Disaster preparedness is not a compliance checklist item; it is a core business strategy that directly defends revenue, brand reputation, and operational viability. For decision-makers in commercial insurance and risk management, a robust preparedness plan is a key indicator of an organization's resilience. This guide provides an actionable framework for assessing threats, building response capabilities, and ensuring a business can withstand disruption.

Why Business Resilience Is a Competitive Advantage

Image

In a volatile market, treating disaster preparedness as a perfunctory task is a critical miscalculation. For underwriters, brokers, and risk managers, the focus must be on framing resilience as a competitive differentiator. A well-structured plan shifts an organization from a reactive posture—managing chaos during a crisis—to a proactive one, fundamentally improving its ability to absorb shocks from natural disasters, cyber attacks, or supply chain failures.

The financial and reputational stakes are immense. A single disruptive event can halt operations, erode customer trust, and inflict long-term damage on shareholder value. According to FEMA, 40% of small businesses never reopen following a disaster, and another 25% that do manage to reopen fail within a year. These statistics underscore the direct correlation between preparedness and long-term survival.

The Strategic Value of Proactive Planning

A forward-thinking approach to disaster planning delivers tangible benefits that extend beyond compliance. It builds a more adaptable organization capable of converting risk into an operational advantage.

Key advantages for risk and insurance professionals include:

- Enhanced Operational Continuity: A tested plan minimizes downtime by enabling critical functions to resume quickly, protecting revenue streams during periods of vulnerability.

- Strengthened Brand Reputation: Organizations that manage crises effectively project stability and reliability, preserving trust with customers, partners, and investors.

- Improved Risk Underwriting and Pricing: A client with a documented and tested preparedness plan represents a lower-risk profile. This translates directly into more favorable insurance terms and accurate pricing.

A documented plan is more than a safety net; it signals to the market that an organization is well-managed and resilient. In the commercial insurance landscape, this level of readiness is a powerful differentiator.

Moving Beyond Theory to Action

This guide provides a practical framework for building a robust defense. We will move beyond abstract concepts to deliver actionable insights tailored for risk managers, brokers, and underwriters. The objective is to provide the tools to develop a comprehensive strategy that not only ensures survival but also positions your company—or your clients—for long-term success.

By embracing disaster preparedness as a core business function, a potential liability is transformed into a source of enduring strength and a tangible competitive edge.

How To Conduct A Business Risk Assessment

Effective disaster preparedness begins with a clear understanding of the threats an organization faces. A comprehensive risk assessment is the foundation of a resilient business, replacing guesswork with a data-driven strategy. The process methodically identifies potential threats and quantifies their operational impact, enabling focused allocation of resources, appropriate insurance coverage, and a plan that directly addresses primary exposures.

The purpose is to concentrate mitigation efforts on protecting personnel, assets, and the bottom line.

Starting With A Business Impact Analysis

The cornerstone of a credible risk assessment is the Business Impact Analysis (BIA). This diagnostic process pinpoints essential operational functions and calculates the financial and non-financial costs of their disruption over time.

A BIA methodically maps core processes and addresses critical questions:

- What are our most critical business functions and their dependencies (personnel, technology, suppliers)?

- What is the maximum tolerable downtime for each function before severe financial or reputational damage occurs?

- What are the direct financial impacts (lost revenue, contractual penalties) and indirect costs (brand damage, customer attrition) of a disruption?

The answers establish a clear hierarchy for protection and restoration efforts, forming the logical foundation of the entire preparedness plan.

Identifying A Full Spectrum Of Risks

Once critical functions are identified, the next step is to catalog the specific threats that could disrupt them. This requires looking beyond obvious natural disasters to include human-caused incidents, which can be equally or more damaging. Businesses should utilize various effective risk assessment methods to ensure a comprehensive evaluation.

A broad range of potential hazards should be considered:

- Natural Hazards: Floods, wildfires, hurricanes, earthquakes, and severe storms.

- Human-Caused Incidents: Cyberattacks, data breaches, prolonged power outages, terrorism, and civil unrest.

- Technological Failures: Critical system failures, IT infrastructure collapse, and telecommunications outages.

