Operating vehicles for business purposes mandates commercial auto insurance—a non-negotiable legal requirement. This coverage should be viewed not as a bureaucratic hurdle, but as a foundational shield protecting your enterprise from the significant financial consequences of an accident.

These state-specific regulations are designed to prevent a single operational incident from escalating into crippling lawsuits and causing severe business interruption.

Understanding Your Core Insurance Obligations

For any risk manager, broker, or underwriter, the dialogue surrounding commercial auto insurance must begin with asset protection and strategic risk mitigation. Compliance is the baseline; survival is the objective. A single major accident involving an underinsured vehicle can trigger extensive legal battles, inflict lasting reputational damage, and halt operations.

Fundamentally, meeting these obligations ensures business continuity. When a company vehicle is involved in an incident, an adequate policy acts as a financial firewall, covering legal defense costs, medical expenses, and property repair liabilities that could otherwise deplete corporate assets.

State-by-State Regulatory Landscape

The United States lacks a single federal mandate for commercial auto insurance, resulting in a complex patchwork of state-level regulations. Each state dictates its own minimum liability limits, creating a significant compliance challenge for businesses operating across state lines.

This regulatory fragmentation is a critical operational risk. A policy that is compliant in one state may leave a business dangerously exposed and in violation of legal requirements in another.

For a comparative international perspective, this guide on UK fleet insurance requirements offers valuable insights into regulations outside the U.S.

