Cyber insurance training is no longer an optional "nice-to-have" but a core competency for any professional in the commercial insurance sector. It equips underwriters, brokers, and risk managers with the specialized knowledge to navigate a risk environment that evolves in real-time.

This is not about high-level threat awareness. It's about building actionable skills to underwrite policies accurately, provide clients with decisive risk counsel, and mitigate financial losses before they escalate.

Why Cyber Insurance Training is a Business Imperative

Image

While headline-grabbing cyber-attacks dominate the news, the most significant threat for insurance professionals is more mundane: human error. As the root cause of the vast majority of breaches, human fallibility makes a well-trained professional the most effective defense against financial and reputational damage.

Investing in cyber insurance training is not an expense; it is a strategic investment in building a more resilient and profitable book of business. For brokers and underwriters, this expertise elevates a policy transaction into a high-value risk advisory relationship.

Building a Defensible Position

A deep understanding of cyber risk enables a shift from a reactive to a proactive posture. This directly impacts the bottom line in several critical areas:

- Accurate Underwriting: Precisely evaluate a client's security controls to price risk correctly and avoid unexpected loss ratios.

- Effective Client Advisement: Guide clients through complex policy language, critical exclusions, and necessary security protocols with confidence.

- Reduced Coverage Disputes: Minimize ambiguity by ensuring policies are structured precisely and client expectations are managed from the outset.

Data confirms this strategic imperative. Human error is a factor in approximately 85% of cybersecurity breaches. This fact alone underscores the urgent need for structured cyber insurance training that aligns teams on coverage, compliance, and claims handling. The payoff is substantial: firms with robust training programs report a 30-40% reduction in coverage disputes and claim processing times.

By mastering the nuances of cyber risk, insurance professionals can prevent costly coverage gaps and build sustainable market growth, transforming a volatile threat into a manageable business risk. To understand the broader advantages of modern training methodologies, explore the reasons to leverage interactive video for training.

Navigating Cyber Insurance Market Dynamics

Image

To effectively underwrite or broker cyber policies, one must first comprehend the market's often-contradictory dynamics. The landscape is defined by explosive growth occurring alongside significant profitability and capacity challenges. A firm grasp of these forces is non-negotiable for sound decision-making.

Demand for cyber coverage is escalating as businesses recognize their digital vulnerabilities. However, insurers struggle to keep pace, constrained by a lack of robust historical loss data and a constantly shifting threat landscape. This mismatch creates a volatile environment where premiums and policy terms are in perpetual flux.

Sizing the Global Opportunity

The global cyber insurance market presents immense potential, but its current scale must be viewed in context. This snapshot clarifies its position within the broader industry.

Global Cyber Insurance Market Snapshot

| Metric | Value/Projection |

|---|---|

| 2024 Global Market Value | $15.3 billion |

| Market Share (vs. P&C) | Less than 1% |

| North American Premiums | $10.6 billion (69% of global total) |

| European CAGR (2020-2024) | 26% |

This data shows that while the market is substantial, it remains a fraction of the overall property and casualty sector. For professionals equipped with specialized cyber insurance training, the gap between its current size and its potential represents a significant runway for growth.

North America is the dominant market, but Europe's rapid expansion signals a global opportunity. You can find a deeper analysis of these market trends to understand the shifting competitive landscape.

The core challenge for underwriters and brokers is not merely selling a policy, but pricing risk with confidence in a market where historical data is a poor predictor of future losses and adversaries continuously evolve their tactics.

Identifying Key Growth Areas

For forward-thinking brokers and carriers, the most significant opportunities lie in underserved markets. Small and medium-sized enterprises (SMEs) are a prime example. Often overlooked as small-ticket clients, they are prime targets for cybercriminals and are in critical need of expert guidance.

Well-trained professionals can capitalize on this market gap by:

- Articulating value beyond price, helping clients understand unseen risks.

- Guiding SMEs through implementing the foundational security controls required for insurability.

- Developing tailored solutions for a large, untapped client base.

