In an era defined by volatility—from extreme weather events and geopolitical shifts to supply chain disruptions—proactive risk management is a core operational necessity. For decision-makers in the commercial insurance and climate risk sectors, the challenge is twofold: safeguarding their own organizations while providing clients with credible, forward-looking guidance. Generic advice falls short when faced with systemic threats.

This article delivers a detailed analysis of eight high-impact business resilience strategies. Each strategy is broken down into actionable components and practical implementation steps tailored for underwriters, brokers, and risk managers. We will explore how to build a robust operational framework that not only withstands crises but also identifies opportunities within them, ensuring long-term stability and growth. The focus is on practical application, enabling you to translate these concepts into tangible value for your organization and your clients.

1. Diversification Strategy

A diversification strategy is a foundational component of business resilience, designed to mitigate risk by intentionally spreading operations and revenue sources. Instead of relying on a single product, market, or geographic location, a diversified business builds a portfolio that creates a crucial buffer, ensuring a disruption in one area does not cripple the entire organization.

For risk managers and insurance underwriters, a company's diversification level is a key indicator of its operational stability. A well-diversified enterprise is inherently less vulnerable to localized climate events, regional economic downturns, or sector-specific regulatory shifts. Amazon's evolution from an online bookseller to a global leader in e-commerce, cloud computing (AWS), and digital streaming demonstrates this principle. When retail sales fluctuate, the consistent performance of AWS stabilizes overall revenue, showcasing a resilient and adaptable business model.

Implementing a Diversification Plan

Successful diversification is a structured, strategic process, not a random expansion. It requires a data-driven approach to identify and capitalize on new market opportunities without compromising core operations.

- Conduct Thorough Market Research: Before entering new markets or launching new products, analyze demand, competition, and regulatory hurdles. This data-driven approach minimizes risk and maximizes the potential for success.

- Balance Risk and Growth: Assess your organization's risk tolerance. Begin with related diversification (e.g., a commercial property insurer expanding into business interruption insurance) before considering unrelated ventures.

- Maintain Core Competencies: Ensure that expansion efforts do not dilute the quality or focus of your primary business. New ventures should complement, not compromise, core strengths.

