Predictive analytics is not about forecasting the future with a crystal ball. It is a strategic discipline that uses historical data, statistical algorithms, and machine learning to calculate the probability of future outcomes. In sales, this technology moves teams beyond reactive reporting on past performance to leveraging forward-looking insights that shape strategy. The shift is from asking "what happened?" to knowing *what is most likely to happen next* and why.

Why Predictive Analytics Is a Competitive Imperative in Sales

In high-stakes sectors like commercial insurance and risk management, accurate forecasting is fundamental to success. Traditionally, this meant relying on historical performance, broad market trends, and professional intuition. However, this approach is like driving a vehicle by only looking in the rearview mirror—it confirms where you have been but offers no insight into the road ahead.

Predictive analytics fundamentally alters this dynamic. Instead of being constrained by past results, it analyzes vast datasets with sophisticated algorithms to identify patterns and probabilities that are invisible to the human eye. For underwriters, brokers, and risk managers, this capability is transformative. It enables a strategic shift from a reactive posture to a proactive, data-driven operation.

The Shift from Traditional to Predictive Sales Forecasting

The move to predictive analytics is not merely an upgrade; it is a fundamental re-engineering of the sales forecasting process. Legacy methods depend heavily on intuition and lagging indicators, while a predictive approach is grounded in data and forward-looking probabilities.

| Aspect | Traditional Forecasting | Predictive Analytics |

|---|---|---|

| Data Source | Historical sales data, salesperson intuition | Vast datasets: CRM, market trends, customer behavior |

| Methodology | Subjective judgment, manual spreadsheets, past performance | Statistical models, machine learning algorithms |

| Focus | Reactive (analyzing past events) | Proactive (forecasting future outcomes) |

| Accuracy | Often low, subject to bias and unforeseen events | High, continuously refined by new data |

| Outcome | General targets, often missed | Precise lead scoring, churn prediction, resource planning |

This table highlights the core evolution: a move from a system based on informed guesswork to one built on intelligent, data-driven guidance.

The Strategic Shift from Guesswork to Guidance

Consider a traditional sales team as a crew of experienced sailors using a paper map and a compass. Their skills are valuable, but their tools are limited to what is already known. A team leveraging predictive analytics is equipped with a full suite of sonar and advanced weather radar. They can identify submerged risks and anticipate storms before they arrive, enabling them to chart a faster and safer course to their destination.

This data-driven guidance delivers a material business impact in several critical areas:

- Intelligent Prioritization: Models automatically identify and rank leads most likely to convert, enabling sales teams to focus their efforts on high-probability opportunities.

- Resource Optimization: Accurate forecasting of demand and sales cycles allows for more effective allocation of personnel and marketing capital.

- Proactive Retention: The system can flag clients exhibiting behaviors consistent with churn risk, providing an opportunity for intervention *before* they attrit.

Predictive analytics is not designed to replace the expertise of a seasoned broker or underwriter. It is designed to augment their skills with precise, data-backed intelligence, empowering them to make faster, more confident decisions.

Market Momentum and Financial Urgency

This is not a niche trend; it is a significant market transformation. The global predictive analytics market is projected to grow from USD 18.75 billion in 2024 to USD 285.50 billion by 2035, a compound annual growth rate of 28.09%.

This explosive growth signals a clear imperative for decision-makers: failure to adopt these technologies is no longer a missed opportunity—it is a direct threat to competitive viability. For firms in the commercial insurance and recovery sectors, this represents an essential evolution required to maintain relevance in a rapidly advancing industry.

Artificial intelligence is the engine driving this evolution. The practical application of an AI agent for sales automates and optimizes many of the tasks that predictive models inform. Integrating these capabilities into operations provides a powerful advantage in anticipating customer and market behavior, ensuring a sustainable competitive edge.

How Predictive Analytics Boosts Sales Productivity

In high-stakes industries like commercial insurance and risk management, sales productivity is measured not by the volume of activity, but by the quality of outcomes. Predictive analytics functions as a high-precision navigation system for sales teams, guiding them directly to the most promising opportunities and away from low-potential leads.

This technology fundamentally transitions the sales motion from a broad, quantity-based approach to a precise, quality-driven strategy.

