In the high-stakes world of climate risk and commercial insurance, generic sales tactics are ineffective. Decision-makers—including underwriters, brokers, and risk managers—are inundated with noise and operate with an urgency driven by real-world climate events. To penetrate this market, your approach must be precise, timely, and directly relevant to their immediate operational challenges. Effective prospecting is no longer a volume game; it is a strategic imperative built on identifying acute needs at the exact moment they arise.

This guide moves beyond theory to deliver eight actionable sales prospecting best practices tailored for professionals who convert climate-driven risks into tangible business opportunities. Each strategy is designed for immediate implementation, enabling you to engage high-value prospects with relevance and authority. We will explore proven methodologies to connect with high-intent decision-makers, build credibility, and drive revenue in a rapidly evolving market. From refining your Ideal Customer Profile to leveraging trigger events, these techniques are essential for turning crisis into opportunity and establishing a dominant position in the climate economy.

1. Ideal Customer Profile (ICP) Development

Effective prospecting begins not with a list of contacts, but with a precise definition of your target. An Ideal Customer Profile (ICP) is a data-driven description of the perfect client for your climate risk or insurance solutions. This framework goes beyond simple firmographics (company size, industry) to include technographics (their existing risk modeling software), operational footprint (geographic exposure to specific perils), and behavioral traits (their stated ESG goals, risk tolerance, and buying patterns).

Ideal Customer Profile (ICP) Development

Developing a clear ICP is one of the most critical sales prospecting best practices because it focuses your efforts on high-value accounts most likely to convert and become long-term partners. For example, a commercial insurer might define its ICP as mid-sized logistics companies with significant assets in hurricane-prone coastal regions. This precision allows for hyper-targeted campaigns that address specific risk exposures, significantly boosting engagement. A well-defined ICP aligns every stage of the B2B sales funnel with business objectives.

How to Implement ICP Development

To build a powerful ICP, analyze your most successful existing clients.

- Interview Your Best Customers: Conduct structured interviews to understand the specific business pain points that led them to seek a solution, their evaluation criteria, and the measurable value they derive from your services.

- Analyze CRM and Underwriting Data: Identify common attributes among your most profitable and lowest-risk accounts. Look for patterns in industry classification, geographic concentration, asset value, and historical loss data.

- Create "Negative" Personas: Define the characteristics of clients who are a poor fit—those who churn quickly, have high loss ratios, or require disproportionate resources. This prevents wasted effort on low-potential prospects.

Key Takeaway: An ICP is a dynamic asset, not a static document. Update it quarterly with new data on emerging risks, market trends, and client performance to maintain its strategic accuracy.

To structure your analysis, consider leveraging resources like B2B buyer persona templates to ensure you capture all critical details.

2. Social Selling on LinkedIn

Modern prospecting in the commercial insurance sector has moved from cold calls to strategic digital engagement. Social selling on LinkedIn involves using the professional network to build credibility, share valuable risk management insights, and engage with potential clients long before a direct sales pitch. The objective is to establish yourself as a trusted advisor on topics like climate resilience, regulatory changes, or new underwriting technologies.

Social Selling on LinkedIn

Adopting social selling is one of the most effective sales prospecting best practices because it warms cold outreach by nurturing leads with valuable, non-promotional content. This strategy allows you to understand a prospect's challenges based on their digital footprint—such as their posts about supply chain disruptions or new risk modeling hires—enabling highly relevant and timely engagement. For a deeper dive into converting your social presence into tangible leads, explore specific LinkedIn Lead Generation Strategies.

How to Implement Social Selling on LinkedIn

To integrate social selling into your prospecting workflow, focus on delivering tangible value.

- Share High-Value Content: Regularly post and share content that directly addresses the pain points of your ICP, such as analyses of recent CAT events, summaries of new climate disclosure regulations, or case studies on risk mitigation.

- Personalize Your Outreach: Avoid generic connection requests. Reference a prospect’s recent article on parametric insurance, a shared industry connection, or a company announcement about a new sustainability initiative.

- Engage Before Connecting: Interact with a prospect's content by providing insightful comments or sharing their posts for several weeks before sending a connection request. This builds familiarity and demonstrates genuine interest in their work.

- Utilize LinkedIn Sales Navigator: Leverage this tool to identify key decision-makers on risk committees, track company updates, and receive alerts on your target accounts for more strategic outreach.

Key Takeaway: The goal of social selling is not to close deals on the platform, but to build sufficient credibility and rapport that moving the conversation to a formal meeting becomes a natural next step.

