For decision-makers in the commercial insurance and climate risk sectors, the dialogue around natural disasters has fundamentally shifted. Theoretical risk modeling has been replaced by the immediate reality of bottom-line impact. The increasing frequency and severity of catastrophic events demand a clear business case for proactive risk mitigation.

Failure to prepare is no longer an operational oversight; it is a direct threat to financial stability, investor confidence, and market reputation.

Image

The financial consequences are too significant to ignore. In the first quarter of 2025 alone, natural disasters generated at least $83 billion in global economic losses, with insured losses reaching $53 billion. This represents the second-highest Q1 total on record, largely driven by catastrophic events like the California wildfires, which accounted for over $52.5 billion in losses.

From Compliance Checklist to Competitive Edge

Viewing disaster preparedness as a mere compliance requirement is a critical error. The correct perspective is to treat it as a strategic imperative for operational resilience and market leadership. This is the mindset that risk managers, underwriters, and brokers must adopt to safeguard their portfolios and clients.

A robust preparedness strategy is not just a defensive measure; it is an offensive play that provides a clear competitive advantage.

- Minimize Downtime: Resume operations while competitors are still assessing damages.

- Strengthen Stakeholder Trust: Demonstrating resilience builds confidence with investors, clients, and internal teams.

- Improve Insurability: Documented risk mitigation efforts often lead to more favorable terms and premiums from carriers.

The Response Game is Changing

The tools for managing catastrophic events are also evolving. The focus has shifted from isolated corporate actions to integrated, technology-driven responses. Innovations like drone operations in emergency services are fundamentally altering the speed and efficacy of disaster response. This technological advancement creates urgency for businesses to develop plans that leverage modern capabilities.

The objective is to move beyond abstract warnings and connect proactive preparation directly to long-term financial performance. This guide provides the frameworks to achieve that goal.

This guide is designed to deliver practical, actionable strategies for assessing climate risk, building effective response plans, and aligning insurance coverage with emerging threats. It is about transitioning from reactive damage control to a proactive strategy that secures your organization's future.

Conducting a Proactive Climate Risk Assessment

Image

A generalized awareness of climate threats is insufficient. To effectively prepare for natural disasters, risk managers and underwriters must move beyond high-level warnings and conduct a rigorous, data-driven climate risk assessment.

This is not a bureaucratic exercise; it is the process of translating abstract threats into quantifiable business impacts. A properly executed assessment forms the foundation of a resilient operational strategy, identifying critical vulnerabilities before a catastrophe exposes them.

The initial step is a granular analysis of geographical exposures. This requires pinpointing every critical asset, including manufacturing plants, distribution hubs, and key supplier facilities.

By overlaying these locations with specific hazard maps—such as floodplains, wildfire corridors, and hurricane-prone coasts—you can create a clear visualization of primary physical risks. This map becomes the foundational layer for prioritizing mitigation efforts.

Identifying Geographical and Structural Vulnerabilities

After mapping the physical footprint against known hazards, the next step is to analyze the structural integrity of the assets themselves. A warehouse located in a high-risk flood zone presents a known problem. However, a warehouse in that same zone with inadequate drainage, built to outdated codes, and with critical equipment at ground level represents a much greater liability.

The assessment must delve into the specific details of each facility. Key questions to address include:

- Building Codes: Does the structure meet or exceed current codes for wind resistance, seismic stability, or fire-retardant construction?

- Critical Infrastructure: Where are electrical panels, servers, and HVAC units located? Are they elevated and protected from potential flood damage?

- Site Defenses: What mitigation measures are already in place, such as flood barriers, reinforced roofing, or wildfire defensible space?

The answers provide an actionable list of upgrades and retrofitting projects that can significantly reduce potential damage and shorten recovery times. For underwriters, this data is invaluable when evaluating a property’s risk profile.

Analyzing Supply Chain Interdependencies

The impact of a natural disaster rarely remains within your property lines. Modern supply chains are complex networks where a single disruption can halt operations across the globe. A thorough risk assessment must analyze these interdependencies.