Image

At its core, predictive analytics enhances performance by analyzing extensive customer datasets to identify prospects actively seeking solutions. For brokers and underwriters, this translates directly into shorter sales cycles, higher conversion rates, and more efficient use of time. It elevates the team from basic lead generation to intelligent opportunity identification.

Pinpointing High-Potential Leads with AI-Powered Scoring

One of the most immediate applications of predictive analytics is AI-powered lead scoring. Traditional methods often rely on simple demographic data or single actions, such as a website visit, which provide little insight into a prospect's actual intent or fit.

Predictive models operate at a much deeper level. They analyze thousands of data points from past successful deals to construct a precise profile of the ideal customer. The system then evaluates every new lead against this profile, assigning a numerical score based on the probability of conversion. This data-driven ranking enables sales teams to instantly identify which leads warrant immediate attention, eliminating the guesswork that consumes valuable resources.

For example, a model might determine that a commercial property manager in a high-risk climate zone who recently engaged with content on flood insurance is 85% more likely to purchase a policy than a business that only downloaded a generic brochure. The sales team can then prioritize its outreach strategy accordingly.

Predictive lead scoring transforms the sales pipeline from a cluttered list into a prioritized roadmap. It ensures that skilled professionals focus their time on opportunities with the highest probability of closing, maximizing the return on their effort.

Uncovering Buyer Intent Signals

Beyond scoring existing leads, predictive analytics excels at identifying prospects who have not yet initiated contact. It achieves this by analyzing intent data—the digital footprints that indicate a buyer is actively researching solutions.

These signals can include:

- Topic Research: A company suddenly increases its consumption of articles or webinars related to commercial storm damage recovery.

- Competitor Engagement: Key decision-makers from a target account begin following competitors on social media or visiting their pricing pages.

- Keyword Surges: An increase in online search activity for terms like "business interruption insurance for wildfires" originating from a specific geographic region.

By capturing and interpreting these behaviors, predictive models can flag companies as they enter a buying cycle. This allows sales teams to engage proactively with relevant information at the precise moment it is most needed. This targeted approach is highly effective; studies indicate that companies leveraging predictive analytics with intent data see an average sales revenue increase of 25%.

Driving Efficiency and Reducing Sales Cycles

The primary objective is to generate revenue more efficiently. Predictive analytics achieves this by systematically removing friction and wasted effort from the sales process, creating a more direct path from initial contact to a closed deal.

This efficiency gain is derived from several key functions:

- Eliminating Unqualified Leads: The system automatically filters out leads that do not match the ideal customer profile, freeing teams from pursuing prospects with a low probability of conversion.

- Personalizing Outreach: By understanding a prospect's needs and interests *before* the first conversation, sales representatives can tailor their messaging for maximum impact and build rapport more quickly.

- Optimizing Timing: Predictive models can suggest the optimal time to contact a lead based on historical engagement data, increasing the likelihood of a positive response.

Focusing exclusively on high-quality, pre-qualified opportunities allows the team to accelerate deals through the pipeline. Of course, identifying promising prospects is only one part of the equation. To understand the foundational strategies behind lead acquisition, our comprehensive guide on how to generate insurance leads provides a valuable complement to this targeted approach. For firms in commercial insurance and recovery, these capabilities translate to closing more business in less time and with fewer resources.

Essential Predictive Models for Sales and Risk

Predictive analytics is not a monolithic tool but a suite of specialized models, each designed to address a specific business challenge. For professionals in commercial insurance and risk management, selecting the appropriate model is key to unlocking tangible value. These models serve as strategic instruments for identifying opportunities, mitigating threats, and deploying resources effectively.

These models analyze historical data—from past wins, losses, and client interactions—to identify the latent patterns that signal future outcomes. They transform raw information into clear probabilities, providing a roadmap for action. However, the efficacy of any model is contingent upon the quality of the underlying data.

