The era of viewing climate change as a distant, abstract threat is definitively over. For businesses, particularly in the commercial insurance and risk management sectors, it's no longer a future forecast—it is a present-day operational and financial reality demanding strategic action.

This is not an environmental issue; it is a balance sheet issue. The climate change business impact manifests as direct physical damage to assets, complex supply chain disruptions, and emerging financial liabilities. For underwriters, brokers, and risk managers, the traditional reactive playbook is obsolete. Proactive, data-driven strategy is now the minimum requirement for navigating this new terrain.

The New Reality of Climate Risk for Business

To effectively manage the business impact of climate change, decision-makers must look beyond broad environmental headlines to the specific, localized, and increasingly severe operational hurdles. For risk managers, underwriters, and brokers, the core task is to translate these complex threats into quantifiable financial and strategic risks.

This requires a clear-eyed assessment of enterprise resilience through the lens of three distinct but deeply interconnected risk categories:

- Physical Risks: The most direct threat, encompassing damage to property, plant, and equipment from acute events like floods, wildfires, and hurricanes. It also includes chronic impacts, such as rising temperatures and sea levels, that degrade asset value and disrupt operations over time.

- Transition Risks: The financial and strategic headwinds arising from the global shift to a low-carbon economy. These include policy changes rendering assets obsolete, technological disruption, and shifts in market or customer preferences toward sustainable products and services.

- Liability Risks: The escalating threat of litigation. Companies face legal action for failing to mitigate their climate impact or for inadequate disclosure of climate-related financial risks to investors and stakeholders, creating new, complex challenges for liability underwriters.

A Top-Tier Concern for Global Leaders

This is no longer a niche concern; it is a boardroom-level priority. The Allianz Risk Barometer 2025 validates this shift, ranking climate change as the fifth highest risk for businesses globally, its highest-ever position.

For decision-makers, the message is clear: the increasing frequency and severity of extreme weather events pose a direct threat to operational continuity and profitability. For a detailed analysis, the full Allianz 2025 risk report provides critical context.

Decoding Physical Climate Risks For Your Assets

Image

To accurately assess how climate change impacts a business, abstract threats must be translated into concrete vulnerabilities. The focus must shift to how a specific peril could affect a specific asset or supply route. These are physical climate risks, the most direct and visible threats stemming from extreme weather events and gradual environmental shifts.

For risk managers and insurance professionals, this demands a granular assessment of how specific hazards impact properties, disrupt supply chains, and threaten operational viability. A practical framework for this assessment involves categorizing these threats, which is foundational for building effective resilience strategies and credible underwriting models.

Acute Physical Risks

Acute risks are sudden, high-intensity events that deliver a severe shock to business operations. These event-driven hazards can cause immediate and catastrophic damage, and their frequency and intensity are increasing.

Actionable examples relevant to risk assessment include:

- Hurricanes and Typhoons: Cause direct infrastructure damage and trigger widespread, prolonged power outages that halt production.

- Wildfires: Possess the capacity to destroy entire facilities, forcing costly evacuations and interrupting business for extended periods.

- Severe Flooding: Results in inventory and equipment losses, rendering property inaccessible and causing significant business interruption claims.

A critical component of resilience is operational readiness for recovery. For instance, knowing precisely how to file a flood insurance claim is a practical, necessary step in mitigating financial loss post-event.

Chronic Physical Risks

In contrast to acute shocks, chronic risks are long-term shifts in climate patterns that gradually erode asset value, drive up operating costs, and degrade the business environment. Their slow-moving nature makes them easy to deprioritize, yet their cumulative impact can be equally devastating.

Key chronic threats for strategic consideration include:

- Rising Sea Levels: Permanently increase the risk profile of coastal properties, transportation networks, and critical infrastructure.

- Persistent Heat Stress: Reduces labor productivity, strains energy grids, and increases operational expenses through higher cooling costs.

- Changes in Water Availability: Leads to prolonged droughts that disrupt agricultural, manufacturing, and industrial processes.

These chronic pressures establish a new, more challenging operational baseline. They compel businesses to adapt proactively or face steady financial degradation. Both acute and chronic risks are fundamentally altering the risk profile of every physical asset.

Putting a Price Tag on Climate Disruption

When a severe weather event strikes, the impact transcends operational disruption; it translates directly to the balance sheet, turning logistical challenges into significant financial liabilities. For underwriters, brokers, and risk managers, understanding this direct connection is critical for accurate risk pricing and providing effective, actionable advice to clients.

