Navigating storm damage insurance claims is no longer a reactive task; it is a critical business function demanding a proactive strategy. As the frequency and severity of catastrophic weather events escalate, the financial and operational risks for commercial property owners and their insurers have intensified. Mastering the claims process is now a core component of effective risk management.

The Evolving Complexity of Storm Damage Claims

Image

The landscape for commercial storm damage claims has fundamentally shifted. What was a relatively predictable process for underwriters, brokers, and risk managers has evolved into a high-stakes challenge defined by increasing financial pressure and operational complexity.

This shift is not anecdotal; it is substantiated by financial data. Global insured losses from natural catastrophes are on a steep upward trajectory, placing immense strain on carrier capital. This forces insurers to tighten underwriting standards, re-evaluate pricing, and apply far more rigorous scrutiny to every submitted claim.

The Financial Reality of Escalating Climate Risk

Recent data brings this new reality into sharp focus. For instance, global insured losses from natural catastrophes reached approximately USD 137 billion in 2024, marking the fifth consecutive year this figure has surpassed the USD 100 billion threshold.

Critically, only about 43% of total economic damages were insured, exposing a significant global protection gap. The Swiss Re Institute provides extensive data that quantifies this escalating challenge for the industry.

This sustained financial pressure directly impacts claim handling. Insurers must manage their exposures with greater precision, creating a more demanding environment for policyholders seeking to recover losses.

For commercial property owners and their risk advisors, this means the burden of proof is higher than ever. A meticulously documented, strategically prepared claim is no longer best practice—it is essential for financial recovery and operational continuity.

Key Challenges for Insurance Decision-Makers

The complexity extends beyond macroeconomic trends. Decision-makers in the commercial insurance space face a convergence of challenges that complicates the claims process.

- Intricate Policy Language: Insurance contracts feature increasingly specific definitions and exclusions. Nuanced terms for events like a "named windstorm" versus a standard wind event can dramatically alter deductibles and trigger coverage, requiring expert interpretation.

- Increased Scrutiny from Adjusters: With significant capital at risk, adjusters are mandated to verify every aspect of a loss. They will demand comprehensive, indisputable evidence to validate the claim.

- Supply Chain and Labor Disruptions: Post-catastrophe environments create demand surges for materials and skilled labor, leading to project delays and cost inflation that can exceed initial loss estimates.

Effectively managing a storm damage claim requires strategic foresight and a disciplined approach well before a weather event occurs.

Building a Pre-Storm Loss Mitigation Strategy

Image

The most defensible storm damage insurance claims are not assembled in the chaotic aftermath of a disaster. They are built on a foundation of meticulous, proactive preparation. For risk managers and brokers, this preparatory work is the single most effective method for protecting a commercial asset and ensuring an efficient claims process.

A reactive claims strategy invites friction, delays, and disputes. By implementing a pre-storm strategy now, you establish a baseline of proof that is difficult for an insurer to contest. This preparation is the critical first step in any claim negotiation.

Establish a Comprehensive Evidence Locker

The core of a proactive strategy is a digital "evidence locker"—a detailed, secured archive documenting the property's exact pre-storm condition. This is not a casual photo-taking exercise; it is the creation of a meticulous catalog that serves as irrefutable proof of the asset's value and state of repair.

A robust evidence locker should include:

- Annual Video Walkthroughs: Conduct a slow, steady video tour of the entire property, both interior and exterior. Narrate the video, identifying high-value equipment, recent capital expenditures, and the condition of critical systems like the roof, HVAC, and building envelope.

- High-Resolution Photo Inventory: Supplement the video with a library of timestamped, high-resolution photographs. Capture wide, medium, and detailed close-up shots of all significant assets and structural components, with special attention to the roof, windows, and siding.

- Secure Digital Records: Store all files in multiple, secure cloud-based locations to ensure redundancy and accessibility. Key stakeholders must have access credentials to retrieve these files immediately following an event.

This documentation creates an undeniable "before" state. Presenting an adjuster with a timestamped video of a pristine roof dated two months before a hurricane systematically dismantles potential arguments about pre-existing damage.

