When a physical disaster—a fire, storm, or catastrophic theft—forces a business to shut down, property insurance covers the cost of rebuilding. But what covers the revenue lost during the closure? How do you maintain payroll, rent, and supplier payments when income stops?

This is the critical function of business interruption insurance. It is not just another policy; it is a financial lifeline designed to sustain a business's financial health during a period of operational paralysis.

A Strategic Overview of Business Interruption Coverage

Image

Standard commercial property insurance is designed to replace tangible assets: the building, equipment, and inventory. However, rebuilding is only one part of recovery. If cash flow ceases during the months required for restoration, the physical repairs become irrelevant to the business's survival.

Business interruption coverage provides financial continuity by compensating for the income lost during the restoration period. The policy is structured to return the business to the financial position it would have occupied had the disruptive event not occurred. A firm grasp of general insurance principles is foundational to understanding how these policies operate.

Core Function and Purpose

The primary purpose of business interruption insurance is to ensure financial stability when operations are halted by a covered peril. For example, if a tornado causes direct physical damage to a facility, this policy activates to replace the revenue that would have been earned.

This coverage is not a standalone product. It is typically added as an endorsement to a commercial property policy or included in a Business Owner's Policy (BOP). Its function is to cover the fixed costs that continue even when the business cannot operate.

Key covered expenses include:

- Lost Net Income: The projected profit the business would have earned, based on historical financial data.

- Continuing Operating Expenses: Fixed costs such as rent, mortgage payments, insurance, and utilities.

- Employee Payroll: Essential for retaining key personnel, ensuring the business can resume operations efficiently.

- Temporary Relocation Costs: Expenses associated with operating from a temporary location.

A critical point of clarification for clients is that this insurance does not cover *any* event that closes a business. The trigger is specific: the operational shutdown must be a direct result of physical loss or damage to the insured property from a covered peril.