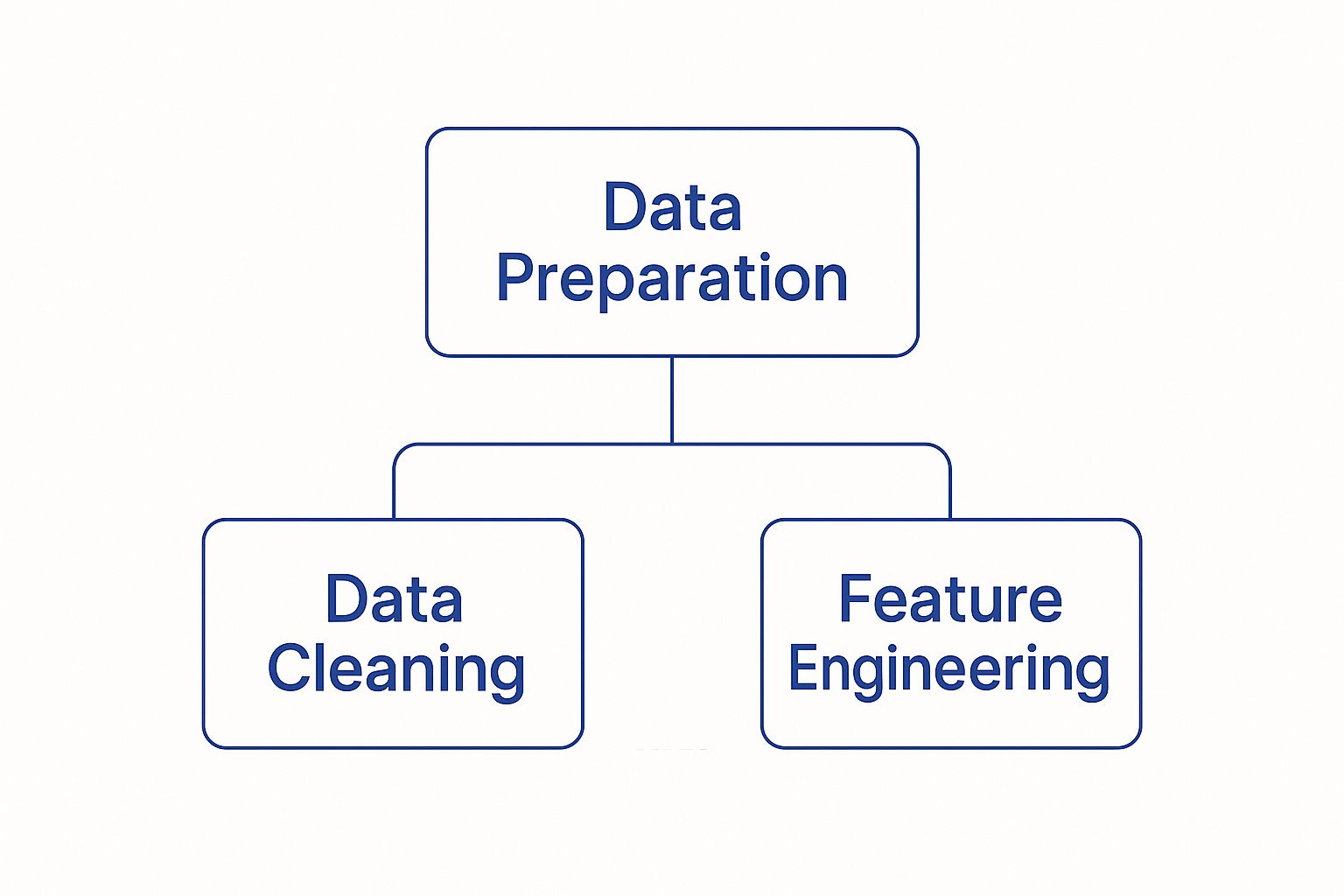

This image illustrates the foundational requirements. Before any model can generate reliable insights, the data must be rigorously prepared.

Image

As shown, model performance rests on a foundation of clean data and intelligent feature engineering, which ensures the algorithm learns from the correct signals. With this prerequisite understood, we can explore the models that offer the greatest impact for sales and risk management.

The following table provides an overview of common predictive models and their business applications.