Conduct an Annual Policy Deep Dive

An insurance policy is a complex legal contract. Assuming coverage without a thorough review is a critical and costly error. For risk managers and brokers, an annual policy review is a non-negotiable discipline.

This review must focus on the details that generate the most conflict in storm damage insurance claims. The objective is to achieve absolute clarity on coverage grants, limits, and, most importantly, deductibles.

For example, many policies contain separate and significantly higher deductibles for a "named windstorm" or "hurricane." The policy's definitions section dictates the trigger. In some cases, a hurricane deductible can apply to tornado damage if a hurricane watch is active anywhere in the state, as was seen after Hurricane Milton in Florida.

Work with your broker to confirm these critical definitions:

- What is the precise trigger for the hurricane or named storm deductible?

- How does the policy differentiate "flood" from "wind-driven rain"?

- Are there sub-limits for key coverages like debris removal or business interruption?

Proactively clarifying these terms prevents devastating financial surprises post-loss and transforms the policy from a reactive document into a strategic risk management tool.

Critical Actions in the First 48 Hours Post-Storm

Following a major storm, the first 48 hours are critical. The actions taken during this window set the tone for the entire storm damage insurance claim. The process requires a balance of immediate safety protocols and methodical evidence collection.

Safety is the paramount concern. Before entering the property, assess for downed power lines, gas leaks, and structural instability. Once the site is secure, the primary mission is to capture the scene exactly as the storm left it. This raw, untouched evidence is your most powerful asset.

Document First, Mitigate Later

The natural impulse to begin cleanup must be resisted. The first operational step is to create a complete visual record of all damage. This initial documentation forms the bedrock of the entire claim.

- Take Timestamped Photos and Videos: Use a smartphone to document everything. Start with wide shots to capture the overall scope of damage, then zoom in on specific areas like a damaged roof section or a flooded interior. Finally, capture detailed close-ups of specific failure points. Geotagging and timestamping are crucial.

- Focus on Points of Intrusion: Adjusters must see precisely how wind or water breached the building. Capture clear photos of broken windows, compromised roof flashing, damaged siding, or other points of entry.

- Narrate Video Documentation: While recording a video walkthrough, provide a verbal account of the damage. For example: *"This is the east-facing wall of the main warehouse. High winds have peeled back the metal siding, exposing the underlying insulation. Water is actively penetrating the interior wall at this location."*

This immediate, raw evidence is difficult for an insurance carrier to dispute and counters arguments of pre-existing conditions or post-event exacerbation.