- Supply Chain Disruptions: The failure of a key supplier, transportation blockages, or geopolitical events that interrupt material flow.

A common oversight is focusing solely on internal risks. True resilience requires assessing dependencies on third-party suppliers, utility providers, and public infrastructure.

The financial threat from these events, particularly those linked to climate, is escalating. Projections estimate that insured losses from climate disasters could reach $145 billion—a 6% increase from previous totals. This trend reflects the growing economic impact on fixed assets and supply chains. Companies that fail to adapt could see earnings decrease by up to 7% annually.

A Business Impact Analysis formalizes this assessment, clarifying which business areas require the fastest recovery. This sample matrix illustrates how to prioritize functions based on their potential impact and recovery objectives.

Business Impact Analysis (BIA) Prioritization Matrix

| Business Function | Potential Impact (Financial, Operational, Reputational) | Recovery Time Objective (RTO) | Recovery Point Objective (RPO) | Priority Level |

|---|---|---|---|---|

| Customer Support Call Center | High (Reputational damage, customer churn) | 4 Hours | 1 Hour | Critical |

| Online Sales Platform | High (Direct revenue loss) | 2 Hours | 15 Minutes | Critical |

| Payroll Processing | Medium (Employee morale, regulatory fines) | 24 Hours | 24 Hours | High |

| Warehouse Operations | Medium (Operational delays, fulfillment issues) | 48 Hours | 8 Hours | Medium |

| Marketing & Communications | Low (Delayed campaigns, short-term brand impact) | 72 Hours | 48 Hours | Low |

By completing a BIA, an organization creates a clear roadmap for allocating resources—such as backup systems for a sales platform or a remote work plan for a call center—to protect its most vital functions.

Creating A Data-Driven Risk Matrix

The final step is to synthesize these findings into a risk matrix. This tool prioritizes threats by plotting the *likelihood* of an event against the *severity* of its impact, as determined by the BIA.

