In the competitive commercial insurance market, lead generation is the engine that drives growth. It is the structured process of identifying and nurturing potential clients—from a business facing new climate risks to an enterprise re-evaluating its existing coverage.

However, effective lead generation insurance strategies are no longer about casting a wide net. Success is now a function of precision: connecting with high-intent prospects at their exact moment of need. This targeted approach is how leading firms build a sustainable growth pipeline and secure market leadership.

The New Rules Of Insurance Lead Generation

Image

The playbook for acquiring high-quality commercial insurance leads has been rewritten. The era of broadcasting untargeted messages is over. Today’s decision-makers are inundated with generic sales pitches, compelling underwriters, brokers, and risk managers to adopt a more sophisticated, data-driven methodology.

This evolution is driven by two primary factors: evolving client expectations and the digital-first nature of modern business. Commercial clients demand personalized, relevant engagement that speaks directly to their unique operational risks. A one-size-fits-all strategy is ineffective for building a consistent pipeline of qualified opportunities.

Why The Old Playbook Is Failing

Traditional lead generation methods that were effective a decade ago now deliver diminishing returns in the commercial insurance sector. Their core deficiency is a lack of precision and an inability to scale efficiently.

The limitations of these legacy approaches are clear:

- Low Conversion Rates: Cold outreach is a high-volume, low-yield activity that consumes valuable time and resources chasing unqualified contacts.

- High Acquisition Costs: Outdated tactics like print advertising or unfocused digital campaigns represent significant capital expenditure with no reliable method for measuring ROI.

- Poor Timing: These methods rarely connect with a prospect during their critical window of need, such as the period immediately following a major risk event.

This market evolution coincides with significant industry growth. The global lead generation sector, which includes insurance, is projected to reach USD 6.38 billion by 2025, expanding at an 8.3% compound annual growth rate. This expansion is fueled by digital marketing and a high demand for actionable business intelligence, underscoring the necessity of modern strategies. You can explore more statistics on the dominance of digital strategies in lead generation.

The primary challenge for today's insurance professional is not a lack of potential leads, but a surplus of market noise. The new imperative is to cut through this noise with timely, relevant, and data-backed insights that demonstrate immediate value to a prospect.

Ultimately, sustainable growth requires a system that delivers a predictable flow of high-quality leads. This necessitates a shift from a reactive to a proactive model, using data to identify and engage prospects with tangible, immediate risks, thereby positioning your firm as a strategic partner, not just another vendor.

Modernizing Your Lead Generation Playbook

The commercial insurance industry is at a strategic crossroads. Legacy methods for client acquisition are no longer viable. Traditional tactics like cold calling, print advertising, or generic trade show participation once formed the bedrock of business development. Today, their returns are diminishing in a business environment driven by data and digital connectivity. These methods cast a wide, expensive net with no guarantee of success—a strategy fundamentally misaligned with the precision required to secure high-value commercial clients.

The most significant flaw of the old playbook is its inability to scale or target effectively. Cold calls are notorious for low success rates—often as low as 2.5%—meaning significant hours are expended for minimal return. Similarly, direct mail and print ads lack the mechanism to reach a prospect at their actual moment of need, resulting in high costs and poor engagement.

The Shift To Digital Dominance

In contrast, modern lead generation insurance strategies are built on efficiency, measurable outcomes, and delivering value before a sale is ever requested. Digital channels enable brokers and carriers to move beyond generic messaging and engage in targeted, meaningful conversations with the right decision-makers.

This is not a fleeting trend but a strategic imperative supported by substantial investment. The insurance industry is a major player in digital advertising, with U.S. insurers investing $11.7 billion in 2021. This significant expenditure reveals a critical truth: firms allocating a larger portion of their revenue to modern marketing are experiencing the most substantial growth.

