Managing natural disaster insurance claims has evolved from a back-office function into a core strategic discipline. As catastrophic events increase in frequency and severity, the ability to manage the claims process effectively is critical for commercial insurers, brokers, and risk managers. Success now depends on proactive risk management, operational resilience, and precise execution. This guide provides actionable insights for navigating the complexities of catastrophe claims in the current climate risk environment.

The New Reality of Catastrophe Claims

Image

Climate volatility is fundamentally altering the commercial insurance landscape. The increased frequency and intensity of natural disasters are no longer abstract trends but a direct operational and financial reality for underwriters, brokers, and risk managers. This shift places immense pressure on the entire claims ecosystem, demanding a more sophisticated approach.

A single major event can generate a volume of claims that overwhelms operational capacity, leading to processing delays and increased administrative costs. This "new normal" challenges traditional underwriting models, which often struggle to price these evolving risks accurately. Consequently, a deep understanding of the natural disaster claims process has become a core competency for maintaining profitability and market stability.

The Financial Imperative

The financial stakes have never been higher. In the first half of a recent year, global insured losses from natural catastrophes reached $80 billion, nearly double the 10-year average. This figure is part of a sustained upward trend, with insured losses increasing at an average annual rate of 5 to 7 percent, even after adjusting for inflation.

This persistent growth directly impacts profitability and solvency margins, compelling carriers to implement adaptive strategies to mitigate financial exposure.

For insurance leaders, mastering the claims process is no longer just about operational efficiency. It's a strategic imperative for survival and growth in an era of heightened climate risk.

Strategic Implications for Insurance Leaders

The impact of this new environment extends beyond the balance sheet, reshaping core business strategies and client relationships. Insurance professionals must now address critical challenges with a forward-thinking, tactical approach.

Key areas demanding immediate focus include:

- Shifting Underwriting Strategies: Insurers are adopting more disciplined underwriting stances. This includes tightening terms, overhauling pricing models, and, in some cases, withdrawing from high-risk regions to manage portfolio exposure.

- Sophisticated Risk Modeling: The demand for advanced predictive analytics and climate risk data has accelerated. These tools are essential for forecasting potential losses with greater accuracy and making informed underwriting decisions.

- Enhanced Client Communication: Brokers and agents are pivotal in educating commercial clients on policy limitations and the critical importance of robust risk mitigation strategies. Clear communication is essential for managing expectations.

- Operational Resilience: Claims departments must be structured for scalability. This requires investing in robust processes and technologies that can manage a sudden influx of claims without compromising service quality or accuracy.

Ultimately, the management of natural disaster insurance claims serves as a direct measure of the industry's credibility and resilience. It requires a strategic combination of operational agility, data-driven insights, and clear communication to protect both the insurer's financial health and the policyholder’s trust.

Understanding Key Natural disaster Coverages

Image

Successfully navigating a natural disaster claim requires a granular understanding of the applicable commercial policies and endorsements. For insurance professionals, this extends beyond standard definitions to a technical dissection of coverage nuances. This expertise is critical for structuring effective policies and providing clients with sound risk management advice.

Policy language, sub-limits, and exclusions are not abstract terms; they are the contractual mechanisms that determine financial outcomes following a catastrophic event. A standard commercial property policy provides a foundation, but it is rarely sufficient to cover the full spectrum of catastrophic risks.

True protection is found in specialized policies and endorsements tailored to specific perils. Misinterpreting these distinctions is a leading cause of coverage disputes and client dissatisfaction post-event.

Peril-Specific Policy Dissections

The type of disaster dictates which policy provisions apply, and the details are paramount. For underwriters and brokers, clarifying these distinctions for clients *before* an event occurs is a fundamental risk management function. Each peril presents unique challenges during the claims process.

Here is a practical breakdown of common disaster-specific coverages:

- Hurricane and Windstorm Coverage: This coverage is typically subject to a separate, higher deductible. Instead of a flat dollar amount, it is usually a percentage—often 1% to 5%—of the total insured value. A common point of contention in natural disaster insurance claims is determining whether a named storm deductible or a standard deductible applies.

- Flood Insurance: Standard commercial property policies explicitly exclude flood damage. Coverage must be secured through the National Flood Insurance Program (NFIP) or a private insurer. A critical task for adjusters is differentiating between flood damage (from rising surface water) and other forms of water damage (e.g., from wind-driven rain or pipe bursts).

- Earthquake Coverage: Similar to flood, this is a separate policy or endorsement with a substantial deductible, often 10% to 20% of the property’s value. Claims frequently involve disputes over whether damage resulted from seismic shaking or from secondary causes like fire or ground settlement, which may be covered differently.