By focusing on these areas, professionals can build a profitable, defensible book of business that is insulated from the hyper-competitive large-enterprise space.

Key Pillars of an Effective Training Curriculum

Image

Not all cyber insurance training programs are equivalent. A high-value curriculum provides professionals with a durable framework for making sound decisions under pressure, moving beyond surface-level definitions.

The distinction between a basic certification and true expertise lies in mastering a few core pillars. These pillars connect the technical details of a cyber attack to the commercial realities of an insured's balance sheet. The objective is not just theory; it's to equip brokers, underwriters, and risk managers to confidently handle client consultations, risk assessments, and claim scenarios by translating complex cyber threats into clear business impacts.

Technical Foundations for Business Decisions

First, it is essential to understand the modern threat landscape from an insurer's perspective. The goal is not to transform insurance professionals into cybersecurity engineers but to provide them with the knowledge to identify how a specific attack vector becomes an insurable event. A strong curriculum must deliver a practical understanding of how major threats operate.

Effective training dissects the anatomy of the most common and costly attacks, focusing on their business impact:

- Ransomware: Analyzing the full attack lifecycle, from initial access to data exfiltration and extortion. The focus should be on business interruption costs, notification obligations, and negotiation factors.

- Business Email Compromise (BEC): Detailing the social engineering tactics used to initiate fraudulent payments and, critically, the internal controls that can mitigate these losses.

- Data Breaches: Exploring how sensitive information is compromised and the cascading costs of forensic investigation, credit monitoring, and regulatory fines.

A hallmark of premier cyber insurance training is its relentless focus on the *business consequences* of an attack, not just the technical mechanics. It must answer the question: "How does this specific cyber event trigger coverage and create a significant financial loss?"

Policy Language and Coverage Analysis

The second essential pillar is mastering the policy form itself. Cyber policies are notoriously complex, and their specialized language can create significant coverage gaps if not properly understood. Professionals must be trained to analyze policy language and identify the critical nuances that determine whether risk is truly transferred.

This requires a deep dive into policy structure, key insuring agreements, and common exclusions. For instance, understanding the subtle differences in how various policies define a "computer system" or a "network security failure" can be the difference between a paid claim and a denial.

Effective training builds expertise in articulating these fine points to clients, ensuring there are no surprises when an incident occurs. This is the bedrock of effective risk advisory and sound underwriting.

How to Select the Right Training Program

Choosing the right cyber insurance training is a strategic decision, not just a budget line-item. The goal is to select a program that sharpens your team's skills, enhances market credibility, and delivers a competitive advantage.

Look beyond marketing materials and course outlines. The best training moves beyond abstract theory and immerses teams in practical, real-world scenarios. The objective is to produce professionals who are confident dissecting complex policy language or guiding a client through the first hours of a data breach.