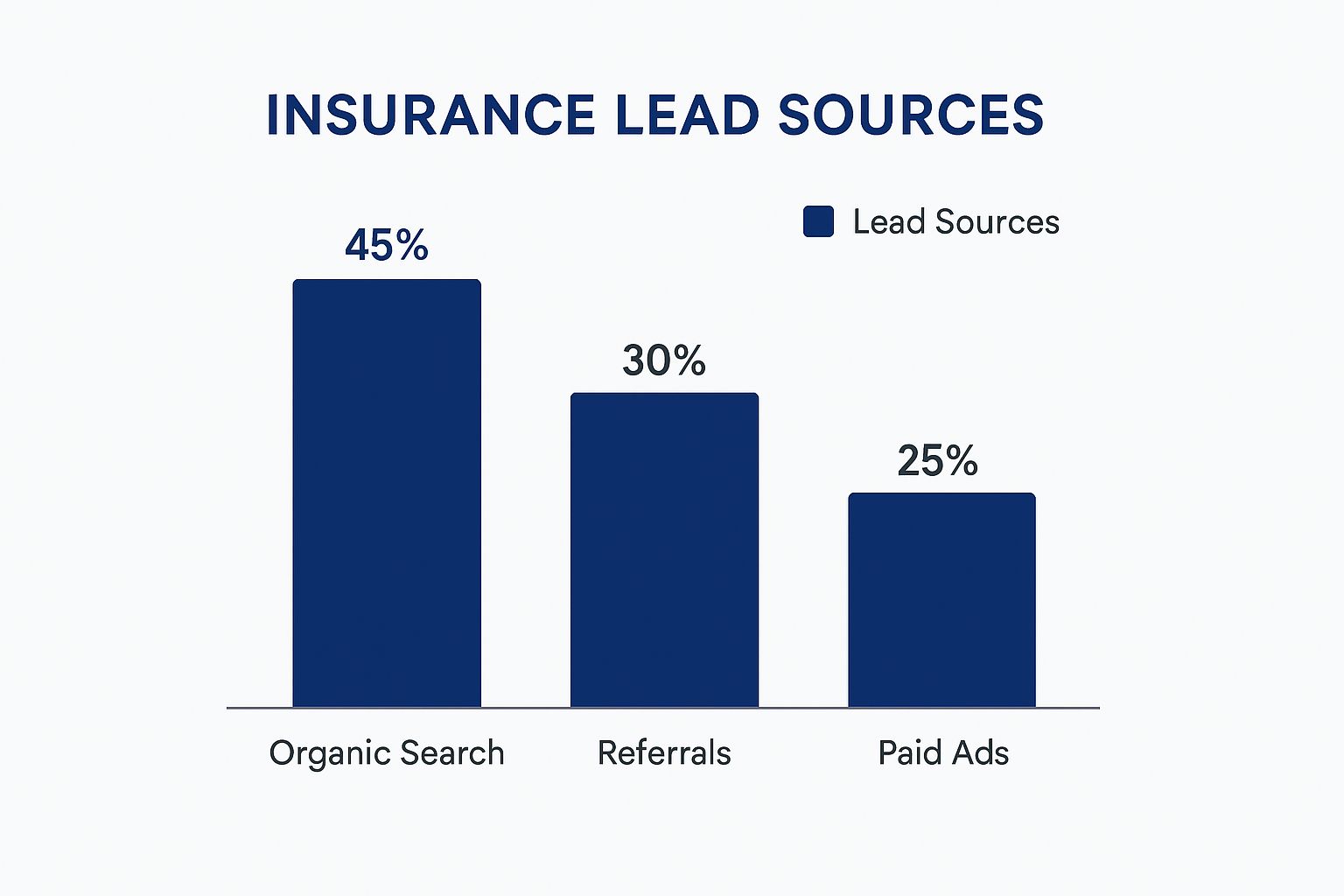

The data clearly indicates where the most successful insurers are sourcing their leads today.

Image

This chart demonstrates that nearly half of all leads originate from organic search, proving that online visibility is non-negotiable for any modern insurance professional.

Effectiveness Of Traditional Vs Modern Insurance Lead Generation

To fully appreciate the scale of this transformation, a side-by-side comparison of the two approaches based on business-critical metrics is necessary. The differences in cost, lead quality, and scalability present a compelling business case for abandoning outdated methods.