- Wildfire Coverage: While standard policies typically include "fire," wildfire claims introduce complexities such as widespread smoke and ash damage, business interruption due to evacuation orders, and costs associated with fire suppression efforts.

Effective management of natural disaster claims begins with precise policy construction. Ambiguous policy language creates future liabilities, while clear definitions of deductibles and sub-limits are essential.

Key Provisions and Valuation Methods

Beyond peril-specific policies, several key clauses and valuation methods significantly influence claim outcomes. A thorough command of these provisions is essential for setting realistic client expectations and achieving equitable settlements.

It is critical to understand what Actual Cash Value (ACV) means for your property. This method subtracts depreciation from the replacement cost, which can result in a significantly lower payout than Replacement Cost Value (RCV), which covers the cost to rebuild or replace with new, similar materials.

For commercial clients, Business Interruption (BI) and Contingent Business Interruption (CBI) coverages are vital. BI covers lost income and ongoing expenses when a covered peril forces a shutdown. CBI extends this coverage to losses resulting from a shutdown at a key supplier or customer. Documenting these losses is complex but non-negotiable for a successful claim. Unambiguous language defining the "period of restoration" is crucial for preventing disputes.

Mastering the Claims Management Lifecycle

When a natural disaster occurs, managing the resulting influx of insurance claims is not a reactive scramble but a disciplined, multi-stage process. For insurance leaders, adopting a lifecycle approach is the only effective way to control costs, ensure regulatory compliance, and maintain policyholder trust under extreme operational stress.

A successful outcome depends on a well-defined workflow that transforms chaos into a structured sequence of actions. This framework prevents bottlenecks and establishes the foundation for a fair and defensible settlement.