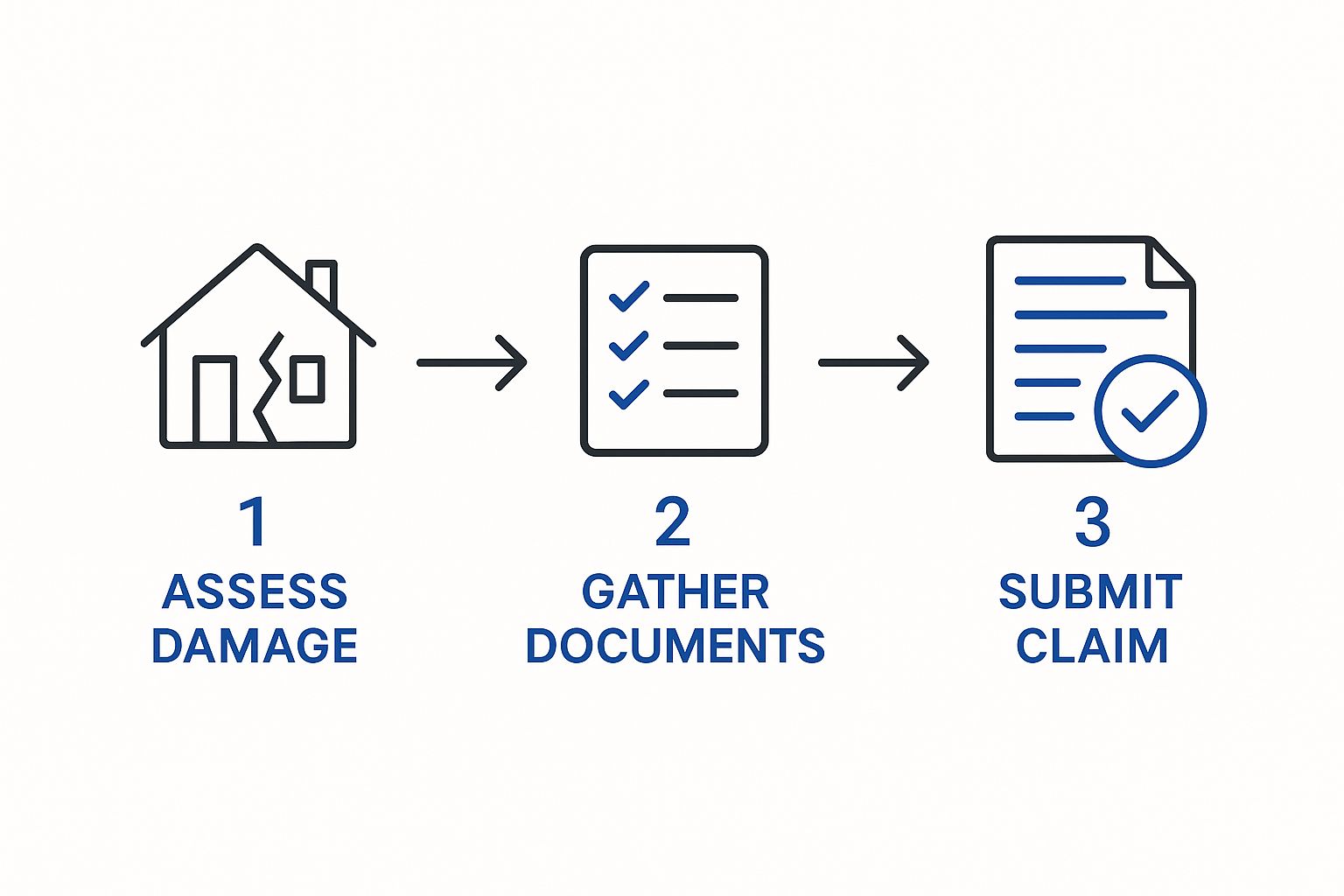

Image

The image above illustrates this initial process, emphasizing that damage assessment and evidence gathering are the non-negotiable first steps before claim filing.

Use this checklist to ensure systematic documentation during the chaotic initial hours.

Post-Storm Documentation Checklist

| Evidence Category | Specific Items to Document | Strategic Importance |

|---|---|---|

| Initial Damage | Timestamped photos & narrated videos (wide, medium, close-up) | Establishes an undeniable record of loss, proving causation. |

| Points of Intrusion | Photos of broken windows, damaged roofing, compromised siding | Shows the adjuster the precise failure points of the building envelope. |

| Interior Damage | Photos of water stains, damaged inventory, ruined equipment | Connects the exterior breach to the financial losses within the property. |

| Temporary Repairs | "After" photos of tarps, boarded windows, etc. | Proves fulfillment of the policy's "duty to mitigate" damage. |

| Mitigation Expenses | Receipts for tarps, plywood, emergency labor, etc. | Ensures reimbursement for all out-of-pocket costs to secure the asset. |

This checklist is a roadmap for building a claim that is difficult for an insurer to challenge.

Execute Necessary Temporary Repairs

After thoroughly documenting the initial damage, shift focus to loss mitigation. This involves making temporary repairs, not permanent ones.

Your policy contains a "duty to mitigate" clause, requiring you to take reasonable steps to prevent further damage. Covering a roof penetration with a tarp or boarding a broken window is not just permitted—it's required. Failure to do so may result in the denial of coverage for any subsequent damage.

Meticulously document every action and expense during this phase.

- Retain all receipts for materials like tarps, plywood, and fasteners.

- Keep a detailed log of any labor hired for emergency services.

- Take "after" photos that clearly show the completed temporary repairs.

Navigating this phase often requires engaging contractors for emergency services. Knowledge of the market, including best practices for [finding reputable roofing professionals](https://core6.marketing/blog/how-to-get-roofing-leads/), can accelerate response times. Handling this initial phase with diligence provides the irrefutable proof needed for a fair and timely settlement.