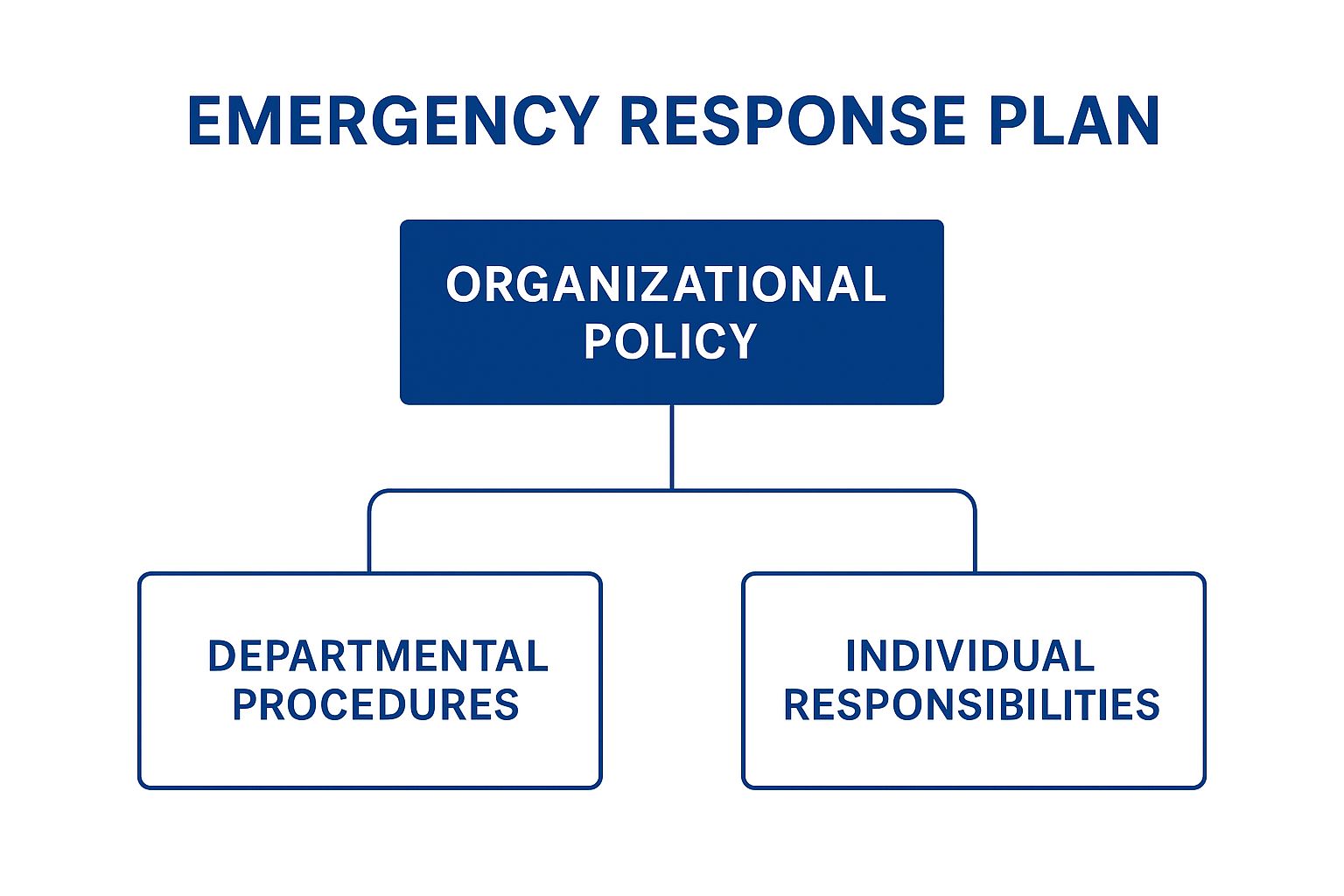

This visual hierarchy illustrates how an emergency response plan should be structured, from high-level corporate policy down to individual responsibilities.

Image

As the diagram shows, effective preparedness connects policy, procedures, and individual roles, ensuring a coordinated, team-based response. The result of this assessment is a data-driven roadmap for optimizing budget, time, and energy on the most significant exposures.

Building Your Disaster Preparedness Plan

Image

A risk assessment identifies potential threats; a disaster preparedness plan specifies the actions to take when those threats materialize. This plan translates abstract risks into concrete, actionable steps, bridging the gap between knowing a flood is possible and knowing exactly who does what when it occurs.

For risk managers and insurance professionals, this documented plan is tangible proof of proactive risk mitigation. It demonstrates an organization's structured capability to respond, recover, and maintain operations under duress—the hallmark of a resilient and highly insurable business.

Assembling Your Crisis Management Team

The first step is establishing a dedicated Crisis Management Team (CMT). This group functions as the command center for the entire response effort. Team composition should be based on functional roles rather than job titles, assigning clear authority to individuals capable of decisive action in high-stress situations.

A cross-functional CMT should include leaders responsible for critical business areas:

- Team Leader: The ultimate decision-maker responsible for activating the plan and orchestrating the response.

- Operations Lead: Focused on restoring essential business functions, whether on-site or at an alternate location.

- Communications Lead: Manages all internal and external messaging to employees, customers, media, and other stakeholders to control the narrative and prevent misinformation.

- IT Lead: Oversees technology recovery, including data restoration, systems functionality, and cybersecurity.

- Safety and Security Lead: Responsible for personnel safety, facility security, and liaison with first responders.

A non-negotiable, clear chain of command is essential. Ambiguity over decision-making authority during a crisis leads to chaos, whereas a defined structure ensures a coordinated response.

Developing Core Response and Continuity Procedures

With the CMT in place, the next task is to develop specific playbooks for the scenarios identified in the risk assessment. These procedures must be clear, concise, and easy to execute under pressure.

Key procedures to develop include:

- Emergency Response Protocols: Immediate actions to protect people and property, such as documented evacuation routes, shelter-in-place instructions, and medical emergency procedures.

- Business Continuity Measures: Steps to maintain critical operations, which may involve activating remote work protocols, shifting work to an alternate site, or rerouting the supply chain.

- IT Disaster Recovery: A specific, technical plan for restoring technology, detailing processes for data recovery, activating redundant systems, and re-establishing network connectivity.