This involves mapping primary, secondary, and even tertiary suppliers for essential components and services. You must identify their locations and assess their vulnerabilities to climate events. A high concentration of critical suppliers in a single, high-risk region represents a significant risk that requires diversification.

For instance, if a manufacturer’s sole supplier for a crucial microchip is located in a hurricane hotspot, that finding should immediately trigger a strategic initiative to identify and qualify alternative suppliers in lower-risk geographic areas.

A proactive climate risk assessment is not a static report. It must be a dynamic, living document—reviewed quarterly—that continuously informs capital allocation, operational planning, and insurance strategy. It is the mechanism by which a business adapts to evolving climate threats.

This approach transforms risk assessment from a simple compliance task into a powerful strategic management tool. For a deeper analysis of the technology enabling this, see our guide on modern climate risk assessment tools that are changing the industry.

Leveraging Data for Quantifiable Insights

To elevate an assessment from a checklist to a strategic instrument, you must integrate advanced data. This may involve partnering with meteorological consultants or utilizing sophisticated climate modeling software. These tools provide forward-looking projections, not just historical data, enabling you to model potential financial losses from various disaster scenarios.

Consider a commercial real estate portfolio on the Gulf Coast. Using data from FEMA’s National Risk Index (NRI), analysis shows that in Texas, 22.47% of recently acquired single-family mortgage value was in tracts with high or very high hurricane risk. In counties declared disaster areas after Hurricane Beryl, that figure rose to 82.13%.

This level of data allows for the accurate quantification of potential losses. By modeling the impact of a Category 4 hurricane on specific properties, you can estimate structural damage, business interruption costs, and the subsequent impact on insurance claims. This is the hard data required to build a compelling business case for investing in mitigation and securing appropriate insurance coverage.

Crafting a Resilient Business Continuity Plan

Following a thorough risk assessment, the next critical step is to develop a robust Business Continuity Plan (BCP). It is a common misconception to view business continuity as solely an IT function addressed by data backups. An effective BCP is a comprehensive operational playbook designed to maintain core business functions during a crisis.

This plan differentiates businesses that recover quickly from those that face prolonged, often fatal, downtime. It must detail everything from decision-making authority to stakeholder communication protocols when primary systems are unavailable.

The financial stakes are immense. The United Nations Office for Disaster Risk Reduction (UNDRR) reports that direct disaster costs average $202 billion per year. Factoring in broader economic ripple effects, that figure escalates to over $2.3 trillion annually. This highlights how a disaster's impact extends far beyond physical damage, affecting supply chains, customer loyalty, and market stability. The complete economic analysis can be reviewed on the UNDRR website.

Establishing Command and Communication Protocols

During a disaster, ambiguity is the primary adversary. A core component of an effective BCP is a clearly defined command structure. This is not the daily organizational chart but a dedicated crisis management team with pre-defined roles, responsibilities, and the authority to make critical decisions.

Key questions—such as who activates the BCP, who serves as the media spokesperson, and who coordinates with emergency services—must be answered and documented well before a crisis occurs.

Equally critical are communication protocols. The plan must specify how information will be disseminated to three key audiences:

- Employees: Ensure their safety with clear instructions for remote work, alternate work sites, and their roles during the crisis.

- Clients and Customers: Proactively manage expectations regarding service disruptions, order delays, and recovery timelines.

- Stakeholders and Partners: Maintain trust and coordinate recovery efforts by keeping suppliers, investors, and regulatory bodies informed.

Core Components of an Actionable BCP

A resilient BCP is not a theoretical document; it is a practical guide with actionable checklists that any member of the crisis team can implement immediately.

Consider a scenario where a hurricane causes a regional power outage, forcing your main office to close for a week. An effective BCP would have already addressed the following:

- Remote Work Infrastructure: Has the VPN been stress-tested to handle full-company remote access? Do employees have the necessary equipment and secure access to critical systems?

