ensuring client success, fostering retention, and generating referrals. |

Now, we will analyze the tactical execution required at each of these critical stages.

Stage 1: Attracting High-Value Decision-Makers

Image

The efficacy of your entire B2B sales funnel depends on the quality of leads you attract at the top. The principle is quality over quantity. Investing resources to drive untargeted website traffic is inefficient if those visitors do not represent your ideal client profile.

For firms in the commercial insurance and climate risk sectors, the objective is not to attract a mass audience. It is to capture the focused attention of underwriters, brokers, and risk managers—the professionals making high-stakes decisions.

This initial top-of-funnel (ToFu) stage is focused on establishing authority. Your goal is to position your brand as a credible, indispensable resource. This means addressing the strategic questions your ideal clients contemplate long before they are actively seeking a specific solution. Success at this stage elevates your firm from a mere vendor to a trusted industry authority.

Building Authority with Targeted, High-Value Content

To engage these high-value prospects, your content must address their specific operational and strategic challenges. A generic blog post will fail to resonate with a senior risk manager evaluating portfolio exposure to catastrophic climate events. You must develop targeted assets that demonstrate deep, practical industry expertise.

Effective content strategies include:

- SEO-Optimized Technical Articles: Develop in-depth content targeting the long-tail keywords your audience uses, such as "hyperlocal climate risk data for insurance" or "modeling wildfire risk for commercial property portfolios." This strategy attracts high-intent organic traffic from professionals actively seeking solutions.

- Data-Driven Industry Reports: Publish reports on emerging trends, such as the financial impact of specific perils on key industry sectors. This content establishes your firm as a thought leader and serves as a high-value lead magnet for capturing contact information.

- Strategic LinkedIn Engagement: Maintain a professional presence where your decision-makers convene. Share sharp analysis of industry developments, offer insightful commentary on regulatory changes, and participate in relevant professional groups. This builds visibility and credibility.

When your content directly addresses the pain points of underwriters and risk managers, you ensure that the leads entering your funnel are relevant from the initial interaction.

The objective at the top of the funnel is not to sell; it is to educate. Provide such compelling value that when a prospect is ready to evaluate solutions, your firm is their first consideration. This is the foundation of a successful B2B sales strategy.

To optimize your top-of-funnel strategy, consider leveraging the best AI lead generation software. These platforms can automate the identification of companies and contacts that match your ideal customer profile, enabling you to fill your funnel with pre-qualified leads. This ensures your high-value content reaches decision-makers with the authority to act, making your entire sales process more efficient from the start.

Stage 2: Nurturing Leads into Qualified Prospects

Image

Once a decision-maker is aware of your brand, your strategy must evolve. This is the middle of the B2B sales funnel (MoFu), where the objective shifts from building broad awareness to demonstrating specific expertise. The focus is on building trust and proving tangible value to a qualified audience.

For risk managers and underwriters, this means moving beyond high-level concepts to demonstrate precisely how your solutions integrate into their operational workflows. This is achieved through lead nurturing: the process of building a relationship with prospects who are not yet ready to purchase. Your goal is to become their definitive educational resource, guiding them to recognize your solution as the logical choice.

This requires delivering the right content at the right time. You must provide in-depth resources that solve their unique problems and demonstrate your firm's domain expertise.

A Playbook for Middle-Funnel Engagement

To effectively engage leads in the commercial insurance and climate risk space, your content must offer actionable, high-value insights. The aim is to demonstrate an unparalleled level of expertise that builds confidence and differentiates you from competitors.

The following content formats are highly effective at this stage:

- In-Depth Webinars: Host sessions—live or on-demand—that analyze complex issues, such as "Modeling Future Flood Risk for Commercial Real Estate Portfolios." Webinars provide a platform to showcase expertise, address technical questions, and build a direct connection with prospects.

- Compelling Case Studies: Risk managers require proof, not promises. Provide detailed case studies with hard data, showing how a peer company used your climate intelligence to mitigate risk or identify new underwriting opportunities. This builds a credible business case.

- Personalized Email Nurturing: Segment your audience based on their engagement (e.g., a report download) and deliver a targeted email sequence offering deeper insights on that topic. This demonstrates that you are attentive to their specific interests.

The middle of the funnel is a strategic dialogue, not a sales pitch. It is where you prove you are a credible partner capable of solving complex business challenges. Success at this stage positions your solution as the logical next step for the prospect.