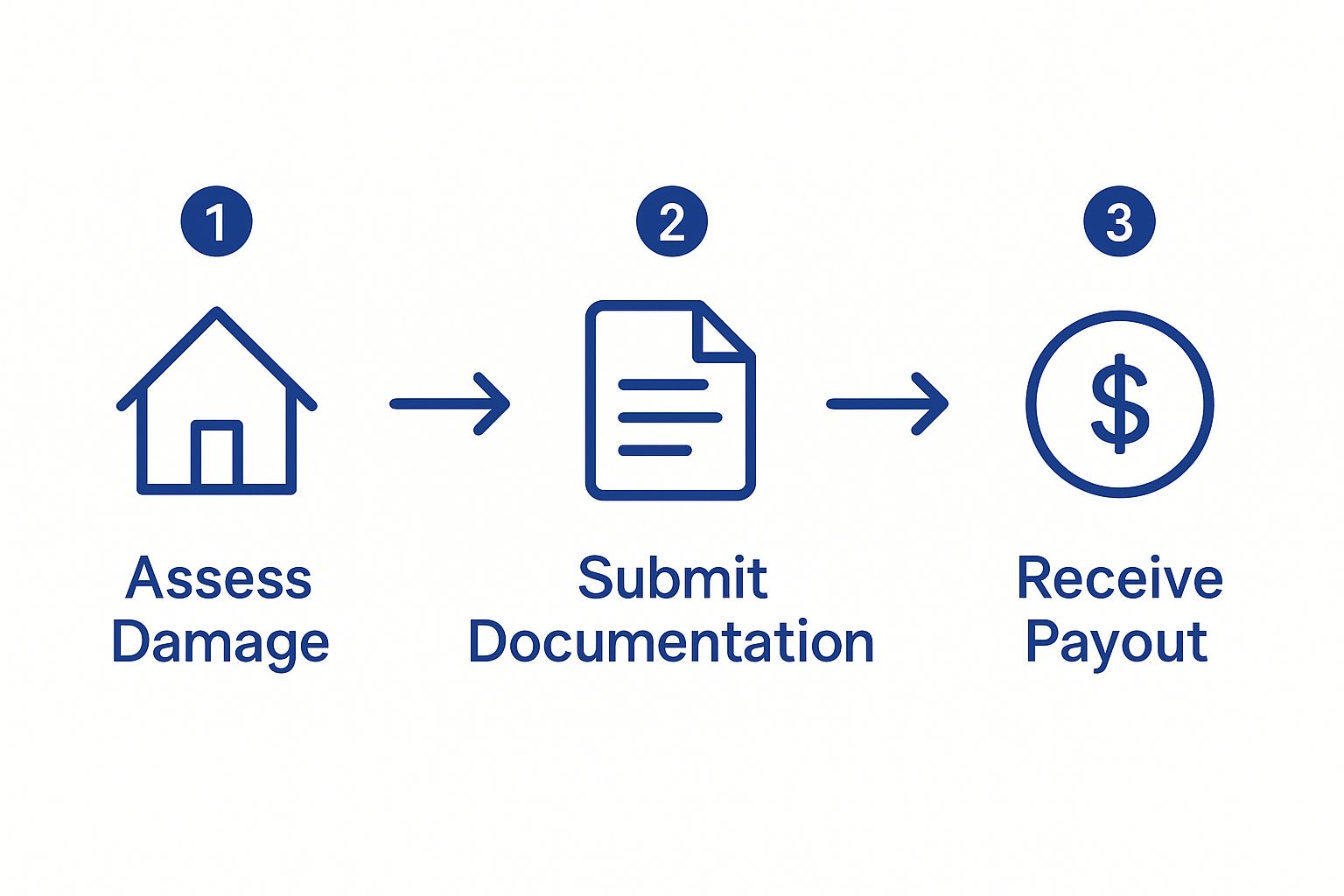

The process can be visualized as a clear path for the policyholder.

Image

This model simplifies the process into three core milestones, reinforcing a critical truth: a timely and accurate payout is the direct result of thorough damage assessment and complete documentation.

Stage 1: Initial Triage and Loss Notification

The lifecycle begins with the First Notice of Loss (FNOL). This is the initial intake point for gathering data and assigning a priority level. Following a catastrophe, claims departments face immense volume. A robust triage system is non-negotiable for managing this surge effectively.

This initial assessment focuses on rapid, accurate sorting:

- Categorizing the Peril: Immediately identifying the event (e.g., hurricane, flood, wildfire) to route the claim to the appropriate specialized team.

- Assessing Severity: Using initial reports to estimate the potential financial impact and flagging high-value or complex claims for senior adjuster review.

- Verifying Coverage: Performing a quick, preliminary check to confirm an active policy covers the property and the specific peril.

The objective is speed without sacrificing accuracy. An effective triage process ensures that resources are allocated to the most critical claims first, preventing high-priority cases from being delayed.

Stage 2: Site Assessment and Damage Documentation

Once a claim is triaged, the focus shifts to on-site assessment. This stage defines and documents the true scope of the loss. For any risk manager or claims leader, this phase is paramount, as it builds the factual foundation for the entire claim. Inadequate execution at this stage is a primary cause of subsequent disputes and litigation.

The goal is to create an irrefutable record of the damage. While this once involved an adjuster with a camera and clipboard, best practices now incorporate technology like drones for aerial inspection of unsafe structures or 3D imaging to create detailed models of damaged property. All evidence must be meticulously cataloged and directly linked to the policy provisions it triggers. For more detail on specific events, our guide on managing storm damage insurance claims provides practical strategies.

The quality of documentation gathered during the site assessment directly correlates with the defensibility of the final settlement. Ambiguity at this stage almost always leads to costly disputes later.

Stage 3: Comprehensive Policy Review and Expert Engagement

With the damage fully documented, the claims team conducts an in-depth analysis of the commercial policy. This goes far beyond the initial coverage check. Adjusters scrutinize all details—sub-limits, endorsements, exclusions, and deductibles—to determine precisely how the policy responds to the established facts of the loss.

This is also the stage for engaging specialized experts. Complex disaster claims almost always require outside expertise to accurately quantify the loss.

- Structural Engineers: Essential for assessing a building's integrity, determining the cause of loss (e.g., wind vs. flood), and defining the required scope of repair.

- Forensic Accountants: Necessary for analyzing financial records and calculating the value of a complex Business Interruption (BI) claim.

- Industrial Hygienists: Engaged to test for contaminants like mold or asbestos following significant water damage.

Engaging these experts early provides the technical validation required to build a robust claim valuation. This replaces speculation with data-driven analysis, which is critical for negotiating a final, equitable settlement with the policyholder.

The claims lifecycle is a journey with distinct, critical phases. The table below outlines these stages from an insurer's perspective, highlighting the primary goal and key actions at each step.

| Stage | Primary Objective | Key Actions for Insurers |

|---|---|---|

| FNOL & Triage | To efficiently manage claim intake and prioritize resources. | Categorize peril, assess initial severity, perform preliminary coverage check, and assign to the correct team. |

| Site Assessment | To create an irrefutable, detailed record of the physical damage. | Deploy adjusters and technology (drones, 3D imaging) to document all damage and link evidence to policy terms. |

| Policy Review & Valuation | To accurately determine coverage and quantify the full financial loss. | Conduct an in-depth policy analysis and engage specialized experts like engineers and forensic accountants. |

| Settlement & Resolution | To negotiate a fair settlement based on facts and policy terms. | Present a detailed valuation, negotiate with the policyholder, and process the final payment upon agreement. |

By navigating these stages systematically, insurers can manage even the most challenging natural disaster claims with professionalism and precision. This structured approach ensures a process that is both efficient for the carrier and fair for the client.