Climate change is not a series of isolated events but a persistent drag on profitability that erodes asset value and undermines long-term corporate viability. A single event can trigger a cascade of costs, from property damage and business interruption to increased insurance premiums. Concurrently, chronic risks like sustained heat or rising sea levels quietly devalue real estate assets, making them more difficult to insure or sell.

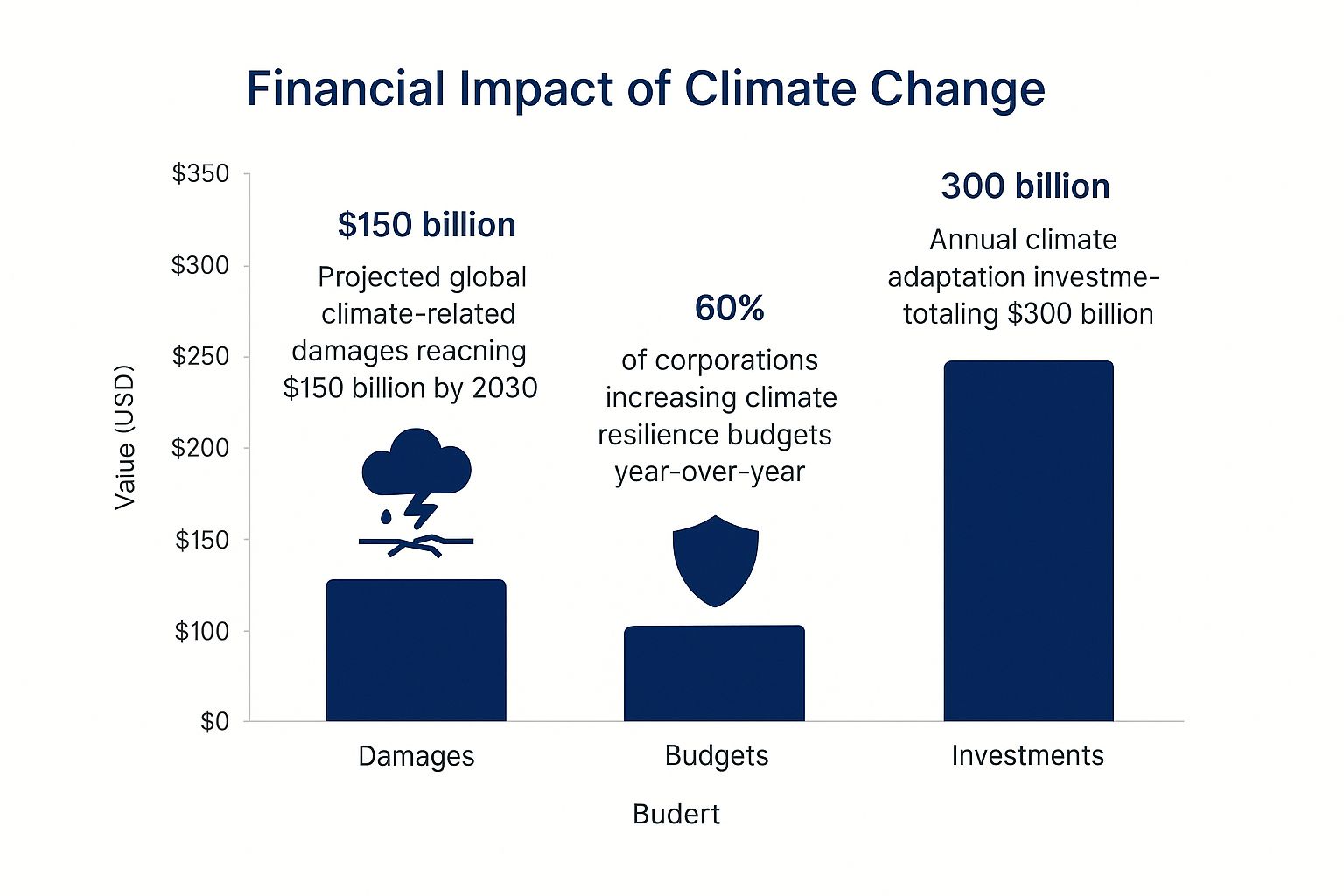

The financial data underscores the urgency, illustrating the scale of projected damages and the significant gap between these threats and current corporate investment in adaptation.