3. Multi-Channel Outreach Sequences

Relying on a single communication channel is no longer sufficient. A multi-channel outreach sequence is a systematic, coordinated approach that uses multiple touchpoints across various platforms—such as email, phone calls, and LinkedIn—to engage risk managers and underwriters. This strategy significantly increases your chances of cutting through the noise by meeting decision-makers on their preferred platforms.

Implementing multi-channel outreach is one of the most effective sales prospecting best practices because it surrounds the prospect with value-driven communication, building familiarity and trust without being intrusive. Sales engagement platforms have demonstrated that structured sequences can lead to significantly higher reply rates and more booked meetings. This methodical approach ensures persistence while maintaining professionalism, which is critical for engaging executives in the insurance and risk management sectors.

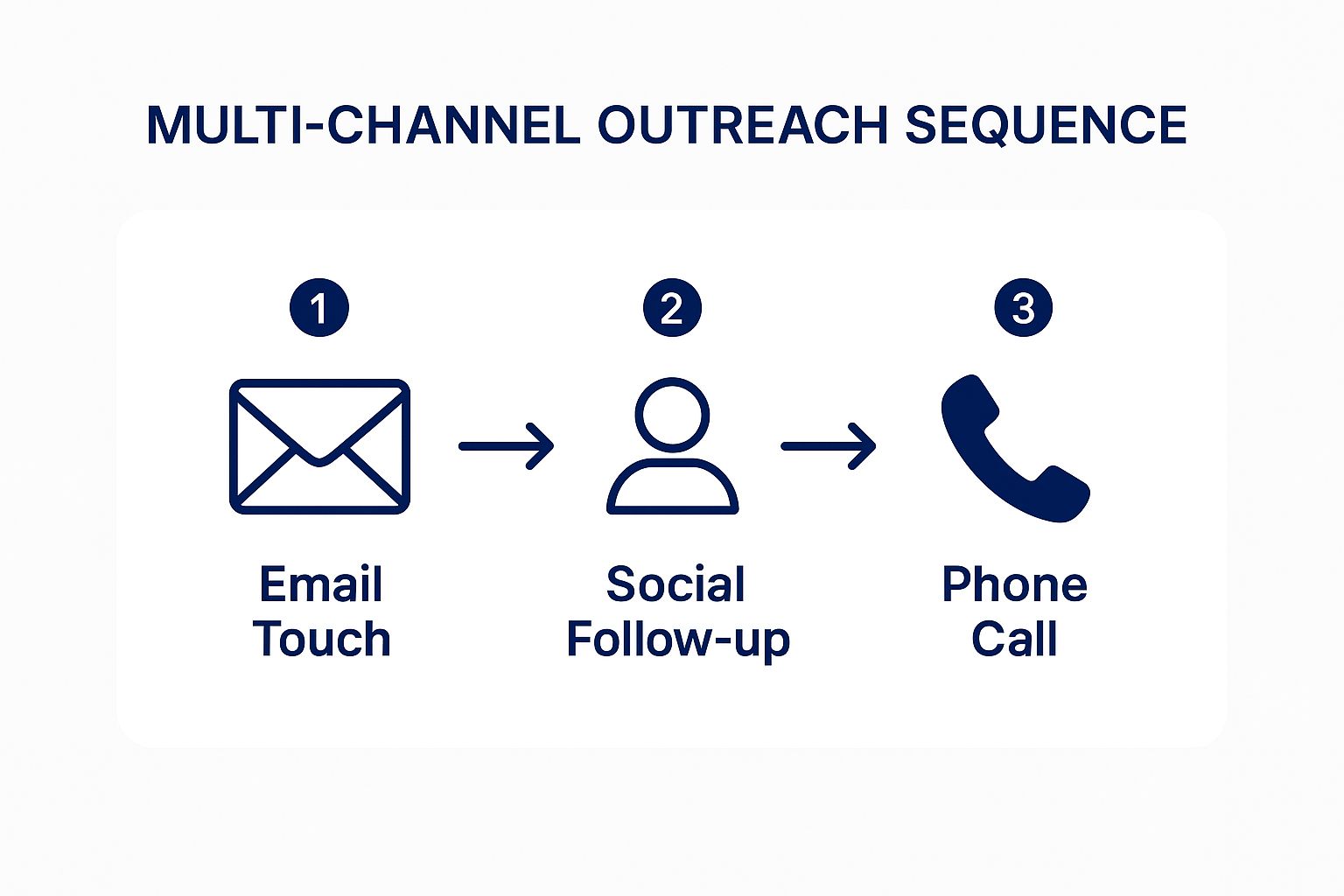

The following infographic illustrates a simple yet powerful three-stage process flow for a multi-channel outreach sequence.

