Outsourcing lead generation is a strategic decision to integrate a specialized engine built to find and qualify potential customers. This frees up your in-house sales team to focus on closing high-value deals while providing immediate access to expertise and technology that would be costly and time-consuming to build internally.

Why Outsourcing Lead Generation Is a Strategic Imperative

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/G-AK_X6gdSc" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

In complex sectors like commercial insurance and climate risk, the sales cycle is long and requires numerous touchpoints. Sales teams are stretched thin, managing client relationships while navigating a rapidly changing market. In this environment, outsourcing lead generation is no longer an option but a strategic necessity.

This is not about offloading tasks; it is about gaining immediate access to seasoned experts, advanced technology stacks, and scalable teams. When you engage a partner, you are investing in specialized lead generation services designed to systematically fill your sales pipeline.

Gain a Competitive Edge

A key advantage of outsourcing is leveraging a partner's deep industry knowledge. An agency specializing in the commercial insurance sector understands the specific pain points of risk managers, underwriters, and brokers. They speak the industry language, comprehend the regulatory challenges, and know how to position your solutions for maximum impact.

This focused expertise translates into higher-quality conversations and better-qualified opportunities for your sales team. It eliminates the significant learning curve an internal team would face when entering a new market or targeting a niche client vertical.

The primary value of outsourcing is not cost reduction. It is the integration of a dedicated growth engine, continuously optimized by specialists, which allows your core team to focus exclusively on revenue-generating activities.

Adapt to Modern Buyer Behavior

The modern buyer's journey has become increasingly complex. It now takes an average of six touchpoints before a prospect is ready to engage with sales, placing immense pressure on teams to manage this intricate process. With 50% of marketers identifying lead generation as their top challenge, the competition for client attention is intense.

An outsourced partner is structured for this reality. They possess the systems to deploy multi-channel campaigns and nurture prospects over the long term, ensuring your brand maintains top-of-mind awareness. This consistent, professional engagement means that when a potential client is ready to make a purchasing decision, your organization is their first call.

For decision-makers in the Insurtech space, we have developed a detailed playbook on generating high-quality insurance leads that provides actionable strategies for these modern tactics.

How to Evaluate a Lead Generation Partner

Image

Selecting the right partner is the most critical decision in outsourcing lead generation. A successful partnership provides a seamless extension of your sales team, driving qualified opportunities into your pipeline. A poor choice results in wasted time and capital with minimal return.

A rigorous evaluation framework is required to move beyond sales pitches and assess a partner's true capabilities. The initial conversation must go beyond vague promises of "high-quality leads" and delve into their specific experience within the commercial insurance and climate risk sectors. A generalist B2B agency lacks the nuanced understanding required to effectively engage risk managers, underwriters, or senior brokers.

Assess Their Industry Expertise and Niche Focus

Begin by requesting case studies and, more importantly, references from companies with a similar profile to your own. Do not settle for a marketing PDF; ask targeted questions about the specific business problems they solved.

For example, how did they adapt outreach strategies to connect with brokers specializing in high-risk coastal properties versus those focused on agricultural clients? The depth and clarity of their answers will reveal their level of expertise.

A partner with genuine industry knowledge will discuss specific compliance hurdles, common client objections, and the unique buying signals relevant to the insurance market. This level of understanding is a non-negotiable requirement.

A true strategic partner delivers market intelligence, not just leads. They should be able to provide data on which messaging is currently resonating with your ideal customer profile and explain the underlying reasons.

Your partner must be fluent in your industry's language. If they cannot hold a substantive conversation about loss ratios, parametric insurance, or specific endorsements, they are not qualified to represent your brand.

Scrutinize Their Technology and Data Practices

A sophisticated technology stack is a key differentiator. A potential partner must be transparent about the tools they use for prospect identification, data enrichment, and CRM integration. You are not just procuring a service; you are investing in their entire operational infrastructure.

Key areas for due diligence include:

- Data Sources: What is the origin of their contact lists? How frequently is the data cleansed and verified? Inaccurate data is the fastest way to deplete your budget.

- Qualification Process: Require a precise, documented definition of a "qualified lead." Ask them to walk you through their qualification process for a hypothetical prospect, from initial contact to final handoff.