The following comparison highlights the criticality of modernization.

| Metric | Traditional Methods (e.g., Cold Calling, Print Ads) | Modern Methods (e.g., SEO, Content Marketing, AI) |

|---|---|---|

| Targeting Precision | Low. Relies on broad, often outdated lists or general demographics. | High. Can target prospects based on specific behaviors, risks, or buying signals. |

| Lead Quality | Low. Leads are typically cold, unqualified, and have no prior engagement. | High. Leads often pre-qualify themselves through search queries or content engagement. |

| Cost Per Acquisition | High. Involves significant manual effort, ad spend, and printing costs. | Lower over time. SEO and content build value that compounds with minimal ongoing cost. |

| Scalability | Low. Directly tied to the number of calls made or flyers mailed. | High. A single piece of high-quality content or a well-optimized website can generate leads 24/7. |

| ROI Measurement | Difficult. It is challenging to attribute a closed deal to a specific print ad or cold call. | Simple. Digital tools provide clear data on every click, conversion, and touchpoint. |

The advantages are clear. Strategies like Search Engine Optimization (SEO) attract high-intent prospects who are actively searching for the solutions you provide. Content marketing builds trust and establishes authority by answering a potential client's critical risk-related questions before any direct contact is made.

The objective of modern lead generation is not merely to find prospects, but to attract clients who already view you as an indispensable resource before the first sales call occurs.

Acquiring a lead is only the initial step. To maximize the return on this effort, you must guide prospects through the sales funnel using intelligent lead nurturing strategies. You can find several effective lead nurturing email examples to begin. This follow-up process is critical for converting initial interest into profitable, long-term client relationships. By fully embracing this new playbook, you are not just maintaining pace; you are positioning your firm to compete, drive sustainable growth, and build a durable lead generation engine.

Building Your High-Performance Lead Engine

Image

A modern playbook is a crucial starting point, but theory alone does not generate revenue. To succeed in lead generation insurance, you must construct a systematic, high-performance engine. This is not a collection of disparate tactics but a deliberate framework engineered to attract, engage, and convert high-value commercial clients with precision.

For brokers, underwriters, and risk managers, this requires moving beyond ad-hoc efforts. It is about building a sustainable system that reliably produces qualified opportunities. This process is methodical, with each component reinforcing the next to create a powerful, self-sustaining mechanism.

Define Your Ideal Client Profile

The foundation of any effective lead engine is a precise understanding of your target audience. An Ideal Client Profile (ICP) is more than a summary of firmographics; it is a data-backed, highly focused description of the perfect client for your insurance products.

A robust ICP for commercial insurance must detail specifics such as:

- Specific Risk Exposures: Are they a coastal business facing increased flood risk, or an agricultural operation dealing with persistent drought?

- Geographic Focus: Pinpoint asset locations are critical, especially when dealing with location-specific threats like wildfires or hurricanes.

- Decision-Making Unit: Identify the key stakeholder. Is it a dedicated risk manager, the CFO, or the business owner?

- Buying Triggers: What event or data point would compel them to seek new or enhanced coverage immediately?

Without a clearly defined ICP, marketing expenditures are inefficient. This foundational step ensures all content and keyword strategies are precisely calibrated to attract your most valuable prospects.

A well-defined ICP acts as a compass for your entire lead generation strategy. It ensures that every dollar spent and every hour invested is aimed directly at the clients you are best equipped to serve.

With this clarity, you can begin constructing the engine that attracts them.

Create High-Value Educational Content

In commercial insurance, trust is the primary currency. The most effective way to earn it is by creating high-value content that addresses your ICP’s most urgent challenges. This is not a sales pitch; it is a demonstration of expertise that builds credibility and authority.

Your content should function as a pre-consultation, directly addressing the pain points of your ideal clients. For example, a broker targeting manufacturing firms in a flood-prone region could publish a detailed guide on securing business interruption insurance for supply chain disruptions caused by extreme weather.