From Engagement to Purchase Intent

As prospects engage with your content, they create a digital footprint. It is critical to track these behaviors—content downloads, webinar attendance, visits to key product pages. This data fuels a lead scoring framework.

Lead scoring assigns points to leads based on their profile (demographics, firmographics) and their engagement level. For example, an underwriter from a target carrier who attends a webinar and downloads a case study is a high-value lead. Their score increases, signaling strong purchase intent.

This data-driven process identifies a marketing-qualified lead (MQL)—a prospect ready for a direct conversation with your sales team. This ensures that sales professionals invest their time engaging educated, high-intent individuals who are seriously considering a purchase.

Stage 3: Demonstrating Unbeatable Value to Active Buyers

Image

When a prospect enters the bottom of your B2B sales funnel (BoFu), the dynamic changes fundamentally. They are no longer just learning; they are actively evaluating vendors. This is the decision stage, where your objective shifts from education to proving the specific, quantifiable value of your solution.

For an underwriter or risk manager, the conversation becomes highly practical. The focus is no longer on *what* climate intelligence is, but *how* your specific platform will enable them to write more profitable policies or uncover previously unidentified portfolio risks. Your goal is to make your solution indispensable to their daily operations.

The bottom of the funnel is where you build the business case. It’s no longer about your general expertise; it’s about your product’s specific, measurable impact on the prospect’s P&L.

From Evaluation to a Clear Decision

To be selected as the clear choice, you must deliver high-impact, personalized experiences that eliminate doubt. Generic sales presentations are ineffective at this stage. Success depends on enabling the prospect to visualize their own success with your product.

These strategies are designed to build an irrefutable business case:

- Personalized Product Demonstrations: A demo must be a consultative session tailored to the prospect's specific operational challenges. For instance, show a risk manager precisely how your climate intelligence platform would have identified uninsured assets in their portfolio during a recent weather event.

- Structured Free Trials: Offer a goal-oriented trial, not just open-ended access. Collaborate with the prospect to define a clear objective, such as using your platform to assess wildfire risk for a critical segment of their book of business. A guided trial ensures they achieve a tangible "win" and experience the platform's value firsthand.

- Transparent ROI Calculators: Decision-makers must justify investments. Provide a clear ROI calculator where they can input their own data—such as average policy value or recent claims losses—to quantify the financial impact of your solution. This reframes your offering from a cost center to a revenue driver.

By equipping active buyers with personalized demos, guided trials, and clear financial justification, you remove friction and solidify trust, converting a highly qualified lead into a new client.

Stage 4: Closing the Deal and Securing New Business

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/y0OtFpC7yag" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

This is the final stage of the pre-sale B2B sales funnel, where qualified intent is converted into revenue. The objective is to execute a seamless closing process that transitions a prospect into a paying client. This is not merely a transaction; it is the beginning of a long-term business relationship, and its execution sets the tone for future engagement.

Precision and professionalism are paramount. For decision-makers like underwriters and brokers, a disorganized or inefficient closing process can erode the trust built throughout the funnel. The key is to maintain momentum and guide the prospect toward a firm agreement while minimizing friction.

From Proposal to Partnership

A compelling proposal is the cornerstone of this stage. The document must be more than a price sheet; it should be a strategic blueprint reflecting all prior conversations. It must explicitly address the prospect's business challenges—such as managing portfolio-level risk in high-threat climate zones—and reinforce the value proposition you have established.

The final proposal should function as a mutual plan of action. It must summarize the prospect's challenges, reaffirm your solution's value, and outline the clear, logical next steps for implementation.

To prevent deals from stalling, focus on these critical actions:

- Proactively Address Objections: Anticipate potential questions regarding implementation, data security, or contract terms, and prepare clear, concise answers. This foresight demonstrates professionalism and builds confidence.

- Align Sales with Legal and Procurement: Facilitate early communication between your team and the prospect’s legal or procurement departments. Standardized, straightforward contract language and a prepared negotiation strategy can significantly shorten the sales cycle.

- Clarify Onboarding and Next Steps: A deal is not truly closed until the client is positioned for success. Clearly map out the onboarding process and establish what they can expect in the first 30 days. This shifts the focus from the transaction to the successful partnership.

Post-Funnel: Turning New Clients into Loyal Advocates

A signed contract marks the beginning of the most profitable phase of the client relationship. In high-stakes B2B industries like commercial insurance, significant value is realized long after the initial sale. This post-funnel stage focuses on transforming a new client into a loyal advocate, creating a powerful referral engine that feeds your sales funnel B2B framework.