- Alternate Operational Sites: If remote work is not universally feasible, have backup locations been identified? This could involve a pre-arranged agreement with a shared workspace or another company office in an unaffected region.

- Emergency Procurement Processes: Are there pre-approved vendors for critical supplies like generators, fuel, or temporary IT hardware? The plan must grant designated individuals the authority to make these purchases without standard bureaucratic delays.

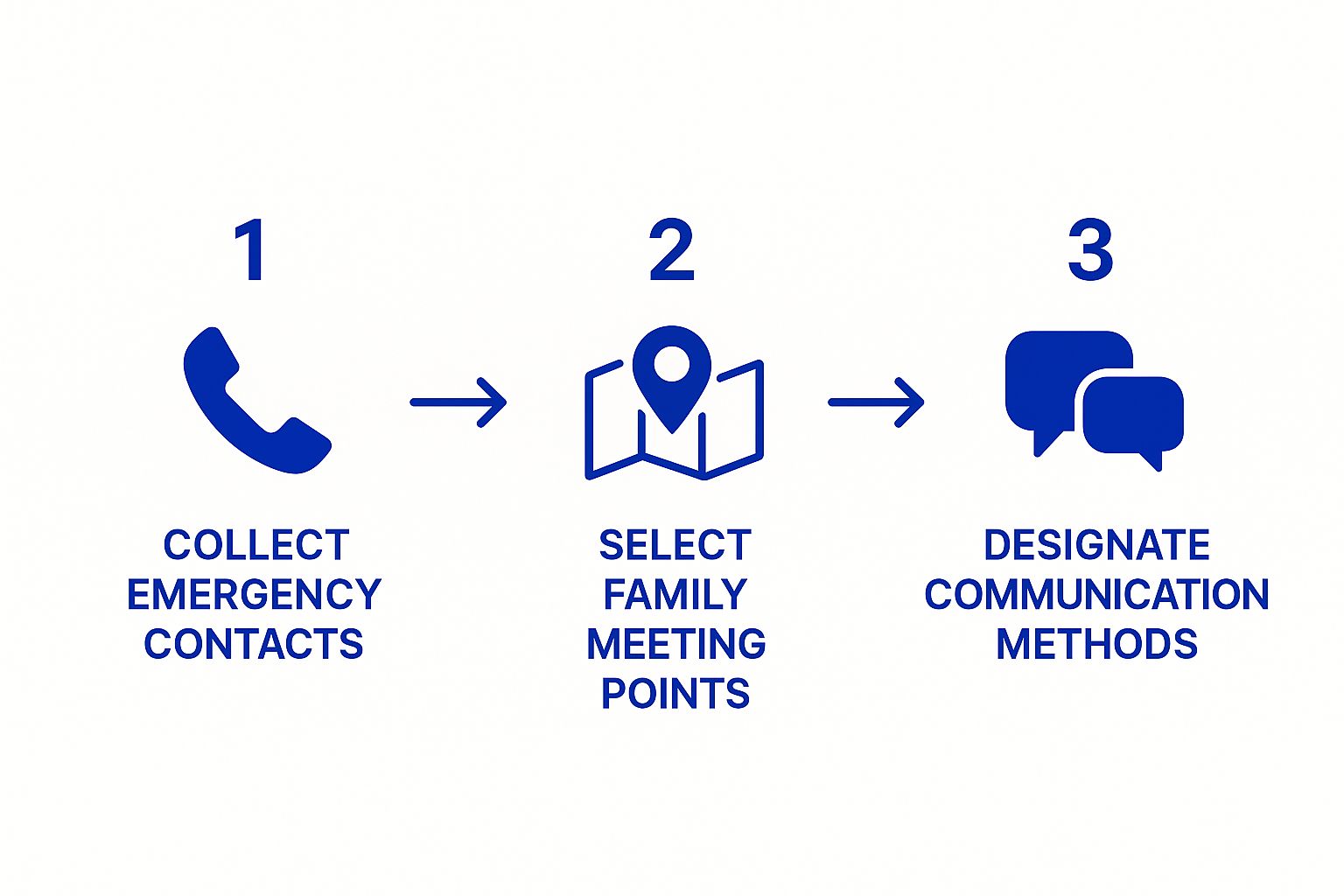

To visualize the foundational steps, this flowchart outlines essential communication protocols for any business.