Infographic showing key data about Multi-Channel Outreach Sequences

This visual process flow highlights the importance of escalating engagement from a low-touch email to a high-touch, direct phone call.

How to Implement Multi-Channel Outreach

To build an effective sequence, orchestrate your touchpoints to provide unique value at each step.

- Map Your Sequence: Plan your touchpoints over 2-3 weeks. A typical sequence might start with a personalized email, followed by a LinkedIn connection request with a note, a follow-up email sharing a relevant case study, and then a direct phone call.

- Vary Your Content: Do not repeat the same message. Tailor communication to the platform: a detailed email with an attached whitepaper, a concise LinkedIn message referencing their recent activity, and a voicemail that is direct and outcome-focused.

- Leverage Technology: Use sales engagement platforms to automate sequences, track opens and replies, and receive alerts for optimal call times. This ensures rigorous follow-up without manual error.

- Include a "Breakup" Email: If a prospect is unresponsive after multiple attempts, send a final, professional email to close the loop. This respectful approach often re-engages a surprising number of prospects.

Key Takeaway: The objective of a multi-channel sequence is to build a coherent narrative. Each touchpoint should build upon the last, telling a consistent story about how you solve the prospect's specific risk management challenges.

<iframe width="560" height="315" src="https://www.youtube.com/embed/YjzacMAOx-c" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

To see how this fits into a larger strategy, explore more on the B2B lead generation process and how to fill your pipeline with qualified opportunities.

4. Intent Data-Driven Prospecting

Timing is a critical factor in sales. Intent data-driven prospecting shifts your focus from "who" to "when," enabling you to identify and engage prospects who are actively researching solutions for climate risk, commercial insurance, or related challenges. This strategy leverages online behavioral signals—such as downloads of industry reports, webinar attendance on risk modeling, or search queries for specific insurance products—to pinpoint accounts demonstrating active buying interest. This transforms your outreach from a cold interruption into a timely, relevant conversation.

This modern approach is one of the most effective sales prospecting best practices because it prioritizes accounts that are already in-market, dramatically increasing conversion rates. For example, by using intent data to identify companies researching "parametric insurance solutions" after a major weather event, an insurer can time their outreach perfectly. The core benefit lies in moving beyond guesswork and using data to engage the right accounts at the peak of their interest.

How to Implement Intent Data-Driven Prospecting

To effectively integrate intent data, you must be systematic and swift.

- Combine Intent with Your ICP: Layer intent signals over your Ideal Customer Profile. This ensures you target not just interested companies, but the *right* interested companies that fit your business model and risk appetite.

- Act Quickly on Spikes: Intent signals are perishable. When a target account shows a spike in interest around a key topic, your sales team must engage within 24-48 hours to capitalize on their active research phase.

- Personalize with Context: Reference the topics they are researching. For example: "I noticed your team was researching solutions for climate risk modeling. We recently published a guide on mitigating wildfire exposure for commercial properties in California that may be useful."

Key Takeaway: The power of this approach comes from layering multiple intent signals. A single whitepaper download is a weak signal, but combining it with website visits and competitor research indicates strong buying intent, signaling a high-priority prospect.

Using intent signals is a core component of advanced sales strategies. You can learn more about how this fits into a broader data-first approach by exploring predictive analytics in sales.

5. Video Prospecting

In a digital landscape saturated with text, video prospecting cuts through the noise. This strategy involves creating short, personalized video messages for individual prospects or small account groups to forge a genuine human connection. It humanizes the sales process, allowing you to convey empathy, expertise, and personality in a way that text cannot.

Video Prospecting

Using personalized video is one of the most effective sales prospecting best practices because it captures attention and builds rapport instantly. This technique is particularly impactful for reaching decision-makers in complex industries like commercial insurance, where establishing trust is paramount to securing a meeting to discuss risk mitigation strategies.

How to Implement Video Prospecting

Focus on authenticity and value, not high-production quality.

- Keep It Short and Personal: Aim for videos under 60 seconds. Address the prospect by name and mention their company. Holding up a whiteboard with their name on it is a proven technique for creating a personalized thumbnail that increases open rates.

- Show, Don't Just Tell: Use screen sharing to provide immediate value. For a risk manager, you could walk through a public satellite image showing their facility's proximity to a flood zone or highlight a key finding in a recent industry risk report.