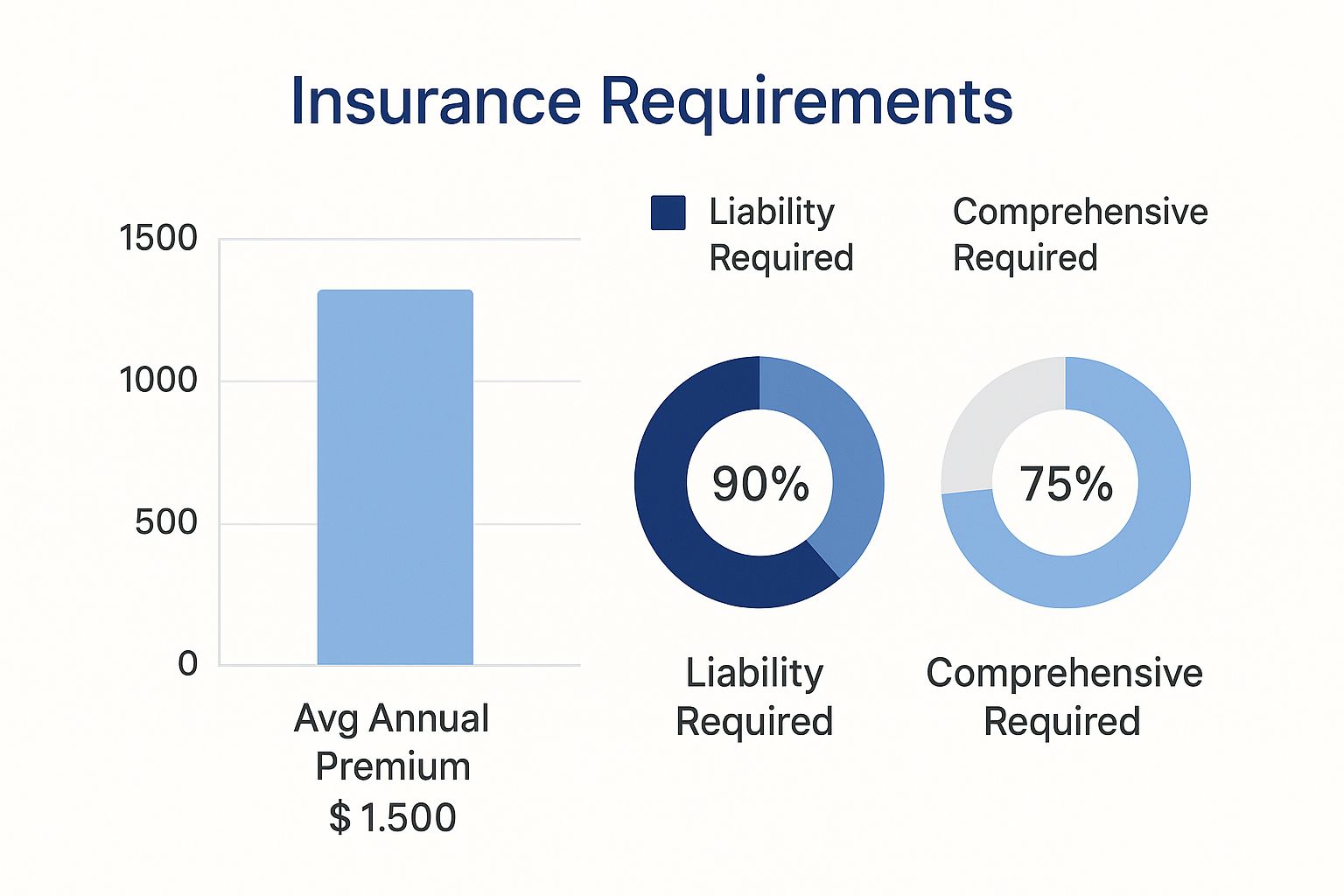

The data below illustrates how businesses typically structure their coverage to meet these requirements.

Image

While liability coverage is the universal starting point, most businesses recognize the necessity of comprehensive coverage to protect physical vehicle assets—a strategic balance between cost and risk.

To illustrate the variance in state minimums, the following table provides a snapshot of liability requirements in several key states.

State Minimum Liability Coverage Snapshot

This table highlights the differing minimum liability limits for bodily injury and property damage, demonstrating the fragmented nature of the U.S. regulatory environment.

| State | Bodily Injury Liability (Per Person) | Bodily Injury Liability (Per Accident) | Property Damage Liability (Per Accident) |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

This data confirms that what is considered compliant in Florida is grossly insufficient in Texas. For multi-state operators, navigating these discrepancies is a critical risk management function.

Why Minimums Are Just a Starting Point

Relying on state-mandated minimums is an unacceptable business risk. These bare-bones limits are rarely sufficient to cover the costs associated with a serious accident.

This is particularly true in the current legal climate, which has seen a rise in "nuclear verdicts"—jury awards in accident lawsuits that can easily exceed $10 million. State minimums offer virtually no protection against such outcomes.

A strategic approach requires an analysis of your company's specific risk profile. Evaluate your fleet size, operational territories, and cargo value. Answering these questions allows you to secure coverage limits that provide genuine financial protection, transforming insurance from a mere expense into a critical tool for corporate resilience.

Translating Policy Language into Business Protection

Image

Insurance policies are known for dense, legalistic language. For decision-makers, however, decoding this language is the key to differentiating between nominal coverage and true asset protection. It is about converting abstract terms into tangible financial safeguards.

A policy is best understood not as a single document but as a suite of specialized shields. Each coverage type is engineered to mitigate a specific financial threat following an accident. The role of an effective broker or risk manager is to assemble the optimal combination of coverages to create an impenetrable defense for the company's assets.

Core Liability Coverages: The Foundation of Your Policy

At the heart of any commercial auto policy lies liability coverage. This is the mandatory baseline required by law and the first line of defense against third-party claims.

- Bodily Injury Liability: This coverage responds when an at-fault accident involving your driver results in injury or death. It is designed to cover the third party's medical expenses, lost income, and legal fees arising from subsequent litigation.

- Property Damage Liability: This counterpart to bodily injury liability covers the cost to repair or replace third-party property damaged by your driver. This most often includes other vehicles but can extend to structures, fences, or public infrastructure.