- Compliance: How do they ensure adherence to data privacy regulations such as GDPR and CCPA? This is a critical point of compliance and risk management.

Their approach to technology and data hygiene distinguishes a professional operation from a simple list broker. For a closer look at how these principles apply directly to insurance, check out our guide on proven https://insurtech.bpcorp.eu/blog/insurance-lead-generation-1754899945356 for more context.

Evaluate Their Team and Reporting Transparency

Finally, evaluate the people and the process. Move beyond the sales representative and insist on speaking with the account manager or strategist who will directly manage your campaign. Their experience and communication style are critical to the partnership's success.

Demand absolute clarity on reporting. What metrics do they track, and what is the reporting frequency? A credible partner will provide a dashboard with real-time access to key performance indicators (KPIs), not just a monthly summary report.

For a broader overview of this decision-making process, this comprehensive guide to outsourcing lead generation offers valuable insights. By building an evaluation scorecard around these three pillars—expertise, technology, and transparency—you can make an informed, objective decision.

Analyzing the True Cost of Lead Generation

It is easy to develop tunnel vision when comparing in-house versus outsourced lead generation costs. The agency's retainer fee is often compared directly to salaries, providing an incomplete financial picture. The sticker price is merely the tip of the iceberg.

To calculate the true cost, you must account for all indirect and hidden expenses associated with maintaining an internal team.

The most obvious expense is salary, but this is only the starting point. You must add benefits, payroll taxes, recruitment fees, and the ongoing cost of training to maintain relevant skills. Then, consider the technology stack: CRM licenses, data provider subscriptions, and sales automation software all contribute to significant monthly operational expenses.

This analysis does not yet include management overhead—the time your sales leaders must dedicate to hiring, training, and managing a lead generation team instead of focusing on high-value, revenue-closing activities.

Uncovering the Hidden Financial Drains

Building an in-house team means funding the entire supporting infrastructure. This includes everything from office space and equipment to the significant cost of ramp-up time. A new team can take months to become fully productive, during which time you are incurring costs with minimal output.

A data-driven analysis tells a clear story. Establishing an in-house lead generation team typically requires 3-6 months, with monthly operational costs ranging from $20,000 to $30,000. The final cost per qualified lead often falls between $250 and $800+.

In contrast, a specialized outsourced partner can be fully operational in just 2-4 weeks. Monthly retainers typically range from $6,000 to $15,000, which can reduce the cost per lead to a more efficient $150 to $600.