This type of content acts as a magnet for prospects with high purchase intent. When a risk manager is actively searching for solutions to specific challenges, your content must provide the answer. This approach inverts the traditional sales dynamic, causing prospects to seek you out.

Implement Technical SEO For Maximum Visibility

Creating exceptional content is only half the battle; it must be discoverable. Search Engine Optimization (SEO) is the technical process of ensuring your website and content appear at the top of search engine results when your ICP is searching. It is how you capture prospects at their exact moment of need.

Focus on local and risk-specific keywords to attract relevant traffic. For instance, a broker might target phrases like "commercial flood insurance Dallas" or "wildfire liability coverage for California wineries." Integrating these terms naturally into your website, blog posts, and page titles makes you visible to the audience that matters most.

User experience is also a critical component. Research shows that 53% of mobile users will abandon a website if it takes longer than three seconds to load. A fast, secure, and easily navigable website is not a luxury; it is a non-negotiable element of technical SEO.

Nurture Leads With Marketing Automation

Not every lead is ready to convert immediately. This is where marketing automation becomes a strategic asset. These platforms enable you to build and nurture relationships with prospects over time, delivering the right information at the right stage of their journey.

For instance, when a prospect downloads your flood risk guide, an automated system can trigger a follow-up email one week later with a case study about a similar business you assisted. This process maintains top-of-mind awareness and builds relationships at scale with minimal manual intervention. This systematic nurturing is what transforms a cold lead into a warm, qualified opportunity, significantly improving your lead-to-close ratio.

Using Climate Intelligence To Find Leads

A high-performance lead engine is powerful, but what if you could add a predictive layer? Instead of waiting for prospects to find you, you could identify their needs *before* they even begin their search.

This is the advantage of using climate intelligence for insurance lead generation. It represents a fundamental shift from a reactive stance to a proactive, advisory role, transforming how insurance professionals source new opportunities. Instead of relying solely on inbound interest, you can use advanced data to pinpoint commercial assets with significant or newly emerging climate risk exposures.

This effectively turns a potential business liability into a highly targeted, value-driven lead for your firm.

Turning Risk Data Into Qualified Opportunities

At its core, climate intelligence uses predictive insights to initiate meaningful conversations about tangible operational risks. Imagine having visibility into every commercial property in a specific ZIP code recently impacted by a flash flood or currently in the path of a wildfire.

Purpose-built platforms like Sentinel Shield monitor environmental events with hyperlocal precision. This is not just about knowing a hurricane made landfall; it is about identifying the exact businesses located within the impacted zones. This process provides several distinct advantages:

- Extreme Relevance: You are contacting a business about a problem they are actively confronting, making your outreach incredibly timely.

- High Intent: A business with a flooded warehouse or fire-damaged inventory has an immediate, undeniable need for your solutions.

- Strategic Positioning: You are no longer just another vendor but a strategic partner arriving with a critical solution at the exact moment of need.

This method transcends generic firmographic data, allowing underwriters and brokers to make contact with a clear, compelling value proposition based on real-world events.

The most powerful lead is one where the prospect’s need is urgent, specific, and directly solvable by your expertise. Climate intelligence delivers precisely these types of opportunities by connecting environmental events to commercial assets in near real-time.

By leveraging this data, you can build lead lists that are not just pre-qualified but are also facing an urgent need, making them far more likely to engage.

Acting As A Strategic Risk Partner

This data-driven approach fundamentally alters the client relationship from the first interaction. When you reach out with specific knowledge of a prospect’s risk exposure, you instantly establish credibility and differentiate yourself from the competition. You are proving your expertise, not just selling a policy.

For example, a broker could use a climate intelligence platform to identify all manufacturing facilities in a region recently re-classified as a high-drought area. The broker’s outreach can then focus on the specific operational risks associated with water scarcity, such as production slowdowns or increased material costs.

This proactive stance empowers you to:

- Educate the Prospect: Many businesses do not fully grasp the financial implications of their new climate risk exposure until an expert points it out.

- Offer Tailored Solutions: The insights gained allow you to propose specific coverage or risk mitigation strategies that directly address the identified threat.