Why It Is a Non-Negotiable Risk Management Tool

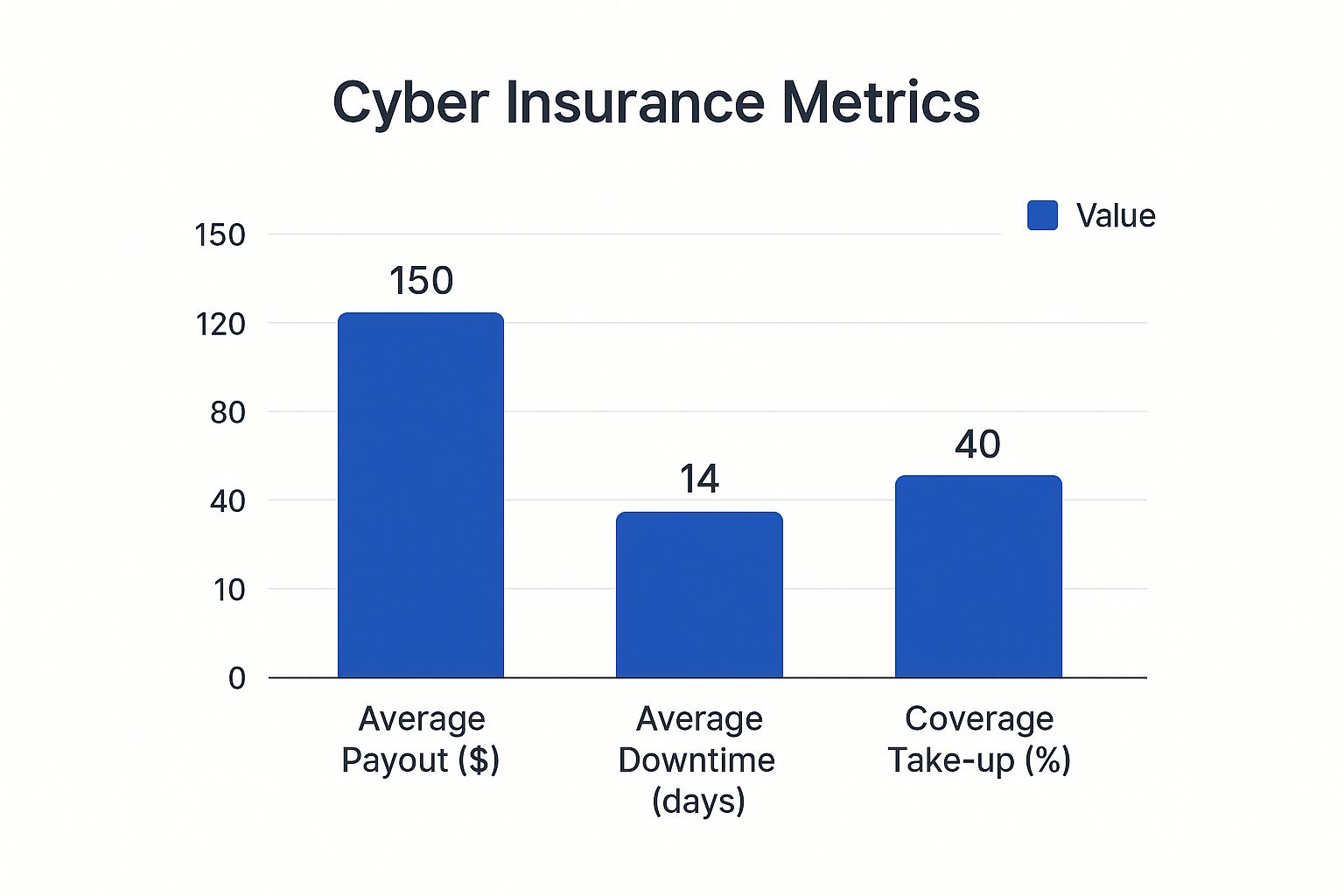

For underwriters, brokers, and risk managers, business interruption insurance is a fundamental component of a comprehensive risk management strategy. Market data underscores its importance.

The global Business Interruption Insurance (BII) market is projected to grow from approximately $150 billion in 2025 to roughly $250 billion by 2033. This growth reflects the increasing frequency and severity of disruptive events that can cripple a business.

Without this coverage, a significant property loss can trigger a cascade of financial failures. Fixed costs accumulate while revenue is zero. By protecting cash flow, this policy provides the capital needed not only to repair physical assets but to successfully reopen and ensure the company’s long-term viability.

Understanding What Triggers a BI Claim

A business interruption policy is not activated by any loss of income; a specific sequence of events must occur. For coverage to respond, the business must first suffer direct physical loss or damage to its property from a peril covered under its primary commercial property policy. This is the foundational requirement for any BI claim.

The process can be viewed as a domino effect. The initial event must be physical damage—a fire in a warehouse, a hurricane damaging an office building, or vandalism destroying essential machinery. Only after this physical loss occurs can the subsequent losses, such as operational shutdown and lost income, be covered.

Image

Post-incident downtime can extend for months, making robust coverage and a detailed risk management plan essential for business survival.

The Prerequisite of Physical Damage

The phrase "direct physical loss or damage" is a critical distinction that insurance professionals must communicate clearly to clients. It means that economic downturns, market competition, or local infrastructure issues will not trigger the policy. The loss must be tangible and directly caused by a covered event.

A clear example: a restaurant's kitchen is destroyed by a fire, forcing a closure for several months of repairs. The lost income during this shutdown is precisely what BI insurance is designed to cover. The fire is the *covered peril*, the destroyed kitchen is the *direct physical loss*, and the forced closure is the *interruption*. A valid claim requires this direct chain of events.

A common area of dispute arises when the damage is less overt. For instance, if smoke from a nearby wildfire infiltrates a building and contaminates inventory without structural fire damage, it may still be considered physical damage. However, coverage often depends on specific policy wording and legal precedent.