The first 90 days post-sale are critical. A structured, efficient onboarding process establishes the foundation for the entire partnership. For a risk manager adopting a new climate intelligence platform, the goal is not just feature training; it is guiding them to a quick, tangible win, such as identifying a valuable, actionable insight within their own portfolio. This immediate ROI builds confidence and integrates your solution into their core workflow.

From Retention to Advocacy

Following a successful onboarding, the focus shifts to proactive customer success. Instead of waiting for support inquiries, regularly engage clients with valuable insights derived from their platform usage or emerging industry trends. This approach positions your firm as an indispensable strategic partner, not just a software vendor.

The objective of post-sale engagement is to make renewal a foregone conclusion. By consistently delivering value that exceeds the initial promise, you build a relationship so robust that considering alternatives becomes unthinkable.

This deep partnership is the catalyst for advocacy. A satisfied client becomes your most effective marketing asset and source of new business.

- Powerful Testimonials and Case Studies: Documenting their success provides the social proof required to persuade new prospects in the decision stage.

- Strategic Upsell and Cross-Sell Opportunities: A deep understanding of their business allows you to identify needs for additional services or premium features that address their evolving challenges.

- High-Value Referrals: An advocate will actively recommend you to their professional network, delivering highly qualified, warm leads directly into the top of your sales funnel.

Implementing a formal customer success plan is essential for executing this strategy systematically. It provides the operational roadmap to convert every new client into a source of recurring revenue and brand advocacy, driving sustainable, long-term growth.

Frequently Asked Questions About the B2B Sales Funnel

Executing a B2B sales funnel, particularly in a technical field like commercial insurance, presents numerous practical questions. Addressing them effectively is crucial for optimizing strategy and performance. Below are answers to common inquiries from industry leaders.

How Long Should My B2B Sales Funnel Be?

The length of a B2B sales cycle is determined by the complexity of the product and the prospect's buying process. A straightforward software subscription may close in weeks. However, for high-value, complex solutions like a climate intelligence platform, the sales cycle is substantially longer, typically ranging from 6 to 18 months. This extended timeline accounts for multi-stakeholder approvals, extensive due diligence, and contract negotiations. The objective is not to meet an arbitrary deadline but to align your process with the customer's decision-making journey.

What Are the Most Important Metrics to Track?

While numerous data points can be monitored, a few key performance indicators (KPIs) provide the clearest insight into your funnel's health. For professionals building a predictable pipeline in insurance and risk management, these metrics are essential:

- Visitor-to-Lead Conversion Rate: Measures the effectiveness of your top-of-funnel content and initial value proposition.

- Lead-to-MQL Rate: Indicates whether your marketing efforts are attracting prospects who fit your ideal customer profile.

- MQL-to-SQL Rate: Assesses the alignment between marketing and sales, showing if MQLs are truly ready for a sales conversation.

- SQL-to-Close Rate: The ultimate measure of sales team effectiveness in converting qualified opportunities into revenue.

- Overall Sales Cycle Length: Tracking the average time from first contact to signed contract is critical for forecasting revenue and identifying process bottlenecks.

How Do I Fix a "Leaky" Sales Funnel?

A "leaky" funnel, characterized by significant prospect drop-off at a specific stage, requires a data-driven diagnosis. Analyze your conversion metrics to pinpoint where the largest leaks occur.

For example, a low visitor-to-lead rate may indicate that your top-of-funnel content is not resonating or that you are targeting the wrong audience. A low MQL-to-SQL rate suggests that your lead nurturing is insufficient to build trust or demonstrate value. A high drop-off rate after the demo stage signals that your value proposition or business case is not compelling enough. Identify the specific leak, then implement targeted solutions, such as refining content, improving follow-up protocols, or strengthening your ROI demonstration.

A sales funnel encompasses the entire customer journey, from awareness to purchase. A sales pipeline is the subset of active, qualified deals that the sales team is currently managing. The funnel feeds the pipeline.

The funnel represents the macro-level strategy for generating leads, while the pipeline provides the micro-level, operational view of opportunities the sales team is working to close. Effective B2B growth requires mastery of both.

---

Ready to fill your sales funnel with high-intent, geo-targeted leads right when they need you most? Sentinel Shield uses real-time climate intelligence to connect you with businesses actively searching for risk management and recovery solutions. Stop chasing leads and let the most motivated ones find you.

Discover how Sentinel Shield can transform your lead generation.