Managing the Claims Filing and Adjustment Process

Image

Filing the storm damage insurance claim initiates the process, but the substantive work occurs during the adjustment phase. This is where you transition from documenting a loss to negotiating its value.

The objective is to manage the process, advocate for the full policy entitlement, and build a professional, cooperative relationship with the insurer's representatives. Upon reporting the loss, a claim number is issued and an adjuster is assigned. This individual is your primary point of contact, making a professional and organized first impression critical.

Working with the Insurance Adjuster

The insurance adjuster's role is to investigate the claim on behalf of the carrier. They verify the cause of loss, determine coverage under the policy, and calculate the cost of damages. Understanding their function is key to effective collaboration.

Present your evidence in a clean, organized package containing pre-storm photos, post-storm videos, and detailed logs of mitigation expenses. A well-prepared file immediately establishes credibility.

From this point forward, document every interaction. Maintain a detailed log of all communications.

- Log every call and email, noting the date, time, participants, and subject matter.

- Follow up phone calls with a confirmation email to create a written record of verbal discussions. For example: "John, confirming our 10:15 AM call. As discussed, you will review the roofer's estimate and provide feedback by Friday."

- Never rely on verbal commitments. If a deadline, approval, or next step is important, secure it in writing.

This approach ensures clarity and protects against misunderstandings that can derail a claim.

Challenging an Initial Low Assessment

It is not uncommon for an adjuster's initial estimate to be lower than your own. This is often a starting point for negotiation. Your meticulous documentation is the primary tool for this process.

The financial pressure on insurers is significant. Aon's 2025 Climate and Catastrophe Insight Report found that insured losses from natural catastrophes reached USD 145 billion in 2024. This figure covered only 40% of total economic damage, leaving a global protection gap of 60%. These figures underscore why carriers scrutinize every payout. Review the full Aon catastrophe report findings for more detail.

Case Study: A warehouse owner's hail-damaged roof was undervalued in an initial settlement offer. The adjuster's estimate was based on standard asphalt shingles, not the premium TPO roofing system that was installed.

Resolution: The owner responded not with argument, but with evidence. They supplied original installation invoices for the TPO material, manufacturer's technical specifications, and two new quotes from certified commercial roofers. They also provided pre-storm drone footage showing the roof's condition. Faced with this undeniable proof, the insurer revised the offer to cover the full replacement cost with like-kind-and-quality materials.

The key takeaway for storm damage insurance claims is that successful negotiation hinges on evidence, not emotion. Maintain professionalism and support your position with irrefutable facts to secure a fair and accurate settlement.

Avoiding Common Pitfalls That Derail Claims

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/HniduurLA4k" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Successfully navigating a storm damage insurance claim requires avoiding preventable errors. In the high-pressure environment post-disaster, simple mistakes can delay, reduce, or invalidate an otherwise legitimate claim. For risk managers and brokers, understanding these common tripwires is key to guiding clients toward a full recovery.

One of the most damaging errors is the premature disposal of damaged property. While the impulse to clear debris is strong, throwing away ruined inventory or building materials is equivalent to destroying evidence. The adjuster must be able to inspect the physical damage to verify the loss.

Navigating Key Documents and Deadlines

After a loss is reported, the insurer will require a Proof of Loss form. This is not a routine document; it is a formal, sworn statement detailing the exact dollar amount being claimed. Submitting an inaccurate or incomplete Proof of Loss can severely limit your ability to recover additional funds later.

Adherence to deadlines is critical. The policy contains strict timelines for reporting the loss and submitting the Proof of Loss. Missing a deadline can provide the carrier with a technical basis for denial, regardless of the claim's merit.

Treat a Proof of Loss form with the gravity of a legal filing. Never sign it under pressure or before you have a comprehensive, fully vetted estimate of your total damages. If there is any uncertainty, seek expert guidance.

The Danger of Premature Settlement Offers

Insurers often present a quick, initial settlement offer. While tempting, especially when cash flow is critical, accepting this first offer is frequently a significant financial mistake.

These early figures are typically based on a preliminary inspection and rarely account for latent damage, code upgrade costs, or the full scope of business interruption losses.