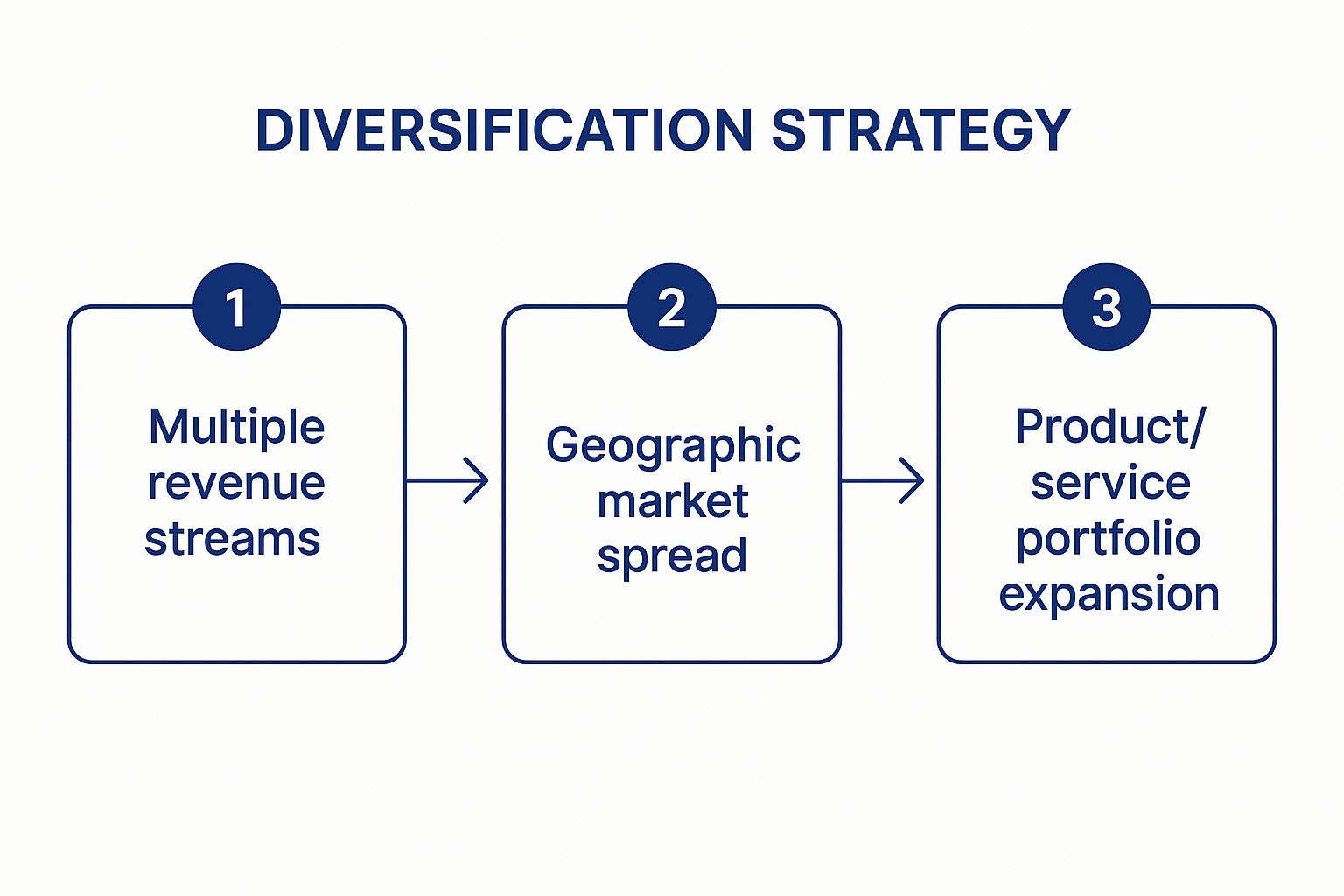

The following infographic illustrates a three-step workflow for implementing a diversification strategy, providing a visual roadmap for building a more resilient enterprise.

Infographic showing a three-step process for implementing a diversification strategy, including creating multiple revenue streams, expanding geographic markets, and broadening the product/service portfolio.

This process flow highlights how building multiple revenue streams, spreading across geographic markets, and expanding the service portfolio work in concert to create a robust and stable operational framework.

2. Business Continuity Planning (BCP)

Business Continuity Planning (BCP) is a proactive framework for ensuring an organization can maintain essential functions during and after a crisis. It moves beyond simple disaster recovery by establishing comprehensive policies and procedures to manage potential threats, from cyber-attacks to natural disasters. This holistic approach is one of the most critical business resilience strategies, as it maps out operational continuity before a disruption occurs.

For insurance underwriters and risk managers, a robust BCP is a clear indicator of a company’s proactive risk management posture. It demonstrates foresight and preparedness, often translating to lower perceived risk and more favorable policy terms. A well-documented BCP shows that an organization has identified its vulnerabilities and has a tested plan to protect its people, assets, and operations. After the 9/11 attacks, JPMorgan Chase activated its BCP, relocating critical operations to backup sites and resuming business within days—a testament to the power of meticulous planning.

Implementing a Business Continuity Plan

An effective BCP is a dynamic strategy, not a static document. It requires cross-departmental collaboration and a commitment to regular testing and refinement. A Business Continuity Plan Form Template can provide a structured starting point.

- Involve All Departments: Ensure every department, from IT to HR and operations, contributes to the plan. This creates a comprehensive strategy that accounts for all critical business functions and dependencies.

- Test Plans Regularly: Conduct simulations and drills, such as tabletop exercises or full-scale failover tests, to identify gaps and ensure employees understand their roles during a crisis.

- Maintain Updated Communication Channels: Keep contact lists, emergency notification systems, and stakeholder communication protocols current. Clear, reliable communication is vital during a disruptive event.

- Document and Distribute: Maintain detailed documentation of all processes and store copies in multiple secure, accessible locations, including both physical and cloud-based repositories.

This video from the Disaster Recovery Institute International (DRI) provides further insight into the core principles of business continuity and resilience.

<iframe width="560" height="315" src="https://www.youtube.com/embed/qKFPa1Ce9U4" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

By systematically preparing for disruptions, organizations can significantly reduce downtime, financial losses, and reputational damage. To further strengthen your framework, explore the specifics of creating an effective business disaster recovery plan.

3. Agile Organizational Structure

An agile organizational structure moves companies from rigid, top-down hierarchies toward a more flexible and adaptive framework. This approach, a key component of modern business resilience strategies, emphasizes rapid response, cross-functional collaboration, and iterative decision-making. By breaking down silos and empowering small, autonomous teams, businesses can pivot quickly in response to market volatility and unforeseen disruptions.

For risk managers and insurance underwriters, an agile structure signals a company’s inherent capacity to manage uncertainty. These organizations are better equipped to handle sudden operational challenges, from supply chain breaks to climate-related events, because their teams are empowered to solve problems without bureaucratic delays. Spotify’s "squad" model, for example, allows small, self-organizing teams to own features from end to end, fostering innovation and rapid adaptation that traditional structures cannot match.

