The traditional playbook for sourcing new insurance clients is obsolete. Pursuing volume may create activity, but it fails to build a profitable book of business. The key to sustainable growth is not acquiring more leads; it is acquiring the *right* leads. This requires a strategic shift toward high-value clients whose complex risk profiles align directly with your firm's expertise. The objective is to build a pipeline of advisory relationships, not transactional sales.

Moving From High Volume to High Value Leads

Image

The commercial insurance brokerage market is intensely competitive. The strategy of casting a wide net for prospects is no longer effective. The most successful brokers are not those with the largest contact lists, but those with the most relevant ones. The industry has transitioned from a volume-based game to a value-based one.

This evolution is driven by significant market dynamics. Consolidation is accelerating; in 2025, the top 20 global brokers generated a combined $109.6 billion in revenue, and the industry saw 1,034 M&A deals as major players acquired competitors. This competitive pressure, alongside new digital platforms and increasing regulation, makes it difficult for a generalist broker to differentiate. Firms that thrive specialize, adopt technology, and proactively address emerging risks like climate change. To understand the competitive landscape, you can explore additional broker market insights.

Redefining Your Ideal Client

To attract high-value leads, you must first define your Ideal Client Profile (ICP) with precision. An effective ICP is more than a premium size; it is a detailed blueprint that guides every prospecting and business development activity. It provides strategic clarity on where your firm delivers maximum, undeniable value.

When constructing your ICP, analyze these critical factors:

- Industry Specialization: Avoid broad categories like "manufacturing." Instead, focus on specific niches such as "pharmaceutical logistics" or "renewable energy construction." Specialization creates a competitive advantage by demonstrating deep expertise in unique risk environments.

- Risk Complexity: High-value clients often face multifaceted risks that standard policies cannot adequately address. Assess your firm's capability to navigate the complexities of international supply chains, evolving cyber threats, or significant climate-related property exposures. These are your target clients.

- Advisory Potential: Target businesses that view their broker as a strategic risk partner, not a vendor. Focus on forward-thinking decision-makers who require strategic guidance and seek long-term relationships, rather than simply the lowest-cost premium.

Key Insight: A well-defined Ideal Client Profile acts as a critical filter. It prevents wasted resources on misaligned prospects and concentrates your efforts on clients you can serve most effectively, directly improving your win rate.

From Profile to Pipeline

Once established, your ICP becomes the guiding principle for all lead generation. Every purchased list and marketing campaign must be validated against this profile. If an audience does not align with your ideal client, it is a poor investment.

For example, if your brokerage specializes in coastal property risk for luxury hotels, your resources are best allocated to targeting hospitality groups in hurricane-prone regions. Pursuing manufacturing facilities in the Midwest would be an inefficient use of capital and time. This precision ensures every outreach is relevant and positions you as an authority from the first point of contact.

Committing to this value-first strategy is fundamental to building a pipeline filled with the right opportunities. This foundation is essential before implementing advanced, data-driven prospecting techniques.

Using Technology and Data for Smarter Prospecting

While a CRM is a foundational tool, contact management alone is insufficient to secure high-quality leads for insurance brokers. Gaining a competitive edge requires leveraging modern technology and data analytics to identify businesses with escalating risks—often before they recognize the need for enhanced coverage.

This data-driven strategy transforms your role from a reactive quote provider to a proactive risk advisor delivering specific, evidence-backed insights. This is a vital approach in a market where technology is fundamentally altering business operations. The global insurance brokers and agents sector is expanding, driven by AI-powered digital platforms and M&A activity that reshapes lead pipeline construction. You can review these dynamic market shifts and trends on The Business Research Company.

Pinpointing Risk with Advanced Analytics

In practice, this technology enables you to analyze vast datasets for actionable risk signals. For commercial brokers, this means identifying companies that are becoming increasingly vulnerable.

Consider identifying prospects based on real-world risk indicators:

- Supply Chain Disruptions: Monitor global trade data to identify businesses with suppliers in politically or environmentally unstable regions.