Proactive planning is the most effective way to mitigate the impact of a disaster. For actionable guidance on building operational resilience, review our guide on [disaster preparedness for businesses](https://insurtech.bpcorp.eu/blog/disaster-preparedness-for-businesses-1753512966451).

Beyond Your Own Four Walls

While damage to the insured's property is the most common trigger, BI coverage can extend beyond its physical boundaries. These extensions are vital for businesses dependent on specific suppliers or those vulnerable to disruptions in their immediate vicinity. Two of the most critical extensions are Contingent Business Interruption and Civil Authority coverage.

The following scenarios illustrate how these coverages function in practice.

Common Triggers and Coverage Scenarios

This table outlines common events that activate BI coverage and the typical expenses a business can claim.

| Triggering Event | Example Scenario | Typical Covered Expenses |

|---|---|---|

| Direct Physical Damage | A fire destroys a retail store's primary location, forcing a 6-month closure for rebuilding. | Lost net profits, employee payroll, rent for a temporary location, ongoing operating expenses (utilities). |

| Contingent Business Interruption | A key parts supplier's factory is flooded, halting the supply of components needed for your production line. | Lost income from your own halted production, costs to source alternative suppliers, expedited shipping fees. |

| Civil Authority | A gas leak at a neighboring building causes police to block access to your entire street for two weeks. | Lost profits during the two-week closure, payroll for staff who cannot work, marketing costs to announce reopening. |

Understanding these scenarios demonstrates how a single event can have cascading effects, impacting businesses not directly damaged by the initial peril.

Contingent Business Interruption (CBI)

This provides protection when physical damage to a key supplier, customer, or partner disrupts your own operations.

- Supplier Impact: A fire destroys the factory that produces a critical component for your product. CBI can cover your lost profits until the supplier recovers or an alternative is secured.

- Customer Impact: Your primary customer's distribution center is destroyed by a tornado, leading them to cancel all orders. CBI can help cover this sudden revenue loss.

Civil Authority Coverage

This coverage activates when a government entity, such as the police or fire department, prohibits access to your business due to physical damage to a *nearby* property.

- Example: A chemical spill at a neighboring plant causes authorities to cordon off a one-mile radius, which includes your office. Although your property is undamaged, this coverage can compensate for lost income while access is restricted.

For brokers and underwriters, accurately assessing these extended risks is crucial. A business's true operational exposure often extends far beyond its property lines, and a well-structured policy must reflect that reality.

Deconstructing Your Business Interruption Policy

Image

To effectively advise a client or manage risk, professionals must move beyond a summary understanding of business interruption insurance coverage and analyze its components. The ability to translate policy language into actionable guidance is a key differentiator for brokers, underwriters, and risk managers.

A business interruption policy consists of specific clauses that define the scope, duration, and financial limits of its protection. A misunderstanding of these components can lead to a significant gap between a policyholder's expectations and the actual claim payout.

The following three elements are central to nearly every BI policy.

The Period of Restoration

The Period of Restoration defines the timeframe during which the insurer will cover lost income. This period is not indefinite.

It formally begins at the moment of direct physical damage and concludes when the damaged property *should have been* repaired or replaced with reasonable speed and similar quality.

The "should have been" clause is critical. It stipulates that unnecessary delays in rebuilding, whether caused by the policyholder or other non-covered factors, are not included in the covered period. The clock starts at the time of the disaster and stops when operations *can* resume, not necessarily when they have fully returned to pre-loss levels.

This distinction is vital for managing client expectations. For example, if a factory requires six months for physical reconstruction but an additional two months to re-establish its supply chain and customer base, the standard Period of Restoration would likely only cover the initial six months of downtime.

Understanding Coverage Limits

Coverage limits establish the maximum amount a business can receive from a claim. These limits must be based on a detailed financial analysis of the business's true exposure, not arbitrary figures.

Underwriters and brokers play a key role in guiding clients through this calculation, often using a comprehensive worksheet to project future revenues and expenses to determine an adequate limit.