Image

This data highlights a critical adaptation gap that businesses must close to maintain financial stability.

The Direct Hit to Corporate Earnings

A primary concern is the direct impact of climate-related asset damage on corporate earnings. Projections are stark: businesses face a potential 6.6% to 7.3% decline in earnings by 2035, escalating to 9.9% to 12.8% by 2055.

This financial pressure is particularly acute for specific sectors. Industries such as travel, utilities, and telecommunications could see earnings decline by more than 20% by 2035.

The table below provides a sector-specific breakdown of these projections.

Projected Earnings Decline by Sector Due to Climate Hazards

This table illustrates the projected percentage drop in corporate earnings by 2035 and 2055 for various business sectors due to climate-related physical asset damage.

| Sector | Projected Earnings Decline by 2035 | Projected Earnings Decline by 2055 |

|---|---|---|

| Travel & Tourism | Up to 22.4% | Up to 30.1% |

| Utilities | Up to 20.8% | Up to 28.3% |

| Telecommunications | Up to 20.1% | Up to 27.5% |

| Agriculture | Up to 12.6% | Up to 19.8% |

| Real Estate | Up to 10.5% | Up to 15.7% |

| Manufacturing | Up to 8.9% | Up to 13.2% |

| Retail | Up to 7.1% | Up to 11.4% |

These figures represent billions in potential lost value and a fundamental challenge to profitability. The upward trend in projected losses underscores the urgent need for proactive risk management.

This is not exclusively a problem for asset-heavy industries. Technology, software, and life sciences companies are also exposed through supply chain disruptions and rising operational costs. No sector is immune to the financial consequences of climate risk. Further insights are available in a 2024 analysis from the World Economic Forum.

Understanding Transition and Liability Risks

Image

Focusing solely on physical climate damage provides an incomplete risk picture. The global shift toward a low-carbon economy introduces a distinct set of financial and operational threats known as transition risks.

These risks are not driven by weather events but by systemic shifts in policy, technology, and market sentiment as the world adapts to new climate realities. The dynamic is analogous to the economic disruption caused by the transition from horse-drawn transport to the automobile; businesses that failed to adapt faced extinction not from a natural disaster, but from a fundamental technological and societal pivot.

The Financial Effects of a Greener Economy

The financial consequences of this transition can be swift and severe. For underwriters and brokers, this creates a new, complex layer of risk that must be identified, quantified, and communicated to clients.

Transition risks manifest in several critical ways:

- Policy and Legal Risks: The implementation of carbon taxes, stricter emissions standards, or new disclosure requirements can abruptly increase operating costs and devalue carbon-intensive assets.

- Technology Risks: Innovations in renewable energy, battery storage, or sustainable materials can render older, less efficient technologies obsolete, leading to significant asset write-downs.

- Market and Reputation Risks: Consumers and investors are increasingly directing capital toward businesses with strong environmental, social, and governance (ESG) credentials. Companies perceived as laggards risk losing market share and access to capital.

As businesses navigate this transition, forecasting energy costs becomes critical. Tools like an energy bill forecaster can help manage the financial implications of shifting energy policies and prices.

The Growing Threat of Liability

Parallel to transition risks is the rapidly escalating threat of liability risks—the legal and financial exposure for climate-related damages. This is no longer a theoretical concern. Litigation is increasing against companies for two primary reasons: failing to mitigate their climate impact and failing to adequately disclose climate-related financial risks to investors.

This form of corporate accountability is a major focus for insurance professionals, who are now tasked with underwriting these emerging, complex, and potentially large-scale legal exposures.

How to Build a Climate-Resilient Business Strategy

<iframe width="100%" style="aspect-ratio: 16 / 9;" src="https://www.youtube.com/embed/ngMmaY2IDeM" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

Building a resilient business strategy is about making a high-return investment in operational continuity and competitive advantage. It requires moving from discussion to decisive action.

The first step is a meaningful climate risk assessment. Generic industry reports are insufficient. Decision-makers need granular, hyperlocal data to understand the specific threats facing their unique operational footprint. This involves pinpointing exactly which assets, supply routes, and operational hubs are most exposed to both physical and transition risks.

Executing this often requires broader organizational change. This is particularly relevant regarding modernization for SMBs, where adopting new technologies and processes is essential for building adaptive capacity.