- Build Deeper Trust: By acting as an advisor from the first touchpoint, you build a foundation of trust that makes the entire sales process smoother and more effective.

Ultimately, using climate intelligence for lead generation enables you to create a proprietary market of high-intent prospects, providing the power to find untapped opportunities and engage decision-makers with a level of relevance that traditional methods cannot match.

Finding Untapped Insurance Lead Channels

Image

A solid lead engine fueled by SEO and content is the baseline for competition. However, market leaders consistently identify high-value prospects in channels their competitors overlook.

To gain a true competitive edge in lead generation insurance, you must move beyond the standard digital marketing playbook. The objective is to discover new ways to engage clients at their precise moment of need, creating an acquisition path that feels like a necessary solution rather than a sales pitch.

Two of the most powerful and underutilized channels are embedded insurance partnerships and AI-powered predictive analytics. These are not buzzwords but actionable strategies that unlock hyper-targeted lead lists and integrate your services directly into a client's workflow.

The Strategic Power Of Embedded Insurance

Embedded insurance is a powerful method for lead acquisition that involves integrating your coverage directly into another product or service a client is already purchasing. Instead of actively shopping for insurance, the client is offered relevant protection at the point of need.

Consider a commercial real estate transaction. As the deal is being finalized, property insurance is offered as part of the closing process. This approach is timely, relevant, and highly convenient for the client.

This strategy transforms the lead generation dynamic by placing your offers directly in the path of high-intent buyers. It allows you to leverage the trust and customer base of an established partner, creating a steady, predictable stream of qualified prospects.

The potential is significant. The embedded insurance market is projected to exceed $722 billion in global premiums by 2030, driven by partnerships in auto, real estate, B2B software, and more. You can learn more about this growing insurance trend and its impact on distribution.

Embedded insurance is the ultimate form of right-place, right-time marketing. It removes the friction of a separate purchasing journey and positions insurance as an integral part of a larger, necessary transaction.

By forging strategic partnerships with companies whose customers align with your Ideal Client Profile, you can build a highly efficient lead channel with minimal direct marketing expenditure.

Using Predictive Analytics To Uncover Future Risks

The other frontier for finding untapped leads is leveraging AI-powered predictive analytics to identify future risks before they materialize. This represents a significant leap from reacting to past events—as with climate intelligence—to forecasting where the next wave of need will emerge.

This strategy involves using sophisticated data models to analyze a wide range of inputs, from economic forecasts and supply chain data to long-term climate projections. The system then flags companies or entire industries on a collision course with a specific, insurable risk.

This foresight enables you to:

- Anticipate Market Needs: Pinpoint sectors that will soon require new types of coverage due to regulatory changes, new technologies, or emerging environmental threats.

- Generate Hyper-Targeted Lists: Build lead lists of companies statistically likely to face a specific problem, allowing you to approach them with a perfectly tailored solution.

- Establish Thought Leadership: Approaching a prospect with insights about risks they have not yet considered positions you as a strategic advisor, not a salesperson.

For example, an analytics platform might predict that new water usage regulations in a specific region will significantly impact agricultural businesses within the next 18 months. An astute broker could use that insight to proactively develop specialized coverage and initiate conversations with those businesses long before the problem becomes a crisis.

This type of foresight provides a substantial first-mover advantage, allowing you to capture a market segment before your competitors are even aware it exists.

Measuring And Optimizing For Profitability

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/haAUUI325Tc" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

While clicks and traffic are useful indicators, a successful insurance lead generation program is ultimately defined by profit. If an initiative cannot be measured, it cannot be improved. This makes a robust measurement framework non-negotiable for sustainable growth.

It is time to move beyond vanity metrics. Decision-makers must focus on key performance indicators (KPIs) that directly impact the bottom line. Without clear measurement, you are operating blindly, unable to distinguish between a resource-draining campaign and a highly profitable one. A data-driven approach is the only way to confidently allocate resources for maximum return.