- End with a Clear Call-to-Action: Conclude your video with a direct and simple next step. For example, "Does this approach to mitigating supply chain risk align with your priorities? If so, let's connect for 15 minutes next week."

Key Takeaway: The goal of a prospecting video is not to sell, but to initiate a conversation. Focus on being a helpful, authentic expert who understands the prospect's challenges to dramatically increase your response rate.

For those looking to streamline their efforts, exploring the best AI video generator tools can significantly enhance your video prospecting strategy.

6. Account-Based Prospecting

Account-Based Prospecting (ABP), also known as Account-Based Marketing (ABM), shifts from a wide-net approach to a highly focused strategy that treats individual high-value accounts as markets of one. Instead of targeting a large volume of leads, this method involves identifying key target companies and orchestrating a coordinated, personalized outreach campaign to multiple stakeholders within those organizations.

This strategic approach is a cornerstone of modern sales prospecting best practices because it aligns sales and marketing resources to penetrate the most valuable accounts. For the B2B insurance and climate risk sectors, where deals are complex and involve multiple decision-makers (e.g., Risk Manager, CFO, Head of Operations), ABP is particularly effective. Hyper-targeting ensures all messaging is relevant to each stakeholder's specific concerns.

How to Implement Account-Based Prospecting

Executing an effective ABP strategy requires deep research and coordinated communication.

- Research and Select Target Accounts: Use your ICP to identify a select list of high-value companies. Deeply research their business challenges, recent financial reports, stated climate goals, and existing insurance partners.

- Map the Buying Committee: Identify all key stakeholders involved in the purchasing decision, from influencers and risk analysts to ultimate decision-makers on the executive team. Understand their individual roles and priorities.

- Coordinate Personalized Outreach: Develop a unified messaging strategy and execute a multi-channel campaign targeting the entire buying committee. Coordinate outreach across email, phone calls, LinkedIn, and even executive-level events.

Key Takeaway: Account-Based Prospecting is a team sport. Success requires tight alignment between sales, marketing, and even underwriting to create a seamless and compelling experience for the target account at every stage.

This focused strategy complements broader lead generation efforts. To understand how ABP fits into a larger strategy, you can explore the principles of inbound marketing and lead generation.

7. Referral and Warm Introduction Systems

The most effective prospecting often comes from a trusted source. A referral and warm introduction system is a structured process for leveraging your existing network—satisfied clients, partners, and professional contacts—to connect with new prospects. This approach bypasses gatekeepers and establishes immediate trust, significantly shortening the sales cycle and increasing close rates. It transforms prospecting from a high-volume activity into a targeted, relationship-driven strategy.

Building a formal referral system is one of the most impactful sales prospecting best practices because it turns your network into an extension of your sales team. A warm introduction from a respected peer is far more likely to result in a booked meeting, which is fundamental to effective B2B appointment setting.

How to Implement a Referral System

To systematically generate warm introductions, you need a proactive, repeatable process.

- Time Your Ask: The best time to ask for a referral is immediately following a major value-delivery moment, such as after a smooth claims process, a successful risk assessment, or a positive quarterly business review.

- Make It Effortless: Do the work for your referrer. Provide them with pre-written email templates, key talking points about your value proposition, and a clear description of the ideal prospect you're looking to meet.

- Establish a "Give-to-Get" Mindset: Actively look for opportunities to provide valuable introductions for your clients and partners. This builds goodwill and makes them far more likely to reciprocate.

- Recognize and Reward: Acknowledge every referral, regardless of the outcome. A simple thank-you note, a LinkedIn recommendation, or a formal rewards program can motivate your network to continue sending opportunities your way.

Key Takeaway: Do not treat referrals as a passive activity. Integrate the "ask" into specific stages of your client lifecycle, such as onboarding and business reviews, to ensure a consistent flow of high-quality, warm leads.

8. Trigger Event Prospecting

Effective outreach is about timing. Trigger Event Prospecting is the practice of monitoring and responding to specific business changes that signal an immediate need or buying opportunity. For the climate risk and insurance industry, these events include regulatory changes, new executive hires (like a Chief Sustainability Officer), M&A activity, facility expansions, or—most powerfully—a recent climate-related event impacting their assets.

This strategic approach transforms cold outreach into a timely, relevant conversation. Capitalizing on these moments is a powerful sales prospecting best practice because it aligns your solution with a prospect's urgent priority. Reaching out to a logistics company about supply chain risk insurance immediately after a major port is shut down by a hurricane is infinitely more effective than a generic pitch.