The goal is to eliminate guesswork. Whether facing a wildfire evacuation or a ransomware attack, the team should have immediate access to clear, actionable steps. This is how organizations effectively mitigate business interruption, a top global risk alongside cyber threats and natural disasters.

A disaster plan is a living document, not a "set it and forget it" file. It must be continuously updated after every drill, near-miss, and operational change. An outdated plan creates a false sense of security and is more dangerous than no plan at all.

Ensuring Your Plan Is Comprehensive and Actionable

As you assemble the plan, it is critical to ensure there are no gaps. The plan is only as strong as its weakest component.

To verify comprehensiveness, benchmark your plan against a detailed guide like Your Ultimate Business Continuity Plan Checklist. Such resources provide a valuable sanity check, confirming that all critical areas, from stakeholder communications to supplier dependencies, have been addressed.

Ultimately, an effective disaster preparedness plan is a practical, executable playbook. For underwriters and brokers, reviewing this document offers a clear assessment of a client's operational maturity and risk posture, providing tangible evidence of their commitment to protecting people, assets, and continuity.

Executing a Crisis Communication Strategy

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/dd860c77YKk" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

In a disaster, information becomes as critical a resource as power or water. A well-executed crisis communication plan projects control, builds confidence, and protects brand reputation during periods of high vulnerability. For risk managers and insurance professionals, a client's communication strategy under pressure is a direct indicator of their overall resilience.

Failure to control the narrative allows misinformation to dictate public perception, which can inflict more lasting damage than the initial event. A proactive communication plan enables an organization to lead with clear, consistent, and empathetic messaging, which is the foundation of effective crisis management.

Establishing Robust Notification Systems

The first priority in any incident is to reach key stakeholders. Relying on a single channel like email is inadequate, as it can be compromised during a power outage or network failure. A multi-layered emergency notification system (ENS) is essential to ensure critical alerts are received.

This system should function as a communication web, pushing messages across multiple platforms simultaneously for maximum speed and reach.

- Mass Text Messaging: SMS is often the fastest and most reliable channel for immediate, high-priority alerts like evacuation orders.

- Automated Phone Calls: Pre-recorded voice messages can deliver detailed instructions to employee landlines and mobile phones.

- Company Intranet and Mobile Apps: These platforms serve as centralized hubs for detailed updates, safety protocols, and key documents.

- Designated Phone Hotlines: A dedicated, pre-recorded information line provides a central point of contact for stakeholders seeking updates, freeing up internal staff.

This built-in redundancy ensures that no single point of failure can sever communication lines during a crisis.

Developing Pre-Approved Message Templates

During a crisis, there is no time to draft press releases or debate wording. Pre-approved message templates for various scenarios provide a significant tactical advantage. These templates should be written, vetted by legal and leadership teams, and stored for immediate deployment.

Your communication strategy should operate with the precision of a fire drill. Pre-scripted messages for employees, customers, suppliers, and investors allow your team to focus on executing the response, not on crafting the perfect sentence under duress.

Develop specific templates for each key audience:

- For Employees: Messages must prioritize safety. Provide clear instructions (e.g., "Do not report to the office until further notice") and information regarding work status and compensation.

- For Customers: Communications should be empathetic and transparent about service disruptions, providing realistic timelines for restoration.

- For Suppliers and Partners: Updates should address impacts on logistics, orders, and payments to maintain supply chain integrity.

Creating a Single Source of Truth

To counter rumors and maintain control of the narrative, establish a single source of truth—one official, public channel where all stakeholders can find verified information. This centralized hub prevents conflicting messages from different departments and builds credibility.

Common choices include a dedicated status page on the company website (e.g., status.yourcompany.com) or a frequently updated social media account. This practice is a non-negotiable component of managing public perception and coordinating an effective response.

By combining a centralized information source with a robust notification system and pre-approved messaging, an organization creates a powerful communication framework. This allows it to speak with a single, authoritative voice, turning a moment of chaos into a demonstration of stability and leadership.