Best Practices for Evidence and Documentation

In a natural disaster claim, credible, comprehensive evidence is the determining factor. For brokers advising clients and for claims handlers adjudicating losses, mastering evidence collection is not a procedural formality—it is the core strategy for achieving a prompt and equitable settlement.

A claim file should be constructed like a fortress, where each piece of evidence—a timestamped photograph, a contractor’s estimate, a mitigation expense receipt—reinforces its structural integrity. The more organized and detailed the evidence, the better the claim will withstand scrutiny.

Establishing the Initial Damage Record

The hours immediately following a disaster are critical for capturing a clean record of the loss before any alterations occur. This initial evidence establishes the baseline for the entire claim, creating a clear "before-and-after" narrative for the adjuster.

First-response documentation should include:

- Photos and Videos: Systematically capture wide-angle shots of the entire property from multiple angles, followed by detailed close-ups of specific damage points. A video walkthrough provides a comprehensive sense of the scope and scale of the destruction. Ensure all digital files are timestamped and securely backed up.

- A Written Damage Log: Maintain a factual, objective log of all observed damage. Note the location and extent of each issue, from structural breaches to water intrusion.

- Proof of Mitigation: Document all steps taken to prevent further damage, such as boarding windows or tarping a roof. Retain receipts for all materials and labor, as these costs are typically recoverable under the policy.

Assembling Comprehensive Proof of Loss

Beyond documenting physical damage, a complete claim must quantify the financial impact of every aspect of the loss. This requires meticulous record-keeping to substantiate the value of everything from destroyed inventory to extra expenses incurred to maintain operations.

For example, when water damage occurs, the risk of mold growth escalates quickly. Applying effective strategies to halt mold growth is critical not only for safety but also for documenting necessary remediation costs for the claim.

The burden of proof rests with the policyholder. A disorganized or incomplete submission is the fastest path to delays, investigations, and friction with the insurer.

A well-supported claim requires detailed worksheets and third-party validation. These documentation principles are transferable across different perils. The methodical approach outlined in our guide on fire damage restoration steps, for example, offers valuable lessons applicable to documenting claims for floods, hurricanes, and other events.

The financial scale of these events underscores the importance of precision. In the first half of a recent year, natural disasters caused an estimated $162 billion in global economic losses, with insurers covering approximately $100 billion. The U.S. alone accounted for $126 billion in economic losses—the highest half-year total recorded—highlighting why precise documentation is essential.

Leveraging Technology for Accuracy and Speed

Modern technology offers powerful tools to enhance the speed and accuracy of evidence collection. For both brokers and claims handlers, advocating for the use of these tools can dramatically improve claim outcomes, transforming the process from a reactive paper chase into a proactive, data-driven strategy.

Key technological advantages include:

- Drone Imagery: Drones provide safe and rapid access to inaccessible areas, such as storm-damaged roofs on multi-story buildings. The resulting high-resolution aerial photographs and videos offer an undisputed view of the damage.

- Digital Inventory Systems: Using software to catalog business property *before* a disaster is a strategic advantage. These systems store photos, purchase dates, and values for all assets, accelerating and simplifying the proof of loss process.

- 3D Scanning: For major structural damage, 3D scanning technology creates precise digital models of a building. This provides adjusters and engineers with exact measurements and an immersive view of the damage, removing ambiguity from repair negotiations.

Navigating The Most Common Claims Process Pitfalls

Image

Even a well-documented claim can be derailed by predictable and costly pitfalls. For insurance professionals, proactive identification and mitigation of these risks are essential for preserving client relationships and protecting financial outcomes. It is always more effective to anticipate these issues than to resolve a dispute after it has escalated.

The financial magnitude of modern disasters amplifies these risks. In a recent year, global insured losses from natural disasters totaled $137 billion. However, with total economic losses reaching nearly $318 billion, a staggering $181 billion insurance protection gap remained.

This gap is not merely a statistic; it represents every underinsured business, denied claim, and dispute that eroded trust. Successfully navigating natural disaster claims requires a clear strategy for managing risk and communicating with clients, with a sharp focus on common points of friction.