Image

This graphic reinforces the critical sequence: collect contacts, identify safe locations, and establish communication channels. This forms the bedrock of any effective response plan.

A well-structured plan must cover several key areas. The following table outlines the essential components of a comprehensive BCP, serving as a checklist to ensure all critical functions are addressed.

Key Components of a Business Continuity Plan

| Component | Objective | Key Actions |

|---|---|---|

| Business Impact Analysis (BIA) | Identify critical business functions and the impact of their disruption. | Prioritize recovery activities; determine recovery time objectives (RTOs). |

| Crisis Management Team | Establish a clear command structure for decision-making. | Define roles and responsibilities; create succession plans. |

| Communication Plan | Ensure timely and accurate information flow to all stakeholders. | Develop pre-approved message templates; establish multiple communication channels. |

| IT Disaster Recovery | Protect and restore critical data, systems, and applications. | Implement regular data backups; test failover systems and cloud recovery. |

| Operational Recovery | Resume critical business processes at alternate locations. | Secure alternate work sites; pre-arrange supplier agreements. |

| Plan Maintenance & Testing | Ensure the BCP remains current, relevant, and effective. | Conduct regular drills and tabletop exercises; update the plan annually. |

A well-defined BCP is not merely a document; it comprises tested, actionable strategies ready for immediate deployment.

Your Business Continuity Plan is not a static document. It is a living strategy that must be tested, reviewed, and updated at least annually. Untested assumptions are liabilities.

Developing a BCP is a significant undertaking, but it is a non-negotiable component of enterprise resilience. For further detail, refer to our complete guide to disaster preparedness for businesses. Ultimately, a well-crafted BCP is one of the most powerful tools a risk manager can deploy to protect revenue, reputation, and operations against escalating climate threats.

Safeguarding Your Physical and Digital Assets

After assessing risks and drafting a business continuity plan, the next phase is implementation: protecting the core assets that drive your business. For risk managers and underwriters, this is where strategy becomes tangible. Safeguarding buildings, equipment, and data is not a simple budget item; it is a direct investment in recovery speed and a key factor in how insurance claims are evaluated.

Protecting physical infrastructure requires a proactive, hands-on approach. Waiting for a disaster to reveal facility weaknesses is a costly lesson. Instead, use the risk assessment to guide targeted upgrades that directly counter identified threats.

Fortifying Physical Infrastructure

Consider a distribution center in a hurricane-prone region. A standard structure is inadequate against severe wind and flooding. The potential for catastrophic loss is substantial, but specific, preventative actions can significantly mitigate this risk.

- Structural Retrofitting: This includes reinforcing roofs, anchoring HVAC units to prevent them from becoming projectiles, and installing impact-resistant windows to mitigate damage from high winds.

- Flood Mitigation: Implement modular flood barriers, elevate critical machinery and electrical systems, and maintain clear, functional drainage systems.

- Fire Resistance: For facilities in wildfire zones, using fire-resistant construction materials and establishing defensible space around buildings is non-negotiable.

These are not mere maintenance expenses; they are critical data points for underwriters. A business that can provide documented proof of these upgrades presents a lower-risk profile, which often translates to more favorable insurance terms and premiums.

Securing Your Digital Core

While fortifying physical structures, you must apply the same rigor to your business's digital infrastructure—its data. A natural disaster can easily trigger a secondary crisis if data is lost or compromised, bringing recovery efforts to a complete halt. The objective is to create a data infrastructure that is both redundant and secure, capable of withstanding physical damage and the opportunistic cyber-attacks that often follow major events.