Image

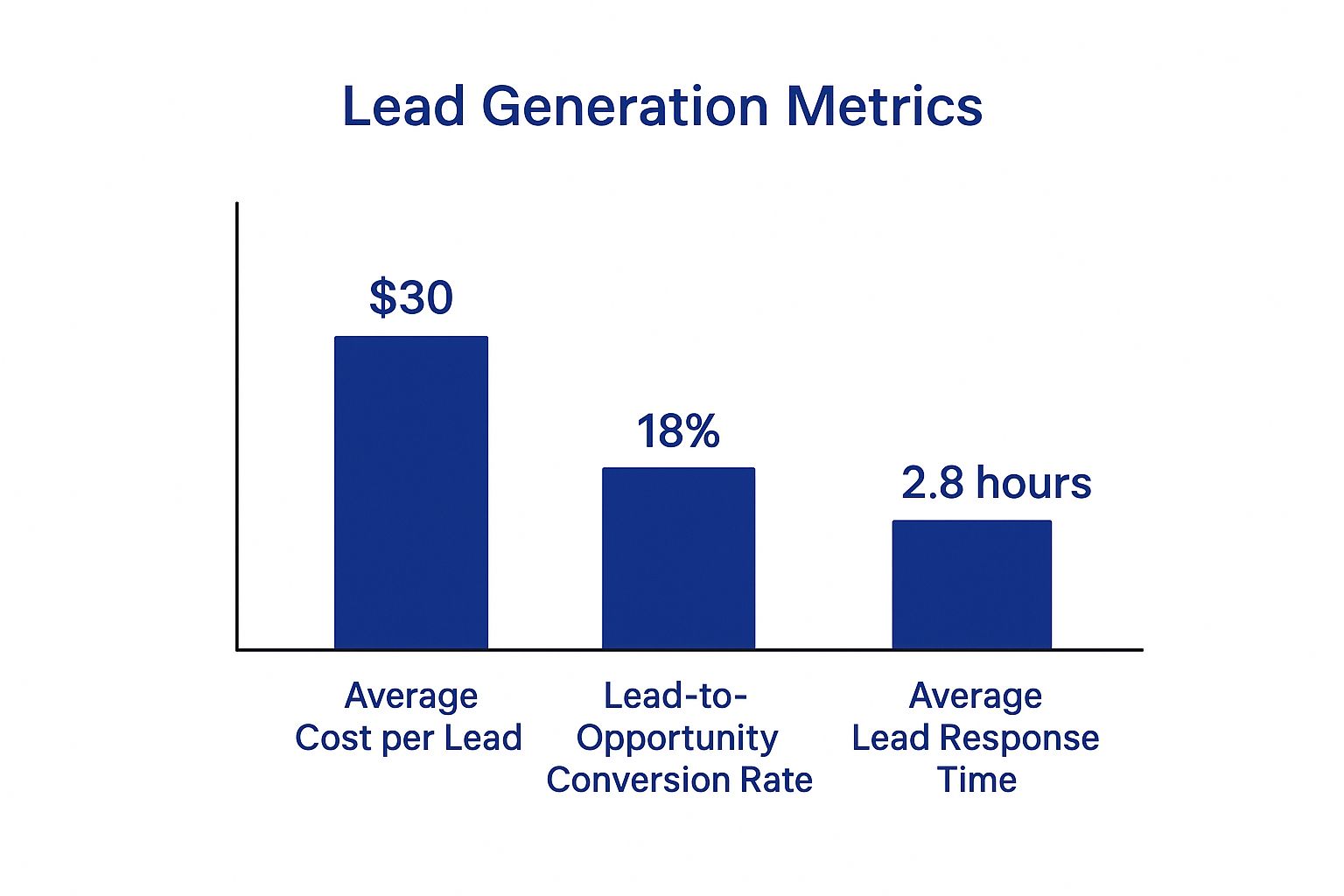

This data highlights why specialized teams consistently outperform on efficiency. They are structured to deliver a lower cost per lead and faster response times, both of which directly impact conversion rates.

In-House vs Outsourced Lead Generation Financial Breakdown

When key financial and operational metrics are laid out side-by-side, the contrast between building internally and partnering with an agency becomes even more pronounced. This table breaks down the core components for consideration.

| Metric | In-House Team | Outsourced Agency |

|---|---|---|

| Time to Full Productivity | 3-6 Months | 2-4 Weeks |

| Typical Monthly Investment | $20,000 - $30,000+ | $6,000 - $15,000 |

| Cost Per Qualified Lead | $250 - $800+ | $150 - $600 |

| Recruitment Costs | $5,000 - $15,000 per hire | $0 (included) |

| Software & Tooling Costs | $1,000 - $3,000+ monthly | $0 (included) |

| Management Overhead | High (Sales leader time) | Low (Dedicated account manager) |

| Flexibility to Scale | Low (Hiring/firing process) | High (Adjustable retainer) |

This breakdown makes it clear that the outsourced model absorbs many of the hidden costs—recruiting, software, training—that can rapidly escalate the budget of an in-house operation. This allows you to allocate resources toward closing deals rather than managing infrastructure.

Evaluating Different Pricing Models

Outsourced partners utilize several pricing structures. Understanding these models allows you to select the one that best aligns with your business objectives.

- Pay-Per-Lead: A straightforward model where you pay a predetermined price for each qualified lead delivered. This is ideal for businesses requiring a predictable, results-based method for pipeline development.

- Retainer/Subscription: A fixed monthly fee provides access to the agency's team, technology, and strategic expertise. This model is best suited for complex, long-term campaigns that require continuous optimization.

- Performance-Based: Payment is tied directly to specific outcomes, such as qualified appointments set or even closed deals. This is the lowest-risk option but typically commands a premium for each successful outcome.

The optimal model depends on your risk tolerance and sales cycle length. For many firms in the commercial insurance space, a hybrid model is most effective—a baseline retainer to secure dedicated resources, combined with performance bonuses to align all parties on achieving results.