A frequent error is basing limits solely on historical data without accounting for growth. A rapidly expanding company could find its coverage limit is insufficient to cover its actual projected income for the year of the loss, resulting in a significant financial shortfall.

To ensure limits are adequate, consider:

- Gross Earnings vs. Gross Profits: Policies can be written on either basis. Understanding the specific definitions and calculations used in the policy is essential for structuring appropriate coverage.

- Seasonality: A retail business generating 70% of its revenue in the fourth quarter requires a limit that reflects this peak season, not an annualized average.

- Interdependencies: The calculation must account for the time required to replace specialized equipment or restore critical IT infrastructure, which can extend the recovery timeline well beyond the physical construction schedule.

The Role of the Deductible

The business interruption deductible functions differently from a standard property deductible. It is typically a time-based waiting period, a critical detail that directly impacts cash flow immediately following a disaster.

A common policy might feature a 72-hour waiting period. This means the insurer begins covering lost income only after the business has been shut down for three full days. The business is responsible for absorbing all losses incurred during this initial period.

This structure necessitates that businesses maintain a short-term cash reserve to bridge the gap before coverage activates. For risk managers and brokers, advising on the appropriate waiting period is a balance. A longer period can reduce premiums but increases the immediate financial burden on the policyholder in a crisis.

How to Navigate the Claims Process Effectively

Successfully filing a business interruption insurance coverage claim requires executing a pre-established plan. For risk managers and business leaders, the hours following a disruption are critical and demand a methodical, detail-oriented approach. This is the only way to secure a fair and timely settlement.

The process is centered on two core principles: immediate action and meticulous documentation. Delays in gathering records or notifying the insurer create friction that will postpone the financial support the business needs to recover.

Immediate Steps After a Loss Occurs

The first 72 hours after a covered event are the most critical. Actions taken during this window dictate the trajectory of the entire claims process.

Priorities include formally notifying the insurer and taking immediate steps to mitigate further losses. Prompt notification initiates the claims process, while effective mitigation demonstrates responsible management of the situation.

Your initial action plan must include:

- Prompt Notification: Immediately contact your insurance broker or carrier to report the loss. This is the non-negotiable first step that satisfies policy requirements and starts the process.

- Damage Mitigation: Fulfill your contractual duty to take reasonable steps to prevent further damage. This may involve boarding up windows, applying tarps to a damaged roof, or relocating undamaged inventory to a secure location.

- Document Everything: Use a smartphone to capture extensive photos and videos of all physical damage from multiple angles. This visual evidence provides an indisputable record of the initial loss for the adjuster.

Navigating post-catastrophe chaos requires a defined strategy. For detailed guidance, see our analysis of handling [storm damage insurance claims](https://insurtech.bpcorp.eu/blog/storm-damage-insurance-claims-1753773334149), which provides specifics on documentation and initial response protocols.

Building a Bulletproof Claim with Documentation

After managing the immediate crisis, the focus must shift to constructing the financial case for your claim. An insurance adjuster's role is to validate the loss based on the evidence provided. A claim based on incomplete records or estimates will inevitably lead to delays and disputes.

The objective is to present a clear, logical, and fully supported calculation of lost income and extra expenses. The quality of your documentation directly correlates to the efficiency of the settlement process.

The purpose of a business interruption claim is to restore the business to the financial position it would have occupied without the loss. This requires projecting future performance based on past results, making historical financial data the foundation of the claim.

Key documents to assemble include:

- Historical Financials: A minimum of three years of profit and loss statements, balance sheets, and tax returns are needed to establish a credible performance baseline.

- Current-Year Performance: Provide financial reports from the months immediately preceding the loss to demonstrate current business trends and growth.

- Expense Records: Compile detailed proof of all continuing operating expenses (rent, utilities, payroll) and any new, *extra* expenses incurred to minimize the shutdown, such as equipment rentals.

- Business Forecasts: Pre-loss sales projections, marketing plans, and budgets substantiate your claim regarding what the business *would have* earned.