These two coverages function in tandem. Without them, the business bears the full financial burden of these costs, which can escalate into six or seven-figure liabilities after a major incident.

For risk managers, the primary takeaway is that liability coverages shield the business from external claims. They are the first defense against lawsuits that can deplete capital that would otherwise be allocated to operations and growth.

Protecting Your Own Fleet: Physical Damage Coverage

While liability coverage addresses damages to others, it provides no protection for your own vehicles. This gap is filled by physical damage coverage, which is typically divided into two key components.

- Collision Coverage: This covers repairs to your vehicle following an impact with another object, such as a vehicle, pole, or structure, regardless of fault.

- Comprehensive Coverage: This protects against non-collision events. It covers damage from theft, vandalism, fire, weather events like hail, or animal strikes. For any business reliant on its vehicle fleet, this coverage is essential for asset preservation.

Filling Critical Gaps with Specialized Coverages

Beyond the fundamentals, specialized coverages are available to address specific, high-stakes risks that standard liability policies do not cover. Overlooking these can leave a business critically exposed.

Uninsured/Underinsured Motorist (UM/UIM) coverage is a crucial backstop. It funds your company's medical and vehicle repair costs if your driver is struck by a party with insufficient or no insurance.

Similarly, Personal Injury Protection (PIP) or Medical Payments (MedPay) coverage helps pay the medical expenses for your driver and passengers, often regardless of fault. This ensures immediate access to medical care without waiting for protracted claims investigations.

Navigating a Hardening Insurance Market

Image

Rising commercial auto premiums are an industry-wide phenomenon. The market is currently in a "hard market" cycle, characterized by stricter underwriting, reduced capacity, and increased costs for insureds.

This market shift is a direct response to a confluence of economic and legal pressures that have eroded underwriting profitability in the commercial auto sector.

For risk managers, brokers, and underwriters, understanding these market dynamics is essential. It provides the context needed to explain rising costs to executive leadership and underscores the heightened importance of robust risk management. Current conditions are the result of escalating claims costs and increasing volatility.

The Forces Driving Higher Premiums

Several concurrent factors are driving commercial auto insurance rates upward. Each contributes to an environment where the cost and frequency of claims are outpacing premium collection, compelling insurers to adjust their pricing and underwriting criteria.

- Persistent Driver Shortages: A lack of experienced, qualified drivers often leads to the hiring of less-seasoned operators, which directly correlates to a higher incidence of accidents and claims.

- Inflationary Repair Costs: Modern commercial vehicles are equipped with sophisticated sensors, cameras, and diagnostic systems. While enhancing safety, this technology makes repairs significantly more expensive, driving up physical damage claim severity.

- Supply Chain Disruptions: Delays in sourcing parts extend vehicle downtime, increasing business interruption costs and the duration of claims for rental or replacement vehicles.

In addition to these operational pressures, the legal environment has become increasingly perilous.

The most significant financial threat is the proliferation of "nuclear verdicts"—jury awards that now routinely exceed $10 million. These awards create shockwaves throughout the insurance market, forcing underwriters to price policies defensively to account for the catastrophic risk of a single major claim.

A Decade of Underwriting Pressure

This is not a new challenge. For the better part of the last decade, insurers have sustained significant underwriting losses in the commercial auto line. They have consistently paid out more in claims and expenses than they have collected in premiums.

This structural imbalance has made commercial auto one of the most volatile lines of insurance. U.S. insurers have reported underwriting losses for 12 of the last 13 years, with combined ratios frequently exceeding 100%.

Recent premium hikes, which have ranged between 9% and 9.8%, are a direct effort to restore market stability.

In response, many businesses are adopting new strategies, such as shifting to smaller vehicles or restricting routes to local areas, to manage spiraling insurance costs.

How Global Trends Impact Your Local Policy

A commercial auto insurance policy is shaped not only by state regulations and company driving records but also by powerful global market forces. The global insurance market functions as an interconnected pool of risk. A major event in one region—such as a surge in multi-million-dollar U.S. lawsuits—creates ripple effects that influence how insurers price policies worldwide.