Ultimately, the true cost of lead generation is not the monthly expenditure. It is a comprehensive equation that weighs the total investment against the speed, quality, and volume of the opportunities generated. For a closer examination of this topic, refer to our guide on effective lead generation for insurance professionals.

Integrating Your Partner for Seamless Collaboration

Image

Securing the right partner is only the first step. The success of an outsourcing initiative depends on how effectively that partner is integrated into your daily operations. A disjointed relationship creates friction and missed opportunities, whereas deep collaboration creates a unified and powerful sales engine.

The objective is to treat your outsourced team as a genuine extension of your company, not a separate vendor. This requires a deliberate onboarding process that goes beyond a kickoff call to embed them within your culture, workflows, and communication channels from day one.

Establishing the Ground Rules for Success

Before the first outreach call is made, a detailed operational playbook must be established. This is not about micromanagement; it is about creating clarity and operational efficiency. Without a clear framework, leads will inevitably fall through the cracks and accountability will be impossible to maintain.

Start with the most critical process: the lead handoff protocol. This protocol must definitively answer these questions:

- What defines a "sales-ready" lead? Specify the exact data points and qualifying criteria required before a lead is transferred to your internal team. This could include budget confirmation, a specific documented pain point, or purchase authority. Be granular.

- How will leads be delivered? Determine the single, standardized method for lead delivery, whether it's a direct push to your CRM, an email notification, or a dedicated Slack channel.

- What is the expected follow-up time? Establish a clear service-level agreement (SLA) for how quickly your team must act on a new lead (e.g., 4 hours, 24 hours). This metric is non-negotiable.

This initial alignment prevents the common friction between sales and marketing teams, ensuring all stakeholders are operating from the same set of expectations.

Creating a Unified Communication and Reporting System

Effective integration is contingent upon transparent, real-time communication. Relying on a weekly report is an outdated practice. The most effective partnerships operate within a shared digital workspace.

Establish a dedicated Slack or Teams channel for instant communication between your internal sales representatives and the outsourced team. This fosters a collaborative environment where strategic questions are answered in minutes, not days, and feedback on lead quality is shared immediately.

The most successful outsourced relationships function less like a vendor-client dynamic and more like two internal departments collaborating. Shared communication channels and transparent, real-time data are the foundation of this unity.

Alongside instant communication, a shared performance dashboard is essential. Both teams must have access to the same real-time data on KPIs such as leads generated, qualification rates, and appointments set. This transparency builds trust and enables rapid, data-driven adjustments to campaign strategy.

For a deeper analysis of these mechanics, our guide on how to generate insurance leads provides actionable frameworks.

By prioritizing deep integration from the outset, you transform a vendor agreement into a strategic partnership that consistently drives high-quality opportunities into your sales pipeline.

Measuring Performance and Maximizing Your ROI

Image

If you cannot measure your outsourced lead generation efforts, you are guessing with your budget. It is easy to become distracted by vanity metrics like call volume or email open rates. While these numbers may indicate activity, they do not measure business impact.

For decision-makers in commercial insurance and climate risk, the only metrics that matter are those that connect directly to revenue. It is imperative to be surgical with your Key Performance Indicators (KPIs) and track what truly drives business growth.

Focus on Bottom-Line KPIs

To accurately assess the performance of an outsourced partner, you must measure the entire funnel—from the first touchpoint to a closed deal. This is the only way to gain a clear understanding of lead quality and sales velocity.

Your focus should be on a few critical, revenue-centric metrics:

- Cost per Sales Qualified Lead (SQL): An SQL is an opportunity that your sales team has reviewed and accepted as viable. Calculate it by dividing the total campaign cost by the number of SQLs generated. This is your primary measure of efficiency.

- Lead-to-Close Ratio: What percentage of leads delivered by your partner convert into closed business? This is the ultimate test of lead quality. A low ratio indicates you are paying for conversations that do not progress.

- Pipeline Contribution: How much new, potential revenue did your outsourced partner add to your sales pipeline in a given period? This KPI ties their activity directly to your financial growth targets.