Agile Organizational Structure

Implementing an Agile Structure

Transitioning to an agile model is a cultural and operational transformation that requires deliberate planning. It is not about abandoning structure but redesigning it for speed and flexibility.

- Start with Pilot Programs: Before a full-scale overhaul, test agile principles with a few cross-functional pilot teams. Use these small-scale experiments to learn and refine the approach for your specific business context.

- Invest in Collaboration Tools: Equip teams with the digital tools required for seamless communication, project management, and information sharing in a decentralized workforce.

- Train Agile Leaders: Shift leadership roles from command-and-control to coaching and enabling. Leaders must foster an environment of psychological safety where teams feel secure enough to experiment and learn from failure.

- Establish Clear Goals: While methods can be flexible, strategic objectives must be clear and well-communicated. Autonomous teams thrive when they have a defined "north star" to guide their independent decisions. To refine workflows within an agile structure, consider implementing proven business process improvement methods.

4. Supply Chain Resilience

Supply chain resilience is a business's capacity to prepare for, withstand, and recover from disruptions. This critical business resilience strategy involves building redundancy, flexibility, and visibility across every link in the supply chain. A resilient supply chain is a strategic asset that protects revenue and market position against unforeseen events, not merely a cost-efficiency measure.

An illustration depicting a resilient supply chain with multiple transportation routes and diverse supplier locations, highlighting global connectivity and risk mitigation.

For risk managers and insurance underwriters, the robustness of a company's supply chain is a direct indicator of its overall risk profile. A business with a single-source supplier in a high-risk climate zone presents a far greater liability than one with a diversified and transparent network. Apple’s multi-sourcing strategy for key components is a prime example, allowing it to navigate geopolitical tensions and natural disasters by shifting production between suppliers in different countries. This resilience is also vital for temperature-sensitive goods, where a cold chain power loss can lead to catastrophic financial losses.

Implementing a Resilient Supply Chain

Building a resilient supply chain is an ongoing, proactive process that requires a holistic view of potential threats and a commitment to agility.

- Map the Entire Supply Chain: Gain deep visibility by mapping not just primary (Tier 1) suppliers, but also their key sub-suppliers (Tier 2 and 3). This process identifies hidden dependencies and single points of failure.

- Develop Backup Supplier Relationships: Cultivate relationships with alternate suppliers in different geographic regions. These should be pre-vetted and ready to activate, not just names on a list.

- Invest in Visibility Technology: Utilize IoT, AI, and blockchain to monitor inventory, shipments, and supplier performance in real-time. This data allows for rapid response to delays or disruptions.

- Regularly Stress-Test Scenarios: Conduct simulations of potential disruptions, such as a major port closure, a supplier bankruptcy, or a sudden demand surge, to test your response plans and identify weaknesses.

For a deeper dive into specific methodologies, consider these Top Supply Chain Resilience Strategies to Strengthen Your Business.

5. Financial Risk Management

Financial risk management is a core pillar of business resilience, providing a systematic framework to identify, assess, and mitigate financial threats. This discipline involves proactively managing cash flow, credit exposure, and market volatility to protect an organization's profitability and long-term viability. Resilient businesses establish robust controls and reserves to weather economic shocks rather than reacting to them.

For risk managers and insurance underwriters, a company's financial management practices are a direct measure of its stability. An organization with strong liquidity, managed debt, and a clear hedging strategy is better positioned to handle operational disruptions, from supply chain breaks to sudden market downturns. For instance, Southwest Airlines' long-standing fuel hedging strategy has historically protected it from volatile oil prices, allowing for more predictable operational costs and a significant competitive advantage.

Implementing a Financial Risk Management Plan

Effective financial risk management is a strategic function requiring continuous monitoring and adjustment. Building financial resilience involves a multi-faceted and disciplined approach.

- Establish Adequate Financial Reserves: Maintain liquid reserves equivalent to at least six to twelve months of operating expenses. This cash buffer provides critical support during unforeseen events without forcing reliance on costly debt.

- Implement Robust Credit and A/R Management: Develop strict credit policies for customers and actively manage accounts receivable. A clear collections process minimizes the risk of bad debt and ensures consistent cash flow.

- Utilize Hedging Instruments Strategically: For businesses exposed to commodity price or currency fluctuations, use financial instruments like futures, forwards, or options to hedge against adverse market movements.

