For most underwriters, brokers, and risk managers, a referral is a welcome but unpredictable event. Top-tier professionals, however, don't rely on chance. They engineer a system that generates high-value introductions consistently.

*The critical shift is moving from a reactive mindset to a proactive framework for growth.*

Stop Waiting for Referrals. Start Engineering Them.

In the high-stakes world of commercial insurance and climate risk, passively awaiting introductions is a significant strategic failure. Our industry is built on trust, and a referred prospect is a fundamentally different class of lead. They arrive with a baseline of confidence that translates directly into higher conversion rates, greater client loyalty, and more durable long-term relationships.

The challenge is not in recognizing the value of referrals, but in transitioning from treating them as fortunate accidents to building a reliable engine for new business acquisition.

This guide provides a structured, relationship-centric framework to achieve that. We will move beyond *hoping* for the next introduction and into building a deliberate process that consistently fills your pipeline with ideal opportunities. To build a robust strategy, you must first master the fundamentals of cultivating referrals.

A proactive referral strategy is built on three core pillars:

- Become Intrinsically Referable: This is non-negotiable. Your service, insights, and execution must be so exceptional that clients and partners are compelled to advocate for you. Mediocrity cannot be systematized.

- Systematic Network Activation: You must strategically identify and map the clients, partners, and industry contacts best positioned to introduce you to your next ideal client—then cultivate those relationships with purpose.

- Frictionless Execution: The process for making a referral must be seamless. Complexity is the enemy of action; if it is difficult to introduce you, it will not happen, regardless of goodwill.

This transition requires more than occasional requests. It demands integrating referral generation into the core of your lead generation process, transforming it into a measurable and predictable component of your growth model. When executed correctly, you turn chance into a dependable revenue stream.

Build a Referral-Worthy Reputation

Image

Before soliciting a single referral, you must be undeniably referable. This foundational principle is often overlooked. A referable reputation is not built on singular achievements but on the consistent delivery of high-value service that makes clients *want* to recommend you.

Exceptional service is the baseline requirement.

This means moving beyond reactive policy management. A referable underwriter or broker is proactive—offering forward-looking risk advisories, providing seamless claims support during critical events, and delivering strategic counsel that measurably improves a client’s risk posture and financial performance.

This is the transition from vendor to trusted strategic partner. It is the essential prerequisite for any referral conversation and aligns with the core of an insurance agent's responsibilities, where the client's strategic interest is paramount.

Define Your Ideal Referral

To obtain high-quality referrals, you must articulate precisely who you are looking for. Vague requests yield vague, unqualified leads. Develop a clear Ideal Referral Profile that your network can immediately understand and act upon.

Specify key attributes, such as:

- Industry Vertical: Commercial real estate developers with portfolios of coastal properties.

- Revenue Tier: Mid-market firms with $50M - $250M in annual revenue.

- Risk Profile: Businesses with significant exposure to hurricane, flood, or other climate-related perils.

This level of clarity eliminates guesswork and empowers your network to identify high-value opportunities on your behalf.

Key Takeaway: The more precise your ideal client definition, the easier you make it for others to send qualified, high-value business your way. Your network cannot act on ambiguous information; provide a clear target.

Finally, package this profile for easy distribution. A concise "Referral Brief"—a one-page PDF outlining your value proposition, target industries, and ideal client profile—makes it effortless for contacts to share your information. Preparing this removes friction from the process and significantly increases the probability that satisfied clients and partners will advocate for you.

Identify and Cultivate Your Referral Network

A powerful referral network is not an accident; it is a deliberately constructed asset. Generating a consistent flow of quality introductions requires a clear map of your most valuable sources and a strategic plan to deliver value to those relationships.

First, segment your network. A satisfied client requires a different engagement strategy than a strategic partner. A one-size-fits-all approach is a missed opportunity.

Segment Your Key Referral Sources

Your network can be segmented into three primary groups. Each offers unique opportunities and requires a tailored approach to maximize its potential for generating predictable business flow.

- High-Performing Clients: These are your most credible advocates. They have experienced your value firsthand and can provide authentic testimonials about how you solved critical business problems. Their endorsement is invaluable.