- Regulatory Changes: Track new regulations that create compliance liabilities for companies within your niche industries.

- Financial Distress Indicators: Analyze public financial records and news reports for early warnings that may impact a company’s risk profile.

By correlating these data points, you can build a highly targeted prospect list. Your initial outreach can then reference these specific, data-supported challenges, immediately demonstrating your expertise and diligence.

The Power of Real-Time Climate Intelligence

The data-driven approach is particularly potent in the context of climate risk. With the increasing frequency of extreme weather events, any business with physical assets is concerned about its exposure. A real-time climate intelligence platform like Sentinel Shield provides a significant advantage in lead generation.

These platforms continuously monitor environmental data for wildfires, floods, and severe storms at a hyperlocal level. When a threat emerges, the system can instantly identify commercial properties within the impact zone.

This dashboard illustrates how climate intelligence pinpoints specific, address-level risk.

Armed with this level of detail, your outreach becomes timely and precise. You are no longer making an unsolicited call; you are offering tangible solutions at the exact moment a business needs them, creating a high-quality, warm lead.

Pro Tip: Do not just present data; interpret it. Frame the conversation around operational resilience. For example: "I noted your primary distribution center was in the path of last week's storm system. We should discuss structuring a policy that protects your inventory and business continuity from the next event."

This method inverts the traditional sales dynamic. You are not selling a product; you are providing a critical advisory service powered by real-time intelligence, building credibility and trust with unparalleled speed.

To scale these efforts, consider automating lead generation with proven strategies and AI tools. This allows your team to focus on high-value client conversations rather than manual research. Integrating these technologies creates a prospecting engine that consistently delivers high-quality leads for insurance brokers and solidifies your firm's position as an essential risk partner.

Building an Inbound Engine with Content and SEO

Image

While proactive outreach is critical, a resilient lead pipeline is multidimensional. The ultimate goal is to create a system where ideal clients find *you*. This is the function of a robust inbound engine, driven by high-value content and strategic search engine optimization (SEO).

This strategy transforms your website from a digital brochure into a magnet for qualified prospects, establishing your firm as an expert advisor long before direct contact. These inbound leads typically have higher conversion rates because they are actively seeking the solutions you provide.

Creating Content That Attracts Decision-Makers

To capture the attention of a risk manager or CFO, generic content is ineffective. Your content must address their specific, high-stakes challenges with credible, actionable insights. It should serve as a preview of the advisory value your firm delivers.

Focus on creating resources that your target clients will find immediately useful:

- Detailed Risk Management Guides: Develop in-depth content on complex issues. A guide titled "A CFO’s Playbook for Mitigating Supply Chain Disruption Risk" is more compelling than a general article because it addresses a decision-maker's specific concerns.

- Industry-Specific Trend Analysis: Publish reports on emerging risks within your areas of specialization. An analysis of new cyber liability trends in the healthcare sector will attract practice managers and hospital administrators.

- Data-Driven Case Studies: Demonstrate your capabilities. A case study detailing how you structured a policy for a commercial property in a high-risk flood zone, substantiated by climate intelligence data, provides powerful social proof.

The objective is to move beyond surface-level advice. It is established that 92% of consumers trust peer recommendations; for B2B decision-makers, expert content serves a similar purpose by proving competence and building trust.

Your content's primary function is to answer the questions a risk manager is actively researching. By providing the best answer, you earn their attention and create an opportunity for a meaningful conversation.

Optimizing Your Expertise for Search Engines

Excellent content must be discoverable. SEO is the mechanism that makes this possible. For a specialized B2B field like commercial insurance, SEO is not about manipulating algorithms; it is about structuring your digital presence so that search engines can recognize your expertise and connect you with relevant audiences.

A common error is targeting overly broad keywords. Focus on "long-tail" keywords that signal high commercial intent. A prospect searching "commercial insurance" is browsing. A prospect searching "product recall insurance for food manufacturers in Texas" has an immediate, specific need.