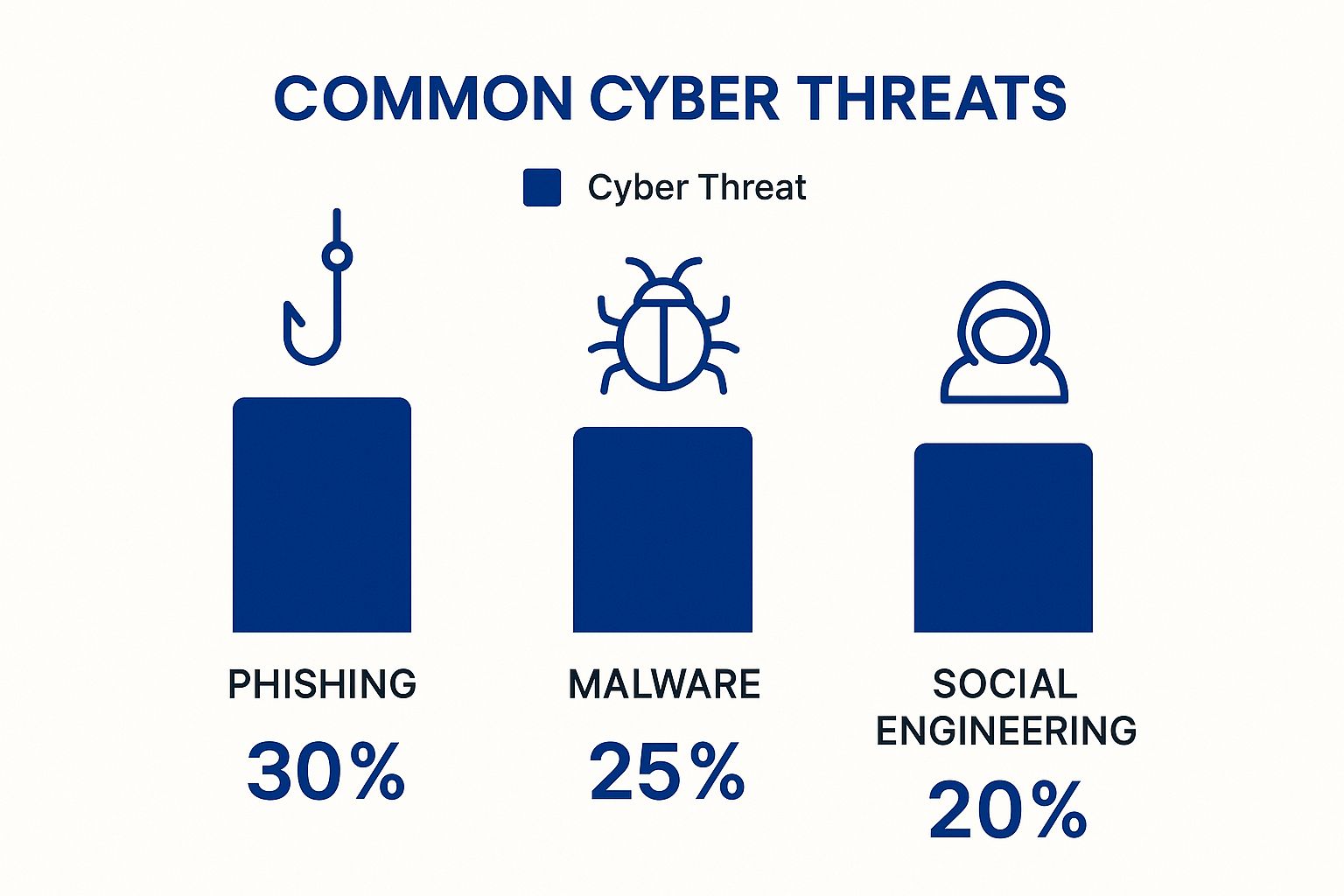

A top-tier curriculum must reflect the threats your clients actually face. The image below provides a stark reminder of modern claims drivers.

Image

The data is clear: human-driven attacks like phishing and social engineering are behind a significant number of security failures. Therefore, any cyber insurance training program must dedicate substantial time to how these attacks function and, critically, how insurance policies are designed to respond.

Key Evaluation Criteria

When comparing training providers, a structured approach helps you focus on what will deliver tangible results for your underwriting, broking, or risk management functions.

Consider these non-negotiable criteria:

- Instructor Experience: Who is leading the instruction? Prioritize instructors with direct industry experience—former underwriters, claims managers, or breach coaches. Practical experience is more valuable than a purely academic background.

- Curriculum Timeliness: Cyber risk evolves rapidly. The curriculum must be dynamic and continuously updated to reflect the latest attack vectors, new regulations, and critical shifts in policy language.

- Practical Application: Does the training move beyond lectures? Look for case studies, hands-on claims scenarios, and role-playing exercises. The true measure of effectiveness is the ability to apply knowledge under pressure.

- Recognized Certifications: While not the only factor, a respected certification adds credibility. It demonstrates a formal commitment to professional development and provides a clear benchmark of expertise for your team and clients.

Choosing the right program is about empowerment. The goal is not just to educate your team, but to build their confidence. You want them to have the authority to advise clients with conviction, price risk with precision, and navigate the chaos of a cyber claim like a true expert.