- Strategic Partners: Identify other professionals who serve your ideal clients. These include law firms, accounting practices, and risk management consultants who advise the same decision-makers you target. They represent powerful, non-competitive allies.

- Influential Industry Connectors: These are the consultants, board members, and heads of industry associations whose opinions carry significant weight. An introduction from one of these individuals can open doors that are otherwise inaccessible.

Reciprocity is the engine of a successful referral network. You cannot operate on a purely transactional basis. Deliver value *first*—whether through a critical insight, a strategic introduction, or direct assistance—to build a foundation of mutual trust.

Nurture Relationships with Purpose

Once you have segmented your network, nurture each relationship with a clear objective.

For your top clients, timing is critical. The optimal moment to request an introduction is immediately following a major success, such as a favorable renewal or the efficient resolution of a complex claim. This is when your value is most tangible.

With strategic partners, implement a more structured approach. Move beyond informal agreements to build a systematic exchange of value. This could involve co-hosting a webinar on emerging climate risks or establishing a formal process for exchanging qualified opportunities. The goal is to create a mutually beneficial arrangement where both parties see a clear return. This is how you generate superior [leads for insurance brokers](https://insurtech.bpcorp.eu/blog/leads-for-insurance-brokers-1753079787918), elevating your strategy beyond simple networking.

The financial impact of a systematic approach is well-documented. For instance, data from Software Oasis on the economics of referrals shows that referrals are a primary business driver across professional services. In consulting, 31% of firms derive 60–80% of their business from referrals, while another 19% generate 80–95% from this channel. This data confirms that a structured framework transforms networking from an activity into a predictable revenue engine.

Master the Art of the Referral Request

Image

Earning the right to a referral and effectively requesting one are distinct skills. Many seasoned professionals hesitate at this step, concerned about appearing transactional or jeopardizing a strong relationship.

The solution is to reframe the request entirely. You are not asking for a favor. You are offering to extend the value you provide to help another business within your client's network solve a critical problem.

Timing is paramount. The ideal moment for this conversation is immediately after you have delivered a significant win for your client. This is not a speculative inquiry; it is a logical continuation of a successful partnership.

Seize High-Value Moments

Identify trigger points in the client lifecycle where your value is most evident. These are the moments when trust is at its peak and the opportunity for a referral conversation naturally arises.

- Post-Renewal Success: You have secured favorable terms, potentially achieving significant premium savings or coverage enhancements. Client satisfaction is high.

- After a Successful Claims Resolution: You have guided them through a critical event, demonstrating your expertise and commitment under pressure. Their confidence in you is maximized.

- During a Strategic Risk Review: You have provided actionable intelligence on emerging climate risks or new compliance mandates, reinforcing your role as a strategic advisor.

Key Takeaway: Do not *ask* for a referral. Instead, *offer* to help others facing similar challenges. This subtle but critical shift transforms the dynamic from self-serving to value-driven.

Your language must reflect this reframed approach. Avoid generic, ineffective questions like, "Do you know anyone who needs insurance?" This places the burden on your client and lacks professional gravitas.

Instead, be specific and problem-oriented. This methodology aligns with modern [sales prospecting](https://insurtech.bpcorp.eu/blog/sales-prospecting-best-practices-1757057270840) techniques that prioritize relationship-building and consultative selling.

For example, after navigating a complex supply chain claim for a manufacturing client, you might say:

"I'm pleased we were able to resolve that claim successfully. I am currently focusing on helping other risk managers in the manufacturing sector mitigate these exact supply chain vulnerabilities. Does anyone in your professional network come to mind who would benefit from a conversation about this issue?"

This request is professional, specific, and framed around extending value. It positions the referral not as an ask, but as a logical extension of a productive, high-trust partnership, making it simple for your client to agree.

Design a Formal Referral Program That Scales

To transform referrals from a sporadic bonus into a predictable growth channel, you must implement a formal, structured program. Moving beyond ad-hoc requests requires a system that defines success, incentivizes participation, and operates with operational efficiency.

The first step is to establish clear objectives and KPIs. You must track key metrics such as your referral conversion rate, the average deal size from referred clients, and the total revenue attributed to the program. While benchmarks vary by industry, establishing your own baseline is essential for continuous improvement.