To refine your SEO strategy, implement these foundational tactics:

- Local SEO: For firms serving specific geographic markets, optimizing your Google Business Profile is essential. Incorporating location-based keywords (e.g., "construction risk broker in Houston") is a simple yet effective method to attract local leads for insurance brokers.

- On-Page Optimization: Ensure your high-value content naturally includes relevant keywords in titles, headers, and body text. Your website should have a logical structure that facilitates easy navigation for both users and search engines.

- Technical Health: A fast, secure, and mobile-responsive website is a baseline requirement. Google has confirmed that 53% of mobile users will abandon a site if it takes longer than three seconds to load, making site speed a direct factor in lead generation.

As insurance is a financial service, reviewing top SEO strategies for financial services can provide directly applicable insights. The principles of establishing authority, trust, and relevance are critical for success.

By consistently publishing expert-level content and optimizing it for search, you build a sustainable and powerful lead generation asset that works for your brokerage 24/7.

Turning Market Volatility into a Catalyst for Leads

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/94gHaHKmD4Q" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Market instability presents a significant opportunity for prepared brokers to generate high-quality leads for insurance brokers. When rates fluctuate, new catastrophic risks emerge, and carrier appetites tighten, business owners begin to question the adequacy of their current coverage.

This uncertainty creates an ideal opening for strategic conversations. By shifting the focus from price to risk advisory, you position your brokerage as an expert guide in a volatile environment, attracting sophisticated clients who prioritize long-term stability over short-term cost savings.

Capitalizing on a Shifting Premium Landscape

After years of sustained rate increases, the commercial insurance market is showing signs of moderation. Recent data indicates that global commercial insurance rates decreased by 3% in the first quarter of 2025—the third consecutive quarterly decline after a seven-year hard market cycle.

This trend is widespread across most lines of business. For a detailed analysis, you can review the latest global insurance market index from Marsh. However, this stability is fragile; a single active hurricane season could reverse the trend, highlighting the market's inherent volatility.

This dynamic is a strategic opportunity. Business owners who felt trapped in a hard market are now exploring whether they can secure better terms. Your objective is to proactively address this inquiry.

Adapt your outreach strategy to market conditions. Different environments require different approaches.

| Market Condition | Client Mindset | Broker's Strategic Focus | Actionable Tactic |

|---|---|---|---|

| Softening Market | "Am I overpaying? Could I get better terms now?" | Opportunity & Optimization | Proactively offer a no-cost coverage review. Frame it as ensuring they are capitalizing on current market conditions, not just pursuing a price reduction. |

| Hardening Market | "How severe will my renewal be? Can I mitigate a large increase?" | Stability & Risk Management | Showcase your expertise in navigating difficult carrier negotiations. Highlight your ability to structure creative solutions that control costs without compromising coverage. |

Any significant market movement provides a valid reason to initiate a conversation with a prospect.

Key Takeaway: Market shifts are conversation starters. Whether rates are rising or falling, the change itself provides a compelling, timely reason to connect with prospects and demonstrate your advisory capabilities.

Turning Risk into Relevant Outreach

Beyond premium fluctuations, the increasing frequency of major weather events offers another powerful engagement vector. When a wildfire, flood, or severe storm impacts a region, businesses in that area become acutely aware of their risk exposure. In these moments, generic marketing is ignored, while specific, data-driven outreach is highly effective.

This is where a tool like Sentinel Shield becomes invaluable. By leveraging its real-time climate intelligence, you can identify commercial properties within a disaster's footprint. Your outreach is no longer a cold call but a relevant, timely advisory service.

Consider this practical example: A major hailstorm strikes a Texas county. Within 24 hours, you can generate a list of every commercial property owner in the affected area. Your outreach is now laser-focused.