Core Metrics For Insurance Lead Generation

To gain a clear understanding of performance, you must track the metrics that connect marketing expenditure to actual revenue. These three KPIs are the foundation of any profitable lead generation system.

- Customer Acquisition Cost (CAC): This is the total cost to acquire one new client. It is calculated by dividing total campaign spend by the number of new clients acquired. A low CAC is a primary indicator of an efficient strategy.

- Lead-to-Close Ratio: This metric measures the quality of your leads by calculating the percentage that convert into paying clients. A high ratio indicates that you are attracting the right prospects and your sales process is effective.

- Lifetime Value (LTV): LTV represents the total revenue you can reasonably expect from a single client over the entire business relationship. A high LTV demonstrates that you are acquiring valuable, long-term clients, not just making one-off sales.

An optimized lead generation strategy achieves a healthy balance where the LTV is significantly higher than the CAC. This is the ultimate proof that your program is not just creating activity—it is actively fueling profitable growth.

Creating An Optimization Framework

Once you are consistently tracking these core metrics, you can begin the work of optimization. This involves analyzing performance data, identifying weaknesses, and implementing targeted adjustments to improve results.

For example, a high CAC combined with a strong lead-to-close ratio suggests that while your sales team is effective, your lead sources are too expensive. This insight might lead you to reallocate budget from high-cost pay-per-click ads to more cost-effective channels like SEO or referral marketing. To gain a comprehensive view of campaign success, particularly with email, it is crucial to monitor the right key email marketing metrics.

By continuously evaluating performance against these core business objectives, you can make informed, data-backed decisions. This iterative loop of analysis and adjustment ensures your lead generation insurance program evolves, improves, and consistently delivers a measurable ROI.

Frequently Asked Questions

Even with a well-defined plan, navigating modern lead generation for insurance can present challenges. Here are answers to common questions from brokers, underwriters, and risk managers seeking to build a more effective client acquisition engine.

What Is The Best First Step For An Agency New To Digital Lead Generation?

Your first, non-negotiable step is to define your Ideal Client Profile (ICP). Before allocating any budget to tools or campaigns, you must have a precise understanding of your target audience. What is their industry? What is their revenue? What specific risks are their primary concern?

Defining your ICP correctly is the foundation for all subsequent activities. It dictates your keyword strategy, content creation, and advertising campaigns. An undefined ICP results in wasted resources and time pursuing prospects who are not a good fit for your services.

How Long Does It Take To See ROI From Content And SEO Efforts?

Organic marketing strategies like content and SEO should be viewed as long-term investments, not quick wins. Unlike paid advertising, which can generate immediate traffic at a cost, organic growth is about building sustainable authority over time.

You should expect to see tangible momentum and a consistent trend in qualified leads within 6 to 12 months. The initial phase is focused on establishing your site's credibility and developing a library of high-value content.

The return on this investment, however, is substantial. The upfront effort creates a durable asset that generates a continuous flow of leads long after the initial investment, with value that compounds over time.

Can Smaller Insurance Brokerages Compete With Large Carriers?

Yes. While large carriers have significant budgets, smaller and mid-sized brokerages possess the advantages of agility and specialization. You compete not by outspending them, but by out-specializing them.

Instead of attempting to serve all markets, a smaller firm can dominate a specific niche, becoming the recognized expert on a particular risk, such as climate threats for coastal businesses or supply chain failures for manufacturers.

The winning strategy includes:

- Niche Specialization: Become the go-to authority for a very specific client type or risk profile.

- Superior Service: Offer a level of personalized guidance and custom solutions that a large, bureaucratic carrier cannot match.

- Hyper-Specific Content: Answer the detailed, technical questions your ideal niche clients are actively searching for online.

By building a strong reputation in a focused area, smaller brokerages can become a magnet for the high-value leads that large, generalist carriers often overlook.

---

Ready to stop chasing cold leads and start engaging high-intent prospects at their moment of need? Sentinel Shield uses real-time climate intelligence to deliver qualified, geo-targeted leads directly to your pipeline. Discover how our performance-based model can transform your lead generation efforts.