- Conduct Regular Stress Testing: Simulate various negative financial scenarios, such as a major client loss, a rapid interest rate hike, or a recession, to test the strength of the balance sheet and identify vulnerabilities before they materialize.

A key part of this strategy involves using advanced analytics to foresee potential financial impacts from events like climate-related disasters. Proactive assessment of these specific threats ensures your organization is prepared for both economic and environmental volatility.

6. Digital Transformation and Technology Resilience

Digital transformation is the integration of technology into every facet of an organization, fundamentally changing how it operates and delivers value. As a business resilience strategy, it builds the capacity to adapt to market shifts and recover from technological disruptions. This includes leveraging cloud computing, automation, data analytics, and robust cybersecurity measures to ensure operational continuity.

For risk managers and insurance underwriters, a company's investment in technology resilience is a direct indicator of its preparedness for threats ranging from cyberattacks to operational failures. A digitally mature organization leverages data for better decision-making, automates core processes to reduce human error, and uses cloud infrastructure for scalable and remote operations. Microsoft’s shift from a software-first to a cloud-first model exemplifies how embracing digital change builds a more adaptive and durable enterprise capable of withstanding significant market pressures.

Implementing a Digital Transformation Plan

Successful digital transformation requires a clear vision and a structured, phased approach. The goal is to build technological capabilities that enhance efficiency and create a strong foundation for resilience.

- Start with Pilot Programs: Test new technologies and processes in controlled environments. These pilot programs allow you to gather data and refine your approach before a full-scale rollout, minimizing risk and maximizing ROI.

- Invest in Employee Training: Technology is only as effective as the people using it. Prioritize comprehensive training and change management to ensure your team has the skills and buy-in needed to adopt new systems.

- Prioritize Cybersecurity from the Start: Embed security protocols into every stage of your digital transformation. A proactive, security-by-design approach is far more effective than adding protections after the fact.

- Leverage Real-Time Data: Harnessing real-time data analytics is key to anticipating disruptions and making informed, proactive decisions. Explore how you can use real-time data analytics to fortify your business to enhance your strategic planning.

7. Crisis Communication Strategy

A crisis communication strategy is a structured framework for managing information during a disruptive event. This essential business resilience strategy is a proactive plan designed to protect an organization's reputation and maintain stakeholder trust. By establishing clear protocols, businesses can ensure the timely, accurate, and consistent flow of information to employees, customers, investors, and the public.

For risk managers and insurance underwriters, a well-defined crisis communication plan signals proactive risk management and operational stability. A business prepared to communicate effectively during a crisis is better positioned to mitigate reputational damage, manage liability, and maintain operational control. Johnson & Johnson's textbook response to the 1982 Tylenol crisis—prioritizing public safety through transparent communication and a swift product recall—remains a prime example of how effective crisis management preserves long-term brand equity.

Implementing a Crisis Communication Plan

Developing a robust crisis communication plan is a strategic imperative that requires foresight and detailed preparation. It is not about reacting to events but controlling the narrative and guiding the organization through turmoil.

- Prepare Key Messages and Designate Spokespersons: Develop pre-approved messaging for various potential scenarios, from climate-related disruptions to data breaches. Designate and train specific individuals to be the official voice of the company to ensure consistency.

- Establish Monitoring and Response Protocols: Actively monitor social media, news outlets, and other channels to understand public sentiment and address misinformation quickly. Define clear procedures for when and how to respond.

- Prioritize Transparency and Accountability: In most situations, transparency is critical. Acknowledge the issue, take responsibility where appropriate, and clearly outline the steps being taken to resolve the situation and prevent recurrence.

A structured approach ensures communication remains a stabilizing force during a crisis. For additional frameworks, review these crisis communication best practices.

8. Scenario Planning and Strategic Foresight

Scenario planning and strategic foresight are advanced business resilience strategies that move beyond simple forecasting. This method involves developing multiple plausible future scenarios to prepare for a range of potential outcomes. This process enables organizations to anticipate challenges, identify opportunities, and build adaptable strategies that can withstand significant disruption.

For risk managers and insurance underwriters, a client’s use of scenario planning is a strong indicator of strategic maturity. An organization that actively stress-tests its strategies against diverse futures—from severe climate events to sudden geopolitical shifts—is better prepared to navigate volatility. Shell's long-standing use of scenario planning, which allowed it to anticipate shifts in the global energy landscape decades in advance, is a prime example. This foresight informed long-term capital investments and fortified its position against market shocks.

Implementing a Scenario Planning Process

Effective scenario planning is a disciplined, creative exercise that challenges assumptions and broadens strategic thinking. It requires a structured approach to explore and prepare for what might lie ahead.