How to Train Your Team and Test Your Plan

Image

A disaster plan is a theoretical document until it is tested. For underwriters and risk managers, a tested plan demonstrates a company has moved from paper-based preparedness to a practiced, real-world response capability.

The objective of training is to build organizational muscle memory. During a crisis, personnel must know their roles instinctively without consulting a manual. Regular training and drills transform a static document into a living playbook, ensuring the team is prepared to execute under extreme pressure.

This shift toward proactive readiness is a global trend. The market for disaster preparedness systems, valued at approximately $201.83 billion, is projected to reach $220.17 billion, growing at a CAGR of 9.1%. This growth reflects the increasing demand for effective response tools. For more details, see this market insights report.

Designing Effective Training Exercises

Effective training programs use a layered approach to test all aspects of the plan, from high-level executive decision-making to frontline execution.

This progressive methodology includes:

- Seminars and Workshops: Foundational sessions to introduce the plan to new employees or update the crisis team on major revisions.

- Tabletop Exercises: A facilitator presents a simulated crisis (e.g., wildfire, supplier failure, ransomware attack) to the team, who then talk through their response. This is a low-stress method to validate roles and decision-making processes.

- Functional Drills: Hands-on tests of specific plan components. Examples include testing IT's ability to restore data from backups or the communications team's deployment of the emergency notification system.

- Full-Scale Simulations: The most comprehensive test, designed to mimic a real disaster. It involves deploying personnel and equipment, activating multiple plan components simultaneously, and often coordinating with external first responders.

Conducting Engaging and Productive Drills

To be effective, drills must be realistic enough to force genuine problem-solving. A generic scenario like "a hurricane is coming" is insufficient. A more specific scenario—"A Category 3 hurricane is 48 hours from landfall, directly threatening our main distribution center and two key suppliers"—creates a concrete problem to solve.

The purpose of a drill is not to achieve a perfect score, but to identify weaknesses in the plan. Every failure discovered in a simulation is an opportunity to strengthen the response before a real disaster occurs.

Inject realism and set clear goals. For a wildfire drill, simulate an internet outage to test backup communication systems. The ability to access resources from agencies like Cal/OSHA or Ready.gov under pressure is critical, and drills can validate whether a team knows how to utilize these external assets.

From Feedback to Refinement

The most critical learning occurs during the after-action review. Immediately following the exercise, all participants should convene for a no-blame debrief.

This meeting should answer three key questions:

- What was supposed to happen according to the plan?

- What *actually* happened during the drill?

- What caused the deviation, and what corrective actions are required?

The outcome should be a formal After-Action Report (AAR) that documents successes, identifies gaps, and assigns corrective actions with firm deadlines. This continuous cycle—Plan, Drill, Review, Refine—is the foundation of organizational resilience and ensures the disaster preparedness for businesses strategy evolves to become more effective over time.

Using Technology to Improve Business Resilience

Technology has fundamentally transformed business resilience, shifting the focus from static recovery plans to proactive, data-driven defense systems. For risk managers and insurance professionals, a client's technology stack is a key indicator of their operational maturity and commitment to managing downtime. Strategic technology investments are not merely an expense; they are a demonstrable commitment to protecting assets and ensuring continuity.

The objective has moved from simple recovery to intelligent defense. Technology provides the central nervous system for this defense, enabling faster communication, secure remote data access, and real-time threat monitoring. This delivers a clear ROI by reducing disruption costs and generating better data for underwriting and risk pricing.

Integrating Real-Time Monitoring and Intelligence

True resilience requires looking beyond an organization's immediate environment to anticipate threats. Risk intelligence platforms and the Internet of Things (IoT) provide a significant advantage by enabling active defense.

These systems continuously scan for potential disruptions:

- Risk Intelligence Platforms: These digital watchtowers analyze vast datasets—from weather forecasts and social media to supply chain alerts—to identify emerging threats. An underwriter can use this to assess how a regional flood might impact a client’s critical suppliers before operations are affected.

- IoT Sensors: These digital sensors monitor critical equipment for changes in temperature, vibration, or moisture. An anomaly can trigger an alert, enabling preemptive maintenance before a catastrophic failure occurs.