A common error is relying on a single backup solution. True digital resilience requires geographically dispersed, redundant systems to eliminate single points of failure. If both primary and backup servers are located in the same flood-prone city, you do not have a viable backup plan.

Proper data protection involves a multi-layered strategy. This includes regular, automated backups to multiple secure locations, ideally a mix of on-premise, private cloud, and public cloud solutions. It also requires robust cybersecurity protocols designed to defend against attacks when systems are most vulnerable during a crisis.

Failover systems that can be activated instantly are essential for maintaining operations. A well-implemented strategy for using [emergency alert systems for businesses](https://insurtech.bpcorp.eu/blog/emergency-alert-systems-for-businesses-1756364913911) can provide the timely notifications IT teams need to act swiftly.

Power loss is another critical point of failure that can disrupt both physical and digital operations. To determine the right solution for securing facilities against an outage, a comprehensive [home backup power generator buying guide](https://www.portlandiaelectric.supply/blogs/news/home-backup-power-generator-buying-guide-for-outages) offers valuable insights that can be scaled for a commercial environment.

Ultimately, safeguarding assets is about reducing the potential scope of loss. By investing in both physical fortifications and digital redundancies, you significantly decrease the financial impact of a natural disaster. This proactive stance not only accelerates recovery but also provides underwriters and brokers with the concrete evidence needed to build a stronger, more resilient insurance portfolio for your business.

Aligning Insurance Coverage with Your Risk Profile

Image

After identifying risks and fortifying assets, the final strategic step is to ensure your insurance coverage aligns with your real-world risk profile. For underwriters, brokers, and risk managers, this is where proactive preparation yields its greatest financial return. A policy misaligned with your actual risk profile provides a false sense of security that can lead to catastrophic financial losses when a disaster occurs.

The task is to close the gap between perceived coverage and the actual policy language. This requires a meticulous, line-by-line review of the fine print to understand what your coverage means in a crisis.

The stakes are high. In 2024, global economic losses from natural disasters reached $368 billion. Even with major events like widespread flooding across Europe, an alarming 75% of flood-related damages were uninsured, exposing a massive gap between disaster impact and financial preparedness.

Deconstructing Your Current Policies

A common error is assuming a standard commercial property policy covers all natural perils. This is rarely the case. The true adequacy of your coverage lies in the details that determine whether a claim is paid or denied.

A granular review should focus on several key areas:

- Peril-Specific Exclusions: Does the policy explicitly exclude events like floods, earthquakes, or landslides? These perils typically require separate, dedicated policies.

- Sub-limits and Deductibles: Scrutinize sub-limits for costs such as debris removal or business interruption. A high deductible for a named storm can result in a significant out-of-pocket expense before coverage activates.

- Policy Definitions: How does the policy define "business interruption"? Is it triggered only by direct physical damage, or does it extend to disruptions from a power grid failure or supply chain breakdown?

Understanding these nuances is critical. For businesses in flood zones, knowing how to file a flood insurance claim effectively is not just good practice; it is an essential survival skill that demonstrates the need for specialized knowledge.

Leveraging Mitigation for Better Terms

Your risk mitigation efforts—structural retrofits, redundant data systems, detailed continuity plans—are not just for operational resilience. They are your most powerful negotiating tools with insurers.

When you can present meticulous documentation of every protective measure implemented, you provide underwriters with tangible proof that your business represents a lower-than-average risk.

A detailed dossier of your preparedness strategy can directly influence premiums and policy terms. It demonstrates a serious commitment to risk management, which can unlock superior coverage options that might otherwise be unavailable or cost-prohibitive.

The objective is to transform insurance from a reactive safety net into a proactive component of your risk management strategy. Use your documented preparedness as leverage to secure coverage that accurately reflects your operational realities and financial exposures.

Exploring Innovative Risk Transfer Solutions

Traditional insurance products may not adequately cover indirect losses, such as reputational damage or loss of market share following a disaster. Consequently, forward-thinking risk managers are exploring innovative risk transfer solutions.