How to Implement Trigger Event Prospecting

Integrating this strategy requires a proactive monitoring system and a rapid response protocol.

- Set Up Automated Alerts: Use tools like Google Alerts, LinkedIn Sales Navigator, or specialized climate intelligence platforms to monitor target accounts and industries for key trigger events.

- Define Your Key Triggers: Identify the events most relevant to your solution. For a commercial insurance broker, this could be a company announcing a new factory in a wildfire zone, a major acquisition, or a hailstorm impacting a concentration of their commercial properties.

- Develop Contextual Templates: Create pre-written, easily customizable outreach templates for different trigger types. Your message for a new CFO hire should be different from one acknowledging a recent weather-related operational disruption.

- Act with Urgency: The window of opportunity is small. Respond within 24-48 hours of a trigger event to ensure your outreach is timely and relevant.

Key Takeaway: The power of trigger event prospecting lies in its context. Your outreach is no longer an interruption but a well-timed, relevant solution to a new and pressing business challenge, dramatically increasing your chances of securing a meeting.

To master this technique, it's essential to understand the principles of timing in sales, as pioneered by experts like Craig Elias.

Sales Prospecting Best Practices Comparison

| Approach | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Ideal Customer Profile (ICP) | Moderate to High | Data analysis tools, CRM data | 2-3x higher conversion rates | Foundational targeting & segmentation | Precise messaging, reduced unqualified leads |

| Social Selling on LinkedIn | Moderate | LinkedIn platform, content creation | Builds industry authority, trust | Long-term relationship building with executives | Cost-effective, valuable prospect insights |

| Multi-Channel Outreach | High | Sales engagement platform, content | Higher response rates, comprehensive nurturing | Broad outreach with diversified touchpoints | Maximizes engagement, professional persistence |

| Intent Data-Driven Prospecting | Moderate to High | Intent data platform investment | Higher conversion rates, better timing | Targeting prospects actively researching solutions | Highly relevant and timely messaging |

| Video Prospecting | Moderate | Recording equipment, video tools | Higher open and reply rates | Personalized outreach to key decision-makers | Builds personal connection, conveys complex value |

| Account-Based Prospecting | Very High | Team coordination, deep research | Higher ROI and deal values | Targeting high-value accounts with buying committees | Stronger relationships, sales & marketing alignment |

| Referral & Warm Introductions | Low to Moderate | CRM tracking, relationship management | >5x higher conversions, lower acquisition cost | Leveraging existing networks for warm leads | Pre-built trust, shorter sales cycles |

| Trigger Event Prospecting | Moderate | Alert systems, news/climate data monitoring | 25-50% higher response rates | Timing outreach with business-critical events | Unmatched relevance, reduced competition |

Activating Your Prospecting Engine with Climate Intelligence

Mastering sales prospecting is about building a robust, multi-faceted engine to consistently identify and engage high-value opportunities. The sales prospecting best practices explored here—from defining your ICP to executing multi-channel outreach—are the essential components of that engine. Each serves a distinct purpose: social selling builds authority, account-based strategies focus resources, and video prospecting adds a human connection.

However, for professionals in the commercial insurance and climate risk sectors, the ultimate catalyst is timing. This is where trigger event prospecting, supercharged by real-time climate intelligence, becomes your most powerful competitive advantage.

From Strategy to Action: The Power of Real-Time Data

The difference between a generic outreach attempt and a timely, value-driven engagement is profound. Generic prospecting is a shot in the dark; trigger-based prospecting fueled by actionable data is a targeted intervention. Imagine the impact of contacting a commercial property owner not with a general pitch about flood insurance, but with a precise message acknowledging the specific hailstorm that just impacted their zip code.

This level of precision transforms your role from a salesperson into a strategic advisor. You are no longer just selling a policy; you are offering a critical solution at the exact moment of need. This context-aware approach not only dramatically increases response rates but also builds immediate trust and positions your firm as an indispensable partner in risk management.

Integrating these sales prospecting best practices with a source of real-time, event-driven intelligence is the definitive path to building a resilient, high-growth pipeline. It elevates your prospecting from a speculative activity into a strategic response system, enabling you to connect with high-intent leads with unparalleled context and urgency. This is how modern risk professionals create indispensable partnerships.

---

Ready to transform your trigger-based prospecting with real-time climate event intelligence? Insurtech.bpcorp.eu provides the actionable data you need to identify impacted businesses and engage decision-makers at the critical moment of need. Visit Insurtech.bpcorp.eu to see how our platform can become the fuel for your sales prospecting engine.