Predictive Models and Their Business Applications

| Model Type | Primary Function | Application in Insurance & Sales |

|---|---|---|

| Lead Scoring | Ranks prospects based on their likelihood to convert. | Prioritizes high-potential insurance leads, allowing sales teams to focus on the warmest opportunities. |

| Churn Prediction | Identifies existing clients who are at high risk of leaving. | Flags at-risk policyholders for proactive retention efforts, protecting recurring revenue. |

| Cross-Sell/Up-Sell | Pinpoints opportunities to offer additional products to current clients. | Suggests new coverage lines (e.g., cyber liability for a client with property insurance) based on their profile. |

| Fraud Detection | Analyzes patterns to identify potentially fraudulent claims or activities. | Scans new claims against historical fraud data to reduce financial losses and streamline legitimate payments. |

These models convert data into a strategic asset, guiding teams to make smarter, more profitable decisions. Let's explore three of the most impactful models in greater detail.

Lead Scoring Models to Identify Top Prospects

A Lead Scoring Model is one of the most direct applications of predictive analytics for driving sales. It functions as an automated triage system for the entire sales pipeline. Instead of requiring the team to manually qualify every incoming lead, the model analyzes a new lead’s attributes and behaviors, comparing them against the profile of past successful clients.

It then assigns a numerical score, instantly identifying high-priority prospects. For example, a commercial property manager in a high-risk flood zone who has engaged with multiple articles on disaster recovery will receive a significantly higher score than a business in a low-risk area that only downloaded a generic brochure.

This data-driven prioritization delivers a substantial efficiency gain, allowing top performers to focus their time on conversations with the highest probability of converting to revenue. For a deeper examination of this core challenge, our guide on securing leads for insurance brokers offers strategies that integrate seamlessly with a predictive scoring system.

Churn Prediction Models to Retain Clients

In the insurance and risk management sectors, client retention is as critical as new client acquisition. A Churn Prediction Model serves as an early-warning system for client relationships. It continuously scans for subtle behavioral signals that indicate a client may be considering attrition.

These signals can include a decrease in communication frequency, negative feedback on a recent claim, or even macro-level market trends impacting their industry. By identifying these patterns early, the model flags at-risk accounts, enabling the client management team to intervene proactively.

This transforms client retention from a reactive, crisis-driven activity into a proactive, strategic function. It allows teams to address concerns, offer superior solutions, and reinforce value long before a client begins evaluating competitors.

Cross-Sell and Up-Sell Models to Uncover Opportunities

Finally, Cross-Sell and Up-Sell Models are designed to maximize the lifetime value of existing clients. These models analyze customer data to identify logical opportunities for expanding the business relationship. They search for patterns suggesting that a client is a strong candidate for additional coverage or more comprehensive services.

For instance, a model might identify that businesses purchasing commercial auto insurance frequently add liability coverage within six months, particularly if they are in a growth phase. Armed with this insight, a broker can execute a timely and relevant outreach. This not only increases revenue per client but also deepens the partnership by demonstrating a clear understanding of their evolving business needs.

A Framework for Implementing Predictive Analytics

Integrating predictive analytics into your sales process is a strategic business transformation, not merely an IT project. It requires a clear, structured plan to ensure the technology delivers a measurable return on investment. For decision-makers in commercial insurance and risk management, a disciplined framework is essential for moving from concept to successful execution.

This process is analogous to constructing a high-performance building: it requires a solid blueprint and a robust foundation before any other work can begin. The following steps provide a practical implementation guide for risk managers, brokers, and underwriters.

Image

Define Clear Business Objectives

Before evaluating any data or technology, you must define what success looks like in specific, measurable terms. Vague goals like "improve sales" are insufficient. Objectives must be directly linked to key performance indicators and operational challenges.

Begin by asking precise questions:

- What is our target for reducing customer churn in the next fiscal year (e.g., 10%)?

- What is the desired increase in the lead-to-conversion rate for new climate risk policies (e.g., 15%)?

- What is the goal for reducing the average sales cycle for complex commercial accounts (e.g., 20 days)?

Establishing these concrete targets provides a clear destination for the project and a benchmark for measuring its success, ensuring alignment across all stakeholders.

Assess Your Data Readiness

The output of a predictive model is only as reliable as the data it is fed. A critical component of this framework is a thorough and honest assessment of your data quality and accessibility. Poor data leads to inaccurate predictions, which erodes trust and results in flawed business decisions.