One of the most effective emerging tools is parametric insurance. Unlike traditional policies that pay out after a lengthy damage assessment, parametric coverage provides a pre-agreed sum when a specific, measurable event occurs. For example, a payout is automatically triggered when hurricane wind speeds reach a pre-defined threshold in a specific location.

This model offers significant advantages:

- Rapid Payouts: Because payment is tied to an objective trigger, funds are disbursed quickly. This immediate liquidity is crucial for recovery efforts, bypassing the prolonged claims adjustment process.

- Transparency: Triggers and payout amounts are clearly defined upfront, eliminating disputes over the extent of damage.

- Coverage for Gaps: Parametric solutions can be tailored to cover losses that traditional policies may exclude, proving particularly valuable for business interruption.

By layering innovative solutions like parametric insurance into your risk management program, you can build a more resilient financial backstop, ensuring you have the capital required for a swift and complete recovery.

Common Questions About Disaster Preparedness

Even the most thorough disaster preparedness plan will generate questions from the risk managers, brokers, and underwriters responsible for its implementation. Translating a plan from a document into an effective defense requires addressing these practical, on-the-ground concerns.

Here are some of the most frequent questions from commercial risk professionals.

How Often Should We Test Our Business Continuity Plan?

The standard is at least annually.

However, a simple document review is insufficient. You must conduct tabletop exercises or full-scale simulations with key personnel. The objective is to simulate a real crisis to identify weaknesses in communication, resource allocation, or decision-making authority.

Certain components require more frequent testing. Data backup and recovery systems, for instance, should be tested quarterly. Discovering a six-month backup failure after a data center outage is unacceptable. Regular testing builds the muscle memory necessary for your team to act decisively, not in panic, during an actual event.

What Is the Biggest Mistake Businesses Make?

The most common failure is the "plan and file" mentality.

Many companies invest significant resources to create a comprehensive disaster plan, only to let it become outdated in a forgotten network folder. A Business Continuity Plan (BCP) is a living document that must evolve with your business, technology stack, and the dynamic climate risk landscape.

An outdated plan is more dangerous than no plan at all. It creates a false sense of security while directing your team to the wrong contacts, referencing decommissioned systems, or assigning critical roles to former employees. In an emergency, such a plan is functionally useless.

The most common point of failure in disaster preparedness is not the quality of the initial plan, but the lack of a disciplined, ongoing process for testing, reviewing, and updating it. An untested assumption in a BCP is a hidden liability.

How Can We Justify Preparedness Costs to Leadership?

Frame the expenditure as risk mitigation and return on investment (ROI), not merely an operational cost. Leadership responds to data that protects the bottom line and enhances organizational resilience.

To build a compelling business case, shift the conversation from expense to strategic investment:

- Quantify the Cost of Inaction: Use industry-specific data to calculate the average cost of downtime per hour, which often runs into hundreds of thousands of dollars. This context makes preparedness costs appear minimal by comparison.

- Highlight Insurance and Compliance Benefits: Emphasize that documented mitigation efforts can lead to more favorable insurance premiums and terms. Proactive planning also ensures compliance with regulatory requirements, avoiding potential fines.

- Protect Brand Reputation: A company's response during a crisis is scrutinized by customers, investors, and the public. A well-executed BCP is an exercise in brand protection, demonstrating competence and reliability—invaluable intangible assets.

The cost of proactive preparation is almost always a fraction of the cost of recovery. For a deeper analysis of these topics, review our comprehensive FAQ about disaster preparedness. When you present preparedness as a direct investment in operational continuity and long-term profitability, you will secure the necessary executive buy-in.

---

At Insurtech.bpcorp.eu, we provide the real-time climate intelligence that transforms disaster response into a strategic growth opportunity. Our Sentinel Shield platform identifies businesses impacted by natural disasters at the moment of need, delivering actionable, high-intent leads directly to insurance providers, recovery firms, and legal teams. Don't just react to climate events—capitalize on them. Discover validated corporate opportunities by visiting us at https://insurtech.bpcorp.eu.