The Business Impact of Cyber Insurance Expertise

High-quality cyber insurance training delivers measurable business results, impacting revenue, profitability, and organizational resilience. This is where the investment in professional development appears on the balance sheet, transforming expertise from a cost center into a driver of success.

For insurance carriers, this expertise directly improves underwriting discipline. A well-trained underwriter can analyze a potential insured's security posture, price the risk with greater accuracy, and build a profitable and sustainable portfolio. This skill directly reduces loss ratios and costly claims.

For brokers, advanced training is the key differentiator between a transactional vendor and an indispensable risk advisor. It is the foundation for moving beyond policy sales and into high-value consultations that foster client loyalty.

A knowledgeable broker can confidently guide clients through complex policy language, identify critical coverage gaps, and negotiate superior terms. This work leads directly to higher client retention and a more valuable book of business.

Measuring the Return on Expertise

The benefits are quantifiable. To demonstrate impact, individuals and teams should follow a structured learning path. Using tools like professional development plan templates can provide the framework to guide that growth effectively.

A well-trained team produces measurable outcomes, including:

- Fewer Claim Disputes: When policies are structured correctly and client expectations are managed from inception, the probability of costly disputes decreases significantly.

- Improved Negotiating Power: A risk manager armed with deep cyber knowledge can negotiate more effectively with insurers, resulting in better terms and coverage that accurately fits the company’s risk profile.

- Enhanced Organizational Resilience: For risk managers, this training is not just about policy procurement—it's about ensuring genuine corporate preparedness. It validates that incident response plans are practical and that the business can survive a cyber crisis with minimal disruption.

Ultimately, cyber insurance training is not a cost center; it is a profit driver. It builds a team that can navigate risk with authority, protect the financial health of their clients, and safeguard their own organization. This expertise is what separates market leaders from the competition.

Answering Your Key Training Questions

When decision-makers evaluate cyber insurance training, several key questions consistently arise. Clear answers are crucial for brokers, underwriters, and risk managers who aim to lead in this high-stakes market.

Is Cyber Training Necessary for P&C Veterans?

Yes, unequivocally. The cyber risk landscape evolves faster than any other line of business. Deep expertise in property and casualty is valuable but does not cover the technical nuances of modern attack vectors, the intricacies of digital forensics, or the uniquely complex language of cyber insurance policies.

Without this specialized training, even a seasoned professional can misjudge a client's exposure, leading to inaccurate pricing and critical coverage gaps when an incident occurs. Cyber insurance training is not a one-time event; it is a continuous process required to maintain relevance and effectiveness.

What Is the Most Critical Skill Gained?

While the entire curriculum is important, the single most impactful skill gained from high-quality training is incident response management. A cyber-attack is the moment of truth where the policy, broker, and underwriter are all tested.

Understanding the roles, timelines, and critical decisions during a live event is what separates a policy seller from a true risk advisor.

Knowing how to guide a client through a crisis—from containing the breach to meeting regulatory deadlines—is what minimizes financial and reputational damage. This skill saves businesses.

How Can We Measure the ROI of This Training?

The return on investment for quality training is demonstrable through both quantitative and qualitative metrics. These KPIs show a direct link between enhanced skills and improved business performance.

Measure the financial impact by tracking:

- An increase in quote-to-bind ratios for cyber policies.

- A reduction in the frequency and cost of claim disputes.

- Improved accuracy in initial risk pricing, leading to a healthier loss ratio.

Qualitatively, the ROI is evident in your team’s confidence when advising clients, the positive feedback received for advisory services, and an increased ability to win new business against less-knowledgeable competitors.

---

Are you ready to turn climate-driven risks into qualified leads? Sentinel Shield by BPC GROUP offers a real-time, hyperlocal lead generation platform that connects you with commercial clients right when they need you most. Stop guessing and start engaging with high-intent prospects in disaster-affected zones. Learn more about how our performance-based model can drive growth for your business.