Cashing a settlement check or signing a release form permanently closes the claim. You forfeit the right to seek additional funds if new damages are discovered. The financial pressure on insurers to close claims quickly is immense.

Data from Swiss Re projects that global insured losses from natural catastrophes will reach USD 145 billion in 2025, with a 1-in-6 probability of spiking to USD 258 billion. You can [explore more data on rising catastrophic loss trends](https://www.insurance.com/home-and-renters-insurance/global-natural-disaster-losses-insurance-impact/). With this level of capital at stake, the incentive is to resolve claims efficiently, which can lead to undervalued offers.

Before accepting any offer, ensure it accounts for the *true* cost of recovery, including:

- A detailed scope of work: An itemized, line-by-line breakdown of all repairs from a trusted contractor.

- Code upgrades: Funds required to bring the property up to current building codes.

- Latent damage: An allowance for issues not immediately apparent, such as moisture intrusion or subtle structural compromise.

- Business interruption: A complete accounting of lost income and extra expenses incurred.

Knowing When to Engage Professional Support

Managing a complex commercial storm damage insurance claim is a resource-intensive undertaking. Recognizing when to engage third-party experts is a sign of strategic leadership.

Consider professional support if you encounter these red flags:

- The damage is widespread, complex, or involves specialized systems.

- A significant gap exists between the insurer's offer and your contractor's estimate.

- The claim has stalled, or the adjuster has become unresponsive.

- The carrier invokes complex policy exclusions or alleges pre-existing damage.

In these scenarios, a licensed public adjuster or an experienced insurance attorney can be a critical asset. They represent the policyholder's interests, working to level the playing field and secure the full settlement owed under the policy.

Frequently Asked Questions in Storm Damage Claims

When managing the aftermath of a major storm, the claims process can be complex. Brokers, risk managers, and property owners frequently encounter the same critical questions. Here are direct answers to the most common inquiries.

What is the distinction between wind and flood coverage?

This is one of the most critical and misunderstood aspects of property insurance. Misinterpreting this distinction can lead to significant uninsured losses.

In short, damage from wind, hail, or rain that enters through a storm-created opening in the building envelope is typically covered under a standard commercial property policy. This is damage caused directly by atmospheric forces.

Flood damage, conversely, is defined as damage from rising surface water, such as overflowing rivers or coastal storm surge. This peril is almost universally excluded from standard property policies and requires a separate flood insurance policy, often obtained through the National Flood Insurance Program (NFIP) or the private market. Understanding the precise boundary between these coverages is fundamental to effective risk management.

Is it advisable to hire a public adjuster?

A public adjuster is a state-licensed professional who advocates exclusively for the policyholder. While not necessary for a small, straightforward claim, their expertise can be invaluable for a large-scale, complex storm damage event.

Engaging a public adjuster is a strategic decision. Consider it when:

- The damage is extensive and involves specialized assets or complex structural assessments beyond your internal expertise.

- Your team lacks the bandwidth to manage the intensive documentation and negotiation process.

- The insurer's initial offer is substantially below a credible repair estimate, signaling a contentious negotiation ahead.

A qualified public adjuster will meticulously document the loss, manage all communication with the carrier, and negotiate to maximize your recovery under the policy terms.

What is the actual deadline for filing a storm damage claim?

This question has a two-part answer.

First, your policy and state law will specify a formal deadline, or statute of limitations, which may be one year or more. However, this formal deadline is not your primary concern.

The most critical deadline is immediate. Your policy contains a condition requiring you to provide prompt notice of the loss "as soon as reasonably possible." Delaying this initial notification by days or weeks can give the insurer grounds to argue that you exacerbated the damage or to question the claim's validity. Do not provide the carrier with this opportunity. Prompt notification is a critical first step toward a successful outcome.

---

Connect with your highest-intent prospects at the exact moment a storm impacts their business. Sentinel Shield delivers verified, geo-targeted leads from disaster-affected areas within 24 hours, empowering you to turn climate events into actionable business opportunities. Pay only for the results you get. Discover the power of real-time climate intelligence by visiting https://insurtech.bpcorp.eu.