A successful assessment requires adhering to essential data quality best practices. Key areas to evaluate include:

- Data Quality: Is your data clean, complete, and consistent? This involves addressing issues like duplicate records, missing fields, and outdated information within your CRM.

- Data Accessibility: Can your analytics platform integrate with disparate data sources (CRM, marketing automation, claims systems)? Data silos are a common point of failure.

- Data Volume: Is there sufficient historical data for the model to learn from? A minimum of one year of sales and customer interaction data is a standard baseline.

This stage is foundational. Bypassing a comprehensive data audit is a primary cause of failure for predictive analytics initiatives.

Successful implementation is a strategic business project, not just an IT task. It requires clear goals, clean data, and a commitment to integrating insights into daily operations to achieve a high ROI.

Select the Right Tools and Integration Strategy

With clear objectives and verified data, you can proceed to technology selection. The primary decision is typically between building a custom solution and purchasing a specialized platform. For most organizations, a platform-based approach is more efficient and cost-effective.

When evaluating tools, prioritize integration capabilities. A predictive analytics platform must connect seamlessly with your existing CRM (e.g., Salesforce) to drive user adoption. The objective is to embed predictive insights directly into the daily workflows of the sales team, making data-driven actions intuitive rather than an additional burden.

Train Your Team and Foster Trust

Technology alone cannot guarantee success; the human element is equally critical. Your sales team, including experienced brokers and underwriters, requires training that goes beyond the technical operation of new tools. They must understand the methodology behind the insights and trust the recommendations provided.

This requires a focused change management effort:

- Transparent Communication: Clearly articulate the business rationale for the initiative and explain how it will help individuals achieve their targets and improve their effectiveness.

- Practical Training: Focus on how the analytics will simplify daily work, such as instantly identifying priority leads or at-risk clients.

- Early Wins: Identify and showcase early, tangible successes. Demonstrating that data-driven recommendations produce positive results is the fastest way to build momentum and trust.

Establish a Feedback Loop for Continuous Improvement

Predictive models are not static solutions. Market conditions, customer behaviors, and business strategies evolve. This can lead to "model drift," where predictive accuracy degrades over time.

To counteract this, establish a continuous feedback loop. Implement a process for the sales team to report on the quality of predictions (e.g., was a lead scored as "hot" a genuine high-quality prospect?). This real-world feedback is invaluable for periodically retraining and refining your models, ensuring they remain accurate and relevant over the long term.

Using Analytics to Mitigate Risk and Optimize Resources

While predictive analytics is a powerful engine for driving sales, its strategic value for underwriters, brokers, and risk managers extends to fortifying the entire business. The focus shifts beyond closing deals to enhancing operational efficiency, reducing financial exposure, and allocating resources with precision.

This represents a move from opportunity pursuit to active risk prevention. For example, predictive models can analyze historical data to identify customer segments or policy types with a higher statistical likelihood of resulting in high-cost claims or fraud. This enables underwriters to adjust premiums or terms proactively, mitigating potential losses before they occur.

Image

This proactive posture strengthens the financial health of the business by safeguarding against unforeseen capital drains and ensuring stability in volatile market conditions.

Proactive Problem Solving Through Data

Predictive analytics enables a shift from reactive damage control to proactive problem-solving. By continuously scanning for patterns that precede negative outcomes, these models function as an early warning system. This capability is crucial in the insurance and recovery sectors, where early intervention can dramatically reduce financial impact.

Consider these practical applications:

- High-Risk Customer Identification: Models can flag customers whose behaviors correlate with future non-payment or policy cancellation, allowing retention teams to intervene before revenue is lost.

- Early Fraud Detection: By comparing new claims against historical fraud patterns in real-time, the system can flag suspicious activity for immediate review, preventing costly payouts on illegitimate claims.

This foresight is applicable beyond customer-facing issues. Manufacturers utilizing predictive maintenance have reduced unplanned downtime by up to 50% by anticipating equipment failures. For risk managers, this same principle applies directly to maintaining operational resilience.

Enhancing Forecasting for Resource Allocation

Accurate forecasting is the foundation of efficient resource management. Inaccurate forecasts lead to wasted capital, misaligned staffing levels, and missed opportunities. Predictive analytics replaces subjective, intuition-based forecasting with data-driven models that deliver superior accuracy and reliability.