Investing in Proactive Adaptation

Once vulnerabilities are identified, the focus shifts to building operational redundancy. A common weakness is over-reliance on a single supplier or geographic region. Diversifying the supply chain is one of the most effective strategies to insulate a business from localized disruptions. This upfront investment provides a buffer against the costly operational paralysis that can follow a major climate-related event.

The financial case for proactive adaptation is compelling. Under a business-as-usual scenario, global economic losses from climate change are projected to reach $2,328 trillion between 2025 and 2100. Limiting warming to 1.5°C could reduce those losses by more than half.

This stark contrast demonstrates that climate finance is not an expense but a critical investment in loss prevention. The cost of action now is a fraction of the cost of inaction. For a detailed breakdown of the financial models, review the climate finance and loss projections on Statista. These proactive measures are essential for future-proofing an organization.

The Strategic Imperative of Proactive Risk Management

Image

Managing the business impact of climate change is now a core strategic function. For any forward-thinking organization, proactive risk management has transitioned from an optional activity to a prerequisite for survival and growth. The physical, transition, and liability risks are not isolated challenges; they are interconnected forces reshaping the entire commercial landscape.

As an insurance or risk management professional, your role is central to this new reality. The objective is to guide organizations beyond awareness to decisive action, steering them toward a future that is not only resilient but also profitable. This requires a shift from a defensive posture to an opportunistic one.

The goal is to leverage granular data and strategic foresight not just to withstand climate uncertainty, but to identify and capitalize on the opportunities within it. True resilience is built by turning insight into action.

When executed correctly, risk management transforms from a cost center into a source of competitive advantage. By anticipating disruptions, adapting operations, and making targeted investments in resilience, businesses can protect their bottom line and strengthen their market position for the long term.

Answering Your Top Questions

For risk managers, brokers, and business leaders, getting clear, direct answers to foundational questions is the first step toward building a resilient strategy. Here are concise, actionable answers to the most common inquiries.

Which Industries Face the Greatest Climate Risk?

While asset-heavy sectors like agriculture, utilities, and real estate face obvious direct threats from physical hazards, the critical insight for decision-makers is that no industry is immune. Climate risk is systemic, permeating every supply chain, investment portfolio, and regulatory framework.

The financial services industry underwrites the coastal properties exposed to sea-level rise. The technology sector depends on manufacturing hubs vulnerable to drought. A local retailer's operations can be crippled by a regional power outage following a storm. The impact is universal, demanding a holistic, not siloed, risk perspective.

What Is the Difference Between Climate Mitigation and Adaptation?

In a business context, these terms represent the two essential pillars of a comprehensive climate strategy: one offensive, the other defensive.

- Climate Mitigation is offense. It involves taking action to reduce a company's greenhouse gas emissions to address the root cause of climate change. Examples include transitioning to renewable energy, improving fleet efficiency, and optimizing supply chains to reduce carbon footprints.

- Climate Adaptation is defense. It involves adjusting business processes, strategies, and assets to cope with the climate impacts that are already occurring or are unavoidable. This includes reinforcing infrastructure against extreme weather, securing alternative water sources, or developing products suited to a changing environment.

A resilient business must execute both. Mitigation is a long-term strategic imperative, while adaptation is an immediate operational necessity.

How Can My Business Begin a Climate Risk Assessment?

A practical climate risk assessment can be initiated through a focused, three-step process designed to build a foundation for strategic action.

- Identify Hazards: Use credible climate models and geospatial data to pinpoint the specific physical risks (e.g., flood, wildfire, hurricane) and transition risks (e.g., carbon pricing, regulatory shifts) relevant to your operational locations.

- Assess Vulnerability: Directly link those hazards to your business operations. Analyze how a specific event would impact critical facilities, key suppliers, workforce availability, and financial performance. This step makes the risk tangible.

- Quantify Impact: Translate vulnerabilities into financial terms. This involves modeling potential revenue loss from business interruption, estimating asset devaluation, and calculating increased operational costs to create a clear business case for action.

---

Understanding the business impact of climate change is one thing. Acting on it requires precision and speed. Sentinel Shield delivers qualified, geo-targeted leads of businesses exposed to floods, wildfires, and other climate events within 24 hours. Equip your team to reach high-intent prospects at their moment of need. Turn climate crises into tangible business opportunities with Sentinel Shield.