Leveraging Specialists for Precision and Credibility

For complex claims involving significant financial losses or intricate operational structures, engaging outside experts is a strategic necessity. Their involvement adds a level of professionalism and precision that can significantly accelerate the settlement process.

A forensic accountant is often the most valuable expert to engage. These professionals specialize in quantifying financial losses in a manner that aligns with insurance policy requirements. They construct sophisticated financial models to project lost revenue with a high degree of accuracy, providing the adjuster with a defensible calculation.

If policy language is ambiguous or a dispute arises with the insurer, legal counsel becomes essential. For complex claims or significant disagreements, consulting with [specialized legal counsel for coverage disputes](https://hireparalegals.com/job/attorney-coverage/) is prudent to protect your rights. They can clarify coverage interpretations and guide negotiations, ensuring the claim is managed effectively from a legal standpoint. Assembling the right team transforms a potentially adversarial process into a structured, data-driven negotiation.

Identifying Common Exclusions and Coverage Gaps

Image

Understanding what a policy covers is only half the analysis. True risk management expertise requires identifying what it *excludes*. For underwriters and brokers, guiding clients through common exclusions is critical to preventing unmitigated vulnerabilities.

A standard business interruption insurance coverage policy is not an all-risk solution. Its limitations are tied directly to the perils listed in the underlying property policy. If the property policy excludes an event like flood or earthquake, the business interruption coverage will not respond to income losses from that same event. This direct link is a frequent source of misunderstanding and can lead to significant, unexpected coverage gaps.

Perils Requiring Specific Endorsements

Certain catastrophic events are almost universally excluded from standard commercial property policies and, by extension, from business interruption coverage. These high-risk perils require separate policies or specific endorsements.

Key exclusions include:

- Flood Damage: Standard policies do not cover losses from flooding or storm surges. Businesses in flood-prone areas require a separate flood policy or a specific endorsement. The complexities are detailed in the [flood insurance claims process](https://insurtech.bpcorp.eu/blog/flood-insurance-claims-process-1753860075385).

- Earth Movement: This broad category includes earthquakes, landslides, and mudslides. Coverage for these perils must be purchased separately.

- Pandemics and Viruses: Following the COVID-19 pandemic, most insurers have implemented explicit exclusions for losses due to viruses or bacteria, reinforcing the core requirement that claims must originate from direct physical property damage.

For brokers, proactively identifying a client's specific exposures and recommending appropriate endorsements is a core function of effective risk advisory.

The Global Protection Gap

The disparity between total economic losses from disasters and the amount covered by insurance is a persistent global challenge. This "protection gap" highlights the number of businesses operating with inadequate coverage, often due to unaddressed exclusions.

Between 2014 and 2023, natural disasters caused an estimated $2.349 trillion in economic losses worldwide. Only about $944 billion of that was insured, leaving a staggering protection gap of approximately 60%. This gap is even more pronounced in high-exposure regions like Asia, where it reaches about 85%.

These figures reveal a massive, often unrecognized, financial exposure for businesses. For insurance professionals, closing this gap represents a significant opportunity to provide tangible value and build more resilient client portfolios.

A thorough policy review is non-negotiable. Identifying these common exclusions and gaps enables underwriters to price risk accurately and helps brokers ensure their clients have the comprehensive protection they require, preventing catastrophic financial surprises during a crisis.

The Future of Business Interruption Insurance

Traditional enterprise risk models are becoming insufficient. As global economies become more interconnected and intangible threats grow, the definition of a business interruption is expanding. Insurance professionals must look beyond physical property damage to anticipate the next wave of disruptive events.

Emerging risks are compelling the industry to adapt. Sophisticated cyberattacks and fragile global supply chains now pose significant threats. A ransomware attack can halt operations as effectively as a fire but lacks the physical damage trigger required by most traditional policies. Similarly, a disruption at a single overseas supplier can halt production for a business thousands of miles away. The market is evolving, but it demands a new framework for assessing what constitutes a business interruption.