Structure Your Program for Success

In the B2B commercial insurance sector, simple cash incentives are often ineffective and can undermine professional relationships. The incentive structure should reflect the strategic nature of these partnerships. Offer value that reinforces the relationship and provides a meaningful benefit to your referral partner.

- Co-Marketing Opportunities: Partner with a referrer on a co-hosted webinar addressing an emerging risk, such as new climate exposures. This provides your partner with a platform to showcase their expertise to your audience.

- Charitable Contributions: Offer to make a donation to a charity of your partner's choice in their firm's name. This is a sophisticated gesture that aligns your firm with their corporate values.

- Exclusive Intelligence: Provide early access to proprietary risk reports or invite them to an exclusive, high-level industry roundtable that you are hosting.

This type of value exchange strengthens professional alliances far more effectively than a standard finder's fee.

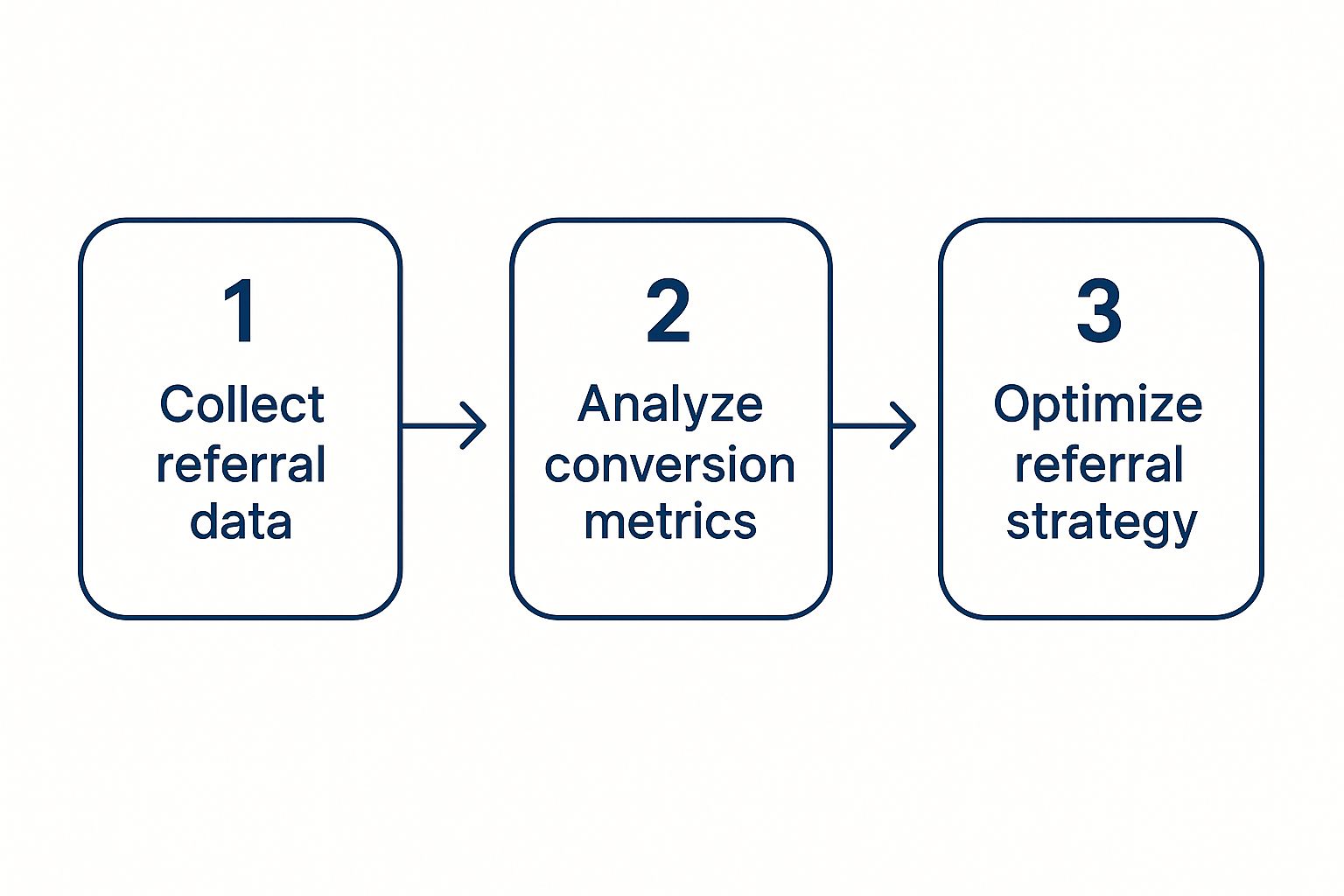

Image

As illustrated, a successful program operates on a continuous feedback loop: collect performance data, analyze results, and refine your approach to optimize outcomes. Reviewing referral program best practices can provide a robust framework for designing and iterating your system.