This technology shifts the paradigm from post-event cleanup to pre-event mitigation, a more cost-effective approach to disaster preparedness for businesses.

The goal is to create a digital early-warning system. By integrating real-time data, you can move from asking "What happened?" to "What's about to happen?"—a critical advantage in any crisis.

Fortifying IT Continuity with Cloud Solutions

For most modern businesses, data is the most critical asset. While a physical disaster can destroy servers, the permanent loss of customer records, financial data, and intellectual property is often the most devastating blow. The downtime required to rebuild from scratch can be fatal to a business.

Cloud solutions provide the ultimate defense against data loss. By moving critical data and applications off-site, organizations create a digital fortress that remains accessible even if physical offices are compromised.

Key cloud-based solutions include:

- Data Backup and Recovery: Cloud services automatically and continuously save data to secure, remote servers. In the event of a disaster, data restoration is reduced from weeks or months to a matter of hours.

- IT Infrastructure as a Service (IaaS): IaaS allows for the replication of an entire IT environment—servers, networks, applications—in the cloud. If the primary data center fails, operations can be "failed over" to the cloud copy with minimal disruption.

Improving Response with AI and Notification Systems

In a crisis, speed and clarity are paramount. Artificial Intelligence (AI) and modern Emergency Notification Systems (ENS) are mission-critical tools for accelerating response and ensuring effective communication.

AI-powered analytics can process complex risk models in seconds, identifying hidden correlations a human analyst might miss. For example, AI can overlay storm-track data with a supply chain map to predict which facilities will be impacted and when, enabling highly targeted warnings.

An ENS delivers these warnings through multiple channels—SMS, email, automated voice calls, and app notifications—to ensure the message is received even if some communication lines are down. This combination of intelligent analysis and robust communication is the foundation of a truly resilient organization.

Answering Your Top Questions

Even with a comprehensive plan, key questions arise during implementation. Addressing these points is crucial for transforming a theoretical plan into a functional one that works under pressure.

Here are answers to the most common questions from risk managers, brokers, and business leaders.

How Often Should We Review Our Disaster Preparedness Plan?

A disaster preparedness plan is a living document and should undergo a full-scale review at least annually.

However, immediate updates are required under specific circumstances:

- After any drill or real-world incident: Lessons learned from after-action reports should be used to address identified weaknesses.

- Following significant operational changes: Events like opening a new facility, launching a major product line, or acquiring a competitor introduce new risks that the plan must address.

- After changes in key personnel: If a member of the Crisis Management Team leaves, their responsibilities must be immediately reassigned.

- As new threats emerge: The risk landscape is dynamic. New cyber threats, evolving climate patterns, or regulatory changes can render parts of a plan obsolete.

What Is the Difference Between Business Continuity and Disaster Preparedness?

These terms are often used interchangeably but refer to two distinct and equally critical phases of crisis management.

The distinction is vital for a comprehensive risk strategy.

Disaster preparedness encompasses the immediate, tactical actions taken during and directly after an event to protect people and assets. This includes evacuations, first aid, and emergency alerts.

>

Business continuity is the strategic plan to restore critical business operations after the initial crisis has passed. It focuses on ensuring the long-term survival of the organization.

In short, disaster preparedness ensures you get through the event; business continuity ensures you have a viable business afterward.

How Do We Get Executive Buy-In for a Preparedness Program?

Securing executive buy-in requires framing preparedness not as an operational cost, but as a strategic investment that protects the bottom line and provides a competitive advantage.

The key is to communicate in the language of financial risk.

Use data from your Business Impact Analysis (BIA) to quantify the cost of disruption. Instead of referring to "downtime," present the specific dollar figure lost for every hour a key system is offline. Connect the program directly to high-level priorities such as protecting shareholder value, maintaining brand reputation, and ensuring revenue stability. When presented as a data-driven strategy to mitigate quantifiable financial losses, the conversation shifts from cost to return on investment.

---

At Sentinel Shield, we turn climate crises into tangible business opportunities. Our platform delivers real-time, geo-targeted leads of businesses impacted by disasters, allowing you to connect with high-intent prospects at their moment of greatest need. Discover how to transform your outreach strategy by visiting us today.