- Involve Diverse Perspectives: Assemble a team from various departments (operations, finance, marketing, R&D) to ensure a holistic view. This diversity prevents groupthink and uncovers a wider range of potential risks and drivers of change.

- Focus on Plausible, Not Just Probable: Develop a set of distinct, plausible future scenarios that explore high-impact, high-uncertainty variables. The goal is not to predict the future but to prepare for multiple versions of it.

- Link Scenarios to Strategic Actions: For each scenario, identify key indicators or "signposts" to monitor. Develop specific trigger points and corresponding strategic actions, ensuring the organization can pivot quickly and decisively when a scenario begins to unfold.

This proactive approach transforms strategic planning from a static annual exercise into a dynamic, ongoing dialogue about the future. By institutionalizing strategic foresight, businesses can build robust plans that are resilient by design.

Business Resilience Strategies Comparison

| Strategy/Approach | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Diversification Strategy | High: multi-area coordination | High: capital and management | Stable cash flow, multiple growth paths | Companies seeking risk reduction and growth | Risk mitigation, market expansion, stability |

| Business Continuity Planning (BCP) | High: detailed plans & updates | High: time, personnel, testing | Minimized downtime, maintained operations | Organizations needing crisis readiness | Rapid recovery, regulatory compliance |

| Agile Organizational Structure | Medium-High: cultural shift | Medium: training, tools | Faster market response, innovation | Fast-changing industries, creative sectors | Flexibility, faster decisions, engagement |

| Supply Chain Resilience | High: supplier coordination | High: tech & operational costs | Continuous production, faster disruption recovery | Manufacturing, retail with complex supply chains | Reduced disruption risk, competitive edge |

| Financial Risk Management | Medium: ongoing monitoring | Medium-High: financial expertise | Financial stability, liquidity security | Finance-sensitive businesses | Loss prevention, creditworthiness, stability |

| Digital Transformation & Tech Resilience | High: tech integration & training | High: technology & change mgmt. | Improved efficiency, new revenue streams | Businesses undergoing modernization | Operational agility, data-driven decisions |

| Crisis Communication Strategy | Medium: planning & training | Medium: team & tools | Maintained trust, reduced reputational damage | Organizations facing public-facing risks | Consistent messaging, brand protection |

| Scenario Planning & Strategic Foresight | High: extensive analysis & expertise | Medium-High: specialized skills | Better decision-making, risk anticipation | Long-term strategic planning | Preparedness, adaptive capacity |

From Strategy to Action: Building a Resilient Future

The journey from vulnerability to resilience is built on a series of deliberate, integrated steps. The business resilience strategies in this article—from diversifying operations to embracing digital transformation—are not isolated tactics. They are essential components of a robust, adaptive organizational framework designed to withstand and even thrive amidst accelerating climate and operational disruptions.

For decision-makers in commercial insurance, resilience has become a core competitive advantage. The ability to pivot with an agile structure, maintain continuity through a robust BCP, and communicate effectively during a crisis are hallmarks of a modern, future-proofed enterprise. These strategies protect assets and ensure operational stability, making an organization a more attractive and insurable risk.

Key Takeaways for Proactive Risk Management

The common thread through each strategy is the necessity of proactive, data-driven decision-making. A plan's value lies in a continuous cycle of planning, testing, and adapting.

- Integration is Paramount: True resilience arises when financial risk management, supply chain visibility, and crisis communication work in concert, not in silos.

- Foresight as a Tool: Scenario planning and strategic foresight are practical tools for anticipating future shocks and preparing decisive, pre-emptive actions.

- Resilience as a Growth Driver: An organization that effectively manages risk is better positioned to seize opportunities, attract investment, and build lasting trust with stakeholders and clients.

Ultimately, implementing these business resilience strategies is an ongoing commitment to organizational adaptability. For insurance underwriters and brokers, guiding clients on this path is a critical service. However, providing that guidance effectively depends on having the right intelligence at the right moment. Knowing which businesses are impacted by a climate event as it happens transforms your role from a reactive service provider to a proactive, indispensable partner. Integrating robust internal strategies with powerful external intelligence is the definitive step toward building a truly resilient future for both your organization and the clients you serve.

Ready to turn climate disruption into a strategic advantage for your firm? Discover how Insurtech.bpcorp.eu provides real-time alerts on businesses impacted by climate events, enabling you to connect with high-intent clients at their moment of greatest need. Visit Insurtech.bpcorp.eu to see how our platform transforms risk intelligence into tangible business growth.