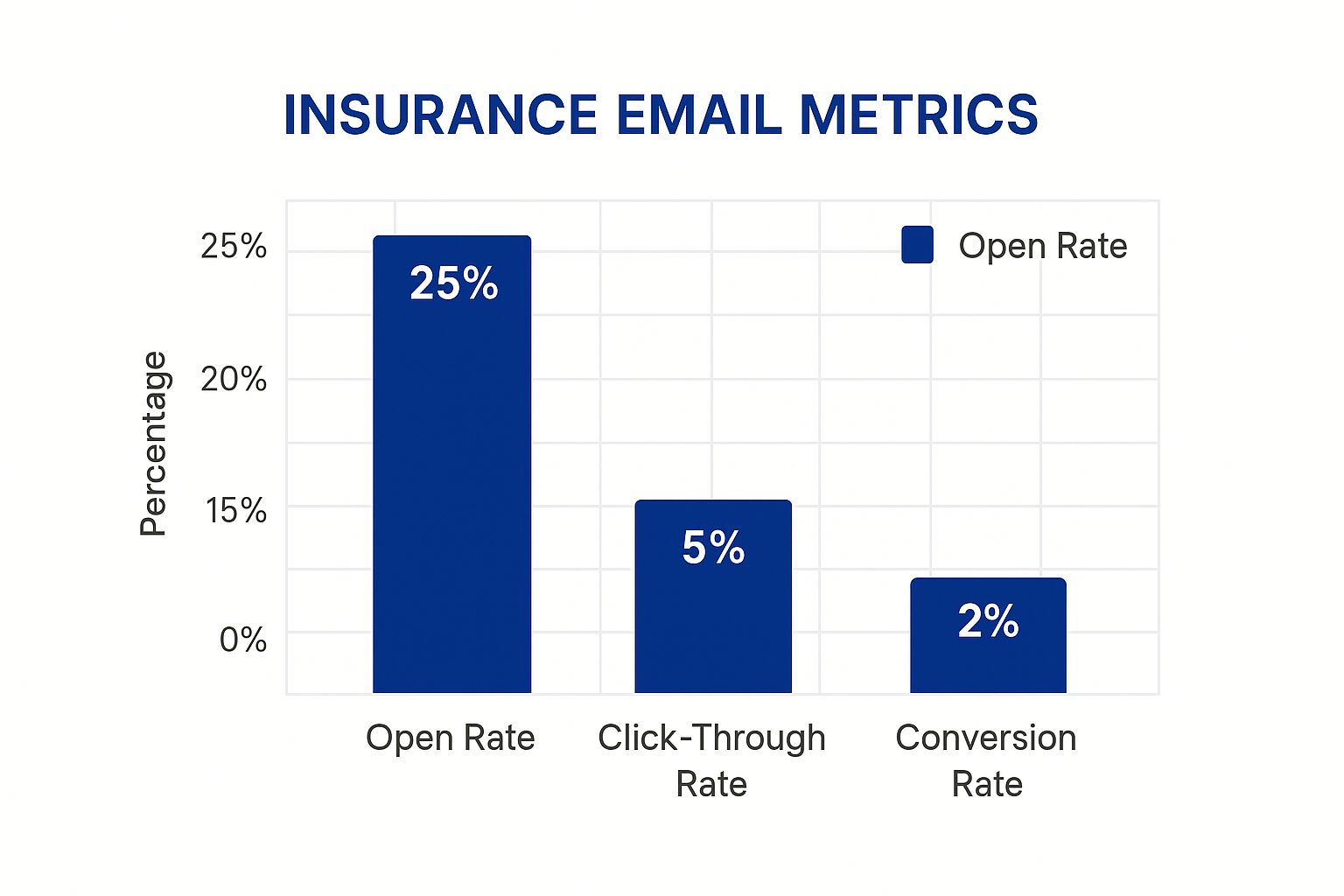

Image

Email open rates are a challenge; driving action is even harder. Your messaging must be hyper-relevant.