Therefore, analyzing only internal claims history is insufficient. To fully grasp premium dynamics, decision-makers must consider these broader trends. This understanding is crucial for anticipating market shifts, justifying coverage decisions, and communicating the rationale for rising costs to leadership, even in the absence of internal losses.

The Global Ripple Effect of US Litigation

A primary driver of market hardening is the casualty insurance sector, which includes commercial auto liability. While rates in some other commercial lines have begun to moderate, casualty lines continue to experience price increases and capacity constraints. This is largely driven by the litigious environment in the United States, which significantly impacts the balance sheets of global reinsurers and carriers.

This trend highlights a critical reality: the legal climate in one major market can directly tighten the availability and increase the cost of coverage globally. When insurers' global portfolios are impacted by massive payouts, they adopt more cautious and selective underwriting strategies across all territories. This places greater pressure on businesses to demonstrate superior internal risk management.

Even as other commercial lines saw rate decreases, global casualty insurance rates recently climbed by approximately 4% in a single quarter. The U.S. market was the primary driver, with casualty rates increasing by 9%, largely due to "nuclear verdicts" exceeding the $10 million mark. As insurers worldwide react to these escalating legal and financial risks, it directly impacts their appetite for writing commercial auto policies and the pricing they apply. More details on these global trends are available at InsuranceJournal.com.

Anticipating Future Market Behavior

For underwriters and risk managers, these global patterns serve as an early warning system. Monitoring the casualty market's behavior, particularly in litigious jurisdictions, provides a reliable forecast of future underwriting scrutiny and price adjustments. This foresight enables a more proactive, rather than reactive, approach to risk management.

These pressures are compounded by other global challenges, notably the increasing frequency of severe weather events. The financial impact of how climate change impacts business operations is now a core consideration for insurers, adding another layer of complexity to risk modeling. By connecting these global factors, you can develop a more resilient insurance strategy capable of withstanding both local and international market pressures.

Setting Coverage Limits That Protect Your Assets

Image

One of the most dangerous misconceptions in risk management is treating state-mandated minimum liability limits as an adequate coverage target. These figures are not intended to protect your business; they represent the absolute floor designed to offer minimal public protection.

Relying on these minimums is a strategic failure. A single serious accident can exhaust these limits almost instantly, leaving your business exposed to devastating financial liabilities.

The objective is not to meet a legal minimum but to construct a financial firewall around your corporate assets. This requires a shift in perspective—viewing insurance not as an administrative expense but as a core component of your asset protection strategy. Your policy must be robust enough to absorb a true worst-case scenario.

How to Run a Practical Risk Assessment

Determining the appropriate coverage limit begins with a rigorous assessment of your company's unique risk profile. A one-size-fits-all approach is ineffective; your limits must reflect your operational reality. An underwriter will evaluate these same factors, so a proactive analysis positions you for a more favorable negotiation.

Key evaluation criteria include:

- Fleet Makeup and Mileage: A business with a single sedan for local sales calls has a vastly different risk profile than a logistics firm operating heavy-duty trucks across state lines. Analyze vehicle types, weight classes, and annual mileage.

- Where You Operate: Geography is a critical variable. Operating in dense urban areas, regions with adverse weather conditions, or known litigious venues necessitates higher limits.

- What Your Contracts Demand: Many commercial contracts stipulate specific and often substantial insurance limits. Failure to meet these commercial auto insurance requirements constitutes a breach of contract and can jeopardize key business relationships.

- Total Assets on the Line: Quantify the total value of your business assets, including property, equipment, inventory, and cash reserves. Your liability limit must be sufficient to shield this entire value from seizure in a lawsuit.