This has a direct impact on operational readiness. A disaster recovery firm, for example, can use predictive models that analyze weather patterns and historical event data to forecast the probable demand for its services in specific regions. This allows the company to pre-position equipment, schedule staff, and manage supply chains effectively, ensuring an immediate and effective response when a disaster occurs.

This level of preparation is vital across all sectors we serve. To learn more about the specific challenges and solutions for your field, explore our analysis of various commercial industries.

By improving forecasting reliability, predictive analytics strengthens the financial health of the entire organization. It ensures that capital, personnel, and equipment are deployed where they can generate the most value and impact, eliminating guesswork and waste.

The Strategic Advantage of Optimized Operations

Ultimately, leveraging analytics to mitigate risk and optimize resources creates a powerful competitive advantage. It builds an organization that is not only more profitable but also more agile and resilient. For brokers, this means having the capacity to manage more clients effectively. For underwriters, it means building a healthier, more predictable book of business.

This strategic approach ensures that all operational components work in concert to minimize downside risk while maximizing upside potential. It transforms the sales function from a standalone revenue generator into an integral part of a robust, data-informed business strategy. By balancing aggressive growth with intelligent risk management, organizations can achieve sustainable success.

Common Questions About Predictive Sales Analytics

Any transformative technology invites rigorous questions. For decision-makers in the climate risk and commercial insurance space, understanding the practical implications of predictive analytics is essential. Here are direct answers to the most common concerns.

The objective is not to replace human expertise but to augment it with data-driven insights, providing teams with the confidence and precision to act decisively.

How Much Data Do We Need to Get Started?

A common misconception is that predictive analytics requires massive datasets. In reality, data quality is more important than data quantity. Modern platforms can deliver significant value with a relatively modest amount of data.

A sufficient starting point is typically several months to a year of clean, structured sales data. This includes fundamental information you likely already possess:

- Lead sources and their progression through the sales funnel

- Records of key client interactions

- Deal outcomes (won/lost) and their associated value

The optimal first step is a data audit to assess what you have, identify gaps, and determine your readiness to build a functional model.

Will Predictive Analytics Replace Our Sales Team?

No. Predictive analytics in sales should be viewed as a co-pilot for brokers and underwriters, not a replacement. It automates the complex task of data analysis, freeing your team to focus on high-value activities: building relationships and closing complex deals.

The system enhances the effectiveness of top performers. By providing a prioritized list of high-potential leads and deep insights into their needs, it enables them to engage the right prospects, at the right time, with the right message. The goal is augmentation, not automation.

What Is the Typical ROI of This Technology?

The return on investment can be substantial, but it is directly correlated with the quality of implementation and the organization's starting point. The greatest gains are achieved by making tangible improvements across the entire sales process, as detailed in our guide on the B2B sales funnel.

ROI is driven by several key factors:

- Higher conversion rates from focusing on high-potential leads.

- Increased average deal sizes through the identification of cross-sell and up-sell opportunities.

- Improved team productivity by eliminating time spent on low-probability prospects.

- Lower customer churn by proactively identifying at-risk accounts.

Many organizations realize a positive ROI within 12 to 18 months. The key to success is linking the implementation to specific business objectives, such as achieving a 15% increase in qualified leads or a 10% reduction in client churn.

How Do We Keep the Analytics Model Accurate?

A predictive model is not a one-time deployment. Markets shift and customer behaviors evolve. Without maintenance, a model's accuracy will inevitably degrade over time.

A predictive model must be managed as a dynamic asset. This requires establishing a routine for monitoring its performance against real-world outcomes. The model must be periodically retrained with fresh data, and a feedback loop should be created for the sales team to report on prediction quality. This continuous cycle of refinement is essential for maintaining the relevance and effectiveness of the insights.

---

At Insurtech.bpcorp.eu, we turn climate intelligence into actionable sales opportunities. Our Sentinel Shield platform identifies businesses impacted by environmental events in real-time and delivers verified, high-intent leads directly to you. Stop searching for prospects and start engaging decision-makers at their moment of greatest need. Discover how our performance-based model can drive your growth by visiting https://insurtech.bpcorp.eu.