Tracking these KPIs establishes an objective, data-driven foundation for all performance reviews with your partner. For benchmarking purposes, a tool like this legal marketing ROI calculator can offer a solid framework for measuring returns, despite being from a different industry.

A partner committed to your success *wants* you to track these numbers. They should be as focused on your Lead-to-Close Ratio as you are, as it provides undeniable proof of their value and is the foundation of a long-term partnership.

Create a Powerful Feedback Loop

Quantitative data tells half the story. The other half comes from the qualitative insights gathered by your sales team during client interactions. These real-world conversations are a critical source of intelligence that can be used to refine targeting and improve lead quality over time.

You must establish a direct, frictionless channel for this intelligence to flow from your sales representatives back to your lead generation partner. This feedback loop is the engine of continuous improvement.

By outsourcing top-of-funnel activities, you enable your internal sales team to focus on their core competency: closing high-value deals. This model reduces burnout and increases efficiency by ensuring they engage only with pre-qualified opportunities.

Lead generation is a specialized discipline requiring expertise in outreach, nurturing, and qualification—skills that dedicated providers hone daily. The outcome is a more efficient sales pipeline and accelerated revenue growth.

By combining hard data with on-the-ground sales intelligence, you transform a vendor relationship into a dynamic growth engine. This process also serves as a powerful tool for market opportunity identification, helping you uncover emerging client needs and market trends ahead of your competitors.

Answering Your Top Questions About Outsourcing

Even with a well-defined strategy, practical and challenging questions arise before engaging a partner. For decision-makers in commercial insurance and climate risk, these concerns are significant, revolving around control, brand reputation, and long-term viability.

Let's address these critical questions directly.

How Do I Maintain Control Over My Brand's Voice?

This is a fundamental concern. Your brand is a core asset, and entrusting its representation to a third party involves risk.

The solution is not micromanagement, but deep integration. A credible partner will collaborate with you to build a comprehensive playbook that governs all outreach activities.

This playbook must include:

- Approved Messaging: Exact scripts, email templates, and value propositions that have been formally signed off on by your team.

- Ideal Customer Profile (ICP): A precise definition of who to target and, just as importantly, who to exclude from outreach.

- Brand Guidelines: Clear rules on tone, style, and language to ensure all communication is consistent with your brand identity.

View your outsourced team as a remote extension of your marketing department, operating within a framework you define. Regular call reviews and feedback sessions are mandatory for maintaining this alignment.

What Happens If the Lead Quality Is Poor?

Poor lead quality is a valid concern, but it is typically a symptom of a poorly defined "qualified lead."

This issue arises from a disconnect between marketing's definition of a lead and what the sales team considers a viable opportunity. From day one, you must establish a concrete, data-backed definition of a Sales Qualified Lead (SQL).

A true partner is incentivized by quality, not quantity. Their success and contract renewal depend on your sales team closing deals. If leads fail to convert, it is a shared problem to be solved collaboratively.

If lead quality declines, the first step is a joint data analysis. Identify where in the funnel leads are being disqualified. Is the initial targeting misaligned? Are qualification criteria being missed?

This is where the feedback loop becomes critical. The intelligence from your sales team—the specific reasons a prospect was not a good fit, the objections raised—is essential data for course correction.

Is Outsourcing a Long-Term Solution?

While outsourcing can provide a short-term solution to fill a pipeline gap, its true strategic value is realized through a long-term partnership.

An outsourced partner that grows with your business becomes an invaluable source of market intelligence. Over time, they develop a deep, institutional knowledge of your ideal customers and the nuances of the climate risk and insurance industries.

This sustained collaboration allows them to refine targeting with surgical precision, test new messaging on the front lines, and identify emerging market opportunities before they become widely known. The initial efficiency gains are valuable, but the predictable, scalable growth achieved over the long term is the ultimate objective. The relationship evolves from a simple service into a core component of your revenue engine.

---

When a climate event strikes, the window to connect with affected businesses is incredibly narrow. Insurtech.bpcorp.eu provides the real-time, hyperlocal lead generation you need to act decisively. Our Sentinel Shield platform identifies businesses impacted by disasters and delivers verified, high-intent leads directly to your CRM within 24 hours, so you can be the first to offer critical support. Learn more about turning climate crises into opportunities at https://insurtech.bpcorp.eu.