The Catastrophic Cost of Getting It Wrong

Consider this scenario: a delivery truck from a mid-sized logistics company causes a multi-vehicle accident. The incident results in serious injuries and extensive property damage. The company carries the state minimum liability coverage of $100,000 per accident.

The total adjudicated claims—for medical expenses, lost wages for multiple victims, and vehicle replacements—reach $1.5 million.

The insurance policy pays its $100,000 limit. The business is now liable for the remaining $1.4 million. This is not an accounting issue; it is an existential threat that can force the liquidation of assets, mass layoffs, or bankruptcy.

This example illustrates why state minimums are a starting point, not a destination. For detailed information on policy structures that provide this level of protection, explore our guide to commercial insurance coverage.

A superior strategy involves layering policies. A primary auto liability policy might provide $1 million in coverage, supplemented by a commercial umbrella policy that adds another $5 million or more in liability protection. This structure provides the financial depth required to withstand a catastrophic event, aligning your coverage with your actual risk profile, not an arbitrary legal minimum.

Proactive Strategies for Compliance and Cost Control

Effective commercial auto policy management is a continuous process, not an annual renewal event. For risk managers and brokers, this represents the most significant opportunity to control costs while ensuring compliance with all commercial auto insurance requirements. Underwriters consistently reward businesses that can demonstrate they are a lower-risk partner.

The goal is to transition from a reactive compliance model to a strategic risk management framework. The objective is to build a demonstrable and measurable safety culture. This transforms your insurance policy from a necessary expense into a competitive advantage.

Building a Defensible Safety Record

The foundation of premium control is meticulous documentation. In underwriting negotiations, a clean, well-organized record is your most persuasive evidence. Vague assurances of safety are insufficient; underwriters require hard data to validate your risk profile.

Essential documentation includes:

- Driver Motor Vehicle Records (MVRs): Conduct regular MVR reviews for all drivers, not just at the time of hire. This allows for early identification and correction of issues like speeding violations before they escalate into adverse claims trends.

- Accurate Loss History Reports: Maintain detailed records of all incidents, including near-misses. This demonstrates to underwriters that you are actively monitoring operational risks and implementing corrective actions.

- Training and Certification Logs: Keep a comprehensive log of all driver safety courses, certifications, and coaching sessions.

This level of organization does more than satisfy compliance checks—it communicates the narrative of a professionally managed, low-risk fleet. For a broader perspective on maintaining legal and regulatory compliance, consult a comprehensive business compliance checklist.

Implementing Rewarded Risk Management Tactics

While documentation provides the foundation, concrete actions to prevent accidents are what ultimately influence your premiums. Underwriters actively seek specific risk management programs with a proven ability to reduce claim frequency and severity.

The most effective strategy is to prove the existence of a proactive safety culture. Implementing modern technology and committing to continuous training demonstrates a serious commitment to risk management that goes far beyond legal minimums. This directly impacts your ability to secure favorable terms.

Consider implementing these high-impact strategies:

- Telematics Programs: Installing devices to monitor driving behaviors such as speeding, hard braking, and idle time provides invaluable data for driver coaching and substantiates your fleet's safety record for your insurer.

- Regular Safety Training: Mandate ongoing safety training covering critical topics like defensive driving, fatigue management, and proper vehicle inspection protocols.

- Swift Post-Accident Protocols: Develop and implement a clear, rapid-response plan for accidents. A robust protocol ensures evidence preservation, provides immediate driver support, and facilitates prompt claims reporting, which can significantly reduce the ultimate cost of a claim.

These proactive measures are essential for building strong, long-term carrier relationships and are a core component of effective business resilience strategies in a challenging market.

---

At Insurtech.bpcorp.eu, we provide the real-time intelligence needed to turn climate-driven disruption into validated business opportunities. Our Sentinel Shield platform empowers insurance professionals to connect with high-intent commercial clients at the moment of greatest need, transforming crises into measurable growth. Discover how our pay-per-opportunity model can fuel your success at https://insurtech.bpcorp.eu.