To ensure scalability, streamline the operational aspects. Utilize your existing CRM or dedicated referral software to manage the entire process, from partner onboarding to tracking introductions through to closed business. Furthermore, consider how a strategy of outsourcing lead generation can complement your referral efforts to maintain a consistently full pipeline.

Referral Program Incentive Structures

Selecting the appropriate incentive is critical to motivating your network. The table below outlines common models suitable for B2B relationships in the insurance sector.

| Incentive Type | Description | Best For | Potential Drawback |

|---|---|---|---|

| Reciprocal Referrals | A mutually beneficial agreement to exchange qualified introductions based on trust. | Strong, established partnerships with non-competing professional services firms (e.g., accountants, lawyers). | Can be difficult to track and enforce; relies heavily on balanced goodwill and performance. |

| Value-Based Rewards | Offering non-monetary value such as co-marketing, exclusive content, or access to events. | High-value professional relationships where a cash incentive would be perceived as transactional. | The perceived value is subjective and may not motivate all partners equally. |

| Tiered Commission/Credit | A percentage of the first-year premium or a flat fee that increases with referral volume or value. | Motivating high-volume referral partners, such as brokers or affinity groups. | Can become costly and may incentivize the submission of lower-quality, high-volume leads. |

| Charitable Donations | Making a donation to the referrer's chosen charity in their name or their firm's name. | Firms with restrictive gift policies or referrers who cannot accept direct compensation. | Lacks direct personal benefit, which may reduce motivation for some individuals. |

The optimal structure is authentic to your professional relationships and provides genuine, motivating value. Directly asking key partners what they would find most valuable is often the most effective way to design a successful program.

Answering Key Questions on Securing Referrals

Image

Even with a well-defined strategy, key questions often arise during implementation. Here are answers to common challenges faced by commercial insurance and risk management professionals.

The optimal time to request a referral is immediately after you have delivered exceptional value. Consider the moment you have successfully navigated a complex claims process for a client, or when a strategic risk review you conducted identified a previously unseen exposure. That is your window of opportunity. Make the request when your value is most tangible and fresh in their mind.

Should I Pay for Referrals?

In the B2B commercial insurance space, cash-for-referral arrangements can feel transactional and may devalue the high-trust relationship you have built. Non-financial, value-based incentives are typically more effective and professionally appropriate.

Instead of cash payments, consider incentives that strengthen the professional partnership:

- Co-host a webinar on a critical industry topic, giving your partner valuable market exposure.

- Make a donation to their preferred charity in their firm’s name, demonstrating an alignment of values.

- Provide exclusive access to proprietary risk intelligence or an invitation to a private industry roundtable.

These incentives position the referral as part of a strategic alliance, not a finder's fee arrangement. The focus remains on mutual benefit and shared expertise.

Referral marketing is not a secondary activity; it is a primary growth driver. In the U.S. market, 52% of small businesses identify referrals as their number-one source for new customers. An examination of these powerful referral marketing statistics underscores why a structured system is essential for sustainable growth.

Finally, effective tracking does not require complex software at the outset. A well-organized spreadsheet or the native features within your existing CRM are sufficient to manage the process. The critical factor is consistency: always log the referral source, date, current status, and final outcome. This discipline is what transforms random introductions into a predictable and measurable sales pipeline.

---

At Insurtech.bpcorp.eu, we transform climate-driven risks into actionable business intelligence. Our Sentinel Shield platform identifies businesses impacted by climate events in real-time and delivers verified, high-intent opportunities directly to you. Stop searching for leads and start connecting with clients at their moment of greatest need. Discover your next opportunity at https://insurtech.bpcorp.eu.