A subject line could be: "Urgent: Post-Storm Insurance Review for Businesses in [County Name]."

The email content should offer a complimentary policy review to identify potential coverage gaps related to storm damage. This proactive, empathetic approach not only generates leads for insurance brokers but also builds your reputation as an expert who provides critical support when it matters most.

Turn Your Clients into Your Best Sales Force Through Proactive Service

Image

The most valuable leads for insurance brokers are not sourced from cold lists but from referrals by existing, satisfied clients. A powerful referral engine is not built by asking for names at renewal; it is the natural outcome of a client experience so positive that it generates unsolicited advocacy.

This requires shifting from a transactional model to a true partnership. When you become an indispensable advisor who consistently demonstrates a commitment to protecting your clients' interests, referrals become a natural byproduct of your service delivery.

Engineer an Unforgettable Client Experience

A world-class service model is intentional. It is constructed around specific, value-driven touchpoints throughout the policy year, not just during a claim or renewal. The objective is to make your expertise so visible and valuable that your firm becomes unforgettable.

Real-time data is a transformative element in this process. Instead of reactively handling bad news, you can proactively identify and mitigate problems with actionable intelligence.

- Proactive Risk Alerts: Using a platform like Sentinel Shield, monitor your clients’ specific asset locations. Contacting a client to warn them of an impending hailstorm approaching their warehouse demonstrates more value than a dozen standard renewal meetings.

- Quarterly Risk Briefings: Schedule concise, data-backed reviews. Discuss emerging cyber threats in their industry or how shifting weather patterns might impact their supply chain. This positions you as a forward-looking risk expert.

- Post-Claim Debrief: After a claim is settled, conduct a post-mortem. Discuss what worked well and identify areas for improvement. This is an opportunity to refine their coverage and reinforce your commitment to their long-term security.

These actions elevate you from a policy provider to a strategic risk partner. This level of service builds intense loyalty and provides clients with a compelling story to share with their professional networks. A study by Influitive found that referred customers have a 37% higher retention rate, proving the durability of these relationships.

Making "The Ask" Feel Natural and Effortless

Even with exceptional service, you must guide clients on how to refer you effectively. Most are willing but often need clarity on who constitutes an ideal referral. Your role is to make the process simple and specific.

Replace vague requests like "send anyone you know my way" with precise criteria based on your Ideal Client Profile. This enables your clients to easily recognize a suitable referral within their network.

A well-timed and specific referral request is not aggressive. It is an invitation for your most satisfied clients to share a valuable resource. You are framing it as a way for them to help their contacts access the same level of expert guidance they receive.

To integrate this into your business operations, follow a clear framework:

- Identify Your Champions: Pinpoint clients who are vocal advocates or have long-standing relationships with your firm. They are your natural ambassadors.

- Pick Your Moment: The ideal time to ask is immediately following a "win"—a successfully navigated claim, favorable renewal terms, or a proactive risk alert that prevented a loss. Capitalize on this positive sentiment.

- Give Them the Tools: Simplify the process. Draft a concise introductory email they can forward. Provide a link to a relevant case study on your website. The less effort required, the higher the likelihood of action.

This structured approach, built on a foundation of proactive service, transforms your existing client base into your most powerful and sustainable source of high-value leads for insurance brokers. It creates a growth cycle where exceptional service fuels referrals, enabling further investment in the tools and expertise that protect your clients.

Answering Your Lead Generation Questions

Implementing new strategies to generate leads for insurance brokers can be daunting. Shifting from established methods raises practical questions about technology, measurement, and market adaptation. This section addresses the most common inquiries from brokers looking to modernize their approach.

The objective is to provide clarity on new technologies, effective ROI measurement, and strategic responses to market dynamics, enabling you to proceed with confidence.

What Is the Most Effective Digital Channel for Commercial Insurance Leads?

There is no single "best" channel for every brokerage; effectiveness depends on your specific niche and target audience. However, a highly effective combination is targeted LinkedIn outreach paired with SEO-driven content marketing.