The Underinsurance Trap

Underinsurance is one of the most common and damaging pitfalls, occurring when a policy’s limits are insufficient to cover the actual cost of rebuilding or replacing property post-disaster. This gap often becomes apparent only after a loss, leaving policyholders with a significant, unexpected financial burden and placing brokers and carriers in a difficult position.

This issue typically stems from several core problems:

- Stale Valuations: Property values and construction costs can increase significantly over time, while policy limits may remain unchanged without regular reviews.

- Ignoring Ordinance or Law Coverage: Many policies fail to adequately account for the increased cost of rebuilding to comply with modern, more stringent building codes.

- Misunderstanding Coinsurance Clauses: Clients often do not understand that failing to insure their property to a specified percentage of its value (typically 80-90%) can result in a substantial penalty on their claim payout.

For brokers, the most effective defense is a proactive offense. This includes conducting thorough annual policy reviews, running updated replacement cost estimates, and clearly communicating the financial risks of inadequate coverage limits.

Misinterpreting Policy Language And Exclusions

Insurance policies are complex legal contracts, making misinterpretation a leading cause of disputes. Ambiguous wording regarding exclusions, deductibles, and sub-limits can create a significant disconnect between a policyholder's expectations and the insurer's coverage determination.

A classic example is the distinction between flood damage and water damage. A standard commercial property policy may exclude damage from rising surface water (flood) but cover damage from wind-driven rain. Following a hurricane, determining the primary cause of loss becomes a highly technical and often contentious process.

The optimal solution is to establish radical clarity from the outset. During policy binding, underwriters and brokers should use real-world scenarios to explain precisely what is—and, more importantly, what is *not*—covered. This proactive communication can prevent major disputes later.

Disputes Over Scope And Valuation

Even when coverage is confirmed, a claim can stall due to disagreements over the scope of repairs and the valuation of the damage. It is common for a policyholder’s contractor to submit a repair estimate that differs significantly from the one prepared by the insurance company’s adjuster.

This is where the claims process can become protracted for months. Understanding the proper procedure for disputing a total loss offer is critical when there is a belief that the valuation is inaccurate.

To mitigate this, sophisticated claims teams engage independent experts—such as structural engineers or forensic accountants—early in the process. Their objective, third-party analysis provides a credible and defensible basis for the settlement offer, de-escalating potential conflicts before they evolve into litigation.

Answering Your Top Questions

Navigating disaster claims generates numerous complex questions. For underwriters, brokers, and risk managers, providing accurate and decisive answers is a critical function. Here are the most common and important questions from industry professionals managing high-stakes commercial claims.

What Is the Role of a Public Adjuster in a Commercial Claim?

A public adjuster is a claims professional hired by the policyholder to manage and negotiate their claim. In a complex commercial loss, they can serve as a single point of contact, potentially streamlining communication. However, their involvement can also establish a more adversarial tone if expectations are not properly managed.

For an insurer's claims team, the strategy is to maintain professionalism, operate with transparency, and adhere strictly to the policy language. The focus should remain on the documented facts of the loss to achieve a fair outcome based on the contract. A collaborative, evidence-based approach is the most effective way to advance the claim efficiently, regardless of third-party involvement.

How Is Business Interruption Calculated After a Disaster?

Calculating a Business Interruption (BI) loss involves projecting the net income the business would have generated had the disaster not occurred. The calculation is based on the projected net income during the "period of restoration," plus any normal operating expenses that continued despite the shutdown. This is not a speculative exercise; it is a forensic process built on historical financial data and realistic market forecasts.

BI claims become contentious over two main issues: the precise definition of the "period of restoration" and disputes over the supporting financial documentation. Underwriters must ensure policy language is unambiguous, while risk managers should advise clients to maintain meticulous financial records. Without them, substantiating a major BI claim is exceptionally difficult.

What Are Concurrent Causation Issues in Claims?

Concurrent causation is one of the most complex issues in property claims. It arises when a loss is caused by two or more perils acting at the same time—one of which is covered by the policy and one of which is excluded. A classic example is a building damaged by both covered wind and excluded floodwater during a hurricane.

To address this, most modern commercial policies include an "anti-concurrent causation" clause. This language typically states that if an excluded peril contributes to the loss in any way, the entire loss may be denied coverage. For claims professionals, this requires a forensic investigation to determine the sequence of events and apply the policy's specific wording accurately.

---

Stop searching for opportunities after a catastrophe and start connecting. With Sentinel Shield by BPC GROUP, you get real-time intelligence on businesses hit by natural disasters, complete with decision-maker contacts and their verified needs. See how our pay-per-opportunity model can drive your growth by visiting our official Sentinel Shield page.