Technology Reshaping Risk Assessment

Technology is fundamentally changing how business interruption risk is evaluated and managed. AI and predictive analytics are moving from peripheral tools to core components of underwriting and claims management.

Insurers can now model complex "what-if" scenarios with unprecedented accuracy, forecasting the financial impact of a hurricane on a specific supply chain or quantifying potential losses from a major data breach. This data-driven approach enables more precise risk assessment and dynamic pricing.

This technological shift provides several key advantages:

- Parametric Triggers: Policies can be designed to pay out automatically when a pre-defined trigger is met, such as a hurricane's wind speed reaching a certain threshold in a specific location. This eliminates lengthy damage assessments and accelerates payment when liquidity is most critical.

- Predictive Modeling: Data analytics can identify operational vulnerabilities *before* a loss occurs, allowing for proactive risk mitigation and transforming the insurance relationship into a strategic partnership.

- Automated Claims Processing: Technology is streamlining the administrative and computational burdens of claims processing, resulting in faster settlements and lower overhead costs.

Market Dynamics and Evolving Coverage

Despite increasing exposure to catastrophes and climate-related disasters, the insurance market is showing signs of softening. According to the Global Insurance Market Index for Q2 2025, global insurance rates declined by 4%, continuing a year-long trend of rate reductions.

Property insurance rates, which underpin most business interruption products, have seen a global decrease, with many insurers offering improved coverage terms to remain competitive. This creates a dual reality for brokers and risk managers: it presents an opportunity to secure favorable terms for clients but also demands a sharper focus on ensuring the business interruption insurance coverage is adequate for emerging risks.

Coverage gaps remain a major threat, particularly concerning challenges like those posed by [climate change and its business impact](https://insurtech.bpcorp.eu/blog/climate-change-business-impact-1753686460888). Success in this evolving landscape will depend not on securing the lowest premium but on anticipating these shifts and guiding organizations toward genuinely resilient risk management strategies.

Frequently Asked Questions

When analyzing business interruption insurance coverage, several practical questions arise for business leaders. Here are direct answers to the most common inquiries to clarify how these policies function in practice.

How Is the Payout for a BI Claim Calculated?

The calculation is a structured process designed to restore the business to its pre-loss financial state. Insurers analyze historical financial data, such as profit and loss statements and tax returns, to project what the business would have earned during the shutdown, known as the "period of restoration." The final payout covers this lost net income plus any continuing operating expenses, like rent and payroll, that must be paid while operations are suspended.

Does Business Interruption Insurance Cover Remote Work Expenses?

Yes, these costs are often covered under a policy provision known as "Extra Expense" coverage. If a covered peril renders the primary business location unusable, this coverage reimburses reasonable and necessary costs incurred to continue operations. This can include expenses for laptops, software for remote work, or the rental of temporary office space to minimize the overall financial impact of the shutdown.

The purpose of Extra Expense coverage is to mitigate the total loss. By covering the costs of a remote or temporary setup, insurers can reduce the size of the larger business interruption claim by enabling the company to resume generating revenue more quickly.

For further analysis and tools to assist with commercial insurance management, explore the various [resources available for risk managers and brokers](https://insurtech.bpcorp.eu/pages/resources) on our platform.

What Is the Difference Between a Deductible and a Waiting Period?

This is a critical distinction. Most business interruption policies do not use a traditional dollar-amount deductible. Instead, they feature a time-based waiting period. For example, a policy with a 72-hour waiting period means that coverage for lost income begins only after the business has been shut down for three full days following the physical damage. The policyholder is responsible for all losses incurred during this initial window. This is fundamentally different from a standard property damage deductible, which is a fixed monetary amount.

---

When a climate event disrupts operations, the window of opportunity is small. Insurtech.bpcorp.eu provides real-time intelligence to connect insurance and recovery firms with businesses at their moment of greatest need. Discover high-intent corporate opportunities, validated and delivered within 24 hours, by visiting https://insurtech.bpcorp.eu.