LinkedIn is a precision tool for direct engagement with decision-makers like CFOs and Risk Managers in specific industries. You can filter by company size, job title, and location, ensuring your outreach is highly relevant.

Simultaneously, high-quality SEO and expert content—such as a guide on mitigating supply chain risk—attract prospects who are actively seeking solutions. This dual approach, blending direct outbound with authoritative inbound, consistently yields a more favorable cost-per-acquisition than broad-based advertising.

My Takeaway: Do not view channels in isolation. The most effective strategy integrates multiple channels, such as using targeted LinkedIn messages to direct prospects to deep-dive expertise showcased on your website.

How Can a Smaller Brokerage Compete with Large Firms for Leads?

Smaller brokerages cannot win by outspending large competitors. You win by out-specializing and out-maneuvering them. Your core advantages are focus and agility.

Instead of operating as a generalist, become the recognized expert in a niche that larger firms may overlook, such as cyber liability for fintech startups or construction risk for renewable energy projects. This focus allows you to build a strong reputation and create marketing that resonates deeply with a specific audience's pain points.

Leverage your size as a strategic asset:

- Be a Partner, Not a Vendor: Provide a high-touch, personalized service level that is difficult for large, bureaucratic firms to replicate.

- Move on a Dime: Adopt new, game-changing tools like Sentinel Shield quickly, without navigating multiple layers of corporate approval.

- Adapt Instantly: Adjust your strategy in response to market shifts within days, not fiscal quarters.

Your agility is your competitive advantage. While a mega-broker is routing a decision through committee, you can be delivering real-time, data-driven insights that create immediate impact for a prospect.

What Is the Best Way to Measure Lead Generation ROI?

To accurately assess the return on investment of your lead generation efforts, you must look beyond simple lead volume. The most meaningful metrics track profitability and efficiency, not just activity.

For each channel, focus on these three Key Performance Indicators (KPIs):

- Cost Per Acquisition (CPA): This is the ultimate measure. Calculate it by dividing the total marketing and sales cost for a specific channel by the number of new clients acquired through it.

- Lead-to-Client Conversion Rate: This metric indicates lead quality. What percentage of inquiries from a channel convert into paying clients? A high rate signifies you are attracting the right prospects.

- Client Lifetime Value (CLV): This measures long-term profitability. What is the total projected profit from a client over the entire relationship? A high CLV can justify a higher initial CPA.

Tracking these KPIs provides a clear, data-backed view of what is working, allowing you to allocate resources to the most profitable channels. To explore a wider range of methods, review these proven lead generation solutions for business growth.

How Vital Is Climate Intelligence for Property Insurance Leads?

Climate intelligence is rapidly transitioning from an optional feature to an essential tool for any forward-thinking broker. As extreme weather events become more frequent and severe, business owners are increasingly concerned about their physical asset risk.

Climate intelligence platforms fundamentally change the client conversation. Instead of arriving at renewal with a standard quote, you can approach a prospect with a data-driven analysis of their property’s specific vulnerability to wildfire, flooding, or hurricanes.

This proactive approach accomplishes three critical objectives:

- It Establishes Your Credibility: You are advising with sophisticated data, not just selling a policy.

- It Delivers Tangible Value: You are offering strategic risk management expertise.

- It Provides Strategic Insight: You are helping them quantify a risk they may have previously underestimated.

This is one of the most powerful methods for identifying at-risk businesses that are prime candidates for your advisory services. It turns a significant climate threat into a clear opportunity to demonstrate your value.

---

Ready to turn market volatility and climate risk into your most powerful source of high-intent leads? With Sentinel Shield, you can get real-time alerts on businesses impacted by extreme weather and reach them within 24 hours. Stop chasing cold leads and start engaging prospects at their moment of greatest need. Discover how our climate intelligence platform can revolutionize your prospecting at https://insurtech.bpcorp.eu.

*Article created using Outrank*